Employees’ Provident Fund (EPF) is a form of a social security scheme in which members must contribute a portion of their salary and the employer also contributes into this fund on behalf of workers. Each and every employee has to submit a declaration and nomination under the Employees’ Provident Fund Scheme, 1952 and Employees’ Pension Scheme, 1995. The employee has to file a nomination through the EPF Form 2 so that the nominated person gets the fund accumulated in the account in case of unfortunate death of the employee.

Note: EPF members can now add/update/change their nominations online on their own using the e-nomination form via the EPF member portal. Earlier nominations were made using EPF Form 2, which the employer would submit offline to EPFO.

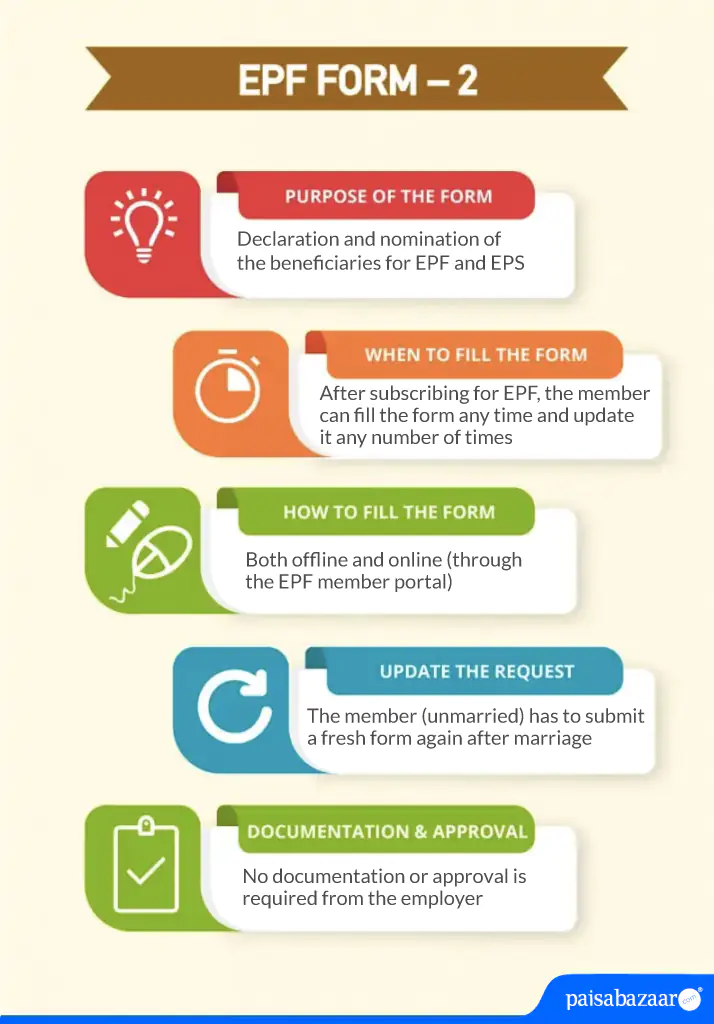

| EPF Form No. | Form – 2 |

| Purpose | Declaration and Nomination of the beneficiary |

| Download Link | https://goo.gl/Vvg4JT |

| When to Fill | Any time after getting enrolled in the scheme |

| How to Fill | Both online and offline facilities are available |

| Update Required | After marriage, the form has to be filled again |

| Submission Limit | There is no limit and the member can change his nominations as many times as he wants. |

| Documents | No additional documents required |

| Approval | No approval required from the employer or the PF Commissioner |

Don’t Know your Credit Score? Now Get it for FREE Check Now

Contents of EPF Form 2

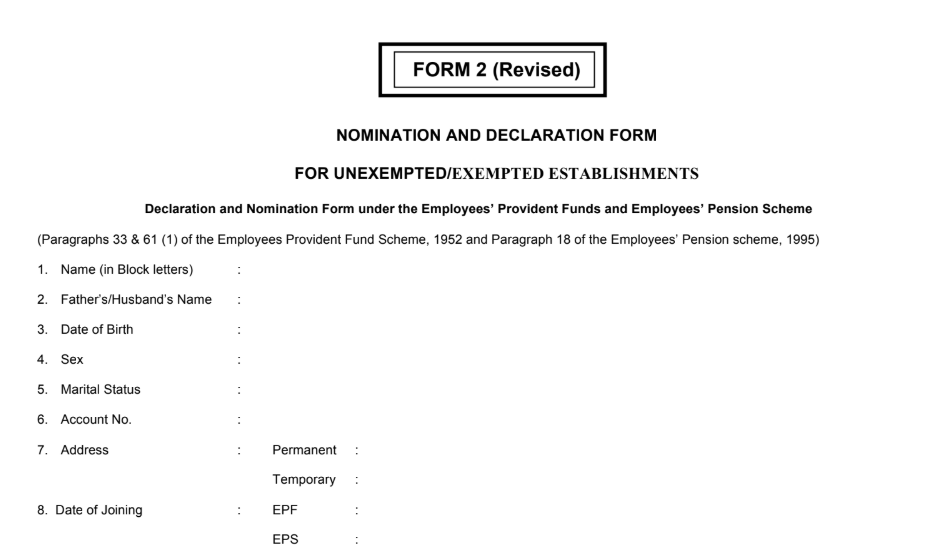

EPF Form 2/PF nomination form has four sections, namely – General Information, Part – A (EPF), Part– B (EPS) (Para–18) and Certificate by the Employer.

