Employee Provident Fund (EPF) is one of the most popular and trusted scheme for securing a long-term retirement fund. It is managed by Employees’ Provident Fund Organization under the Employees’ Provident Fund and Misc. Provisions Act, 1952. Both the employer as well as the employee contribute to the EPF account and one can withdraw the accumulated corpus at the age of 58 after the retirement.

Also Read : All You Need to Know About EPF Contributions

When One can Withdraw the EPF Fund?

- As per the latest rules, one can withdraw 75% of the EPF corpus if the member remains unemployed for one month. He can withdraw the balance 25% and make full and final settlement if he remains unemployed for two or more months.

- The member can also withdraw funds from his EPF kitty under various circumstances like marriage, education, medical emergency or construction of a house etc. However, the withdrawal eligibility depends on certain fixed criterias and withdrawal limit varies from situation to situation.

Also Read : EPF Withdrawal Before Retirement: Is It Right For You?

How to Withdraw EPF Funds Online?

You can withdraw EPF funds online by using UAN Member e-Sewa Portal. You can raise claims like partial withdrawal or full settlement for EPF by using the online portal. However, you can use the online withdrawal claim facility only when your Aadhaar is linked with your UAN.

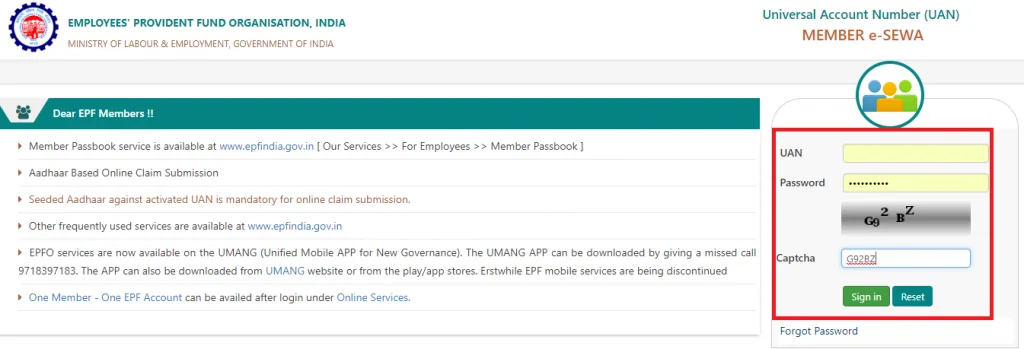

- Login to the UAN Member Portal using your UAN number and the password.

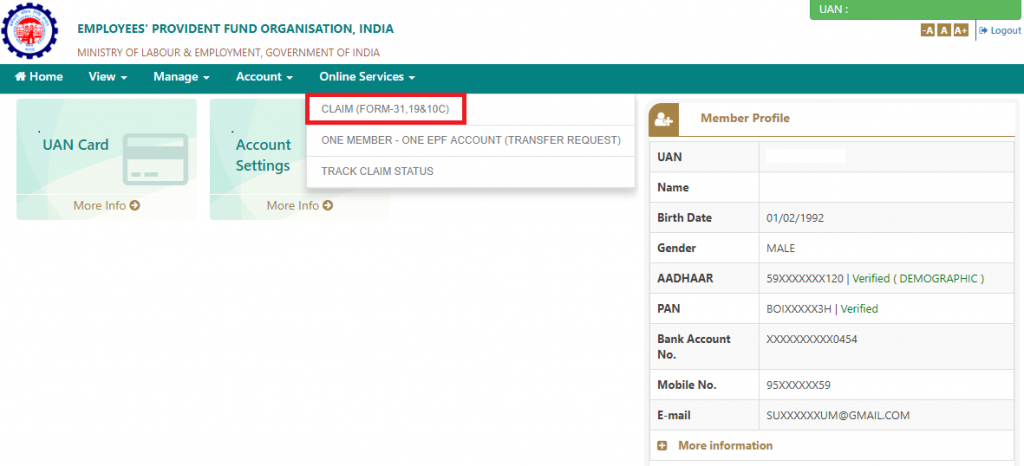

- To raise EPF claims (Form 31 or Form 19), click on ‘Online Service’ and select ‘ Claim Form-31, 19&10C)’ option.

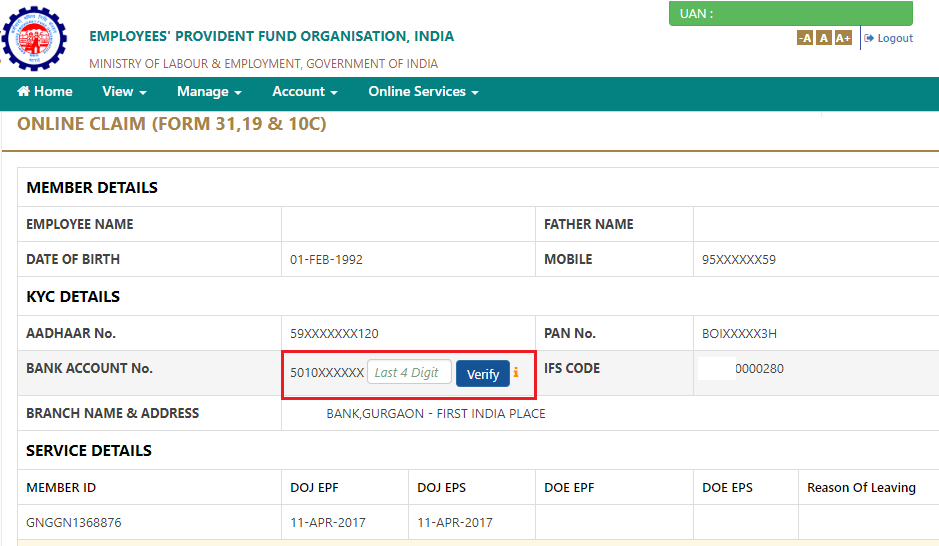

- After selecting the above option, member details will get displayed on the screen. Please enter last four digits of your bank account number in order to verify your credentials and click on ‘Verify’

