The Finance Minister, Nirmala Sitharaman announced the e-assessment scheme in the Union Budget 2019-20. All Income Tax Returns (ITRs) picked for scrutiny going forward will now be assessed under the newly announced e-assessment Scheme, 2019. In the following sections we will discuss what e-assessment means? What effect it will have on the taxpayers and how is it different from the previous scrutiny assessment system?

Table of Contents :

- What is e-assessment scheme/ faceless scrutiny?

- What is scrutiny assessment?

- What does communication via electronic mode mean?

- How will the electronic records be delivered?

- Procedure for faceless e-assessment

- What to do when a show-cause notice is issued after the e-assessment?

- What does it mean when the draft assessment order is sent to the Review Unit?

- What happens after completion of e-assessment?

- How is the new e-assessment different from the offline scrutiny assessment?

- Frequently Asked Questions (FAQs)

What is e-assessment scheme or faceless scrutiny?

In the Union Budget speech 2019-20, the Finance Minister Nirmala Sitharaman announced the faceless e-assessment scheme. As per the scheme, scrutiny assessment from 2019 onwards will be carried out via an electronic mode with no human interface. Thus, there will be no face to face interaction between the taxpayer and the Income Tax Department when a taxpayer’s ITR is picked for a detailed scrutiny. This is expected to make the process of scrutiny more fair and unprejudiced, thereby decreasing the chances of undesirable practices on the part of tax officials.

What is scrutiny assessment?

The Income Tax Department not only reviews the income tax return (ITR) filed by the taxpayers, but also monitors their ITR filing patterns. Based on this, the Department selects some cases for a detailed examination along with some randomly picked cases. This process of detailed examination of one’s ITR is called Income Tax scrutiny. An income tax notice under Section 143(2) of the Income Tax Act is sent to such taxpayers to inform that their ITR has been picked for scrutiny.

What does communication via electronic mode mean?

All communications between the National e-assessment Centre and the assessee, or his authorized representative, will be made exclusively by electronic mode under the e-assessment scheme.

Moreover, all internal communications between the National e-assessment Centre, Regional e-assessment Centers and various units shall be exchanged exclusively by electronic mode.

How will the electronic records be delivered?

First, all the electronic records will be authenticated by affixing digital signature or electronic authentication technique. Subsequently, it will be delivered by way of:

- Placing a copy to the assessee’s registered account; or

- Sending a copy to the assessee’s or his representative’s registered email address; or

- Uploading a copy on the assessee’s Mobile App

Note: A real-time alert will be sent to the assessee or his/her authorized representative at every point of communication. The assessee will have to respond to such a communication through his/her registered account only. Finally, an acknowledgment will be received upon successful submission of response which will deem the response to be authenticated.

Procedure for faceless e-assessment

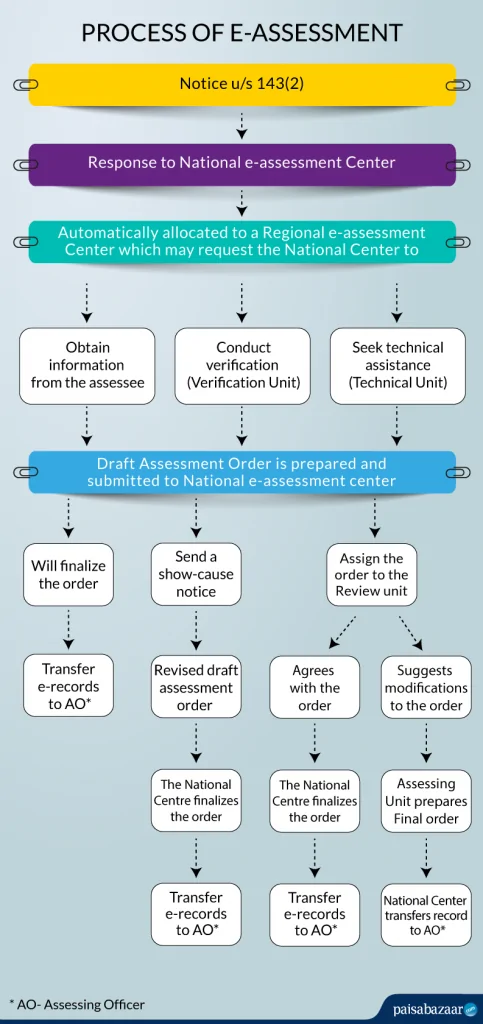

- A notice under section 143(2) of Income Tax Department will be sent by National e-assessment Centre. The notice will specify the issues for selection of the taxpayer’s case for scrutiny.

