Did you receive an Income Tax Notice/ Order? Are you wondering if it is valid or not? Don’t worry! The Income Tax Department has introduced a system of computer-generated “Document Identification Number (DIN)”, which can be used to verify any communication from the IT Department.

All the communications issued by the Income Tax Department relating to enquiry, investigation, assessment, appeals, orders, penalty, verification of information, rectification, prosecution etc. issued on or after 1st October, 2019 will have a unique DIN. Let’s understand how you can use DIN to check the validity of notices and orders issued by the IT Department.

Table of Contents :

Steps to check validity of an Income Tax Notice/ Order

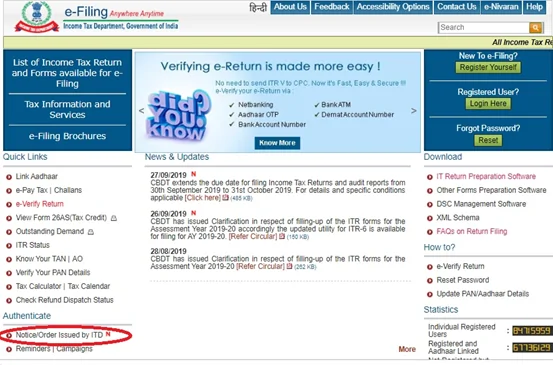

Step 1: Visit the e-filing portal of Income Tax Department.

Step 2: Click “Notice/ Order Issued by ITD” link on the left pane.

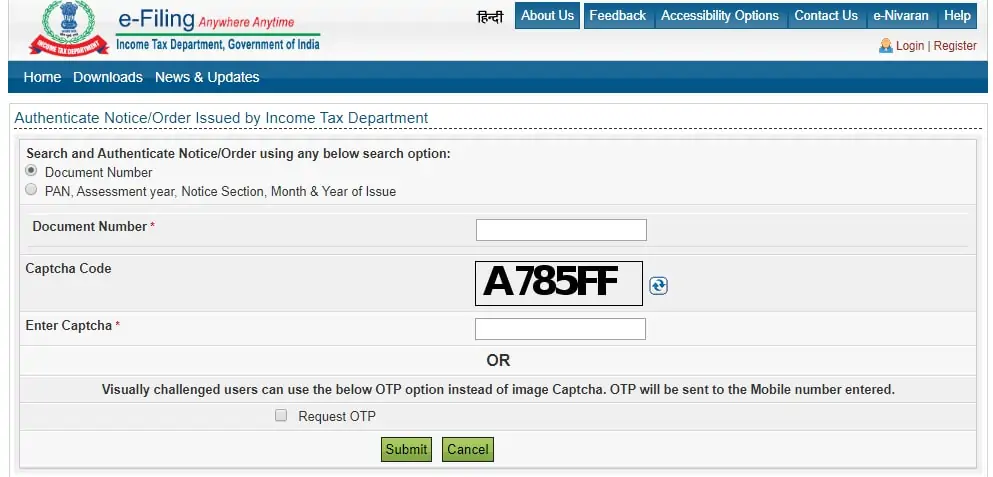

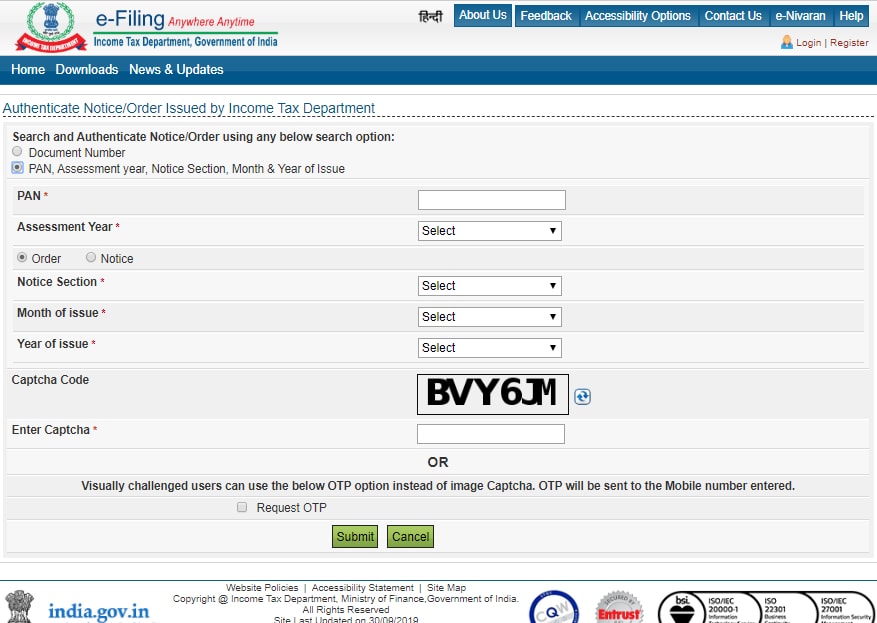

Step 3: You will be directed to the following web page, where you will see 2 ways to authenticate or validate an Income Tax notice/order:

Step 3: You will be directed to the following web page, where you will see 2 ways to authenticate or validate an Income Tax notice/order:

- Using Document Number

- Using PAN, Assessment year, Notice Section, Month

Step 4: If you select “Document Number” as the method to validate, following web page will be displayed. Enter the DIN, captcha code and click “Submit” to check the authenticity of the order/notice.

Step 5: If you select the other option, then the following web page will be displayed. Enter your PAN, assessment year, notice section, month and year of issue, captcha code and select submit to check the authenticity of the notice/order.

What are the benefits of Document Identification Number (DIN)?

In addition to ensure validity of all communications issued by the Income Tax Department, the introduction of DIN will help ensure:

- Greater transparency and improvement in service delivery by the Income Tax Department; and

- Maintenance of a detailed record of the responses with respect to any communication issued by the Income Tax Department.