ITR Filing is one of the most important dates of the financial calendar and as the final step, it requires you to e-verify your ITR subsequent to submission of your returns for the applicable financial year. The task of ITR verification needs to be completed within 120 days of submission of your income tax returns for the applicable fiscal. Under existing income tax rules, the process of income tax return e-filing verification can be completed via either the online of offline route. One way to e-verify your ITR online is by generating EVC (Electronic Verification Code) using Demat account.

How to Generate EVC using Demat Account?

Once you have pre-validated your Demat Account, you are now ready to use your account to generate an EVC for verification of your income tax return.

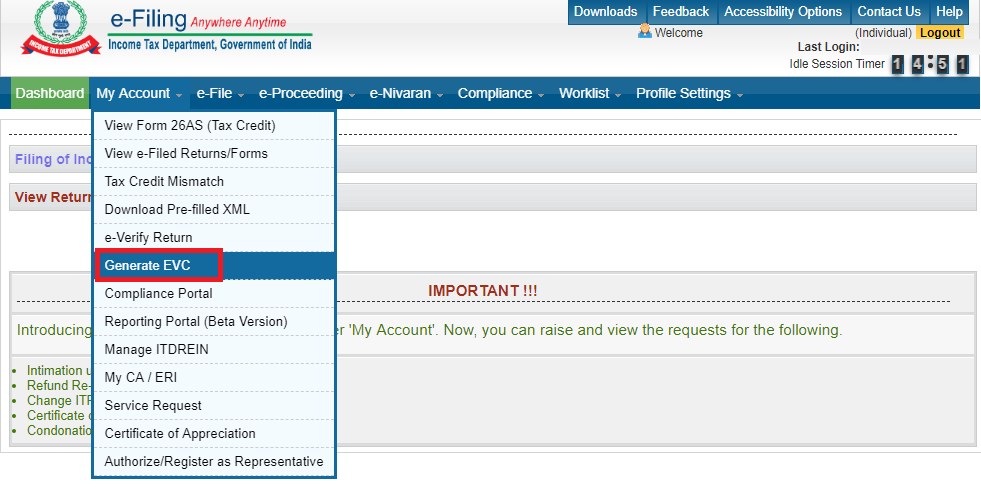

Step 1: Log into your income tax e-filing account and click on the “Generate EVC” link located under the “My Account” menu available from the dashboard view.

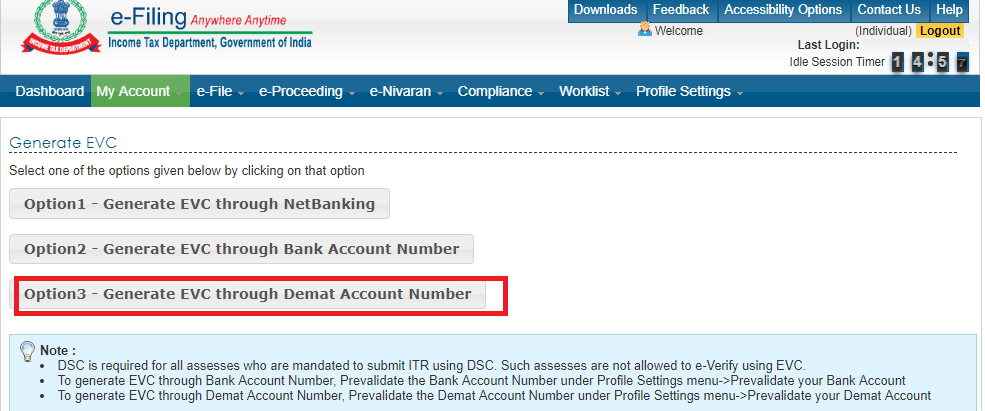

Step 2: Once you have clicked on the “Generate EVC” link, you will be directed to the subsequent page where you will have to choose the “Generate EVC through Demat Account Number” option.

Step 3: On the subsequent page you will have to confirm that you want to receive EVC on registered phone number. Subsequently, you can input this EVC on the e-verify returns page to complete the ITR e-filing and e-verification process.

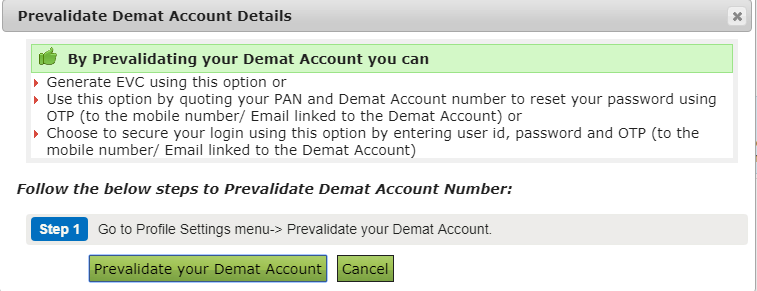

On the other hand, if you are have not pre-validate your Demat account yet, you will see the following page which directs you to pre-validate your Demat account option as shown below:

How to Pre-validate Demat Account for ITR e-Verification?