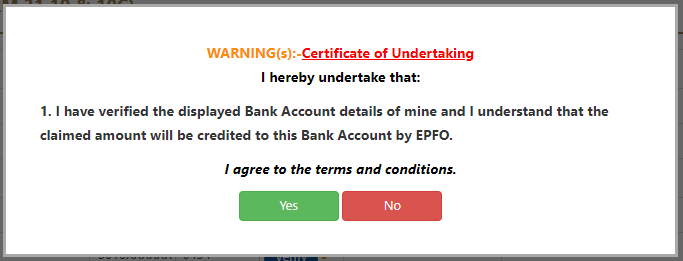

- Click on “Yes” to sign the certificate of undertaking and proceed further and click on “Proceed for Online Claim” option.

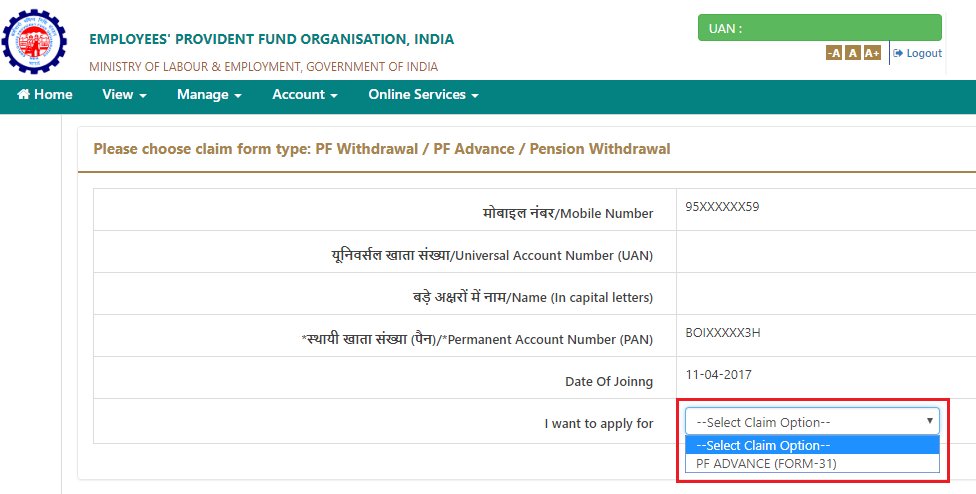

- In case you want to raise a claim for partial withdrawal, Select “Form 31” option. However, in order to make a final settlement, you need to select “Form 19” option.

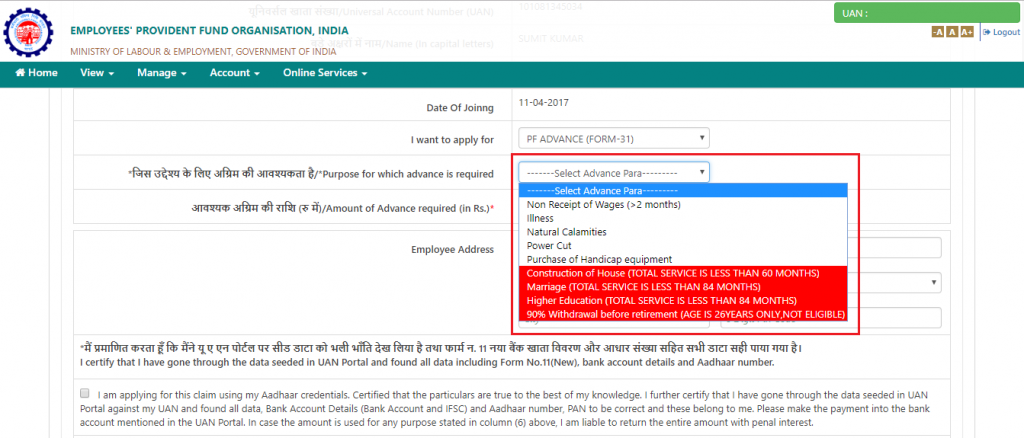

- In case you have selected “Form 31” option (For PF Advance) then a fresh dilogue box will appear where you need to select the “The purpose for which advance is required” along with the amount required and the employee’s address.

- Now click on “ Generate Aadhaar OTP”. Verify the Aadhaar credentials by entering the OTP received on your registered mobile number. Tick on the certification and submit your application.

- You may need to submit a copy of scanned documents (if required) depending on the grounds on which you have raised claims.

- It should be noted that successfully submitting the claim application is not enough for the claimed amount to be deposited in your bank account. For that, your employer has to approve your withdrawal request after which final withdrawal will happen.

1 Comment Comments

Thanks to the excellent guide