- The taxpayer/assessee may respond to the National e-assessment Center within 15 days of the date of the receipt of the notice.

- The National e-assessment Centre will assign the case to one of the regional e-assessment centers through an automated allocation system.

- The regional e-assessment center may request the National e-assessment center to:(i) Obtain necessary information or documents or evidence from the assessee: The National e-assessment center will issue an appropriate notice to the assessee for obtaining the relevant information.

(ii) Conduct enquiry or verification by the verification unit: The National e-assessment center will assign the request to a verification unit via an automated allocation system.(iii) Seek technical assistance from the technical unit: The National e-assessment center will assign the request to a technical unit in any of the Regional e-assessment centers via an automated allocation system. - The assessment unit after taking into account all the information will prepare a draft assessment order either accepting or modifying the ITR of the assessee. A copy of this order will be sent to the National e-assessment center.

Note: The assessment unit will provide the details of the penalty proceedings in the assessment order sent to the National e-assessment center.

- The National e-assessment center will examine the draft assessment order via an automated examination tool in accordance with the approved risk management strategy and may:(i) Finalize the draft assessment order and issue a notice to the assessee to initiate penalty proceedings along with a demand or refund notice, if applicable.

(ii) Give the assessee a chance by sending a notice to call him/her to show cause as to why the assessment should not be completed as per the draft assessment order (when a modification is proposed).(iii) Assign the draft assessment order to one of the review units in any Regional e-assessment centers via an automated allocation system.

What to do when a show-cause notice is issued after the e-assessment?

When a show-cause notice is issued to an assessee, he/she should furnish the response within the specified time limit.

The assessment unit after receiving the response from the assessee will prepare a revised draft assessment order and send it to the National e-assessment center which may:

- Finalize the assessment as per the revised draft assessment order and serve a copy of the order and the notice to the assessee for initiating penalty proceedings; or

- Send another show-cause notice to the assessee, if a modification is proposed.

However, when an assessee fails to submit the response within the specified time limit, the National e-assessment centre will finalize the assessment as per the initial draft assessment order submitted by the Assessment Unit.

What happens after Review Unit receives the draft assessment order?

This happens when the National e-Assessment Center sends the draft assessment order to one of the Review Units in any Regional e-assessment Center via an automated allocation system.

Subsequently the Review Unit will review the order and may:

- Agree with the draft assessment order: The National e-assessment center will finalize the draft assessment order. Alternatively, if a modification is proposed, the center will send a show-cause notice to the assessee.

- Suggest modification to the draft assessment order: After considering the modifications, the assessment unit will send the final assessment order to the National e-assessment center. The center may finalize the order or send a show-cause notice to the assessee, if a modification is proposed.

What happens after completion of e-assessment?

After finalizing the draft assessment order, the National e-assessment center will transfer all the electronic records to the Assessing Officer (AO) having jurisdiction over the case. Then the AO may take the following actions:

- Imposition of penalty;

- Collection and recovery of tax demand;

- Rectification of mistake;

- Giving effect to appellate orders;

- Submission of remand report or any representation to be made or any record to be produced before the Commissioner, Appellate Tribunal or Courts;

- Proposal seeking sanction for launch of prosecution;

- Any other reason considered to be appropriate by National e-assessment Center

Note: The penalties, if applicable will be imposed as per the respective sections of the Income Tax Act, 1961.

