Income tax e-filing refers to the process of submitting income tax return (ITR) online to Government tax authorities in the prescribed format. Income tax e-filing is safer, simpler and quicker than visiting the Income Tax Office to file your returns. Under existing income tax rules in India, e-filing is currently mandatory for most tax assessees and replaces the earlier paper-based system of filing ITR. The last date for e-filing Income Tax Return for AY 2025-26 is 31st July 2024.

Table of Contents :

- Top Income Tax e-filing Options in India

- How to e-File ITR on Income Tax Department Website

- What are the ITR Forms for e-filing Income Tax in AY 2025-26 (FY 2024-25)

- Eligibility Criteria for Income Tax e-filing

- Documents Required for e-filing of Income Tax

- Last Date to File your e-file Income Tax Returns

- How to Register for e-filing on the Income Tax Website

- How to Access your Account at Income Tax e-filing Login Portal

- Advantages of e-filing of Income Tax

- Why Have I Not Received My Income Tax Refund Yet

- Frequently Asked Questions (FAQs)

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Top Income Tax e-filing Options in India

Currently, there are 3 ways to complete income tax e-filing in India:

- On the official Income Tax e-filing website

- Through a registered online tax filing intermediary

- Through a TRP (Tax Return Preparer), CA (Chartered Accountant) or tax lawyer.

How to e-file ITR on Income Tax Department Website

In order to e-file income tax return for the current year, these steps are to be followed:

- Visit the Income Tax Department website.

- Register in case you are a new user or login if you already have an account.

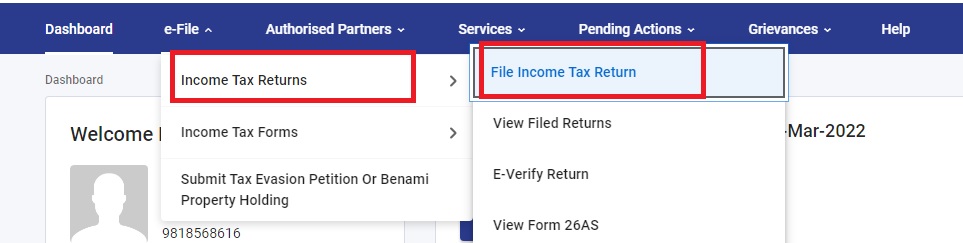

- In the ‘e-File’ drop-down menu, select ‘Income Tax Returns’ option and then choose ‘File Income Tax Return’.

