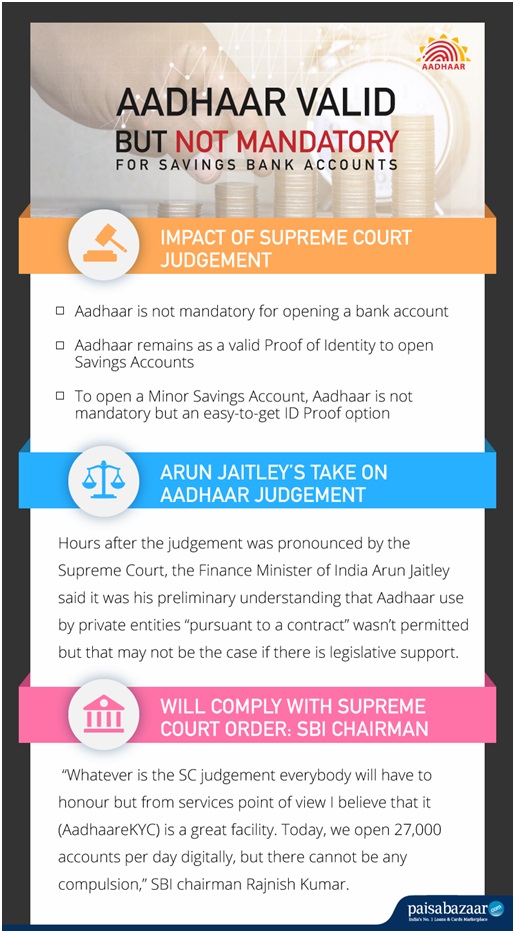

The Supreme Court on Wednesday i.e. September 26, 2018 said that while Aadhaar Card will continue to be mandatory for filing of income tax returns (ITR) & permitted linking of Aadhaar with PAN, but Supreme Court rules Aadhaar not mandatory to open savings bank accounts. Thus, as per the latest judgement by the Supreme Court of India, it is not mandatory to link Aadhaar Card with existing bank accounts or to open new ones.

The Supreme Court of India also said that Aadhaar should be mandatory for welfare schemes and not for services like bank accounts, school admissions and mobile connections. The Supreme Court also ruled that Aadhaar Card would not be mandatory for school admissions or any examinations conducted by the Central Board of Secondary Examination (CBSE), National Eligibility cum Entrance Test (NEET) for medical entrance and the University Grants Commission (UGC).

Here are 4 things to know about Aadhaar linking with bank accounts:

- The Supreme Court of India ruled that it is not necessary for you to link Aadhaar Card to existing savings accounts or to open a bank account.

- No private company or bank can ask for an individual’s Aadhaar as a mandatory document for verification.

- This verdict on Aadhaar came after several petitions challenged the constitutional validity of the system on the basis that Aadhaar violates the right to privacy.

- This verdict was announced by a five-judge constitution bench which includes Chief Justice Dipak Misra, Justice A.K. Sikri, Justice A.M. Khanwilkar, Justice D.Y. Chandrachud and Justice Ashok Bhushan.

Documents to use in place of Aadhaar Card while Opening a Bank Account

| Proof of Identity | Proof of Address |

|

|

What’s still in Question?

The Supreme Court held Aadhaar not mandatory for opening bank accounts. But, it is still not clear about the documents which will be considered valid for opening a savings bank account online or using e-KYC. As Aadhaar was mandatory for opening a bank account online or using e-KYC, the procedure of opening a savings account online is still not clear.