All members of EPFO covered under Employees’ Provident Fund (EPF) Scheme are automatically enrolled for EDLI. Family members/nominees/heirs get insurance benefits in case of death of an active contributing member of the EPFO. Each and every beneficiary has to fill EPF Form 5 IF to claim insurance benefits of up to Rs. 7 Lakhs.

Don’t Know your Credit Score? Now Get it for FREE Check Now

Purpose of Form 5 IF

EPF Form 5 IF is filled by nominees/family members/legal heirs to claim insurance benefits after the death of an active EPFO member. It is worth mentioning that the service can be availed only when the member has died while in service. If he is no longer working at an EPF registered firm (one with 20 employees or more), his survivors will not be eligible for EDLI benefits.

| EPF Form | Form 5 IF |

| Purpose | EDLI Insurance Benefits of up to Rs. 7 Lakh |

| Link | https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form5IF.pdf |

| Eligibility | The employee should be an active EPF member at the time of his death |

| How to Fill | The form has to be filled offline and submitted to the EPF Commissioner’s Office |

| When is it Filled | After the death of the active EPF member |

| Employer Attestation | Mandatory |

| Document | Death Certificate of the member is mandatory |

How to Fill EPF Form 5 IF

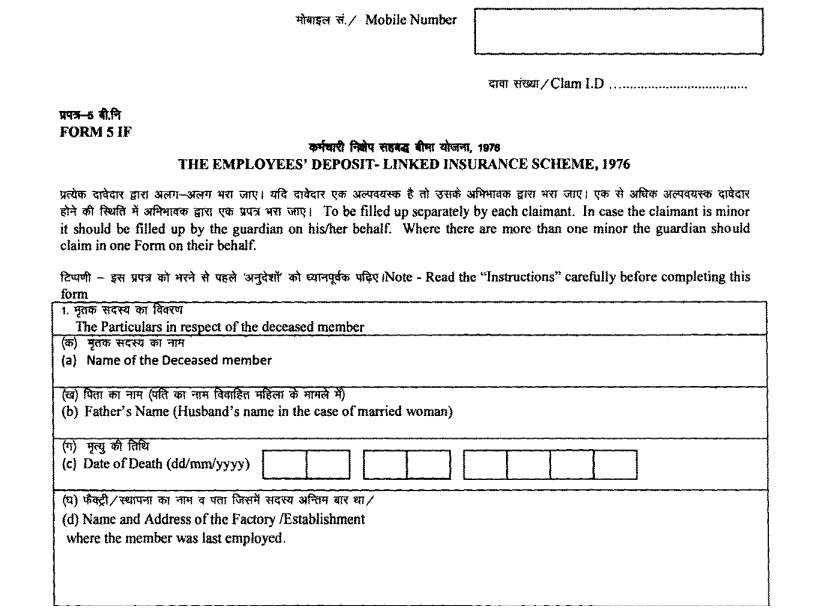

EPF Form 5 IF has to be filled offline and submitted to the regional EPF Commissioner’s office after attestation (by the claimant) to claim insurance benefits after the death of the active member. The form has the following sections which have to be filled by each and every beneficiary separately:

EPF Form 5 IF has to be filled offline and submitted to the regional EPF Commissioner’s office after attestation (by the claimant) to claim insurance benefits after the death of the active member. The form has the following sections which have to be filled by each and every beneficiary separately:

Mobile Number – The mobile number should be filled by the beneficiary to get instant alerts about the status of the claim

- The Particulars in respect of the deceased member

-

- Name of the Deceased member

- Father’s Name (Husband’s name in the case of a married woman)

- Date of Death (dd/mm/yyyy)

- Name and Address of the Factory/Establishment where the member was last employed

- Provident Fund Account No

-

- Details of the claimant/guardian

-

-

- Name

- Date of Birth

- Relation with the deceased

In case the claimant is a guardian, details of the minor nominee/heir and relationship of the guardian with the minor.

-

- Claimant’s Full Postal address (in block letters)

- Mode of remittance: By account payees cheque/Electronic mode of transfer to the savings account

Cancelled cheque should be attached with the application - Advance Stamp Receipt (This acknowledges receipt of EDLI money)

- Certificate to be filled by the Employer (If the establishment is closed, refer to the procedure below)

- I.F. withdrawal Register (For the use of Commissioner’s Office)

Claimants, as well as the employer, have to sign the application form in the space provided.

The form has to be submitted to the EPF Commissioner’s office and the commissioner has to settle the claims within 30 days. If the claim is not settled within the stipulated time-frame, the commissioner has to pay an interest of 12% per annum from the 31st day to the date of actual disbursal.

Documents Required to Fill EPF Form 5 IF

Following documents have to be submitted by the claimants to avail the benefits of the EDLI scheme:

- Death Certificate of the member

- Guardianship certificate if the claim on behalf of a minor family member/minor nominee/minor legal heir and the claim is made by a person who is not the natural guardian.

- Succession certificate in case of a claim by the legal heir.

- Cancelled cheque of the bank account in which payment will be received.

- In case the member was last employed under an establishment exempted under the EPF Scheme 1952, the employer of such establishment should furnish the PF details of last 12 months under the “Certificate” and also send an attested copy of the Member’s Nomination Form.

Don’t Know your Credit Score? Now Get it for FREE Check Now

Read More : How to Check Your EPF Balance and Status Online?

Who can Fill EPF Form 5 IF

Following persons are eligible to fill the EPF Form 5 IF to claim insurance benefits in the event of the death of an active contributing member:

- Members of the family (Nominees) nominated under EPF Scheme

- In case of no nomination, all members of the family (except major son, married daughters with husbands who are alive, and married granddaughters with husbands who are alive)

- In case of no family, and no nomination, legal heir

- Guardian of a minor nominee/family member/legal heir

Read More: Employees’ Provident Fund (EPF): Schemes, Eligibility, Interest Rate, eKYC & Benefits

How to Get the EPF Form 5 IF Attested

The claimant has to get the form attested by the employer under whom the member was working at the time of his death.

There may arise a situation where the establishment gets closed and no officer is authorized to attest the claim form. In such situations, the member has to get the form attested by any one of the following authorities:

- Magistrate

- A Gazetted Officer

- Post/Sub-Post Master

- President of the Village Panchayat where there is not Union Board

- Chairman/Secretary/Member of Municipal/District Local Board

- Member of Parliament/Legislative Assembly

- Member of CBT/Regional Committee EPF

- Manager of the Bank in which the Bank Account is maintained

- Head of any recognized educational institution

General Instructions to Fill EPF Form 5 IF

A claimant has to keep the following points in mind at the time of filling the EPF form 5 IF:

- EDLI benefits can be claimed only if the member was an active contributing member of the EPF Scheme at the time of his death

- This form can be submitted along with Form 20 (for EPF withdrawal) and Form 10C/Form 10D (EPS withdrawal) to process all applications at the same time

- The form can be filled only through the offline method

- The form should be filled in block letters and no overwriting should be done on the form

- A cancelled cheque should be attached with the form to get the amount credited to the bank account

The form has to be submitted to the EPF Commissioner along with the required proof