Employees’ Provident Fund Organisation (EPFO) manages three important retirement schemes for employees – Employees’ Provident Fund (EPF), Employees’ Pension Scheme (EPS) and Employees’ Deposit-Linked Insurance Scheme (EDLI). Once a member of EPFO retires at the age of 58 years, he receives a lump sum of EPF corpus. If employed for at least 10 years, he becomes eligible for a pension. The pensioner (actual, widow or widower pensioner) has to submit a life certificate every year to continue receiving a monthly pension. The certificate is proof that the pensioner is alive and hence entitled to receive the EPS pension.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

What is a Life Certificate for Pensioners

Retired employees who have contributed towards EPF and EPS for more than 10 years are eligible for a monthly pension. EPFO transfers the monthly pension amount in bank accounts of beneficiaries. However, each and every pensioner has to provide a document every year proving that he is alive and that the pension amount should be disbursed in the bank account as usual. This document is known as the Life Certificate.

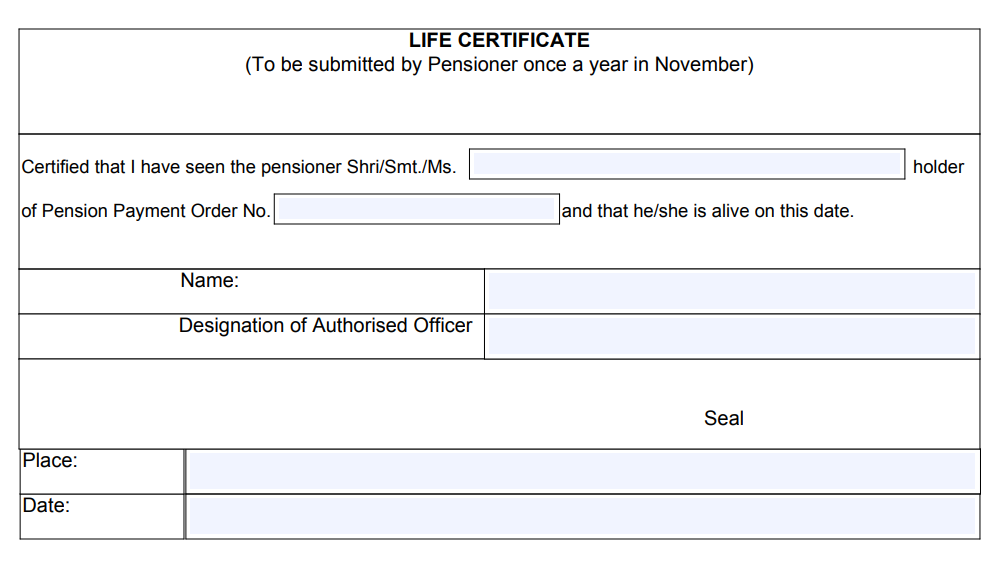

Life Certificate Sample

The life certificate sample can be downloaded from the pensioner portal. An authorized officer (which can mean a bank manager) has to sign the Life Certificate and it has to be submitted to the bank where the pensioner has his/her pension account. The following details have to be mentioned in the certificate:

- Name of the Pensioner

- Pension Payment Order Number

- Name of the Authorized Officer

- Designation of the Authorized Officer

- Seal of the Authorized Officer

- Place

- Date

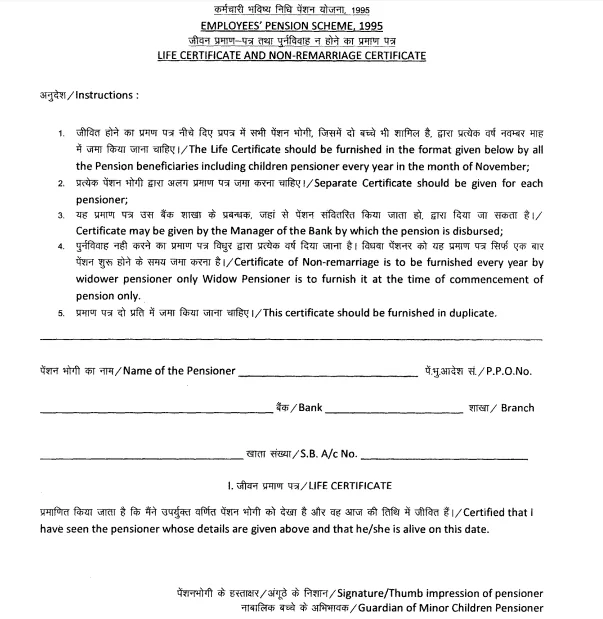

Life Certificate Form

A pensioner has to fill a form to obtain a life certificate. The form can be downloaded from the EPF Portal. An applicant has to fill the following details:

- Name of the Pensioner

- P.P.O. No.