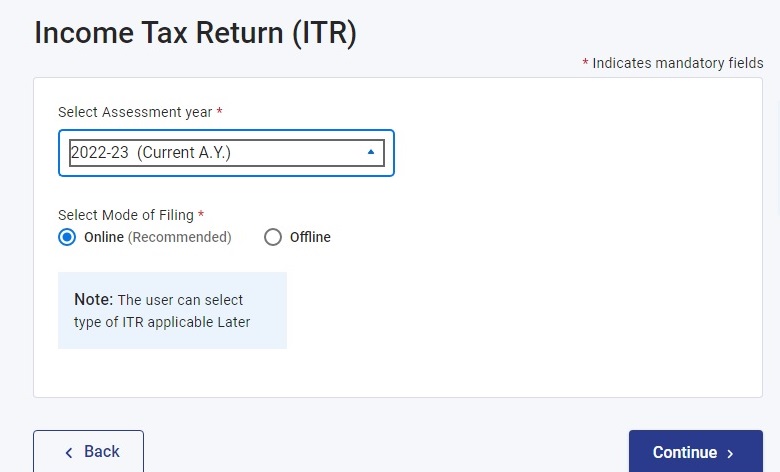

4. Select the assessment year and submission mode

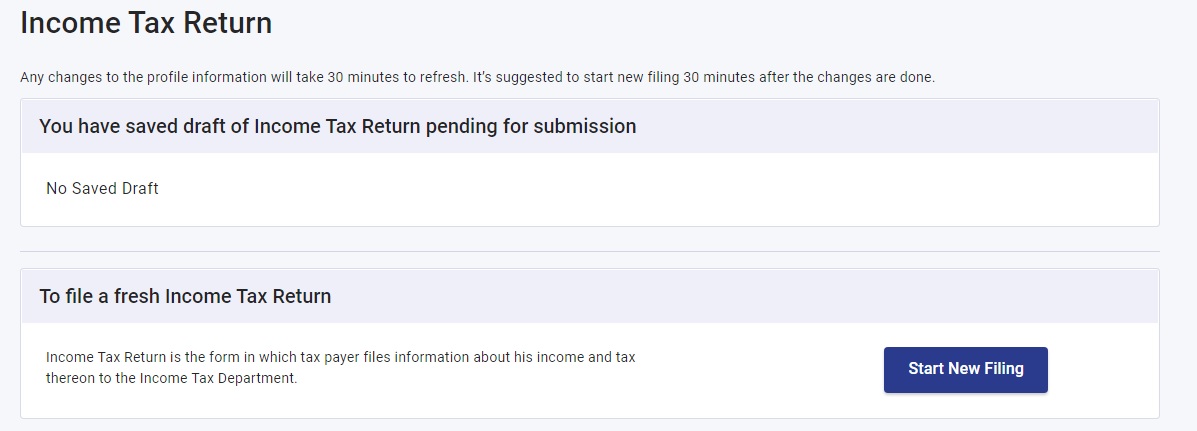

5. To file a fresh ITR, click on ‘Start New Filing’

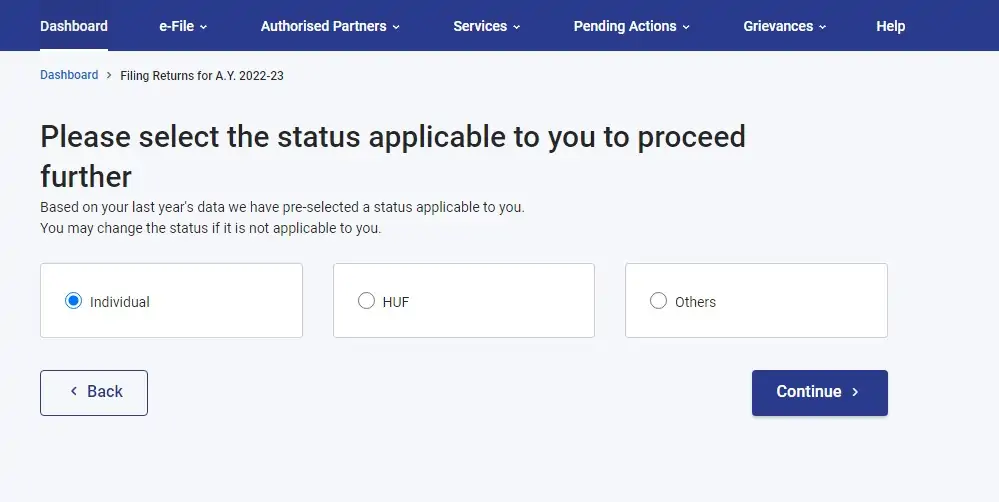

6. Select your applicable status,i.e., whether you are an individual/HUF/Others and click on ‘Continue’

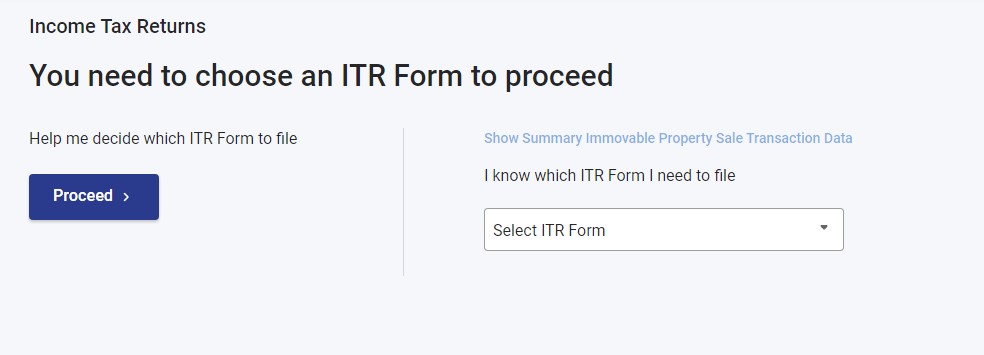

7. Choose an appropriate ITR Form to proceed further. Resident individuals having a total income up to Rs. 50 lakh and those with agricultural income up to Rs. 5,000 can select Form ITR 1.

