Employees’ Provident Fund (EPF) is a retirement benefit scheme wherein a member invests a part of his salary every month and equal contribution is made by the employer towards EPF and EPS accounts of the employee.

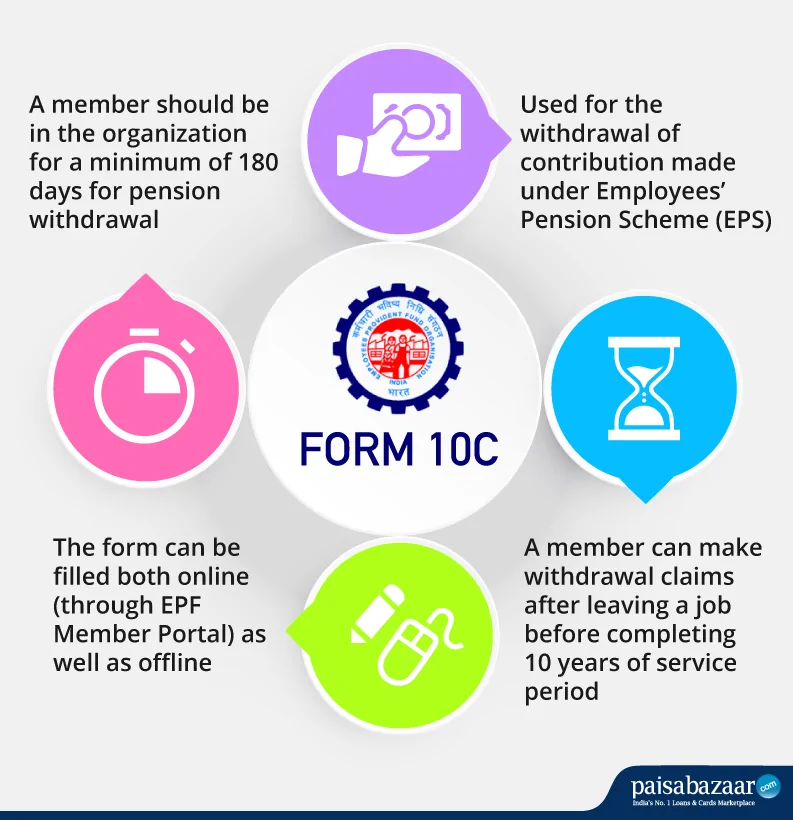

When you switch jobs, you should transfer old PF to the new one by submitting the EPS Scheme Certificate. However, the accumulated pension amount can be withdrawn using EPF Form 10C after 180 days of continuous service and before completion of 10 years of the service period.

| Note: EPF Form 10C has been replaced with EPF Composite Claim Form. To know more about EPF Composite Claim Form, click here. |

| EPF Form No. | Form – 10C |

| Purpose | Pension withdrawal or EPS Scheme Certificate |

| EPF Form 10C Download Link | https://epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form10C.pdf |

| Eligibility | After 180 days of continuous service |

| Mandatory | Yes (for pension withdrawal before 10 years of service or EPS Scheme Certificate) |

| How to Fill the Form | Both online and offline |

| When is it Filled | After leaving the job |

| Settlement Period | 20 days |

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Contents of EPF Form 10C

EPF Form 10C contains following sections that a member has to fill at the time of applying for pension withdrawal :

- Claimant’s Name

- Date of Birth

- Father’s Name or Husband’s Name (in case of married women)

- Name and Address of the Establishment, in which, the member was last employed

- Establishment Details (Office code, establishment code no. and account number)

- 5A. Date of Joining the Establishment

- Reason for leaving service & Date of Leaving

- Full Address

- Are you willing to accept Scheme Certificate in lieu of withdrawal benefits (Yes/No)

- Particulars of Family and Nominees (Spouse & Children & Nominee) – Name, date of birth, relationship with the member and name of the guardian (for minors)

- Details of the member and nominee (in case of death of the member after attaining the age of 58 years without filling the claim)

- Remittance mode (postal order, cheque or savings account)

- Whether applying to avail pension under EPS, 1995

- Signature of the employee and employer (along with the organization’s seal)

- Advance Stamp Receipt – settlement receipt for pension in the savings account

- Scheme Certificate (to be filled by PF Commissioner’s office)

How to Fill EPF Form 10C Online

A member can withdraw the pension amount when he switches a job at least after 6 months of continuous service and before completing 10 years of service period. In case you want to withdraw the pension amount instead of transferring it to the new account, follow the steps mentioned below :

- Login to EPF Member Portal using your UAN and password

- Select “Claim (Form 31, 19 and 10C)” from the “Online Services” menu

- Enter the last 4 digits of your bank account number and click on “Verify”

- Sign the “Certificate of Undertaking” and click on “Yes” to agree to the terms and conditions

- Select the “Only Pension Withdrawal (Form 10C)” in the “I want to apply for” section

- Enter your complete address, tick the disclaimer and click on the “Get Aadhaar OTP” button

- An OTP will be sent to your mobile number registered with Aadhaar (UIDAI). Enter this OTP and click on “Validate OTP and Submit Claim Form”

- Your pension claim form will be submitted and the fund will be disbursed in your bank account after verification by EPFO

Also read : EPF Forms: Complete List of Employee PF Forms

Get FREE Credit Report from Multiple Credit Bureaus Check Now

What is an EPS Scheme Certificate?

An EPS Scheme Certificate is issued by EPFO to members who want to transfer the EPS amount to the new account when they change jobs. Transferring EPS amount is optional till the service period of the employee is more than 180 days and less than 10 years.

However, once the service period of the employee is 10 years or more, he can only transfer the pension amount from one account to another using the EPS Scheme Certificate.

The certificate contains member’s details such as service history, family details, nominees, etc. It is also considered as the authentic record of service as it contains the employment history of the member.

Also read: EPF Withdrawal: How to Fill PF Withdrawal Form and Get Claim Online

FAQs Related to EPS Form 10C

1) Should I fill EPF Pension Form 10C every time I change my job?

Ans: Earlier, you have to fill Form 10C EPF every time you changed your job irrespective of your choice to withdraw or transfer the EPS amount as both actions could be performed using the same form.

However, now the PF and pension is transferred automatically from the old EPF account to the new one under the same UAN.

2) What is the next step after getting the EPS Scheme Certificate issued?

Ans: Once you change your job, you have to fill Form – 11 for self-declaration and transfer of EPF to the new account with the new organization.

You also have to submit the EPS Scheme Certificate (issued by filling EPF 10C Form) to the EPFO through the new employer to transfer the pension amount to the new account.

3) How is the service period of the employee considered?

Ans: The length of the service period is generally rounded off in multiples of six months. In case your employment duration is 3 years and 2 months, your EPS service period will be considered as 3 years.

4) My employment duration is of 120 days. What will be my pension amount if I change my job and withdraw it?

Ans: As per the Employees’ Pension Scheme, 1995, a member becomes eligible to withdraw funds parked in his EPS account only after remaining 180 days in the organization. So, in this case, you will not get any amount from your EPS account.

However, you can withdraw 75% of the EPF amount after 1st month of unemployment (and not the EPS amount). The remaining 25% EPF amount can be withdrawn after 2 months of unemployment.

5) I have remained in the organization for 8 months. How much pension amount will I get if I withdraw the fund?

Ans: If you change your job after 8 months, your service period for EPS will be rounded-off to 6 months and you will get the corpus equivalent to 6 months’ EPS amount. However, you can claim EPF amount for 8 months in case of unemployment.