- Bank

- Branch

- Savings Account Number

- Signature of the Pensioner

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Pension Disbursing Agencies

Pensioners can avail monthly pension from any of the following Pension Disbursing Agencies by submitting their Life Certificate:

- Banks

- Post Offices

- State/UTs Government Offices (Treasuries)

When Should you Fill the Life Certificate

When a person retires at the age of 58 years, he ceases to be the member of EPFO but becomes eligible for a monthly pension. He has to submit a Life Certificate. Digital Life Certificate or Jeevan Pramaan Patra is not yet available for EPS pensioners – it is only available for retired government employees. The Life Certificate submission has to be done every year to continue receiving the pension. It has to be submitted to the EPS pensioner’s bank each year.

What is Jeevan Pramaan or Digital Life Certificate

Jeevan Pramaan is a digital life certification service provided by the Government. It is used by government employees getting a pension to prove that they are still alive. Retired government employees have to submit this certificate every year to their pension disbursing agency. It is not available to private sector EPF subscribers/EPS pensioners. The certificate includes biometric verification of pensioners of Central Government, State Governments or any other Government organization.

Pensioners have to provide their life certificate once every year to the bank/post office where they have their pension accounts. To get the life certificate, the pensioner has to be present in front of the issuing authority/pension disbursing agency. In the case of old and ailing pensioners, this can be a very difficult task. The government has made provisions for such pensioners to get the digital life certificate or Jeevan Pramaan online.

How Jeevan Pramaan Works

Jeevan Pramaan uses the biometric authentication system through Aadhaar authentication. When a Jeevan Pramaan or Life Certificate is issued to the pensioner, it is also stored in the Life Certificate Repository from where the pension issuing authorities (banks or post office) can access it directly. Following is the process of getting the Jeevan Pramaan issued:

- Pensioner Enrolment – The pensioner can download the Jeevan Pramaan PC/Mobile app to register online. Alternatively, the pensioner can also visit a Jeevan Pramaan Centre for enrolment. A pensioner has to provide details such as Aadhaar number, Pension Payment Order (PPO), Bank account details and the mobile number.

- Aadhaar Authentication – The pensioner has to provide the biometrics (fingerprint or iris scan) to authenticate details using the Aadhaar biometric authentication.

- Issue of Jeevan Pramaan – Jeevan Pramaan or life certificate is issued online by the authority after proper authentication. A confirmation SMS is also sent to the mobile number of the pensioner containing the Jeevan Pramaan Certificate ID.

- Life Certificate Repository – The Life Certificate is stored online in the Life Certificate Repository that can be accessed anywhere and anytime.

- Life Certificate Access – A pensioner can download the life certificate online from the mobile app or visiting the Jeevan Pramaan website by entering the Jeevan Pramaan ID or Aadhaar number.

- Pension Disbursing Agency – The pension disbursing agency can access the certificate from the Life Certificate Repository and download the file as well.

- Jeevan Pramaan Online Delivery – The Jeevan Pramaan can be delivered online to the pension disbursing agency without visiting the bank/post office in person. The certificate is as valid as a life certificate submitted in person.

Pre-Requisites for Jeevan Pramaan Certificate Generation

- The pensioner should have an Aadhaar card

- He should have an existing mobile number

- His Aadhaar number should be registered with the Pension Distributing Agency

- He should have a PC with Windows 8.0 and above or Android mobile/tablet 8.0 and above

- He should have a supported biometric device and internet connectivity

2 Comments

Lockdown period how i can submit my life certificate?

You can download your life certificate through DigiLocker and Umang App as well apart from the official website. In order to submit it, you can contact the bank and ask them to get it picked from your home during lockdown.