Note: The information on this page may not be updated. For latest information, click here.

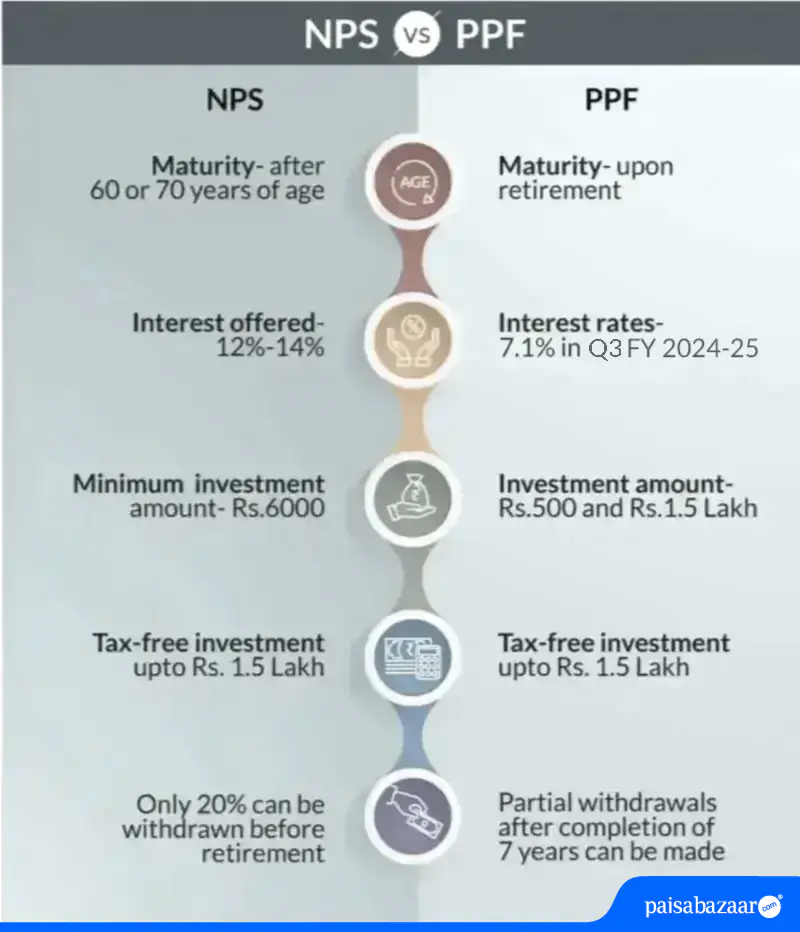

National Pension System(NPS) is a market-linked pension savings vehicle set up by the Government of India. Like mutual funds, the returns of the NPS depend on the performance of pension fund managers and the market. PPF or Public Provident Fund is a government-backed savings vehicle with fixed returns, set by the Government every quarter. The PPF is not a pension or retirement-specific vehicle, it can also be used for other purposes. The NPS scheme, on the other hand, is a retirement-specific savings vehicle. In this article, we will compare the two as investment vehicles.

| Criterion | PPF | NPS |

| Safety | High | Low |

| Returns | Moderate | High* |

| Liquidity | Low | Low |

| Taxation | Fully exempt | Low** |

*High return potential due to long holding period, if the portfolio has sufficient equity allocation. **40% of NPS is tax-free so the overall rate on NPS is low.

NPS Vs PPF Comparison & Returns

Given below are the key points of comparison between PPF Vs NPS:

1) Safety

The NPS is not a fixed return instrument and is not ‘safe’ in that sense. In a broader sense, however, it is tightly regulated by the PFRDA (Pension Fund Regulatory and Development Authority) and is not likely to face large challenges from fraud/malpractice.

The NPS returns depend on the performance of Pension Fund Managers and you can change managers if you are not satisfied with the performance of your manager. The PPF has fixed returns which are set by the Government. The PPF money is utilised by the government as well. As a result, it carries almost no risk of default.

2) Returns

The PPF has a fixed return rate. The exact rate is set every quarter. Historically rates have fluctuated around 8% per annum. Here is a brief history of PPF interest rates:

| Period | Rate |

| January -March 2025 | 7.1% |

| October – December 2024 | 7.1% |

| July- September 2024 | 7.1% |

| April – June 2024 | 7.1% |

| January -March 2024 | 7.1% |

| October – December 2023 | 7.1% |

| July – September 2023 | 7.1% |

| April – June 2023 | 7.1% |

| January – March 2023 | 7.1% |

| October – December 2022 | 7.1% |

| July – September 2022 | 7.1% |

| April – June 2022 | 7.1% |

| January – March 2022 | 7.1% |

| October – December 2021 | 7.1% |

| July – September 2021 | 7.1% |

| April-June 2021 | 7.1% |

| January-March 2020 | 7.1% |

| October – December 2020 | 7.1% |

| July – September 2020 | 7.1% |

| April – June 2020 | 7.1% |

| January – March 2020 | 7.9% |

| October – December 2019 | 7.9% |

| July – September, 2019 | 7.9% |

| April-June, 2019 | 8.0% |

| January-March, 2019 | 8.0% |

| October-December, 2018 | 8.0% |

| July – September, 2018 | 7.6% |

| April – June, 2018 | 7.6% |

| January – March, 2018 | 7.6% |

| October – December, 2017 | 7.8% |

| July – September, 2017 | 7.8% |

| April – June, 2017 | 7.9% |

| January – March , 2017 | 8.0% |

| October – December, 2016 | 8.1% |

| July – September, 2016 | 8.1% |

| April – June, 2016 | 8.1% |

| April 2015 – March 2016 | 8.7% |

| April 2014 – March 2015 | 8.7% |

| April 2013 – March 2014 | 8.7% |

| April 2012 – March 2013 | 8.8% |

| December 2011 – March 2012* | 8.6% |

| April 2011 – December 2011 | 8.0% |

| April 2010 – March 2011 | 8.0% |

| April 2009 – March 2010 | 8.0% |

| April 2008 – March 2009 | 8.0% |

Source: National Savings Institute

The NPS or National Pension System returns depend on the performance of NPS funds. The table below will give you the performance of NPS Equity Funds. Note that an NPS allows a maximum of 75% allocation to equity. The balance amount can be placed in NPS Corporate Bond Funds or NPS Government Bond Funds. You can get up-to-date returns of these here.

| Pension Fund | Returns (1 year) | Returns (3 years) | Returns (5 years)) |

| SBI Pension Funds Pvt. Ltd | 6.30% | 14.80% | 51.80% |

| UTI Retirement Benefit Fund | 5.70% | 2.40% | 6.63% |

| Kotak Mahindra Pension Fund Ltd. | 10.40% | 25.40% | 57.30% |

| ICICI Pru. Pension Fund Mgmt Co. Ltd. | 6.70% | 14.70% | 50.10% |

| LIC Pension Fund Ltd. | 4.70% | 8.20% | 41.50% |

| HDFC Pension Management Co. Ltd. | 7.70% | 9.00% | – |

| Birla Sun Life Pension Management Ltd. | 9.00% | 0.30% | 17.60% |

Also Read NPS Tax Benefits

3) Liquidity

PPF has a tenure of 15 years. You can make partial withdrawals after the end of 6th financial year i.e. beginning of 7th financial year from the year of account opening. However, it is suggested that one should check with the respective website of the bank to determine when partial withdrawal is allowed. Some banks, such as ICICI and Axis, allow withdrawals after 5 years and some after 7 years (SBI and HDFC). The maximum amount that can be withdrawn per financial year is the lower of the following :

- 50% of the account balance as at the end of the financial year, preceding the current year, or

- 50% of the account balance as at the end of the 4th financial year, preceding the current year.

You can also get a loan against the balance in the PPF account from the 3rd to the 6th year after account opening. The maximum amount of loan that can be availed against PPF accounts is 25% of the balance at the end of the 2nd financial year preceding the year in which the loan was applied for.

NPS matures at the age of 60 but you can extend it till the age of 70. You can withdraw up to 25% of your contributions, three years after opening the account under the ‘partial withdrawal’ facility. You can make only three such withdrawals from the NPS. You can make withdrawals on grounds such as marriage or higher education of children, for the construction or purchase of a house or treatment for diseases like cancer and kidney failure.

4) Taxation

Investment in the PPF account up to Rs 1.5 lakh per annum gets you a tax deduction under Section 80 C of the Income Tax Act, 1961. The interest on the PPF is also exempt from tax but must be declared in the annual income tax return. The PPF maturity amount is also exempt from tax. In other words, PPF enjoys ‘exempt, exempt, exempt’ tax treatment.

Investment in the NPS is tax-deductible up to Rs 1.5 lakh under Section 80 C. However such NPS contributions cannot be more than 10% of your salary. You can also get an additional tax deduction under Section 80 CCD (1B) for NPS. The returns on the NPS are also tax-free so long as the money is held in the HDFC account. On maturity, 40% of the NPS balance can be withdrawn tax-free. Another 40% must be compulsorily used to buy an annuity (a monthly income). This annuity will be taxable. The balance 20% can be withdrawn after paying tax or also be used to buy an annuity.

5) Retirement Focus

The PPF can be used to save for retirement but it is not geared specifically to retirement. For example, you can open a PPF account for your minor child and this will mature when he/she becomes an adult or starts his career. An NPS account can only be opened by someone above the age of 18 and it only matures at the age of 60. In other words, the NPS lock-in can be much longer.

Important Notice: NPS Service Discontinuation on Paisabazaar. Read more