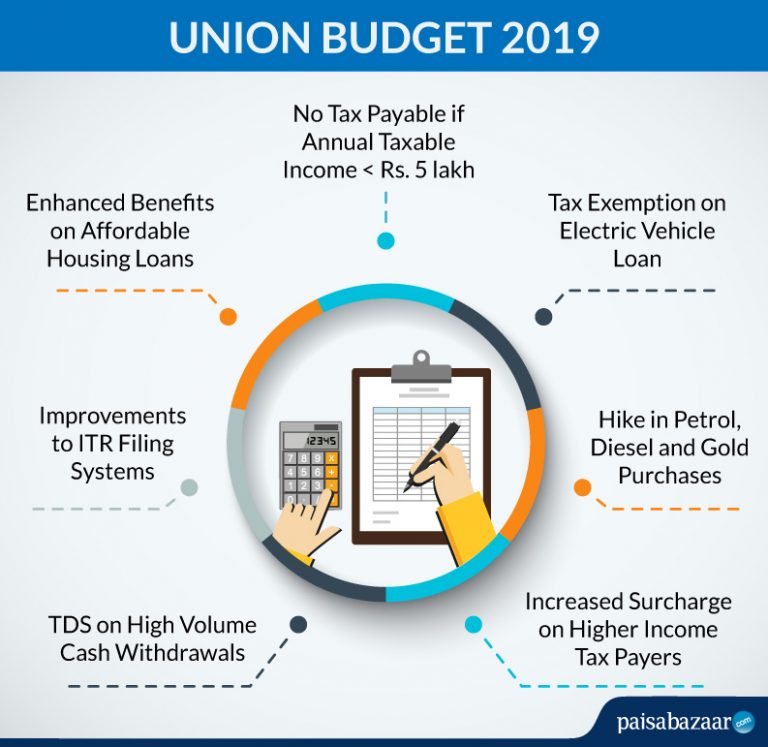

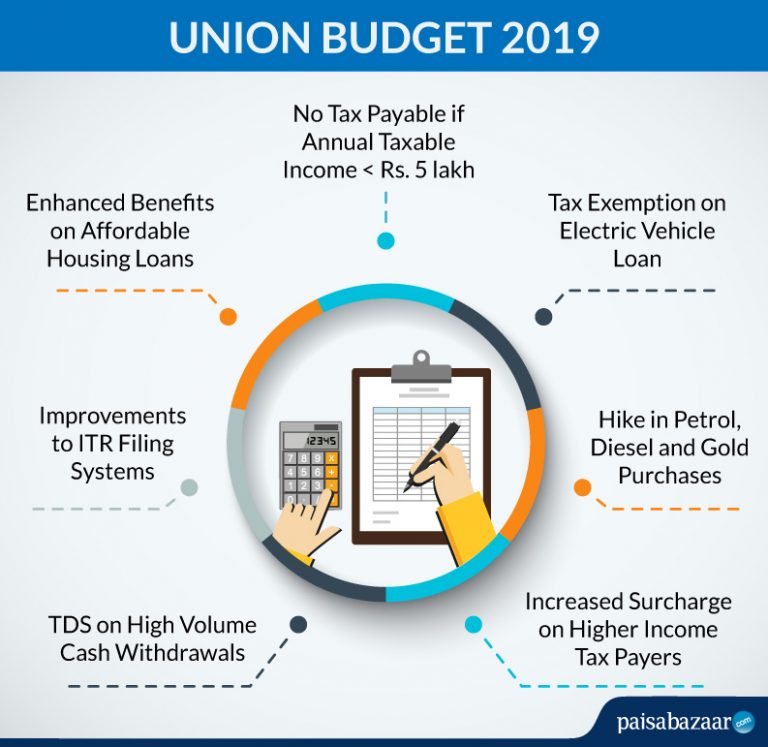

The Union Budget has been announced and was broadly built on the base provided by the Interim Budget 2019 presented on 1st February 2019. The following are some of the key Budget 2019 announcements made by Finance Minister Nirmala Sitharaman that are expected to impact the common man.

