A new and optional income tax regime was announced in Union Budget 2020. Under this new regime, the income tax slab rates have been significantly reduced. However, the concessional slab rates come at the cost of traditional income tax deductions that can be claimed under the old (existing) tax regime. As things stand right now, both these tax regimes will co-exist in AY 2025-26 (FY 2024-25). So, let’s understand the new slab rates and the applicable deductions in this article, so that you can make an informed decision and select the suitable tax regime for you.

Table of Contents :

New Income Tax Slab Rates

An individual or a Hindu Undivided Family (HUF) has now has the option to pay income tax as per the following new income tax slab rates for FY 2024-25:

| Income Slab | Income Tax Rate |

| 0 – Rs. 3,00,000 | Nil |

| Rs. 3,00,000 – Rs. 6,00,000 | 5% |

| Rs. 6,00,000 -Rs. 9,00,000 | 10% |

| Rs. 9,00,00 – Rs. 12,00,000 | 15% |

| Rs.12,00,000 – Rs.15,00,000 | 20% |

| Above Rs. 15,00,000 | 30% |

While the new regime offers lower income tax rates, the following conditions should be met in order to be eligible for payment of income tax as per the new (concessional) income tax slab rates:

- The total income of the individual or HUF should not include business income.

- The total income of the individual or the HUF should be calculated without availing the notified exemptions and deductions allowed under different sections of the Income Tax Act. The list of deductions that are no longer allowed under the new taxation regime has been discussed in the subsequent section.

- The total income should be calculated without setting off any losses, including both carry forward and depreciation-related losses. Moreover, capital losses from sale of house property cannot be deducted from the total income.

- The total income should be calculated without any exemption/deduction for allowances or perquisites under any other law in force at the time.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

