The Central Board of Direct Taxes (CBDT) has notified certain changes in Form 16, the salary TDS certificate, seeking more details about exempted allowances under section 10 of the Income Tax Act, 1961. The new format as notified by CBDT will come into effect from May 12, 2019.

Section 10 of the Income Tax Act includes various tax-exempt allowances given to the employee by the employer such as leave travel allowance (LTA), house rent allowance (HRA), leave encashment, transport allowance, life insurance, pension and gratuity.

What is Form 16?

Form 16 is basically a certificate issued by the employer detailing tax deducted at source for salaried individuals which can be used to claim a tax credit by the employee while filing ITR. The earlier format allowed companies to file consolidated figures or tax break-up in different formats which left some ambiguities in the individual break up.

Also Read: All You Need to Know About Form 16

Get FREE Credit Report from Multiple Credit Bureaus Check Now

What are the Changes with Form 16 Now?

As per the notification, reporting format in Part B of Form 16 has been standardised. The new format will allow the tax department to view detailed break up of such tax breaks claimed by the salaried individual and immediately spot any discrepancy between Form 16 details and ITR filed by the individual. The measure is expected to reduce the possibility of tax leakages.

Concurrent changes have been notified to Form 24Q, the TDS return, filed by companies with the tax department on a quarterly basis. The changes notified will align the details and format of income and tax deduction reporting in ITR, Form 16 as well as Form 24AQ.

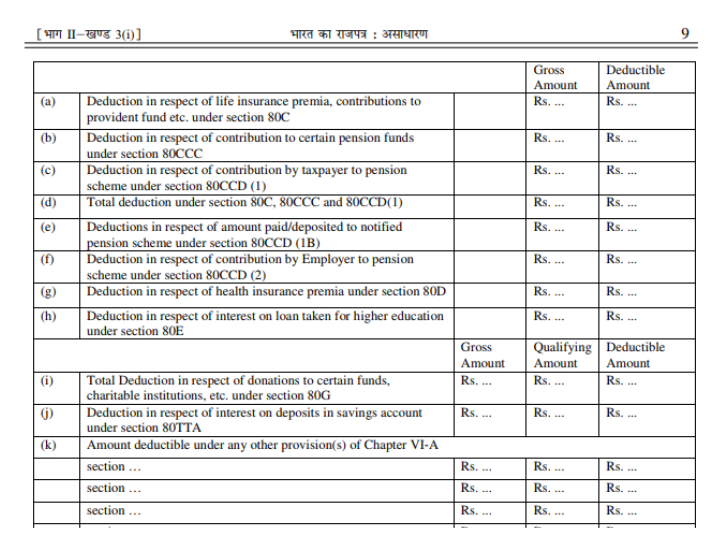

Further, under the new format of Form 16, the employer will also need to provide detailed break up of tax deductions claimed by the employee from his salary under section 80C to section 80U of the Income Tax Act, 1961.

This will not only help the taxpayer to easily file ITR and claim tax deductions by looking at Form 16. The revised format of Form 16 will also consist of an additional column for the standard deduction under the head “Deduction Under Section 16”.

Also Read: Best Tax Saving Investment Under Section 80C