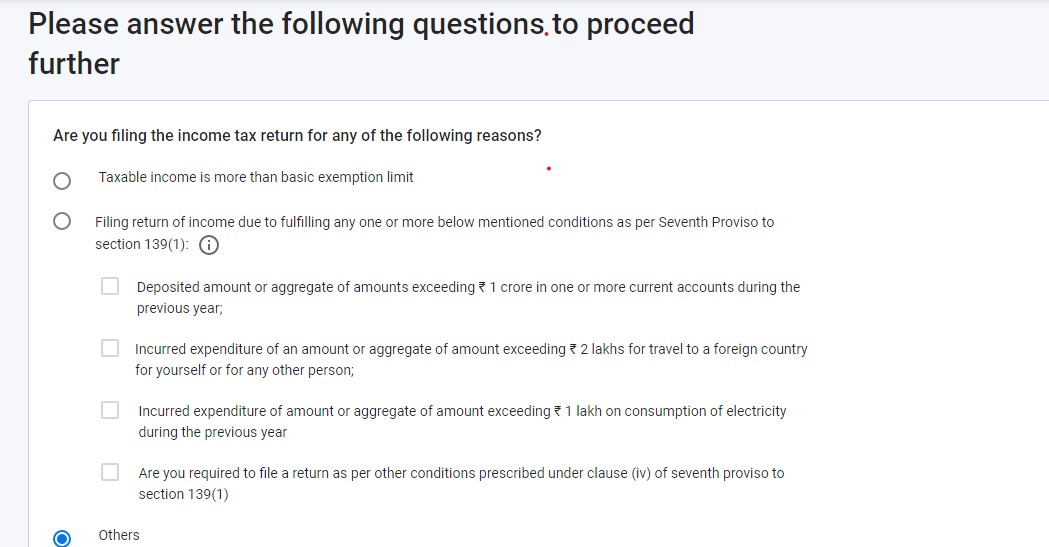

8. Select the reason for which you are filing the ITR

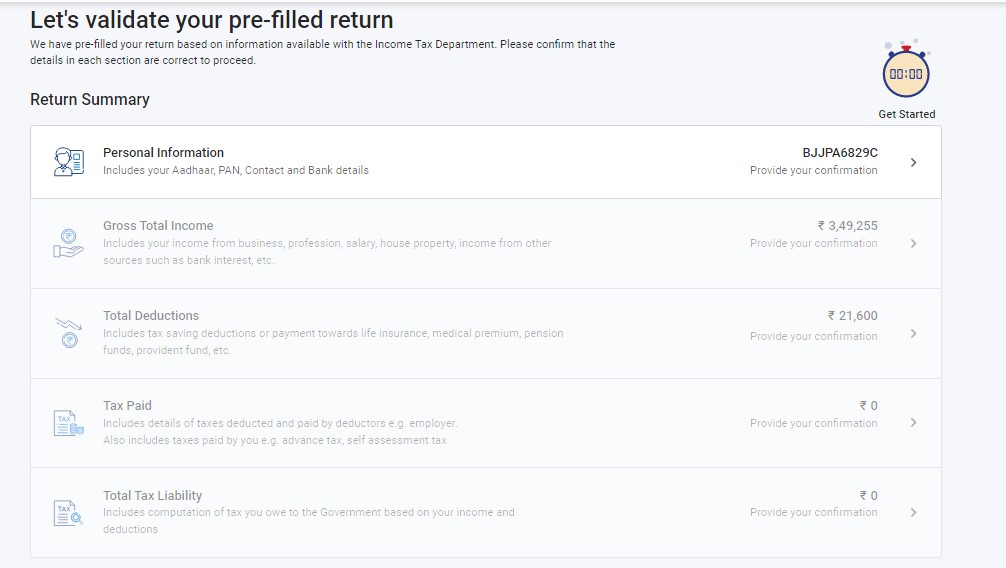

9. You will get your pre-filled return based on the information available with the Income Tax Department. Confirm/Validate the details in each section including your personal information, gross total income, total deductions, taxes paid and total tax liability to proceed further.

