Do you feel that you are paying a huge chunk from your income on taxes? There are high chances that you do not have an efficient tax plan! A defined tax saving plan can help you benefit from tax exemption and earn tax-free income. The tax-saving season, starting from 1st April, is approaching for both salaried and non-salaried taxpayers. Now is the time when you compare and consider different tax-saving schemes for 2020-21.

A high Credit Score may help you get a credit card with better benefits. Check Now

Tax Saving Schemes in India

Here is an overview of the schemes to have a proper understanding of how the returns will be taxed:

| Saving Scheme | Lock-in Period | Returns |

| ELSS | 3 years | 15% to 18% |

| Unit Linked Insurance Plan (ULIP) | 5 years | Returns differ from one plan to another |

| National Pension Scheme (NPS) | Till Retirement | 12% to 14% |

| Public Provident Fund (PPF) | 15 years | 7% to 8% |

| Sukanya Samriddhi Yojana | No lock-in period | 8.5% |

| National Savings Certificate | 5 years | 7% to 8% |

| Bank Fixed Deposits | 5 years | 6% to 7% |

| Insurance | 3 years | Returns differ from one plan to another |

| Senior Citizen Savings Scheme (SCSS) | 5 years | 8.7% |

Read more : Tax Saving Investment under Section 80c

How to Save Tax with Saving Schemes in India

Optimising tax saving helps individuals serve their financial goals. There are different methods and schemes which allow you to save taxes under Section 80(C) of the Income Tax Act 1961.

A maximum of Rs 1,50,000 is exempted from tax when invested in such schemes (under Section 80C). Investors of NPS can avail an additional deduction up to Rs.50,000 under Section 80CCD(1b). Some of the most popular saving schemes with tax benefits are ELSS (Equity Linked Saving Schemes)- a type of mutual fund, Fixed Deposits, Sukanya Samriddhi Yojana, Public Provident Fund, National Saving Schemes, etc.

Ways to Save Tax with Saving Schemes

There are certain factors such as Returns, Liquidity and Safety which directly affect your investment strategy. Here are a few ways & strategies which you can depend upon while selecting a suitable saving scheme for tax planning:

Invest in Market Linked Schemes

Under Section 80(C), ELSS and NPS are the two best market-linked saving schemes as far as returns potential is concerned.

- Investments made in Equity Linked Saving Schemes are eligible for tax exemption up to Rs.1.5 Lakh. These Mutual Fund schemes typically offer 12% to 18% interest rate. But, there are no fixed returns as the amount of returns accrued is directly dependent on how the fund is performing in the market

- Likewise, as a long term investment scheme, NPS allows a tax deduction of maximum Rs.1.5 lakh under section 80C, 80CCD(1) and 80CCD(2). And, under section 80CCD(1B), an additional amount of Rs.50,000 can be claimed by the investor as a tax benefit

- There are two options in ELSS: Dividend and Growth. However, investors with growth option are expected to yield tax-effective returns because from April 1st 2018, the dividends in equity schemes are taxable at 10%

- For NPS, there is a different section according to which if an employer contributes 10% of the basic salary of the individual into NPS, the amount is not taxed

- It is to be noted that only 40% of the fund under NPS is tax exempted at the end of the tenure. Moreover, in order to earn monthly income, it is mandatory to invest 40% of the resources in the annuity plan when your investment matures

- One can invest in NPS with a minimum amount of Rs.1000. The scheme offers safety and transparency in the investments but, since NPS can be withdrawn only under some specific situations, it is not suitable for every investor

Fixed Income Investments and Tax Rebate

PPF is a suitable option to save taxes if you are looking for long-term investment plans-

- It helps the investors get adequate financial help after retirement. The interest rates on PPF & EPF are set on a quarterly basis

- The best part about these schemes are that the contribution made towards PPF or EPF account, interest accrued and maturity amount are all exempted from taxes. This is processed under the implication of EEE status i.e. Exempt, Exempt, Exempt

- A maximum of Rs.1.5 lakh can be claimed for exemption of tax under Section 80C

- Investors wanting to allocate the resources into a short term scheme should not consider investing in PPF as it has a maturity period of 15 years which can be extended by 5 years and EPF which matures after retirement. However, premature withdrawals can be made from the PPF account after completion of 7 years of continuous contribution

Consider Small Deposits such as Sukanya Samriddhi Yojana

Small deposits such as Sukanya Samriddhi Yojana are considered as good options to curb tax cuts. SSY is a scheme specially designed for the girl child. Offering an interest rate of 8.1% and tax exemption benefits, this scheme was introduced under Beti Bachao Beti Padhao campaign.

- SSY investments are eligible for tax exemption up to Rs.1.5 lakh

- The interest accrued, compounded annually, along with maturity proceeds are exempted from taxes

- One can open a SSY account with a minimum investment of Rs.250 and maximum Rs.1.5 lakh in a financial year

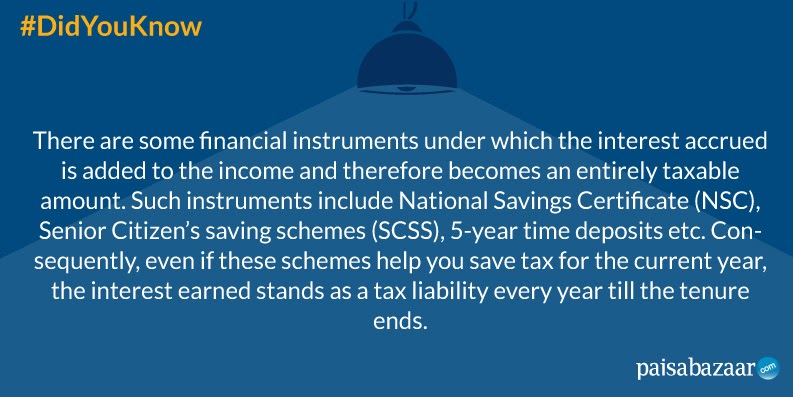

Examine Instruments with Fixed Incomes and Tax-Saving

- Introduced by the Government, National Savings certificate is a fixed income scheme which benefits the investors with tax exemption up to Rs.1.5 lakh under Section 80(C)

- The entire interest accrued is credited to initial investments made and is eligible for tax exemption

- The investors are allowed to claim a tax deduction on NSC investment in the 2nd year and on the interest accrued on the previous year

Over-Diversification should not be in your Check-list

While choosing a suitable tax-saving scheme, investors are advised to avoid over-diversification in the investment strategy. When investors allocate their corpus into different schemes, they eventually fail to keep a record of the performances. Due to diverse strategies, the returns from 80(C) savings face downfalls.

Plan your Tax-saving investments

It is apparently observed that most of the taxpayers delay their tax planning and end up pestering their financial goals. Tax planning must be carried out at the beginning of the financial year so that the invested amount is able to multiply over a period of time and give desirable returns.

Tax-payers must always check their tax-saving expenses such as insurance premiums, EPF contributions, children’s tuition fees etc. if the total amount of the tax-saving expenses is greater than Rs.1.5 lakh, then you are not required to invest the entire amount. Suitable tax-saving schemes such as PPF, FDs, ELSS, NPS must be chosen after considering the financial goal and risk profile.