Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Start Income Tax Filing Now

Let’s Get Started

The entered number doesn't seem to be correct

| To invest in NPS through Paisabazaar, Click Here |

| Already have an NPS account through us? For Subsequent Contribution, Click Here To Set up SIP, Click Here |

Note: The information on this page may not be updated. For latest information, click here.

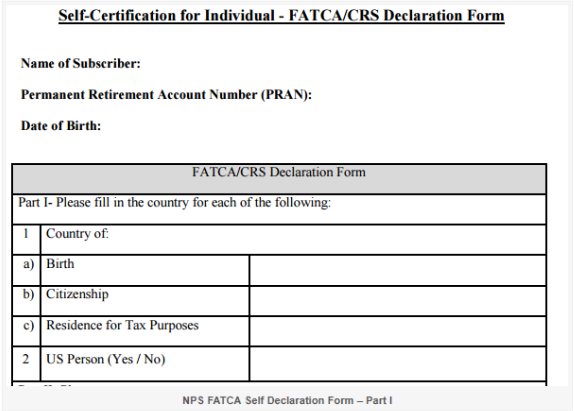

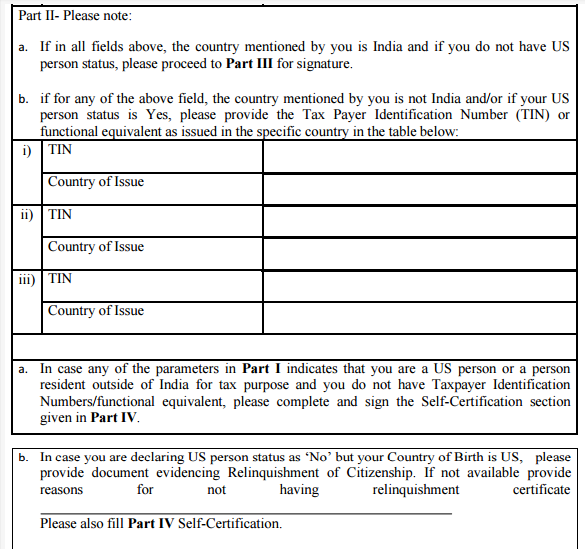

FATCA or Foreign Account Tax Compliance Tax is a US law aimed at obtaining details about the overseas assets of US citizens and tax residents. Under a treaty with India, Indian investors have to provide their tax residence details for various investments such as bank accounts, mutual funds and NPS (National Pension System).

The National Pension System (NPS), earlier known as New Pension Scheme is a pension system open to all citizens of India. It is also open to NRIs, provided that they are Indian citizens. The NPS invests the contributions of its subscribers into equities and debt and the final pension amount depends on the performance of these investments.

Any Indian citizen from the age of 18-65 can open an NPS account. The NPS matures at the age of 60, but can be extended till the age of 70. Partial withdrawals up to 25% of your contributions can be made from the NPS after three years of account opening for specific purposes like home buying, children’s education, or serious illness.

Also Read : NPS Returns: Calculation and Interest Rates

You can do this online at enps.nsdl.com or physically by submitting these details to the nearest branch of your PoP (Point-of-Presence). You can find a list of PoPs here.