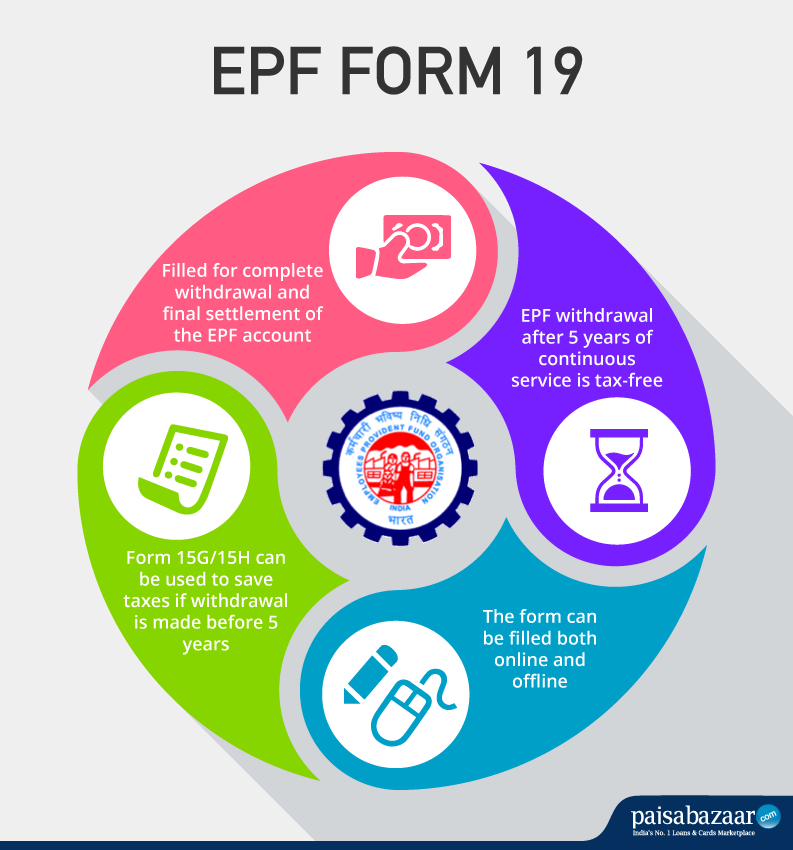

Employees’ Provident Fund (EPF) is a retirement scheme where an employee and his employer contribute a part of the salary during the service period and the member withdraws the lump-sum amount on retirement. An employee can also request for the final settlement of the EPF account once he leaves the job. He has to fill EPF Form 19 to withdraw funds from the EPF account for final settlement.

| Note: EPF Form 19 has been replaced with EPF Composite Claim Form. To know more about EPF Composite Claim Form, click here. |

What is EPFO Form 19 – PF Final Settlement

EPF Form 19 or PF Form 19 is used for final settlement of an employee’s Provident Fund account. This claim form can be used by individuals after they leave their job or retire from their company to initiate the withdrawal process of the employee’s accumulated PF savings, which also include the employer’s contribution and interest.

| EPFO Form 19 Highlights | |

| Purpose/When Can you Use Form 19 |

Final settlement |

| EPF Form 19 Download Link | https://epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form19.pdf |

| Eligibility | All existing employees who want to close their existing EPF account |

| Mandatory | Yes (for final settlement) |

| How to Fill the Form | Both online and offline |

| When is it Filled | At least 2 months after leaving the company |

Important Points to Remember while Filling EPF Form 19

- EPF withdrawal Form 19 can be filled only after two months of leaving the job or on retirement.

- The employee has to provide his mobile number for final settlement

- The form can be filled both online (at EPF Member Portal) as well as offline.

