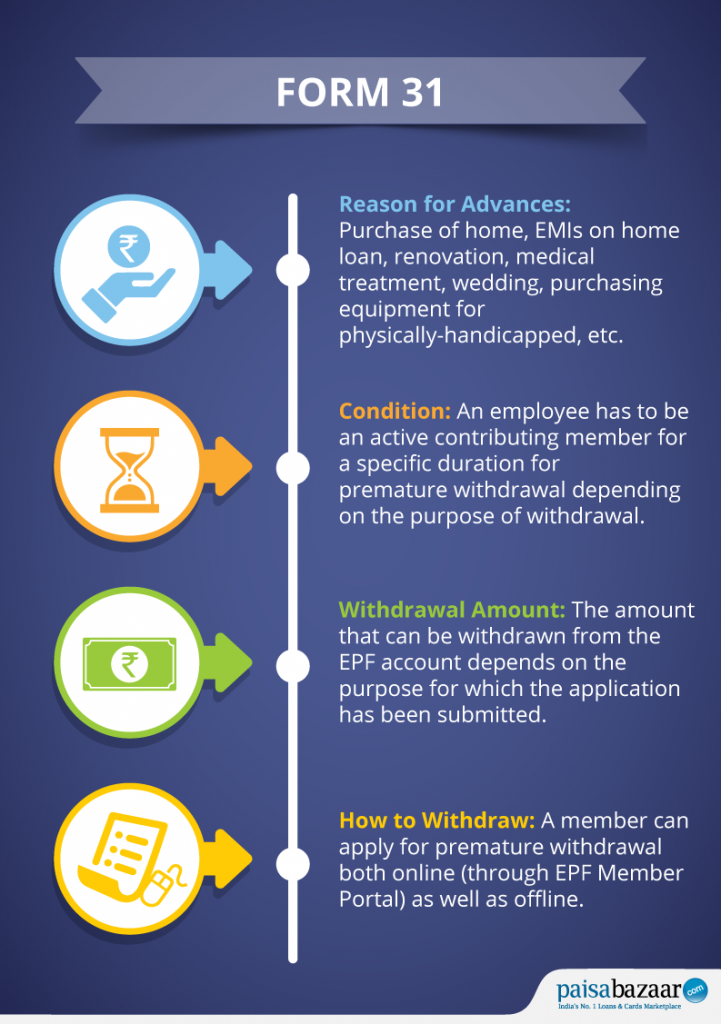

Enabling savings amongst the working class in the country, the government of India came up with the Employee Provident Fund (EPF) wherein a fixed amount is transferred from the employee’s and the employer’s salary account to the employee’s PF account. Employees’ Provident Fund (EPF) helps employees build a corpus for their retirement. However, this corpus can also be utilized to meet various requirements during the employment period. Under certain conditions, members can even apply for partial withdrawals from their PF account by submitting EPFO Form 31 – Application for Advance from the Fund.

| Note: EPF Form 31 has been replaced with EPF Composite Claim Form. To know more about EPF Composite Claim Form, click here. |

Table of Contents:

| EPF Form No. | Form – 31 |

| Purpose | Application for Advances (partial withdrawal) from EPF |

| Link | https://epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form31.pdf |

| Mode of Filling | Both Online and Offline |

| Additional Requirements | Relevant documents have to be submitted |

| Reason for Advances | Home loan, medical requirement, wedding, etc. |

EPF Form 31 can be filled online as well as offline. The employee has to manually fill his details in the form while applying offline, whereas, if the employee fills the EPF withdrawal Form 31 online, most of his/her details will be auto-filled. However, the member has to register his UAN to avail the online service.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Declaration in EPF Form 31

EPF Form 31 is used to make declaration for partial withdrawal of your EPF corpus that has been otherwise reserved for the purpose of retirement. It must be noted that partial withdrawal from EPF is allowed only certain specific conditions such as purchase/construction of home, repayment of home loan, medical emergencies, wedding of self/sibling/child, or education of child/sibling. However, certain eligibility conditions must be met in order to be eligible for the application of such withdrawal.

The form serves as a proof of the fulfillment of the purpose of withdrawal and must be filled and signed duly by the employee. Certain sections of Form 31 need to be filled in by the employer and the EPF commissioner as well, apart from the details filled in by the employee himself. It is of utmost importance that the information provided in the form is up to date and stands true, and must be submitted along with the relevant documents required.

How to Download EPF Form 31

For EPFO Claim Online Form 31 download, you need to follow the steps given below-

- Visit the EPFO portal here

- Log in to the portal using your UAN, password and the OTP received on your registered mobile number

- Go to the ‘Online Services’ section and select ‘Claim’

- This will open a new page wherein you will be asked to enter your details such as name, date of birth, father’s name, PAN, Aadhaar number, date of joining the company, and mobile number.