10. Also, fill in details that were not entered previously.

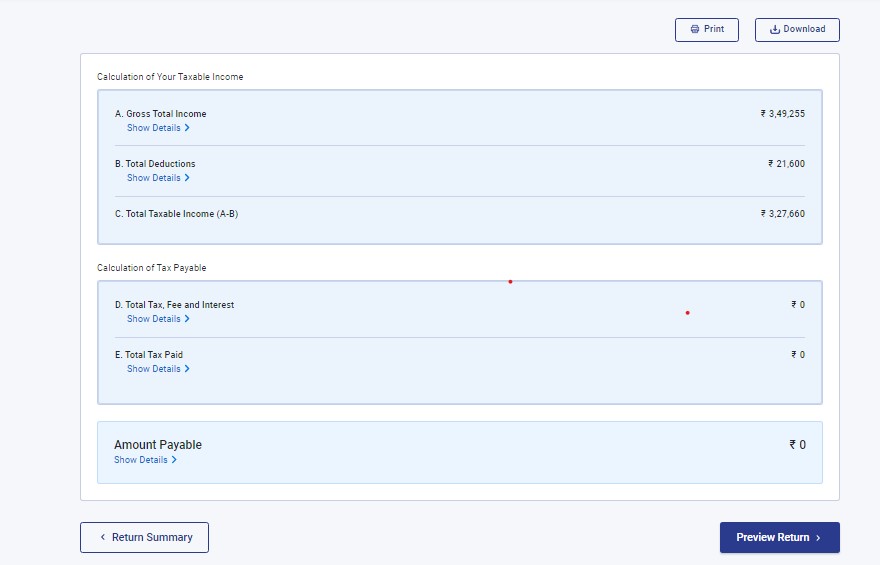

11. Confirm your return summary details.

12. Preview and submit your ITR

Suggested Read: Income Tax for Self-employed

Get FREE Credit Report from Multiple Credit Bureaus Check Now

What are the ITR Forms for e-filing Income Tax in AY 2025-26 (FY 2024-25)

| ITR Form Number | Applicability |

| ITR 1 (SAHAJ) | Resident individuals (except not ordinary residents) with income from salary, single house property and other sources (such as interest, capital gains, etc.) not exceeding Rs. 50 lakh annually. Also to be used by those with agricultural income up to Rs. 5,000 annually. |

| ITR 2 | Individuals/Hindu Undivided Family (HUFs) who do not have income from profits/gains of profession/business. |

| ITR 3 | Individuals/HUFs who have income from profits/gains of profession/business. |

| ITR 4 (SUGAM) | Resident Individuals/HUFs/Firms (excluding LLP) with annual income up to Rs. 50 lakh from business/profession computed u/s 44AD, 44ADA, 44AE. |

| ITR 5 | Tax Assesses except Individual, Company, HUF and those filing ITR 7. |

| ITR 6 | Companies apart from those claiming exemption under Section 11. |

| ITR 7 | Companies/Persons furnishing ITR under Section 139(4A), Section 139 (4B), Section 139 (4C) and Section 139 (4D). |

Eligibility Criteria for Income Tax e-filing

It is now mandatory under Income Tax rules to complete income tax e-filing. The exceptions to mandatory e-filing by tax assessee are as follows:

- The income tax assessee is a HUF/individual with annual income from all sources (exempt and not exempt) of up to Rs. 5 lakh

- The income tax assessee is 80 years of age or older (super senior citizen) for the FY

In both the above cases, income tax returns can be either e-filed or filed using the applicable paper ITR form.

Documents Required for e-filing of Income Tax

You do not need to attach any documents with your ITR Form unless required to do so by order of the Income Tax Department. However, the taxpayer must keep some important documents ready with him/her for a smooth e-filing experience. Some key tax documents for easy income tax e-filing are as follows:

- Form 16 (for salaried/pensioners)

- Form 26AS

- Profit and Loss Statement (for businesses/self-employed)

- All investment documents (u/s 80C, 80D, 80E, 80G, etc.)

- Home loan interest certificate, etc.

Read More on Income Tax Documents

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Last Date to e-file your Income Tax Returns

For the assessment year (AY) 2025-26 i.e. financial year 2024-25, the last date to file your income tax returns is 31st July, 2024 . However, the e-filing deadline is typically subject to extensions by order of the Government of India.

