Note: The information on this page may not be updated. For latest updates, click here.

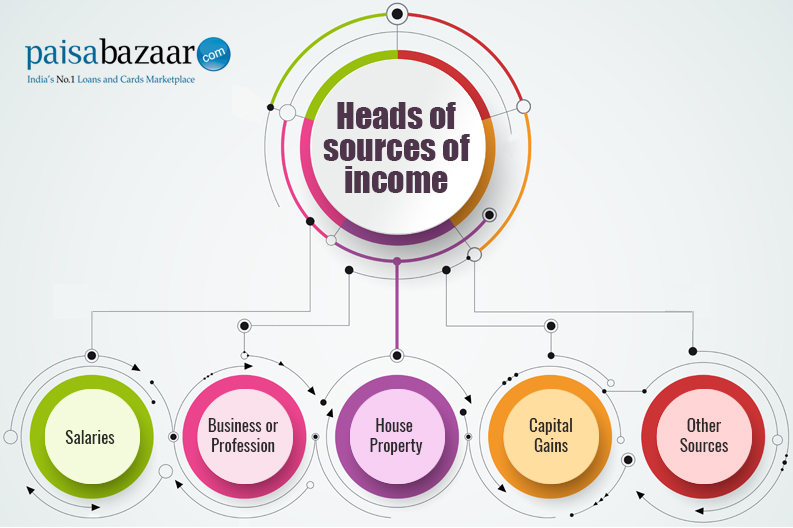

Filing income tax returns (ITRs) is an important step in managing one’s personal finance. One should be vigilant and should not be in a hurry while calculating income tax and filing income tax returns, else one can end up receiving a tax notice from the Income Tax (I-T) Department. One should be careful to include even little sources of income while filing income tax returns. This may help in getting benefits or exemptions from taxation. To avoid such situations, taxpayers should segregate all their income under different heads.

With the deadline for filing ITR for AY 2018-19 fast approaching – August 31, 2018 – taxpayers should tighten their belt and file the ITR by including all their sources of income, even the minor ones and those that appear to be insignificant.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Here are some sources of income which appear to be insignificant, and individuals might tend to miss while filing the ITR :

- Freelance Work: If an individual has taken up some freelance work apart from his/her regular work, he/she should mention it in the ITR form. Many of the freelancers do not showcase their side income (freelancing) when it comes to filing ITRs. This may lead to paying penalty later or receiving notice from the I-T department. Freelancers can use Form 26AS to claim deductions under TDS for Freelancers and save a good amount of money. However, income earned through freelancing is categorized under the income head “Business and Profession”.

- Interest on Saving Bank Account and Fixed Deposit: Most of the salaried individuals usually assume that disclosing their salary income or providing a copy of Form 16 would be enough to be included in the ITR. They fail to understand that interest on savings account and fixed deposits are taxable and need to be included while filing ITRs. Interest on savings account is taxable u/s 80TTA for individuals and for Hindu Undivided Family (HUF), it is up to Rs. 10,000. The point to be noted here is that even if the amount is less than Rs. 10,000, taxpayers need to present it to the government through ITR. Later, they can always claim for deduction. The same logic applies to fixed deposits as well.

- Interest on Investments done for Minor Child: Any income earned on investments made in the name of the minor child needs to be included in the ITR. In such a situation, the income in the form of interest made by parents should be a part of the income of the parents. The income made up to Rs. 1,500 per child per year is exempt from any tax; however, if the amount is more than Rs. 1,500, it is taxable under the parents’ name. This should be revealed under ‘other source of income’ at the time of filing the ITRs.

- Switching units of Mutual Funds during a Year: Individuals investing in mutual funds cannot ignore the interest earned on them. While filing the ITR, they need to mention this investment option and disclose the profit/loss earned during the year. Many a times, individuals change from one scheme of mutual fund to another one of the same fund house. However, this might not show in their bank statement, as a result, any profit/loss made during the change might not reflect. Thus, all these changes need to be shared, along with the details of the profit/loss, in order to avoid any penalty or I-T notice.

- Receiving Gifts: Individuals receiving gifts from friends and family members need to mention it in the ITR forms. This is applicable to amount more than Rs. 50,000. However, it is exempt from tax, if received from parents or on the occasion of marriage.

- Family Pension: The pension received by the family after the demise of a person needs to be mentioned in the ITR form as it is taxable, though not fully. They can get a deduction of Rs. 15,000 or 33.3% of the income, whichever is less.

- Notional Rent: This rent is applicable to individuals with more than one house property. In such a situation, individuals have to declare one property as self-occupied. It is up to the individuals to consider any house as self-occupied house; however, will have to consider the other as let out even if it is not. There is no taxable income in the first case, but for the second case, the rental income is taxable. This rent is called notional rent, which is different from the nominal rent. Many a times, taxpayers get bit confused and tend to miss this point while filing the ITR.

To stay away from any complications arising out of missing or wrongly mentioning various sources of income, individuals need to be careful and give enough time while filing ITRs. In case of confusions, one can consult specialists or get it done online through experts.