At the time of registering and opening a Demat account, PAN (permanent account number) is a mandatory requirement, as a result, it serves as an ideal method for generating an electronic verification code for ITR e-verification. Pre-validation of your Demat account is the first step towards generating an EVC. The following are the key steps for pre-validating your Demat account:

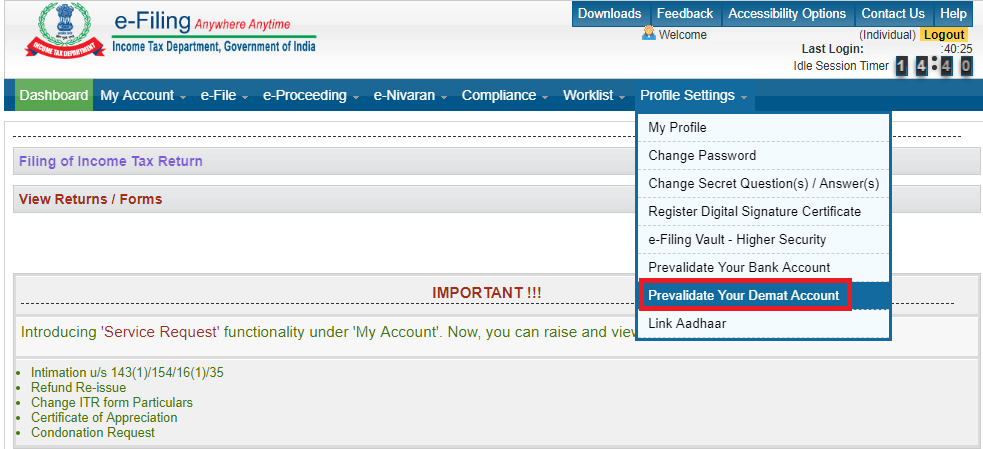

Step 1: Log into your Income Tax e-filing account and click on the “Prevalidate Your Demat Account” link located under the “Profile Settings” menu available in the Income Tax e-filing dashboard view.

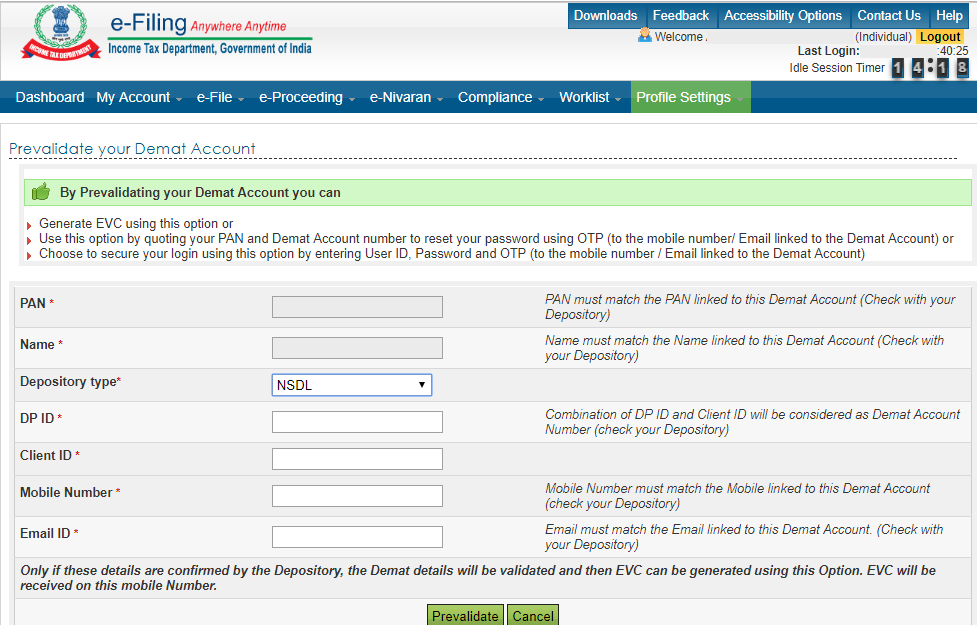

Step 2: On clicking the “Prevalidate Your Demat Account” link, you are redirected to the following page:

On this page, you are required to fill out the various mandatory fields such as Depository Type (NSDL/CDSL), DP ID, Client ID, Mobile Number, Email ID and then click on the “Prevalidate” button.

Step 3: After you have clicked the “Prevalidate” button, you will receive an OTP on your mobile and email ID. Once you have filled those out on the Income Tax e-filing page, your Demat account will be pre-validated for generating EVC, which is sent to your registered mobile number.