How is the new e-assessment scheme different from the offline scrutiny assessment?

| E-assessment Scheme, 2019 | Offline scrutiny Assessment | |

| Mode of communication | Both internal and external communications will be done only via electronic mode including emails and video conferencing. | By means of sending notices and responses in paper format. |

| Personal interaction | No personal interaction between the assessee and the Income Tax Department representative such as assessing officer. | In some cases, the assessee had to personally visit the department and present answers to the Assessing officer. |

| Units involved | This scheme involves the National and Regional e-assessment centers along with Verification and Review units. | This scheme only involved the Assessing Officer and the assessee. |

| Procedure | A draft assessment order prepared by the assessing unit is examined by the National e-assessment Center. The order is then finalized/modified/reviewed to prepare a final draft. The final draft is sent to the assessing officer who implements the final decision as per the order. | The Assessing Officer evaluated the ITR and complete the assessment accordingly. |

| Pros and Cons | Communication via electronic mode will make the process more fair and just. | In certain cases, the personal interaction led to undesirable practices on the part of tax officials. |

>

Frequently Asked Questions (FAQs)

1. What is the E-assessment Scheme, 2019?

Ans. The Finance Minister, Nirmala Sitharaman announced faceless e-assessment scheme in the Union Budget 2019-20. As per the scheme, scrutiny assessment from 2019 will be carried out via an electronic mode with no human interface. In other words, there will be no personal i.e. face to face interaction between the taxpayer and the Income Tax Department when a taxpayer’s ITR is picked for detailed scrutiny.

2. What is scrutiny assessment?

Ans. The Income Tax Department reviews the income tax return (ITR) filed by the taxpayers, but also monitors their ITR filing patterns. Based on this, the Department selects some cases for a detailed examination along with some randomly picked cases. This process of detailed examination of filed returns is called Income Tax Scrutiny. An income tax notice under Section 143(2) of the Income Tax Act is sent to such taxpayers to inform that their ITR has been picked up for scrutiny.

3. How should I reply to the income tax notice u/s 143(2)?

Ans. If your ITR has been picked for a detailed assessment or scrutiny, you will receive a notice under Section 143(2) via an electronic mode. Upon receiving such a notice, you should respond within 15 days through your registered account only. An acknowledgment will be received upon successful submission of response, that will deem the response to be authenticated.

4. How will electronic communications be delivered under e-assessment scheme?

Ans. Electronic communications under the e-assessment scheme will be delivered by:

- Placing a copy to the assessee’s registered account; or

- Sending a copy to the assessee’s or his representative’s registered email address; or

- Uploading a copy on the assessee’s Mobile App

Moreover, a real-time alert will be sent to the assessee or his/her authorized representative at every point of communication.

5. How will electronic communications be authenticated under the faceless scrutiny assessment scheme?

Ans. Under the e-assessment scheme, all electronic communications must be authenticated by affixing digital signature or electronic authentication technique. Thus, whenever you send a response to the IT Department, authenticate it with your digital signature.

6. How is faceless e-assessment different from the earlier system?

Unlike the previous method, e-assessment involves communication via electronic mode only. There is no personal interaction between the assessee and the department. This is expected to eliminate undesirable practices on the part of tax officials. For more info, read the Differences between the new e-Assessment.

7. What will be the advantage of the e-assessment scheme?

Ans. Under the e-assessment scheme, there will be no personal interaction between the assessee and the assessing officer. Also, the Assessing Unit will be selected by an automated system without any bias. Thus, chances of any undesirable practices on the part of tax officials will decrease making the process of scrutiny assessment more fair and just.

8. What effect will e-assessment have on taxpayers?

Ans. As the mode of communication under the e-assessment scheme will be solely electronic, the taxpayer will no longer be required to post documents or personally meet the assessing officer to answer any queries.

9. What to do when a show-cause notice is issued?

Ans. A show-cause notice is sent when a modification is proposed in the previously filed ITR. Upon receiving this notice, you should reply within the specified time limit from your registered account. Remember to authenticate the response by affixing the digital signature. Also, make sure that you receive an acknowledgement upon successful submission of the response.

10. How will the penalties be imposed after the e-assessment?

Ans. After successful e-assessment, a copy of the final draft assessment order is sent to the Assessing Officer having jurisdiction over such case. Subsequently, penalties will be imposed as per the chapter XXI of the Income Tax Act. Relevant notices will be sent to the assessee in such a case.