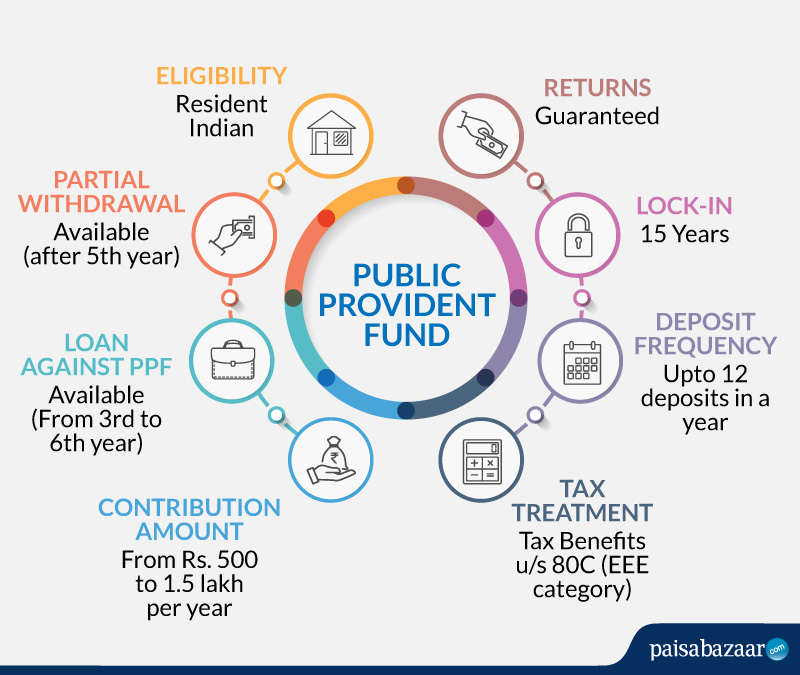

PPF or Public Provident Fund, like all other small saving schemes, including Senior Citizens Savings Scheme (SCSS), Sukanya Samriddhi Yojana, and the National Savings Certificate (NSC), was launched by the government to encourage small savings and to provide returns on those savings. Since the PPF scheme comes under the Exempt-Exempt-Exempt (EEE) category of tax policy, the principal amount, the maturity amount, as well as the interest earned is exempt from taxes.

| PPF – Key Highlights | |

| PPF Interest Rate | 7.1% (Q2 FY 2025-26) |

| Minimum Investment Amount | Rs. 500 |

| Maximum Investment Amount | Rs. 1.5 lakh p.a. |

| Tenure | 15 Years (Can be extended in blocks of 5 years thereafter) |

| Tax Benefit | Up to Rs.1.5 lakh under Section 80C |

4 Comments

I want to open PPF account, on log in to net banking I could not find any option to open new PPF account. Please clarify me how to open ppf account

If you have an account with a bank that provides the facility of PPF, you can find PPF in the investments tab of your netbanking account.

Can the standing instructions be changed during the tenure of PPF ?

You should connect with the bank for clarification regarding standing instructions for PPF investments.