Employees’ Provident Fund (EPF) is a retirement benefits scheme under which the employee and his employer make contributions during the service period and avail benefits on retirement at the age of 58 years or before retirement (in special cases). There are instances when the member is not able to provide the service till retirement. In case of unfortunate death of a member, the surviving family gets an insurance of up to Rs. 7

Lakhs under the EDLI scheme and monthly widow/child/orphan pension under the EPS scheme. The family can also claim provident fund withdrawal using the EPF Form 20. This form can also be used to claim withdrawal in case of a minor or a lunatic member.

Get Free Credit Score with monthly updates Check Now

|

EPF Form |

Form 20 |

| Purpose | EPF withdrawal claim in case of minor/lunatic/deceased members |

| Link | https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form20.pdf |

| Eligibility | The deceased should be a member of the EPFO |

| How to Fill | Offline |

| When to Fill | In case of death of the member |

| Documents | Death certificate is mandatory |

How to Fill EPF Form 20

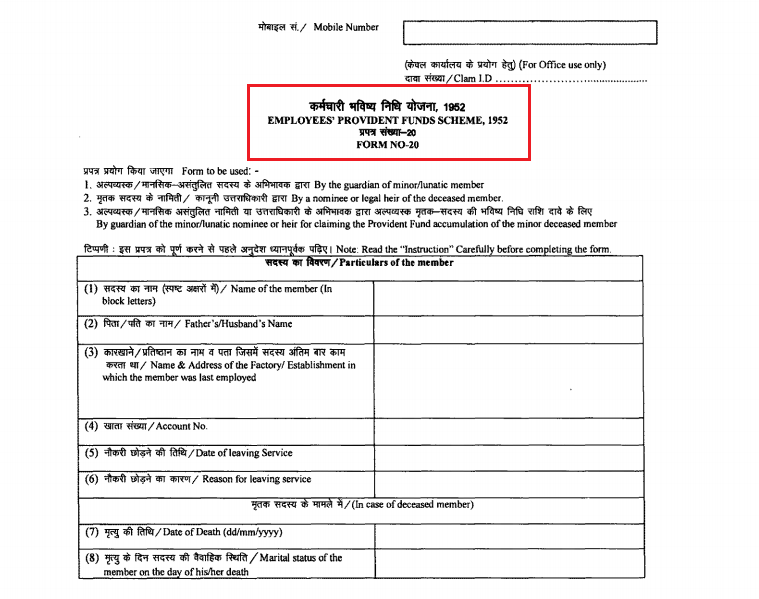

An applicant (family member/heir/nominee/guardian of the member) can fill the EPF Form 20 offline and submit it to the EPF Commissioner’s office through the employer along with the required documents. The EPF Form 20 has the following fields that the applicant has to fill with due diligence:

Mobile Number – Mention the applicant’s number to get timely SMS alerts on the EPF withdrawal status.

Particulars of the Member

- Name of the Member

- Father’s/Husband’s Name (in case of married women)

- Name and Address of the Establishment in which the member was last employed

- EPF Account Number

- Date of Leaving the Service

- Reason for Leaving the Service (Mention “Death” in case of the deceased member)

- Date of Death (dd/mm/yyyy)

- Marital status of the member on the day of his/her death

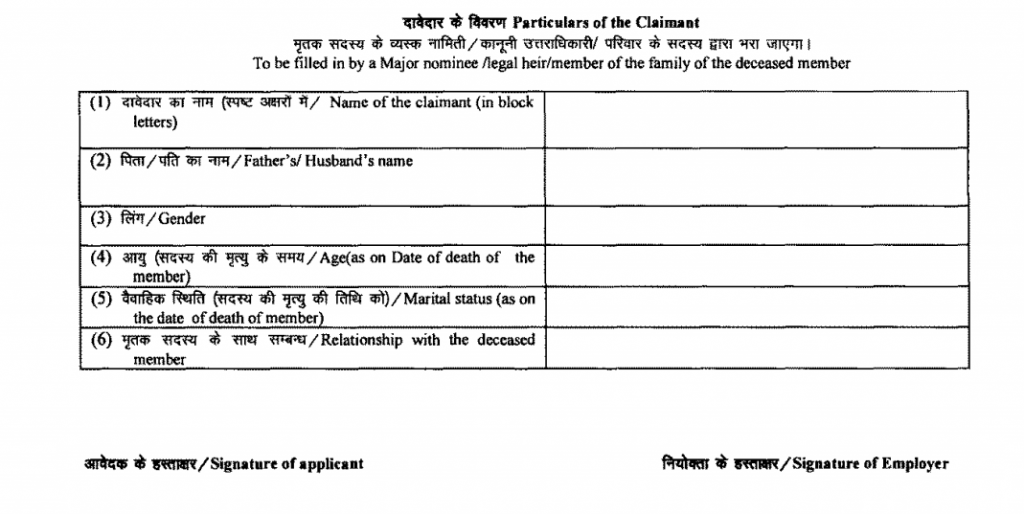

Particulars of the Claimant

- Name of the Claimant

- Father’s/Husband’s Name

- Gender

- Age (as on the date of death of the member)