- PAN is also mandatory for claiming final settlement

- The employer’s signature and seal of the organization is mandatory for the offline settlement process

Don’t Know your Credit Score? Now Get it for FREE Check Now

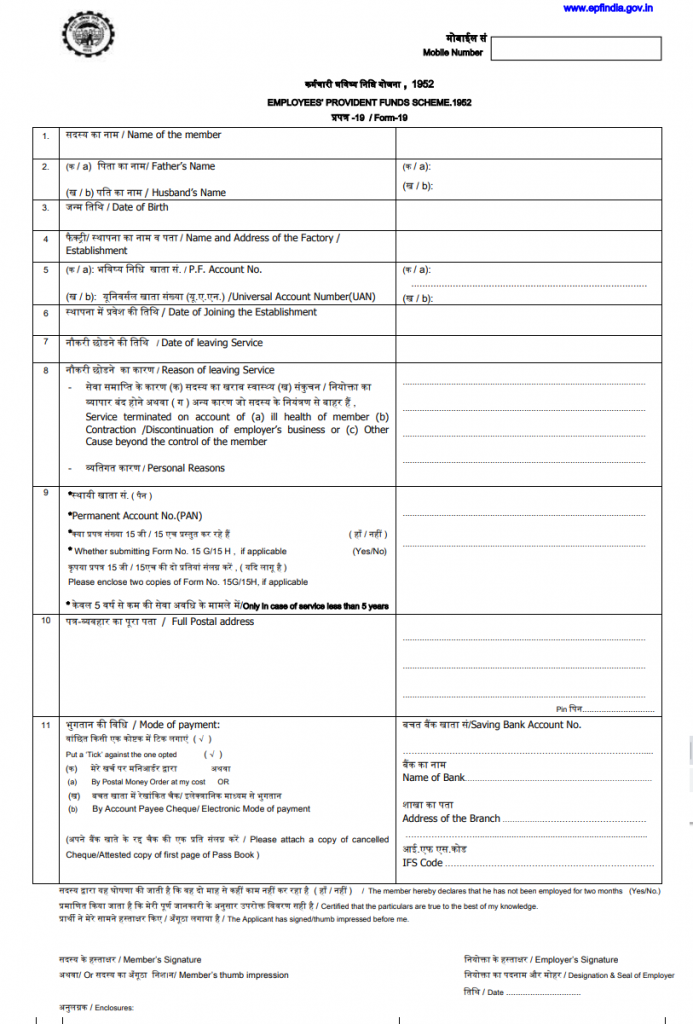

EPF Form 19 Sample Format

Form 19 EPF has the following sections:

- Name of the Member

- Father’s Name or Husband’s Name (for married women)

- Date of Birth

- Name and Address of the Factory/Establishment

- P.F. Account No. and UAN

- Date of Joining the Establishment

- Date of leaving Service

- Reason for leaving Service

- Permanent Account Number (PAN)

- Full Postal address

- Mode of Payment

The member’s signature, as well as the employer’s signature, is required.

The advance stamp receipt has to be filled when you need the payment by cheque. An advance stamp means that you have to affix a revenue stamp of Rs. 1 to the form and sign across the stamp. If you choose the ECS option (electronic credit), you do not need an advance stamp.

The employee has to provide his mobile number at the beginning of the form.

How to Fill EPF Form 19 Online

Once you leave a job, you can either settle your PF account or transfer it to the new EPF account in the new organisation. In case you want to make a final settlement, you can fill EPF Form 19 both online as well as offline. You have to follow the steps mentioned below to fill up the EPFO online claim form:

- Login to your UAN account at the EPF Member Portal

- Click on “Claim (Form – 31, 19, 10C & 10D)” in the “Online Services” section.

- Enter the last 4 digits of your linked bank account and click on “Verify”

- Click on “Yes” to sign the “Certificate of Undertaking”

- Select the option “Only PF Withdrawal (Form-19)” from the drop-down menu in the “I want to apply for” section

- A new section of the form expands where you have to mention your complete address. Tick the disclaimer and click on “Get Aadhaar OTP”.

- An OTP will be sent to the number registered with UIDAI (Aadhaar)

- Enter this OTP in the space provided and submit your application.

- A reference number will be generated after the successful submission of your application

- The withdrawal amount is deposited in the bank account linked with your UAN in 15-20 days.

Get Your Latest Credit Score in Just 2 minutes Check Now

Pre-requisites for Filling EPF Form 19 Online

Here are a few pre-requisites that you must consider before filling up the EPFO online claim form:

- You should first activate your UAN at the EPF member portal

- Your bank account and PAN should be mandatorily linked with UAN

- Your mobile number should also be linked with UAN

- If you are not eligible for final settlement, EPF Form 19 will not be displayed in your withdrawal form. However, if EPF withdrawal Form 19 is present in options, you will find Form 10C as well.

