The GST eWay bill is an electronically generated document that has to be carried by the person in charge of transport of goods (both intrastate and interstate). In the following sections we will discuss some key aspects of the current e Way bill system under GST.

Table of Contents :

- Introduction to the eWay Billing System

- e-Way bill under GST v/s Way bill under VAT

- How to register in the eWay bill system? (GST Registered Taxpayers)

- How to enrol in the e Way bill system? (GST Unregistered Transporters)

- Advantages of e Way Bill System

- Features of eWay Billing System

- What is RFID tagging?

- What is Form GST EWB-01?

- Frequently Asked Questions (FAQs)

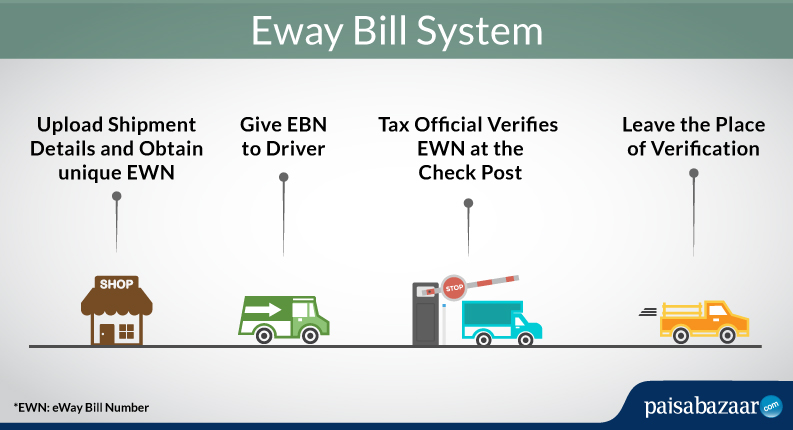

Introduction to the eWay Billing System

Under the GST regime, every registered person who is engaged in transporting goods (not necessarily on account of supply) of value more than Rs. 50,000 within or outside the state of origin is required to generate an eWay bill. It is electronically generated by uploading the relevant information about the goods before their transport on www.ewaybillgst.gov.in. Alternatively, eWay bill can be generated through SMS/ e Way bill android app. Each GST eway bill is generated in triplicate and features a unique eWay Bill Number (EBN). The three copies of the GST e way bill are to be distributed as follows – one for the supplier, another for the recipient and the third one for the transporter of the goods.

What’s more, the registered supplier can fill GSTR -1 using the information supplied at the time of e-Way bill generation on the common portal.

How is an e-Way bill under GST different from a Way bill under VAT?

The eWay billing system under GST has simplified the process for both the GST registered taxpayers and the unregistered transporters. Under the GST regime, the same eWay bill can be used across all the states and union territories in India. This will result in smoother movement of goods and free trade from one state to another.

On the other hand, during the VAT regime, the Way bill (a delivery note with a unique number) was different for each state. This difference often hindered the movement of goods across states. Additionally, it was difficult for the State and the Central Government officers to cross verify such bills generated independently by each state.

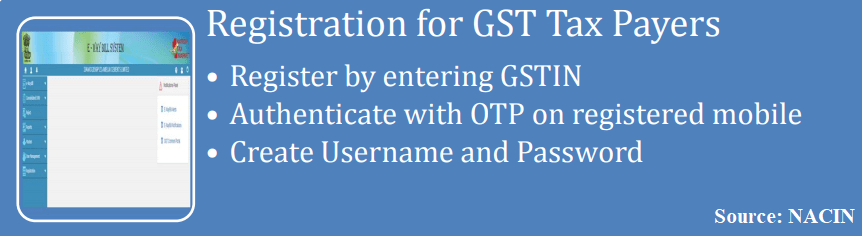

How to register for the eWay Bill System? (GST Registered Taxpayers)

The following are the key steps if you want to enroll for the eway bill system as a GST registered transporter:

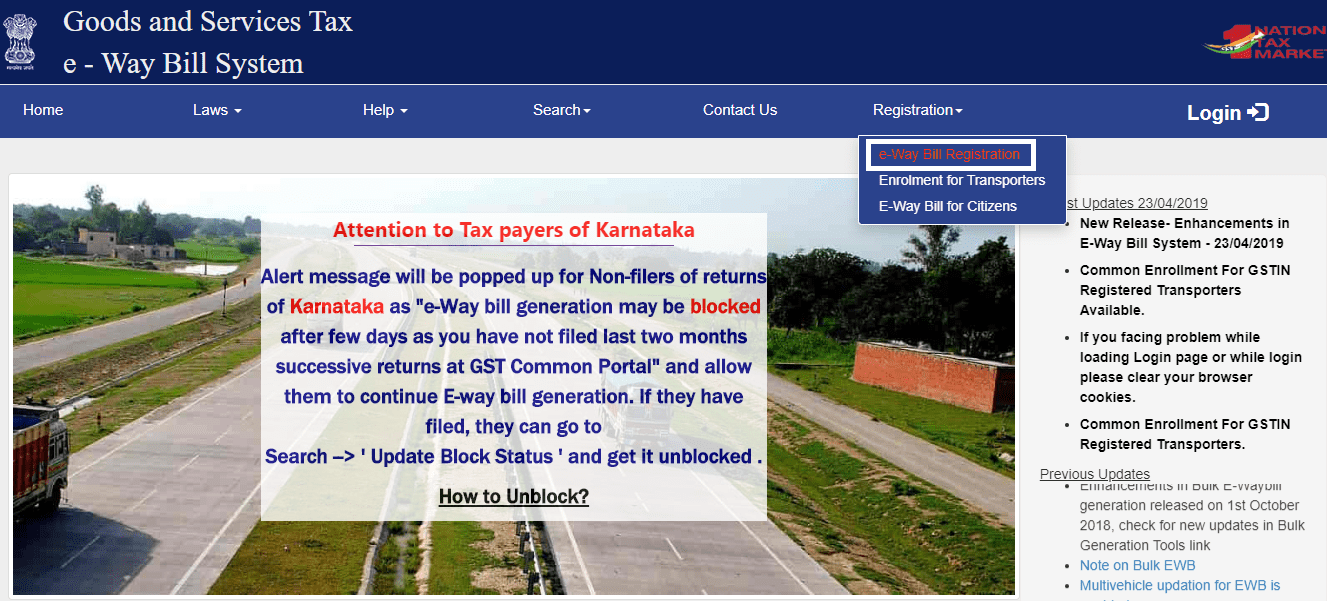

Step 1: Visit the e-way bill portal.

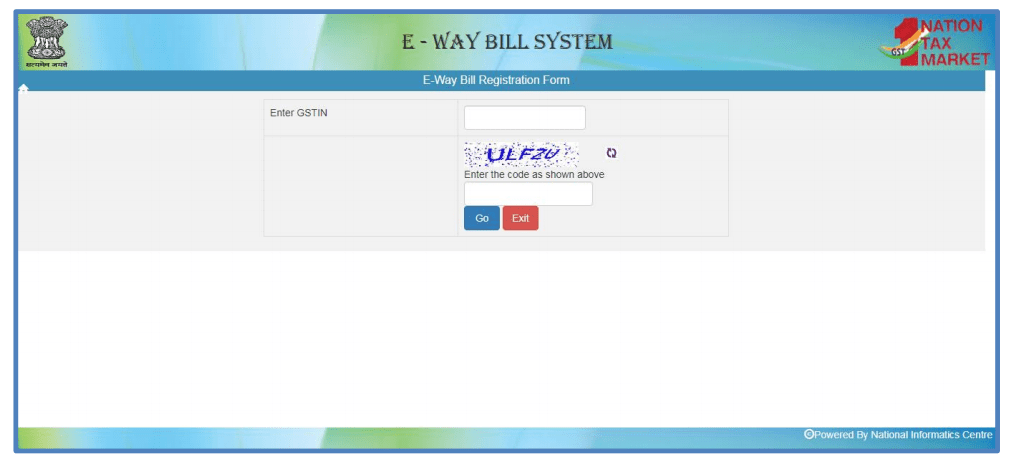

Step 2: Click “e-Way Bill Registration” under the Registration tab. This will direct you to the following eWay bill registration form.