- Marital Status (As on the date of death of the member)

- Relationship with the deceased member

Section to be filled by the Guardian/Manager of Minor/Lunatic Member

or

Guardian of Lunatic/Minor Nominee(s)/Legal Heir (s)/Family member (s) of the Deceased Member

- Name of the Claimant

- Father’s/Husband’s Name

- Relationship with the minor/deceased member

- Claimant’s Full Postal Address (in block letters)

- Mode of Remittance

- By Postal Money Order

- By account payees cheque/electronic mode sent to S.B. A/C (Scheduled Bank/PO)

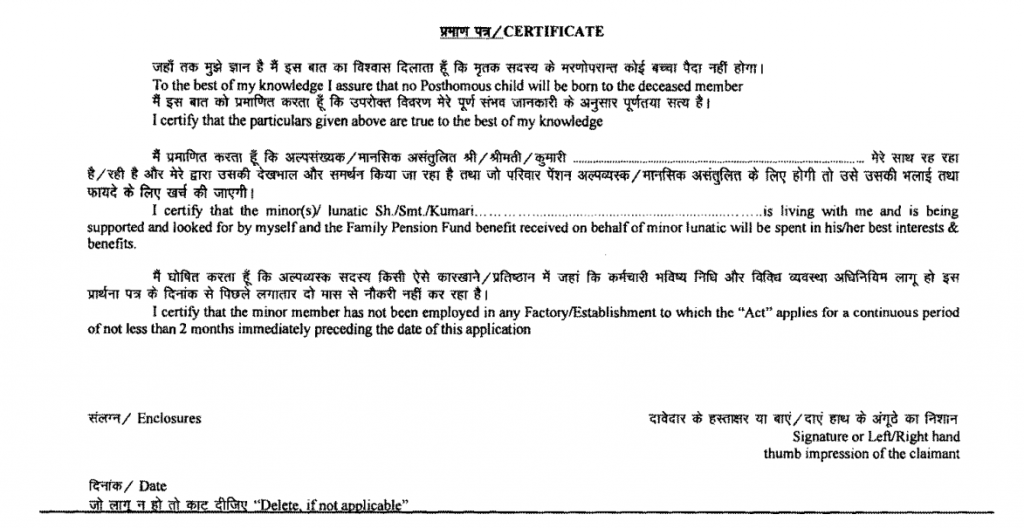

Certification by the claimant

Advance Stamped Receipt [To be furnished only in case of amount disbursal through cheque and bank account]. This acknowledges receipt of EPF money.

Get Free Credit Score with monthly updates Check Now

Eligibility for EPF Form 20

The EPF Form 20 can be filled by any of the following claimants :

- By the guardian of minor/lunatic member

- By a nominee or legal heir of the deceased member

- By guardian of the minor/lunatic nominee or heir for claiming the Provident Fund accumulation of the minor deceased member

Attestation of EPF Form 20

EPF Form 20 has to be forwarded to the EPFO through the employer under whom the member was last employed. The employer, as well as the claimant, has to sign each and every page of the form.

In case the establishment is closed, the form has to be duly verified and attested by any one of the following signatories :

- Magistrate

- Gazetted Officer

- Post or Sub-Post Master

- President of Village Union

- President of the Village Panchayat where there is no Union Board

- Chairman or Secretary or Member of the Municipal or District Local Board/Member of Parliament/Legislative Assembly/Member of Central Board of Trustees

- Regional Committee of Employees’ Provident Fund (EPF)

- Manager of the Bank in which the Saving Bank Account is maintained

- Head of any recognized educational institution

Document Required

- Death certificate, in case the application is by the nominee/surviving family members or their guardian/legal heirs after the death of the member.

- Guardianship certificate issued by a competent court of law, if the application is forwarded by a guardian other than the natural guardian of minor member/nominee/family member/legal heir

- Cancelled cheque so that the payment may be sent through ECS in the claimant’s account

- EPF Form 5 IF for claiming the benefits under the Employees’ Deposit Linked Insurance Scheme (EDLI) if the member dies while in service

- EPF Form 10D for claiming the pension benefits such as widow pension, children pension and orphan pension

- EPF Form 10C for pension withdrawal in case the member has died after 58 years of age and has not completed 10 years of service as on the date of crossing 58 years age.

Points to Remember while Filling

- Mention your mobile number to get SMS alerts on different stages of approval

- Mention all details in BLOCK LETTERS in the form

- Submit the cancelled cheque of the bank account to get the amount disbursed in your bank account

- The address mentioned should be complete and contain the PIN Code.