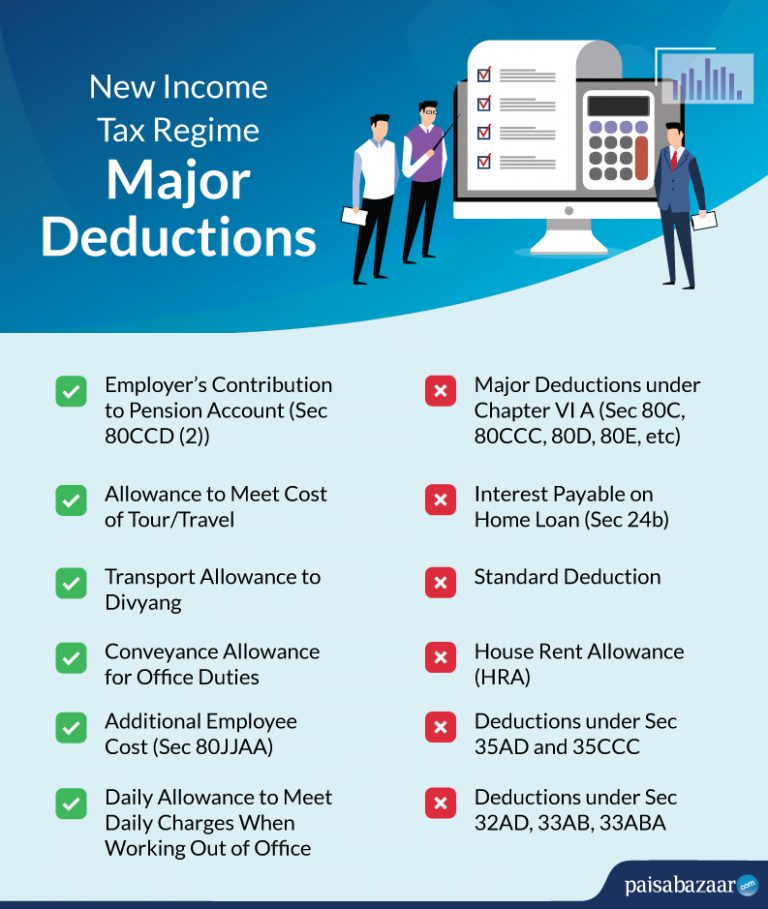

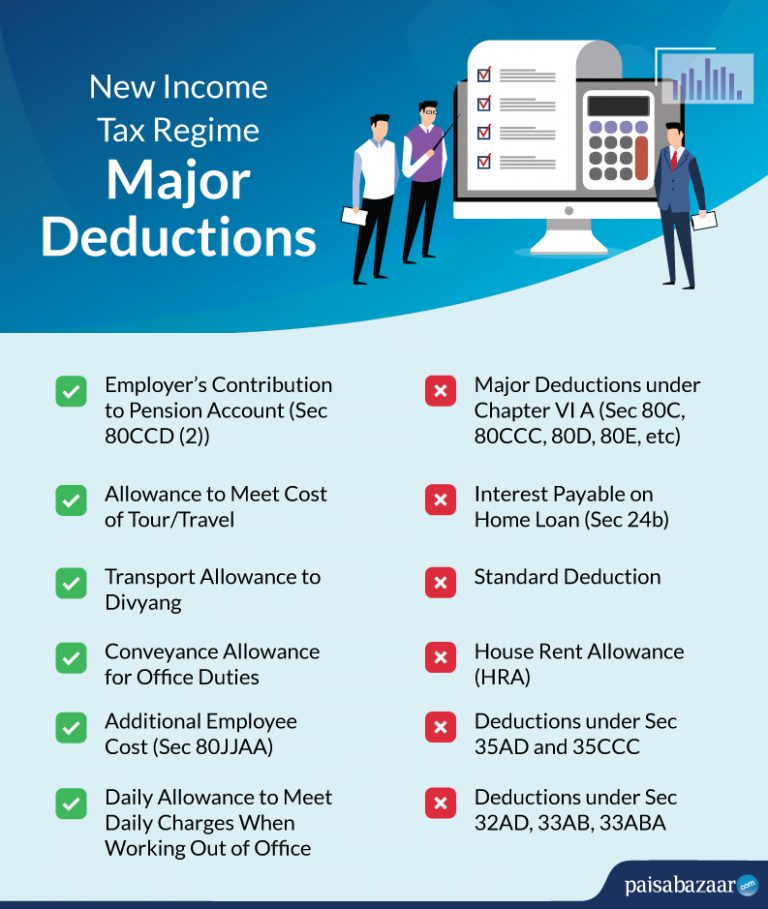

Deductions Not Allowed Under the New Income Tax Regime

Following is a list of key tax deductions that can be claimed under the current tax regime but cannot be claimed under the new income tax regime:

- Deductions under Chapter VI-A, such as those under Sections 80C; 80CCC; employee contribution u/s 80CCD; 80D; 80DD; 80DDB; 80E; 80EEA except those under 80CCD(2) and 80JJAA;

- Interest incurred on home loan (Section 24b);

- Leave travel concession;

- House rent allowance ;

- Allowance for income of minor;

- Standard deduction;

- Deduction for entertainment allowance;

- SEZ unit exemption;

- Deductions under sections 32AD, 33AB, 33ABA;

- Deduction for donation or expenses in scientific research;

- Deductions under sections 35AD and 35CCC;

- Deduction from family pension.

Deductions Allowed Under the New Income Tax Regime

Although most of tax deductions and exemptions cannot be claimed under the new tax regime, the following deductions are allowed under existing rules:

- The employer’s contribution to notified pension account under Section 80CCD (2) of the Income Tax Act. However, this deduction cannot exceed 10% of the employee’s previous year’s salary.

- Up to 30% of additional employee cost as per Section 80JJAA of Income Tax Act.

- Transport allowance given to differently-abled employees (divyang) to commute between the place of residence and the place of work.

- Conveyance allowance given for performance of office duties.

- Any allowance given to meet the cost of tour/ travel.

- Daily allowance given to an employee to meet the ordinary daily charges when he/she has to work at a place different from the normal place of duty.

Which is better – Old or New Income Tax Regime?

While the new regime comes with lower income tax slab rates, it takes away many of the tax benefits. For instance, you cannot claim some of the major tax deductions available under Chapter VI-A of the Income Tax Act. Moreover, you have to let go of the standard deduction which under the old tax regime could be availed by any salaried individual or pensioner irrespective of their annual income.

Thus, the answer to which is better depends on two factors, namely – your total annual income and the deductions and exemptions you can claim under the old tax regime. If your total tax outgo is lesser under the old (existing) tax regime, file ITR as per the old slab rates. Otherwise, you can follow the new tax regime.