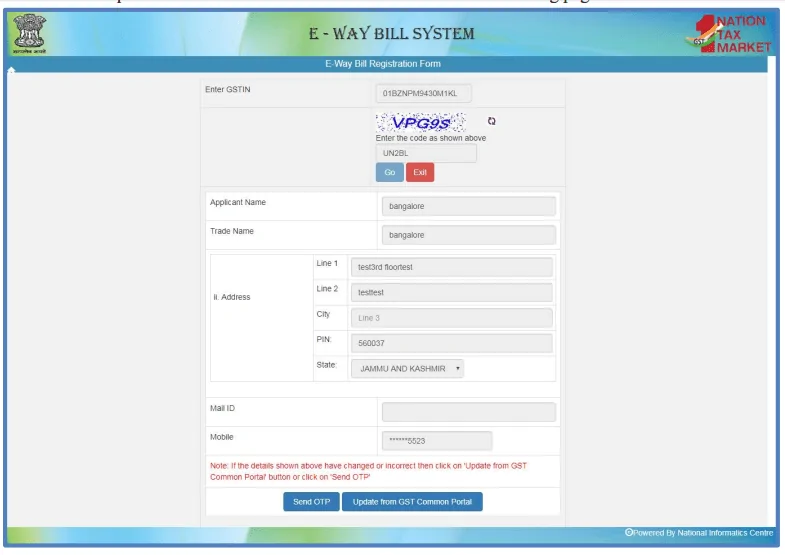

Step 3: Enter your GSTIN and the displayed captcha. Click Go and you will be redirected to the following page.

Step 4: Applicant name, Trade name, Address, Mail ID and Mobile Number are auto populated once your GSTIN number along with displayed captcha. If the details have been changed or are incorrect, click “Update from GST Common Portal”.

Step 5: Click on “Send OTP” to receive an OTP on the registered mobile number. Now enter this OTP and click on “Verify OTP” to validate your credentials.

Step 6: Finally, you need to provide a User ID or username of your choice to login in future. Once, the system validates the entered values, you can use this registered username and password to work on the system.

How to enrol for the e-Way Bill System? (GST Unregistered Transporters)

Being registered under GST is not mandatory for enrolment with the GST ewaybill system. The following are the key steps if you want to enroll for the eway bill system as a GST unregistered transporter:

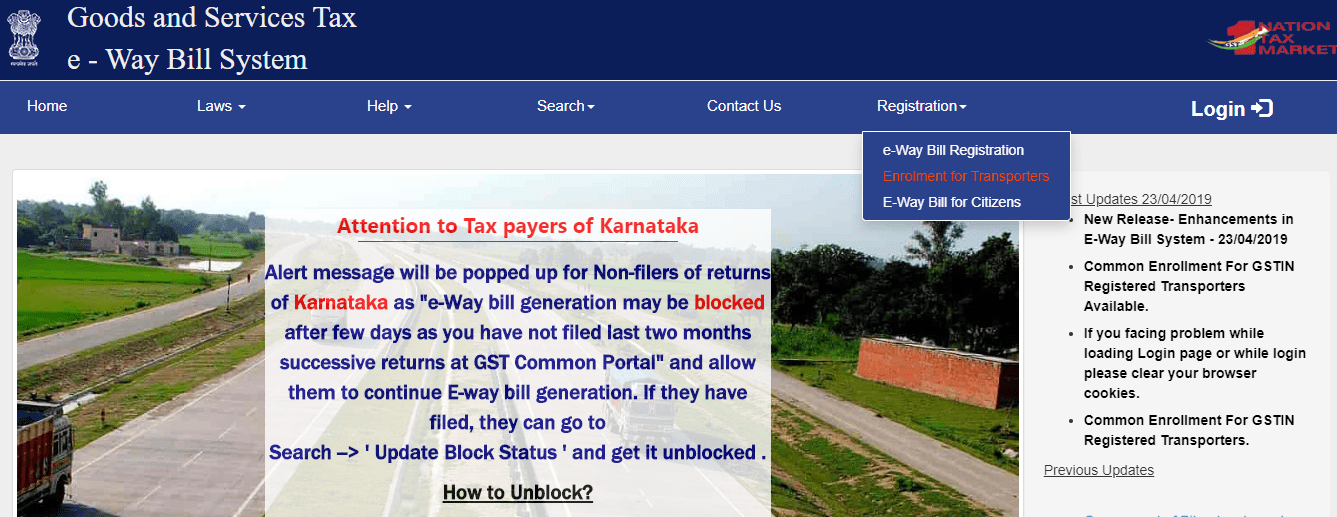

Step 1: Visit the e Way bill portal.

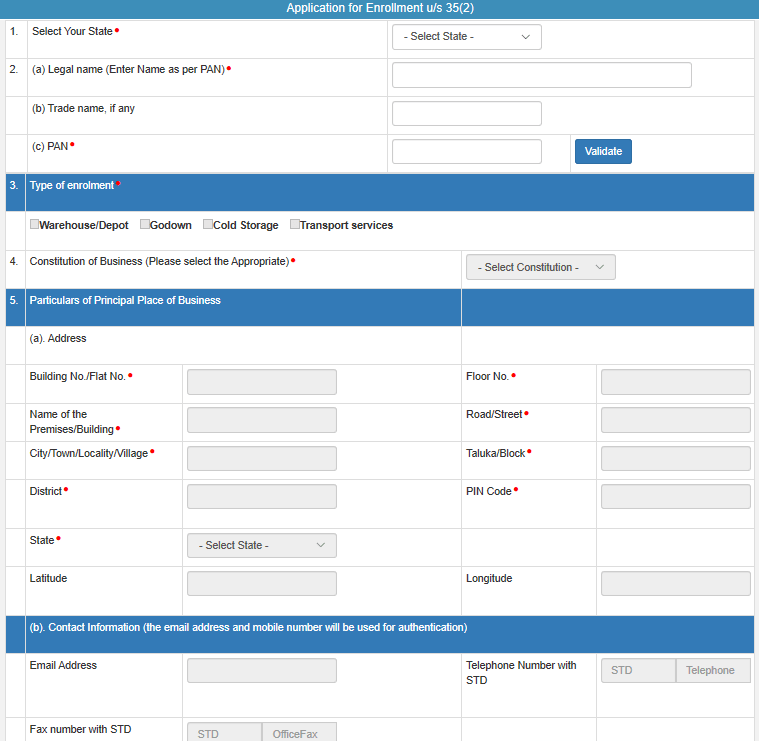

Step 2: Click “Enrolment for Transporters” under the Registration tab and you will be directed to the following Enrollment Form u/s 35(2). Select your state; enter your PAN and business details; create username and password for future login.

Step 3: Provide declaration regarding the correctness of the information by clicking on the checkbox.

Step 4: Click on “Save” button and the system will generate your 15-digit TRANS ID.

You can provide this TRANS ID to your clients. This TRANS ID has to be entered in the e-way bill, which will allow the transporter to enter the vehicle number and authorize the movement of goods.

Advantages of e-Way bill

- A Single e-Way Bill can be used for movement of goods throughout the country.

- No need of Transit Pass in any state under the GST regime.

- Being an online process, traders need not visit tax offices to collect and submit the new Way Bill forms under GST.

