The Pradhan Mantri Jeevan Jyoti Bima Yojana was started by the then Finance Minister, Mr. Arun Jaitley in the annual financial budget of 2015. The scheme was actually launched by the Prime Minister, Mr. Narendra Modi in Kolkata considering the fact that as of the mentioned year (May 2015), only 20% of the country’s population had an insurance policy in their name.

The main idea behind the scheme was to increase the number of health insured citizens in the country. Additionally, the bank accounts that were initially opened under the Pradhan Mantri Jan Dhan Yojana will be used for this scheme as well. This was done to reduce the number of accounts under the scheme with zero balance. The scheme offers a life cover of Rs.2 Lakh to the insured member for the time period of one year, stretching from June 1 to May 31; this time period will be renewed every year.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Features of PMJJBY

- Pradhan Mantri Jeevan Jyoti Bima Yojana is a one-year life insurance scheme available for renewal every year

- The scheme is available to people between the ages of 18 and 50 years with a savings bank account

- The scheme asks for an annual premium from the insured members, which will automatically be deducted from the member’s bank accounts

- It must be noted that the scheme offers a term plan wherein the insurance company will pay the insurance amount to the member’s family only upon the death of the insured member

- In case of death of the member (who is insured), the nominee or the insured member’s family will be paid a fixed amount of Rs.2 Lakh

- The policy will automatically mature when the insured member reaches 55 years of age

- It must be noted that irrespective of the date when the policy was purchased, it will last till 31 May of the next year

- Henceforth, the policy can be renewed on 1 June every year by paying the premium amount from the bank account

- GST is exempted from the Pradhan Mantri Jeevan Jyoti Bima Yojana

- It must be noted that the risk cover under the policy will be applicable only after 45 days of enrolment in the scheme

Eligibility Conditions for PMJJBY

- The member applying for the scheme must be between 18 and 50 years of age

- No health certificate or information of pre-existing disease is required to open the account

- It is mandatory for the insurers to have a savings bank account and give their consent to join/enable auto-debit the premium amount in one installment on or before 31 May of each annual coverage paid under the scheme from their bank accounts

- Entry to the scheme will not be possible beyond the age of 50 years

- The eligible candidates can join the scheme before giving any self declaration of good health during the enrolment period

How to Apply for PMJJBY

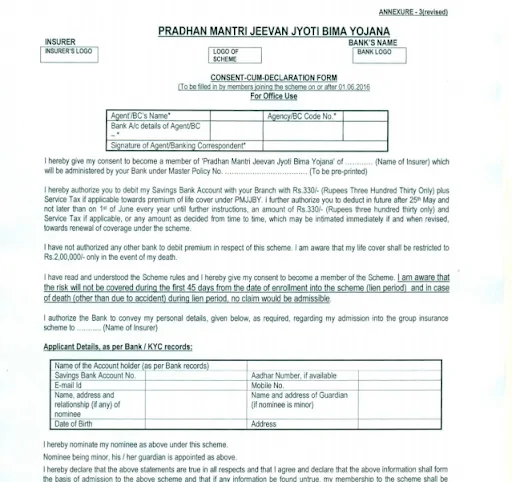

To avail the benefits of Pradhan Mantri Jeevan Jyoti Bima Yojana, the eligible candidates must either fill a form at the bank branch at any time of the year or apply for the scheme online through netbanking service. However, before applying for the scheme, it is mandatory for the members to get their KYC done by submitting their Aadhaar along with the application form.

It must be noted that the premium amount will be deducted automatically from the insured member’s bank account on an annual basis.

Here’s the application form that you must submit while applying for the scheme-

It must be noted that the PMJJBY application form is available in several languages such as English, Hindi, Gujarati, Bangla, Kannada, Odia, Marathi, Telugu and Tamil.

Additionally, individuals who exit the scheme at any given point in time may also re-enter the scheme in the future by paying the annual premium and submitting a self declaration form of good health.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Amount of Premium to be Paid

With effect from 1 September 2018, the Ministry of Finance revised the premium payment structure on a quarterly basis depending upon the request date of joining the scheme. The revised premium amount that must paid under the scheme is as follows-

| Month of Enrolment | Premium to be Paid |

| June, July, August | Rs.330 |

| September, October, November | Rs. 258 |

| December, January, February | Rs. 172 |

| March, April, May | Rs. 86 |

Termination of the Policy

The life insurance policy will be considered terminated upon the occurrence of any of the following and no benefits would be payable-

- Reaching 55 years of age subject to annual renewal subject to that date

- Closure of the account with the bank

- Inability to maintain the sufficient balance to keep the insurance in force

- Trying to join the scheme with multiple insurance companies and/or with multiple bank accounts

How to Claim the Maturity Amount for PMJJBY

In case of death of the policy holder, the nominee or the family members can claim the insured amount of Rs.2 Lakh by contacting the respective banks branch where the insured person was having a bank account.

The nominee or the family of the insured person must submit the following document at the bank; post which the claim amount will be transferred to the nominee’s account.

- Death certificate

- Claim form

- Discharge Receipt (from the bank of any other designated source such as the insurance company, hospitals, insurance agents, etc.)

- Photocopy of the cancelled cheque of the nominee’s bank account

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Banks offering the Facility of PMJJBY

Given below is a list of few of the banks that offer the life insurance policy under the Pradhan Mantri Jeevan Jyoti Bima Yojana-

- ICICI Bank

- HDFC Bank

- SBI Bank

- Bank of Baroda

- Axis Bank

- Kotak Bank

- Yes Bank

- IndusInd Bank

- AU Small Finance Bank