General Information

- Name of the member

- Father’s/Husband’s Name

- Date of Birth

- Gender

- Marital Status

- Account Number

- Address Permanent & Temporary

- Date of Joining in EPF and EPS

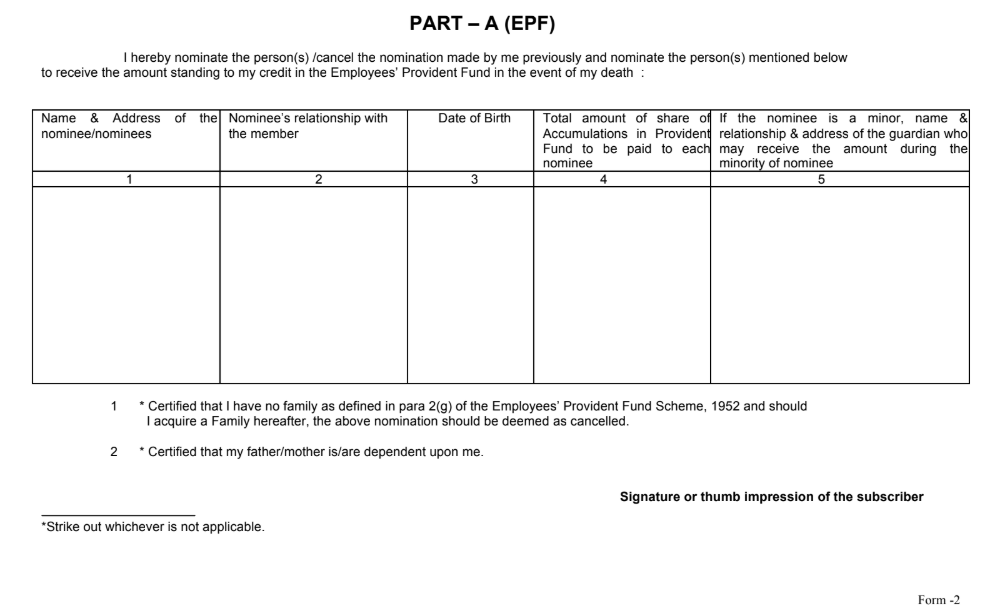

Part – A (EPF)

In this section, EPF account holder is to give information about the nominee whom he or she would like to nominate to receive EPF account balance in case of his or her death. Following details have to be provided in this section:

- Name of the Nominee(s)

- Address

- Nominee’s relationship with the member

- Date of Birth

- Total amount or share of accumulations in Provident Funds to be paid to each nominee

- If the nominee is a minor, name and address of the guardian who may receive the amount during the minority of the nominee

- Signature or thumb impression of the subscriber

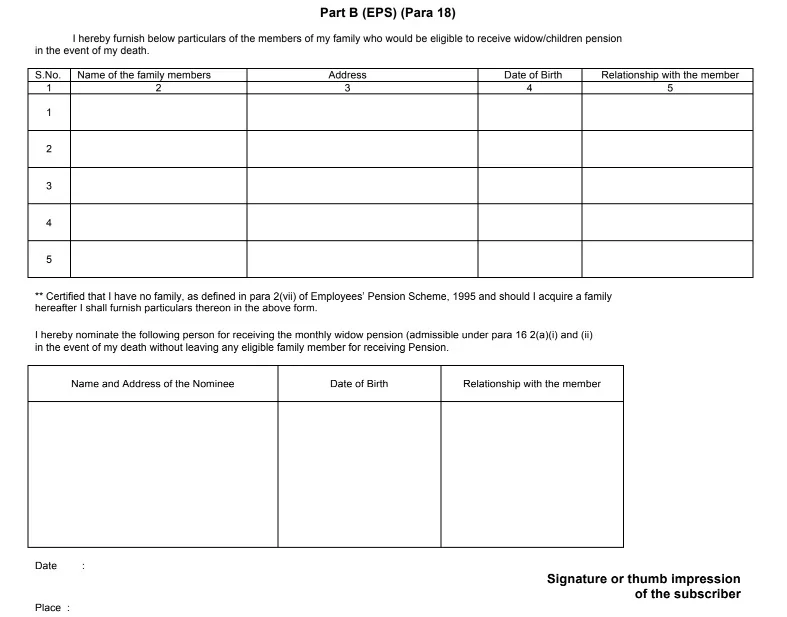

Part – B (EPS) (Para 18)

EPS is the abbreviation for Employees’ Pension Scheme. 8.33% out of 12% of employer’s contribution in EPF is deposited in the EPS account of the member. The EPS proceeds of a member’s PF account is also disbursed to eligible nominees. This section requires you to furnish details of the family member(s) eligible to receive the pension. The member has to mention following details in this section:

- Name of the family member

- Address of the family member

- Date of Birth

- Relationship with the member

- Signature or thumb impression of the subscriber

In case of nomination for monthly widow pension (admissible under Para 16 2(a) (i) and (ii)), the member has to give detail such as:

- Name and address of the nominee

- Date of Birth

- Relationship with member

Certificate by the Employer

The employer has to certify the details mentioned in the form and has to mention following details in the form:

- Name of the employee

- Authorized officer’s Signature

- Designation of the officer

- Date

- Place

- Name and Address of the organisation and Stamp

Also Read: EPS

Don’t Know your Credit Score? Now Get it for FREE Check Now

How to Fill e-Nomination Online

A member who has already registered his UAN at the unified EPF Member Portal can fill his e-Nomination online. In case you have not registered at the EPF member portal, you will have to first activate your UAN and then follow these simple steps for e-Nomination:

- Login to the EPF member portal using your UAN, password and the OTP received on your registered mobile number

- Select the “e-Nomination” option from the “Manage” section

- Enter your “Permanent Address” and “Current Address” in your “Profile” and click on “Save”.

- Select whether you have a family or not.

- Enter details of the family member such as Aadhaar number, name, date of birth, gender, relation, address, guardian (in case of minors) and click on “Save Family Details”. In case you want to add more nominees, select the “Add Row” option

- Now select the nominees from the list and enter the total amount of share. Now click on “Save EPF Nomination

- Your nomination details will be saved and the nominees will get the fund in the proportion mentioned by you in the form. Follow the same steps for the EPS section for availing benefits of the pension scheme.

- To complete the process you are required to ‘e-sign’ the nomination made by you. For this, select the “e-nomination” option listed under the “Manage” section.

- Next, enter the virtual ID of your Aadhaar and click on “Verify”.

- Given your consent for Aadhaar’s e-KYC services.

- Enter your Aadhaar or Virtual ID again and click on “Get OTP” to get an OTP on your mobile number linked with Aadhaar card.

- Enter the OTP to successfully register your nomination with EPFO. Once you complete your EPF, EPS nomination digitally, no further physical documents are required.

Family Members

A married employee with his or her parents and those who are dependent on the employee or without parents can nominate one or more family members. A member has to keep following points in mind while nominating the family member(s) through Form – 2:

In Employees’ Provident Fund Scheme

A family is defined in the Employee’s Provident Fund Scheme as:

- In the case of Male Employees, the nomination can be filled for:

-

- Wife

- Children

- Dependent parents and

- Widow of son and children

- In the case of Female Employees, the nomination can be filled for:

- Husband

- Children

- Dependent parents

- Husband’s dependent parents

- Spouse’s dependent parents

- Widow of son and children

In Employee’s Pension Scheme

A family is defined as:

- Spouse of the employee

- Minor son and unmarried daughter of an employee

- Adopted son or daughter who was adopted before the death of an employee

Important Points to Remember while Nominating Family Members

- The subscriber can change his/her nomination whenever he/she wants to do so.

- The nomination should be in favour of one or more member(s) of the family.

- If the member has no family, he or she can nominate anyone.

- There can be more than one family member as nominees with a defined percentage of the amount to be received by each.

- Every person who joins an EPF-qualified establishment (where 20 or more persons are employed) on or after 16-11-1995 is compulsorily required to join the EPS provided his or her salary is up to ₹ 15,000 per month.

- Minimum 10 years of eligible service will entitle the employee for a pension.

- If the employee has family members, he cannot nominate anybody out of the family.

- Once an unmarried member marries, he will have to file a fresh nomination again.

FAQs on EPF Form 2

Q. What is the purpose of submitting PF nominations?

Making PF nominations helps the nominated person get the fund accumulated in the PF account in case of the unfortunate demise of the EPFO member.

Q. What is EPF Form 2?

EFP Form 2 is the nomination and declaration form that an employee can fill any time after getting enrolled into the EPF scheme.

Q. What information is required in EPF Form 2?

EPF Form 2 has four sections which require the employee to provide his general information, EPF and EPS related details along with a certificate by the employer.

Q. What happens if EPF Form 2 is not submitted?

In case EPF Form 2 is not submitted, the member would not have a clear nominee. Moreover, in case of the employee’s unfortunate demise, the entire accumulated corpus would be paid to the family members in equal shares or to the people who are legally entitled to it if there are no eligible family members.

Q. What is the purpose of EPF Form 2?

The main purpose of EPF Form 2 is to have a clear declaration and nomination of the beneficiary who would receive the entire corpus in case the EPF member passes away before collecting the pension.

Q. What documents are required along with EPF Form 2?

No, additional documents are required to fill EPF Form 2/PF Form 2.

Q. Can EPF Form 2 be submitted directly to the EPFO by the employee?

No, EPF Form 2 needs to have a certificate by the employer and can be only be submitted to EPFO by the employer. However, you can now also file your e-nomination online by logging into the EPF member portal.

Your email address will not be published and will be used to send a reply to your query.

2 Comments

pf form 2 download form 2 pf necessary if i have filed my e-nomination online?

Once you have filed your EPF e-nomination online, you need not download or submit EPF Form 2.