From making payments on the go, online transactions, and cash withdrawals from ATMs to in-store retail POS transactions, a debit card has made doing transactions simpler over time. But this ease of use is accompanied by certain risks and threats of the debit card data breach. Since debit card frauds are on the rise and a lot of financial data is being compromised lately, it has become imperative to take steps for safeguarding your debit card. RBI, in this regard, has introduced a new method known as tokenization that will let customers do transactions without sharing their debit card details online.

In tokenization, transactions become seamless and don’t expose customers’ confidential data. However, to protect your debit card from being compromised, you should also know and take some steps to protect your data from hackers. Let us discuss further how you can protect yourself from a debit card data breach.

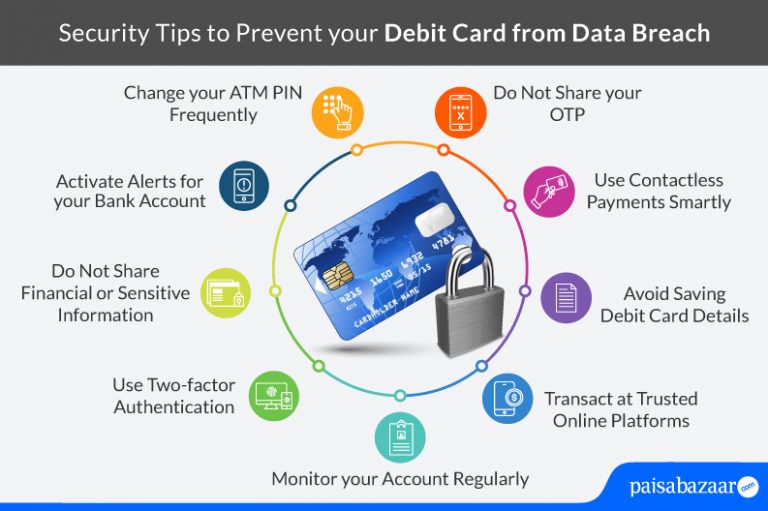

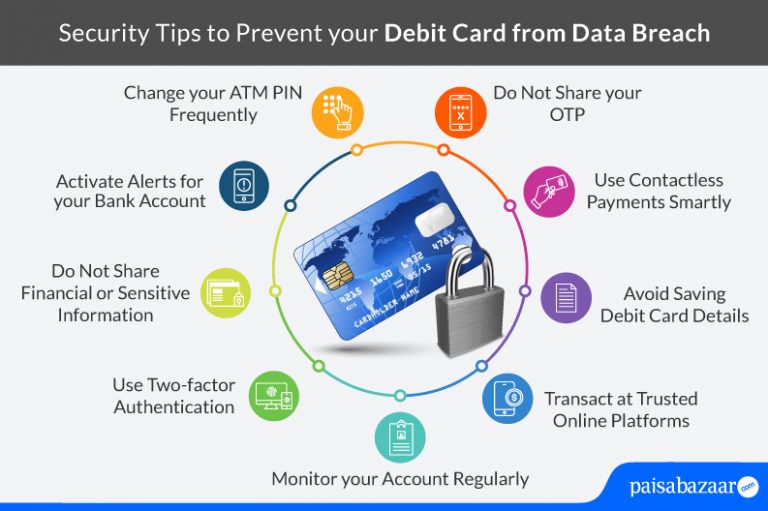

Change your ATM PIN Frequently

It is important to not re-use the old PIN for a long time. You need to make sure that you change your ATM PIN from time to time. Using the same PIN for all your debit cards might make it easier for hackers to hack your card. You should ideally have different PINs for all debit cards. Also, you should avoid sharing your PIN with anyone.

Do Not Share your OTP

The bank sends an OTP to validate a debit card transaction carried out online. If you get an OTP for a transaction that was not carried out by you, do not share it with anyone else and report the incident to the bank immediately.

Using Contactless Payments Smartly

Contactless ATM cards allow you to carry out transactions at merchant POS machines up to Rs. 5,000 per transaction without providing your ATM PIN. If you have two savings accounts and you use the secondary account for daily transactions, you can deactivate contactless payment on your primary account’s debit card. However, with zero lost card liability, if your card is stolen and transactions are carried out, you will not be charged any fee.

Avoid Saving your Debit Card Details

We tend to save our debit card details on online platforms while transacting to save time while doing transactions in the future. This practice is one major reason that leads to a debit card data breach. You should avoid saving the details of your card on online platforms.

Transact only at Trusted Online Platforms

It is better to transact online with known and trusted merchants. Never allow the browser to remember your password as it’s an important security component. You should carry out online transactions at secured websites having SSL certifications.

Monitor your Account Regularly

Keep checking your accounts and transactions through netbanking or mobile banking on a regular basis. If any suspicious transactions are noticed, instantly report them to your bank.

Two-factor Authentication

Sign up for two-factor authentication wherever possible. This will add an additional layer to your account logins and debit card usage. Banks now mandatorily send OTP to validate an online debit card transaction. Hence, you should register your mobile number and email id at the time of opening the account so that only you can receive the OTP while doing transactions from your debit card.

Do Not Share Financial or Sensitive Information

Avoid sharing sensitive financial information online because it is not encrypted and can be misused by hackers and can lead to a debit card data breach.

Activate Alerts from your Bank

You can activate alert messages for your bank account so that you are notified immediately as soon as a transaction is processed. In case of fraud, report the incident to the bank and hotlist your debit card instantly.

How to know if your debit card has been cloned

Card-skimming frauds are on the rise. You need to be vigilant especially at ATMs and gas stations while doing transactions. Scammers skim your card and use your details by cloning the information to do fraudulent transactions. The cloned card will let the scammer do transactions from your debit card in your name. Below mentioned are the points to spot if your debit card is being cloned:

- You can check some evident signs of cloning at the top of the ATM, near the speakers, the side of the screen, the card reader, and the keyboard.

- All ATMs flash light at the time of inserting the debit card, if you find that there is no light being flashed while inserting the debit card, do not insert your card as skimmers are glued on the top of the card reader and will obscure the flashing light.

- At times, the keyboard might be tampered and your PIN might be compromised.

Always be proactive while doing transactions from your debit card either online or offline and be aware of phishing scams. You need to know that not all information is required to be shared online and you should act smartly whilst providing your debit card data online. Keep monitoring financial activities taking place in your account by checking your account statements regularly. By staying vigilant, you can overcome any debit card data breach and risks.