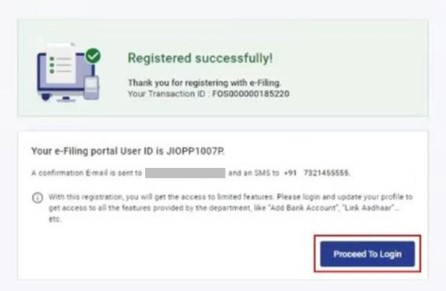

How to Register for e-filing on the Income Tax Website

The following steps will help you register on the Income Tax Department website:

- Visit the Income Tax E-filing Portal

- Click on the ‘Register’ button located on the right hand side of the home page.

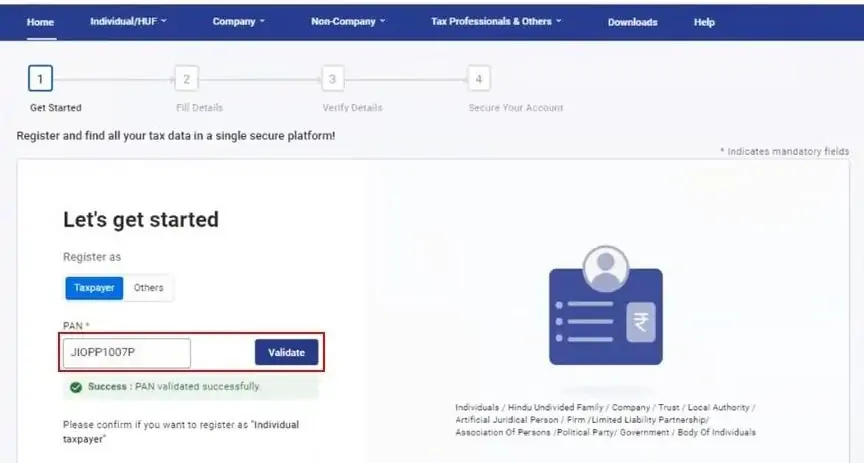

3. Enter your PAN under Register as Taxpayer option and click on the Validate button.

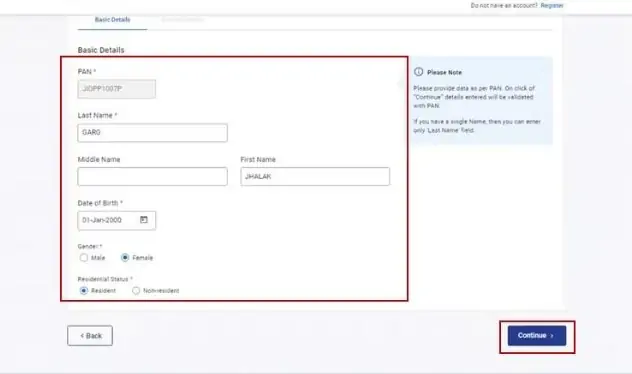

4. On the Basic Details page, fill in all the mandatory details including your name, date of birth/incorporation, gender (in case applicable) and residential status as per your PAN and click on ‘ Continue’.

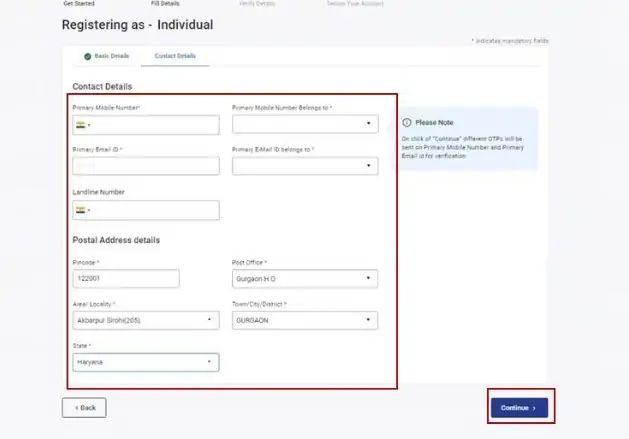

5. Once your PAN is validated, the Contact Details page appears in case of individual taxpayers. Fill in details such as your primary mobile number, address, email id and click on ‘Continue’.