Affordable Housing Home Loan Benefit

Affordable housing has been a prominent project by the current government and Union Budget 2019 is expected to provide further impetus to this. Home loan borrowers can now look forward to an additional deduction of Rs. 1.5 lakh annually on home loan interest payments. This is provided that the home loan is borrowed by 31st March 2020 and used for purchase of a house valued at Rs. 45 lakh or less. This affordable housing loan benefit is in addition to the Rs. 2 lakh tax deduction provided under Section 24 of the Income Tax Act, 1961. In effect, home loan borrowers in the affordable housing category can get tax exemption of up to Rs. 3.5 lakh annually.

Rebate on Annual Taxable Income less than Rs. 5 lakh

Interim Budget 2019 announced a 100% tax rebate up to Rs. 12,500 u/s 87A for those with annual taxable income of Rs. 5 lakh. Union Budget 2019 has confirmed the same, so effectively those with taxable income of Rs. 5 lakh or lower will not have to pay any income tax whatsoever. Know more about Section 87A

Incentives for NPS Subscribers

While National Pension System (NPS) already features various incentives including tax savings u/s 80CCD designed to entice subscribers, Budget 2019 has formalised some key incentives for the benefit of subscribers. These announcements include:

- Increase of exemption limit from 40% to 60% of the final NPS corpus

- Increase of employer’s contribution by central government to 14% from current 10% limit

- Availability of tax relief for Tier 2 NPS investments made by the Central Government employee.

This changes, now formalised, are expected to significantly benefit the common man who invests in NPS.

Tax Exemption on Loans for Electric Vehicle Purchase

Union Budget 2019 has provided further incentive to those planning to purchase emission-free electric vehicles. This year’s budget has proposed a tax deduction of Rs. 1.5 lakh on loans used to purchase electric vehicles. This is expected to generate tax benefits of Rs. 2.5 lakh for the borrower over the loan tenure.

Petrol, Diesel and Gold Prices Hiked

The price of petrol and diesel is possibly one of the most discussed subjects in India. As per the budget announcement, the softening of crude oil prices globally allows the government some leeway to increase its revenue from petrol and diesel. As a result, a cess of Re. 1 per litre has been introduced on both petrol and diesel in Budget 2019, making these items dearer for the common man. Another key import of India i.e. gold is also set to become dearer with customs duty on this and other precious metals being revised upwards from the current 10% to 12.5%.

Surcharge Hike on High Income Individuals

Income tax is progressive in nature and those with higher incomes are required to pay a surcharge on top of their income being taxed at the highest bracket of 30%. Union Budget 2019 has increased the surcharge for those with annual income of Rs. 2 crore to Rs. 5 crore by 3%. Additionally tax payers with income of Rs. 5 crore and above will have their tax rate revised upward by 7%.

TDS Introduced on Cash Withdrawal Transactions

In order to reduce cash transactions by businesses, Budget 2019 has proposed 2% tax deducted at source (TDS) if cash withdrawals made from a bank account exceeds Rs. 1 crore annually. Furthermore, this budget also provided boost to low cost online payments such as UPI, UPI-QRCode, Aadhaar Pay, NEFT, RTGS, some debit cards, etc. by removing merchant discount rates (MDR) for customers and merchants alike. As per the announcement, these costs/charges will be borne by banks and RBI. For the common man, this should translate to easier and perhaps cheaper cost of making digital payments instead of paying in cash.

Improved Income Tax Filing Systems

One of the key announcements of this Budget was (perhaps not unsurprisingly) related to the interchangeability of Aadhaar and PAN with respect to use in income tax return filing. This paves the way to ensure that even those individuals who do not have either PAN or Aadhaar can now file their ITR with ease. However, the wider implications of this announcement are still to be clarified especially with respect to various other financial transactions. This year’s announcement has also mentioned other key changes in the ITR filing process such as introduction of pre-filled ITR forms, faceless e-assessment, random selection of cases for income tax scrutiny, etc. Once implemented these initiatives have the potential of making ITR filing a more streamlined and robust process for the benefit of the common man.