Withdrawing EPF Funds Offline — Composite Claim Form

Composite Claim Form is a combination of EPF Form 19, Form 10C, and Form 31. Form 19 is filled for PF final settlement, Form 10C is filled for pension withdrawal and Form 31 is filled for partial EPF withdrawal. However, only the Composite Claim Form has to be filled for withdrawing funds offline.

Also Read: EPF Withdrawal: How to Fill PF Withdrawal Form and Get Claim Online

FAQs on EPF Form 19

1) What reasons are considered valid for leaving the service?

A. Following reasons are considered valid if the employee makes a claim for final settlement. These reasons have to be given for offline withdrawals. For online withdrawals, these reasons/points are not present in the form :

- Ill health of the member

- Contraction/Discontinuation of employer’s business

- Other causes beyond the control of the member

- Personal Reasons

2) Do I have to submit Form 15G/ Form 15H if I have claimed Final Settlement online?

A. If you want to save tax on EPF withdrawal (in case the withdrawal amount is more than Rs. 50,000 and the service period is less than 5 years), you have to submit Form 15G. Attach 2 copies of the form at the time of submitting the form offline.

3) Will my employment with all employers be counted at the time of PF withdrawal?

A. Total service in the present, as well as previous employment, is considered at the time of EPF withdrawal.

4) Is the revenue stamp required for an online application?

A. No, you do not have to submit a revenue stamp for online applications. However, for offline applications, you have to affix a revenue stamp of Rs. 1 and cross-sign it at the time of submitting the application in case you want the payment through cheque.

Note: The revenue stamp is no longer required since the Composite Claim Form is a cumulative form that has now replaced EPF Form 19, 31C and 31.

5) Can I claim the EPF settlement amount through cheque?

A. Yes, you can claim the EPF settlement amount through cheque. You have to mention the following details in the form itself :

- EPF withdrawal amount

- Rs. 1 Revenue stamp

- Signature of the applicant

6) What happens to the EPS amount if the EPF complete withdrawal is made using Form 19 but the EPS amount is not withdrawn using Form 10C?

- If you have cumulative service tenure of fewer than 10 years then the funds remain as it is to your PF account. You can claim for the EPS amount at any time using form 10C. The claim can be made both offline or online through the UAN Member e-Sewa Portal.

- In case your cumulative service tenure is more than 10 years, then you can not claim for EPS withdrawal. However, you will be eligible to receive an EPS pension once you attain the age of 58 years.

7) Can I submit EPFO Form 19 through my employer?

EPF Form 19 can either be submitted online via the UAN member portal or offline by visiting the nearest EPFO office in person.

8) What are the consequences of not submitting EPFO Form 19 after leaving a job?

Unless you fill and submit the EPF Form 19 you will not be able to withdraw your EPF corpus.

9) Can I withdraw my entire PF amount using EPFO Form 19?

You can only withdraw the EPF amount from your PF account using EPFO Form 19. To withdraw the EPS corpus, you need to fill and submit Form 10C.

10) What happens if there are discrepancies in EPFO Form 19 submission?

In case there are discrepancies or errors in EPF Form 19 or its submission, you will not be able to withdraw your EPF corpus.

11) Can I track the status of my EPFO Form 19 online?

Yes, you can track the status of your EPFO Form 19 online via the UAN Member portal, EPF website or UMANG app.

Read more about How to Track EPF Claim Status

12) Can EPFO Form 19 be used for partial withdrawal of PF amount?

No, earlier Form 31 had to be used to make partial withdrawal from your EPF account. However, the new EPF Composite Claim Form has now replaced Form 31, 19 & 10C.

4 Comments

how to close pf account OR how to apply pf full settlement online without PAN linking?

Its mandatory to link your PAN with UAN to claim a full settlement of your EPF account.

form 19 (pf final settlement) or form 19 in epfo online submit fee?

There are no fees/charges when submit PF Form 19 for final settlement of your EPF account.