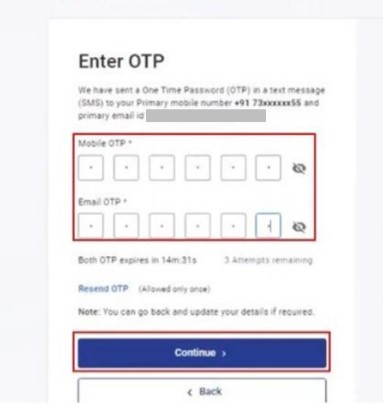

6. Two different OTPs are sent on the primary mobile number and email id. Enter both the 6-digit OTPs and click on ‘Continue’.

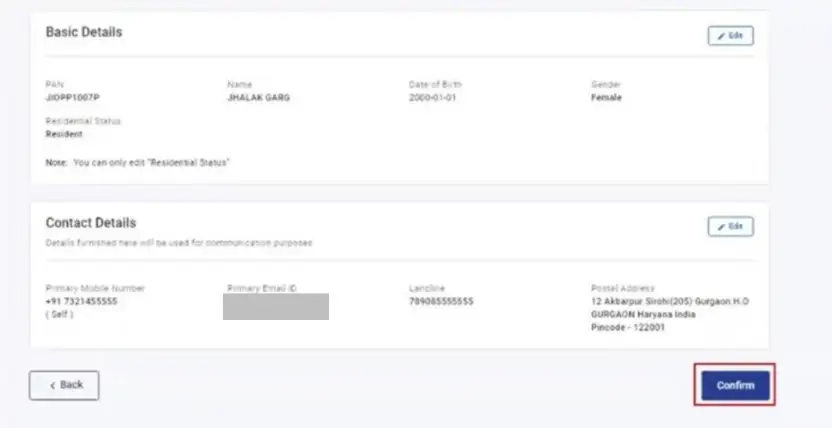

7. Edit the details on the page if needed and click on ‘Confirm’.

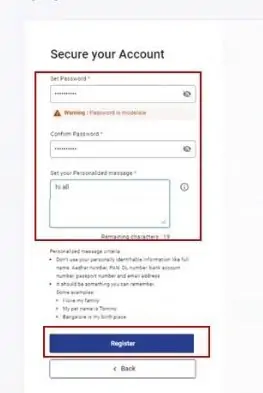

8. On the Set Password page, fill in your desired password in both the Set Password and Confirm Password textboxes. Enter your personalised message and click ‘Register’.

9. Once you have successfully registered, you can click on ‘Proceed to Login’ to start the login process.

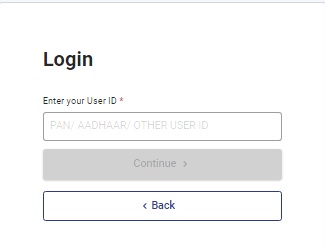

How to Access your Account at Income Tax e-filing Login Portal

After registering yourself on the Income Tax e-filing Portal, you will be able to log in to your account. For Income Tax e-filing Login, follow these steps:

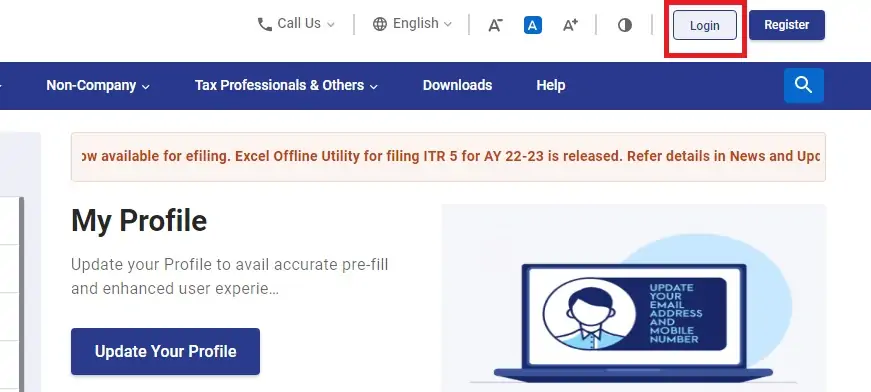

- Visit the Income Tax e-filing Login Webpage

- Click on ‘Login’ located on the right-hand side of the home page

3. Enter your User Id and password to login to your account.

Read More: Income Tax Login

Advantages of e-filing of Income Tax

e-filing of income tax returns has been made compulsory by the Government of India. The process is much easier compared to the earlier paper filing process.The advantages of e-filing of income tax are as follows:

- The last date for filing income tax returns is July 31st every year. If the user files it one or two months prior to this date, they can complete the task more swiftly with less congestion as servers tend to get overloaded when the final date approaches.