- Click on ‘Proceed for Online Claim’

- On the next page that opens, from the dropdown menu, select ‘PF Advance (Form 31)’

- Select your reason for taking the advance and enter the amount and your current address

- Sign the disclosure that appears; check the box saying, ‘Get Aadhaar OTP’

- Enter the OTP that you will receive on the registered mobile number and click on ‘Validate OTP and Submit Claim Form’

Submission of Physical Application Through Form 31

For physical submission, you can download the EPF Form 31 from the EPFO website, fill up the necessary details and submit the form at your respective jurisdictional EPFO office after getting it attested by your employer.

How to Fill EPF Form 31

As you download the EPF Form 31, you will be required to fill certain details yourself. The remaining details need to be filled in by your employer and the EPF Commissioner.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Details to be Filled in by the Employee

- Mobile Number

- Purpose for Advances

- Amount of Advances required

- Name of the member

- Father’s Name/Husband’s Name (in case of married women)

- Name and Address of the Employer

- PF Account Number

- Monthly Basic Wages and Dearness Allowance

- Full Postal Address of the applicant

- Signature of the Employee

- Mode of Remittance

- In whose favour cheque is to be drawn (in case of home loans, EMIs, etc.)

- For any other reason, provide your bank account details

- In case of Advances for marriage, provide complete details such as name, age, date of marriage, address

- Advance Stamp Receipt (Fill the amount)

Also read : EPF Forms: Complete List of Employee PF Forms

Details to be Filled in by the Employer

- Certification by the Employer

- Signature, date, and designation (along with the stamp of the establishment)

- Enclosures

Details to be Filled in by the EPF Commissioner

- Section

- Account number

- Fund to reimbursed

- Mode of Remittance

- Signature of the Accounts Officer

Also Read: EPF Withdrawal: How to Fill PF Withdrawal Form and Get Claim Online

Documents Required Along with EPF Form 31

The following documents have to be produced along with Form 31 depending on the purpose of EPF withdrawal :

| Documents for EPF Withdrawal | |

| Purpose of EPF Withdrawal | Document Required |

| Buying a House | Declaration, Registration certificate of the property |

| Repayment of Loans | Outstanding principal and interest certificate by the lending agency |

| Grant of Advances in special cases | Certificate from the Employer |

| Medical Illness | Certificate by the employer and the doctor |

| Marriage | Declaration to be done in Form 31 itself |

| Physically handicapped | Certificate from the concerned doctor |

| Withdrawal before Retirement | Declaration by the Member |

Purpose of EPF Withdrawal

Employees can withdraw the amount from PF account as an advance for the following purposes through Form 31:

- Eligibility conditions for the Purchase or addition/alteration/improvement/repair of house/flat, construction of house including the acquisition of site:

-

- Completion of 5 years of service is mandatory

- Withdrawal of 24 months’ pay (Basic + DA) is allowed for the purchase of a plot

- Withdrawal of 36 months’ pay (Basic + DA) for the purchase of house/flat/construction or total cost, whichever is lower

- Withdrawal allowed only once during the service period

-

- Eligibility conditions for the Repayment of Loans in Special Cases

- Minimum service period required is of 10 years

- A member can withdraw at least of 36 months’ pay or a total of employee’s and employer’s share plus interest or total outstanding principal with interest, whichever is lesser.

- Certification from the lending agency indicating the principal and interest amount is required

- Eligibility conditions for the Grant of Advances in special cases

- In case of lockout/closure of establishment for more than 15 days and the employees are unemployed without compensation or

- Employees have not received pay for more than 2 months continuously for reasons other than strike or

- Discharge/dismissal/retrenchment of member challenged by him/her in Court, (50% of EPF withdrawal is allowed) or

- In case of establishment’s closure for more than 6 months and employees continue to be unemployed without compensation

- Eligibility conditions for the Advance for an illness of his/her own treatment or family

- Withdrawal of up to 6 months’ pay or employees share plus interest, whichever is lesser

- No service limit is required for availing the advances

- Certification by the employer and a doctor is mandatory

- Eligibility conditions for the Advance for marriage of self/daughter/son/brother/sister or post matriculation education of son/daughter

- Withdrawal allowed only after 7 years of contribution in PF account

- The member can withdraw a maximum of 50% of the employee’s share plus interest

- Withdrawal allowed for this purpose is three times during the service period

- Eligibility conditions for the Advance to physically-handicapped members for purchasing equipment for minimizing hardship

- Lowest of the 6 months’ pay or employees share plus interest or cost of equipment of withdrawal is allowed

- Second withdrawal is allowed after 3 years of first withdrawal

- Eligibility conditions for the Withdrawal within one year before retirement

- Withdrawal is allowed after 54 years of age and within 1 year of retirement, whichever is later.