- Introduction of eWay billing system has increased speed of verification process, which in turn has increased the efficiency of transportation.

- You can check the eWay bills generated by other GST registered businesses/individuals against your GSTIN on the eWay bill portal.

- Environment friendly: No need to keep multiple copies of the GST Way Bills, which makes it an environment-friendly system that saves paper.

- Automated Generation of GSTR-1: It is auto prepared using the details given at the time of e-Way bill generation. This saves time at the time of filing GST returns.

- You can easily track the movement of goods online with e-Way Bill number.

Features of eWay Billing System

-

- User friendly System – The e Way system is user friendly with easy-to-understand and use functionality.

- Easy and quick generation – The eWay bills can be easily generated using a number of methods provided on the dedicated GST eWay bill portal.

- Checks and balances – Several checks and balances have been introduced in the e-Way bill system to eliminate common errors made by users.

- Multiple modes for e-Way Bill generation – The user can generate the eWay bill via different modes using the e Way bill system.

- Creating customised masters – There are some details that have to be mentioned repetitively in the eWay bill, which can be very time consuming. The online GST eWay bill system allows you to create multiple separate masters under the heads of customers, suppliers, products and transporters. This not only saves time but also improves the accuracy this key GST transportation document.

- Managing sub-users – You can create, modify and freeze sub-users for generation of the e-Way Bill. You can also assign specific roles/activities to specific the system.

- Monitoring the e-Way Bills generated against you– You can check the number of e-Way Bills generated by other registered persons against you. You can also reject an e-Way Bill, if it does not belong to you.

- GSTR-1 Generation- The system pulls information from eWay bills into GSTR-1. Hence, you need not upload the transaction details while filing GSTR-1.

- Consolidated e-Way Bill – The e Way bill system allows you to create one consolidated bill, which can be handed over to the transporter instead of giving multiple e-Way Bills for movement of multiple consignments in one vehicle.

- Enables unregistered transporters to use e-Way Bill – Unregistered transporters can enrol and generate eWay bills.

- Common Enrolment – GST registered transporters can generate a Common Enrolment number which they can use to generate one registration number. Such a registration number can be used throughout the country to generate eWay bills.

- Alerts the taxpayers – Taxpayers are notified about various activities, like rejection or verification of an eWay bill through web and SMS.

- QR bar code on the e-Way Bill – It helps in easier and faster verification of the e-Way Bill by tax officers.

- Integrates RFID for tracking the e-Way Bill – RFID integration has made the movement of goods faster as the tax officers can track vehicles without having to stop them on the road.

What is RFID tagging?

RFID stands for Radio Frequency Identification Device. It uses radio waves to capture and read the information on a tag attached to an object. The advantage of an RFID tag is that it can be read from a distance of several feet and the tag itself does not require a separate power source.

Under the e-Way bill system, an RFID tag is attached to the vehicle transporting the goods. It is generally embedded in the windshield (front facing window) of the truck. The RFID pulls details of the goods being transported from the eWay bill. As a result, whenever the truck passes an RFID reader on a highway, its details are fetched on the e Way bill portal. This makes the verification process faster as tax officials can track the vehicle without stopping it.

The RFID tag can be obtained from the distribution centers assigned for each jurisdiction across the country. The list of RFID distribution centers across Uttar Pradesh can be found here.

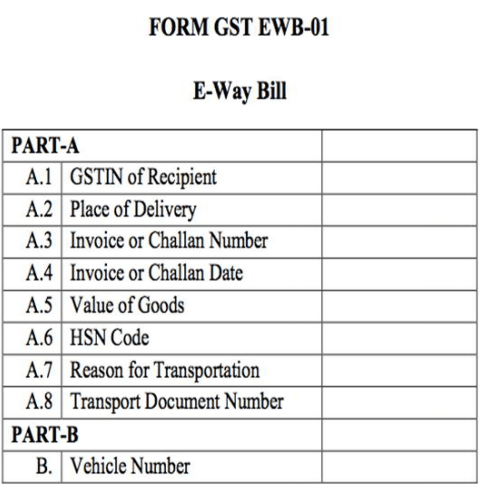

What is Form GST EWB -01?