- Online filing of tax returns helps the taxpayer to keep a record of all the financial transactions with the Income Tax Department in a more effective manner.

- This record can act handy if the taxpayer wishes to carry out a business relation with any other organisation supporting such records in the future.

- If the taxpayer is unable to file income tax returns for the previous year, he is liable to pay penal interest for every extra day till the date when payment is paid. So, advance filing of income tax return saves you from the additional fine.

Also Read: Belated Income Tax Returns

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Why Have I Not Received My Income Tax Refund Yet

In case you have not received your income tax refund till date, it could be due to one of the following reasons:

- Your income tax return has not been processed yet.

Once the return is processed, you may receive a refund (if determined). To check the status of your e-filed IT return, log in to the income tax department website and go to “e-file” → “View e-Filed Returns/Forms”→ “e-Filed Returns/Forms”

- Your income tax return has been processed but no refund is determined.

- Your income tax return has been processed and a refund has been determined, but the ECS credit could not be made.

This could be because of an incorrect bank account number for ECS credit. To check if your refund has been returned to the income tax department, log in and go to “e-file” → “View e-Filed Returns/Forms” → “e-Filed Returns/Forms” and track the status. In case of any issues, you may contact CPC, Bangalore at 18001030025 / 8046122000.

Frequently Asked Questions (FAQ)

Q. Is PAN mandatory to e-file ITR?

Yes. Under existing tax rules, it is mandatory to have a valid PAN in case you want to e-file your income tax. In fact, those eligible for paper-based tax filing also cannot file their taxes unless they have a valid PAN.

Q. Can I file old ITR such as those for FY 2015-16 in the current assessment year (AY 2025-26)?

No. In the current assessment year, all income tax filings except those for FY 2025-26 are closed and new or revised returns for earlier years can no longer be filed. However, you will be able to file old returns in case you receive a notice from the Income Tax Department demanding you to do so.

Q. I already pay TDS. Do I also need to file ITR?

Yes. If you have TDS deductions made on your salary, it indicates that your annual income from various sources exceeds the minimum tax exemption limit. Therefore you will have to file your income taxes under existing IT Act Rules.

Read more on TDS or Tax Deducted at Source & TDS on Salary

Q. I am a salaried tax assessee. Which ITR form should I fill out?

In most cases, ITR Form 1 (SAHAJ) is the most relevant one for e-filing income tax returns. However, in case you have capital gains from share trading you may be required to e-file using a different ITR form such as ITR 2.

Q. Are there any benefits of e-filing Income Tax Returns?

Some of the key benefits of e-filing ITR include:

- Round-the-clock availability

- Quicker turnaround time between submission and verification

- Faster processing and credit of refunds

- Greater accuracy of ITR filing due to automated forms.

Q. Can I face criminal prosecution if the tax returns for my taxable income are not filed?

Yes, if you don’t pay the taxes, you may be required to pay penalties, additional interest or face prosecution. The prosecution may vary based on the amount of tax that you had to pay.

Q. What is the difference between e-filing and e-payment?

Income tax e-filing is the process of electronically submitting your income tax return on the Income Tax e-filing portal, whereas, e-payment is the process of electronically paying tax.

Q. If I have made a calculation mistake in my filed ITR, is it possible to correct it and re-submit my return?

Yes, if you have filed your ITR and you later find out that you have made a mistake, you can re-submit your return. This is known as a Revised Return. However, your return needs to be revised three months before the end of the relevant AY. For instance, for AY 2023-24 the due date for filing a revised return is 31st December 2023.

2 Comments

What are the fees for income tax e file India/e file income tax return?

You are not required to pay any fees/charges e-file income tax return on your own.