- Maximum 90% of the amount in the EPF account of the member can be withdrawn.

Check EPF Form 31 Claim Status

Here’s how you can check EPF Form 31 claim status-

- Visit the EPFO website using this link

- Select ‘Know your Claim Status’

- The page will show you a dropdown list from where you have to select the location of your PF office

- The next page will display your region code and your office code

- Enter the Establishment code that you may have

- You will now be asked to enter your 7-digit account number

- ‘Submit’ your form and you will be able to see the status of your application on the next page

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Points to Remember while Filling EPF Form 31

- Attach cancelled cheque with the form for verification in case you want disbursal of the fund in your bank account.

- Money order can be used as the payout option only when the amount is below Rs. 2,000.

- In case of offline application, certification by the employer is necessary.

- EPF Form 31 online claim applications can be filed only if the member has linked his bank account, Aadhaar, and PAN with his UAN.

- The bank account has to be verified by entering the last four digits of the bank account if the claim is filed online.

- It generally takes a couple of weeks to process the claims and remit funds.

FAQs on EPF Form 31

Q1. Why is my EPF Form 31 rejected?

The EPF Claim Form 31 can get rejected due to any of the following reasons-

- You have availed the claim already in past

- You failed to submit the signed claim form within 15 days of making the online claim application

- The details entered by you do not match the previous records

- Your signature doesn’t match with the records in your office

Q2. What is the processing time for EPF Form 31/Form 31 PF withdrawal time?

The online application of the withdrawal process may take around 5-30 days to get the PF amount in your registered bank account.

Q3. How much amount you can claim through Form 31?

The amount you can withdraw from your PF corpus or Form 31 PF withdrawal limit depends upon your reason for withdrawal and the time period you have been in service.

Q4. How to cancel your EPF Form 31?

Once you have applied for PF withdrawal and submitted Form 31, you are not allowed to cancel your application. You may contact the EPFO Regional Office in case of urgent situations.

Q5. What does under process mean?

‘Under process’ implies that your application is still in consideration and that it is being processed. In such cases, you must keep a check on your claim status till it gets approved and states that ‘your claim has been settled’.

Q6. How many times can you claim Form 31?

You can withdraw your PF 2-3 times on a non-refundable basis, at a minimum gap of 6 months between the loans. However, you can only withdraw once for one specific reason.

Q7. How long is the withdrawal process?

It generally takes around a couple of weeks to process the application and transfer the funds.

Q8. Can I withdraw the entire amount from my EPF account using EPF Form 31?

No, EPF Form 31 can only be used for partial withdrawal. To withdraw your entire EPF corpus you need to fill up EPF Form 19. However, both these forms have now been replaced by a combined EPF Composite Claim Form.

Q9. Can I withdraw funds from both EPF and EPS (Employees’ Pension Scheme) using EPF Form 31?

EPF Form 31 can only be used for partial withdrawal from your EPF account. To withdraw your money from your EPS account, you need to submit Form 10C.

Q10. Is there any tax implication on the amount withdrawn using EPF Form 31?

Yes, TDS will be deducted at a rate of 10% withdrawal is made within the initial 5 years of service and if the withdrawal amount is more than Rs. 50,000. However, in case you fail to provide your PAN details, TDS will be deducted at a rate of 30%.

Q11. Can I withdraw funds using EPF Form 31 if I am still employed?

Yes, partial withdrawal can be made while you are still employed, provided you meet the eligibility criteria.

Q12. What should I do if I face delays in processing my EPF Form 31 withdrawal?

You can send an email to employeefeedback@epfindia.gov.in. or call on the EPFO toll-free number 14470.

4 Comments

My PF withdrawal request is settled on 10th july 2024 its showing in PF portal but i have not received any text messages. I visited to branch they denied for receiving money from PF office. I raised compliant in PF Grievance portal but they are replying pf is settled and money is sent to linked bank account on 11th july 2024

Please guide for this issue

You can log into your EPF portal and double-check the bank account details linked to your PF account. Ensure that the account number, IFSC code, and other details are correct.

If there’s an error in the bank account details, you can submit a request for correction.

If everything seems correct at your bank’s end and they have no record of the transaction, ask the PF office (EPFO) for a payment confirmation. This can be done through the PF Grievance Portal again, requesting specific transaction details such as the UTR number (Unique Transaction Reference) for the transfer.

If the issue remains unresolved, escalate it on the EPF Grievance Portal by selecting a higher authority in the hierarchy. Provide all the details, including your bank statement showing that the funds have not been credited.

What is the fee to download or submit epfo claim online form 31, form 31 in epfo?

You are not required to pay any charges or fee to download or submit EPFO claim online Form 31.