Form GST EWB-01 is used to generate the E-Way bill. It is divided into the following two parts:

Form GST EWB-01 is used to generate the E-Way bill. It is divided into the following two parts:

PART A-

- GSTIN of Recipient – GSTIN or URP

- Place of Delivery – PIN Code of Place where goods are to be delivered

- Invoice/Challan No.

- Invoice/Challan Date

- Value of Goods being transported

- HSN Code ( Harmonised System of Nomenclature Code) of goods being transported. You can check GST rates and HSN Code of various goods using the GST rates and HSN codes tool

- Reason for Transport – Supply/Export/Import/Job Work/SKD OR CKD/Unknown recipient/Line Sales/Sales Return/Exhibition or Fairs/Own use/ Others

- Transporter Document Number – Goods Receipt Number or Railway receipt Number or Airway Bill Number issued/created by the transported

PART B – Vehicle Number i.e. number plate of the vehicle being used to transport the goods.

Frequently Asked Questions (FAQs)

Q1. What is a eWay bill?

Ans. E-way bill or FORM GST EWB-01 is an electronic bill used after GST implementation for transport of goods valued at more than Rs. 50,000. It is generated on the eWay bill portal and is available to supplier / recipient / transporter as well as the tax officials as evidence for movement of goods.

Q2. What is the common eWay bill portal?

Ans. www.ewaybillgst.gov.in is the common portal for eWay Bill System. This government portal can used for the creation and verification of GST way bills generated for transporting goods within India.

Q3. How can a taxpayer under GST register for e-Way bill ?

Ans. Taxpayers under GST can register on the eWay bill portal using his/her GSTIN. After you enter GSTIN, an OTP is sent to your registered mobile number for authentication to create username and password.

Click here to read the step by step procedure for registration on the Government eWay bill portal (www.ewaybillgst.gov.in), if you are a taxpayer under GST.

Q4. How can an unregistered transporter enrol in the eWay bill system?

Ans. Transporters who are not registered under GST can also enrol under the e-Way system by providing their PAN and business details.

Click here to read the step by step procedure for enrolment at eWay bill portal, if you are an unregistered transporter.

Q5. What is the threshold for eWay bill generation?

Ans. An e-Way bill should be generated whenever the value of goods in a consignment exceeds Rs. 50,000. However, for generation of eWay bills in Tamil Nadu and Delhi, the threshold is Rs. 1 lakh. Due to this difference, it is necessary to visit the commercial tax website for each State/Union Territory in order to verify rules related to e way bill generation.

Q6. Is eWay bill required for transport within the same state?

Ans. Yes, an eWay bill should be generated for transport of goods within the same state (intra-state), if the value of consignment exceeds Rs. 50,000 (Rs. 1 lakh for Delhi and Tamil Nadu). It is also necessary to generate eway bill for inter-state transport of goods valued beyond this threshold limit.

Q7. Is generating an eWay bill mandatory?

Ans. It is mandatory to generate an eWay bill when the value of consignment is greater than Rs. 50,000. Failure to generate the e Way bill in such a case can lead to a penalty.

Q8. What is RFID in eWay bill?

Ans. RFID stands for Radio Frequency Identification Device. Under the eWay billing system under GST, an RFID is attached to the truck carrying the goods to be transported. This tag fetches the information from the eWay bill and helps stakeholders as well as transportation officials track the movement of goods without the need for physical verification. As a result, tax officials can complete the verification process without stopping the vehicle.

Q9. How is the GST eWay bill different from the VAT Way bill?

And. Under the GST regime of One Nation-One Tax, single eWay bill is valid across all the states and union territories within India. This is in contrast to the system where separate Way bills needed to be mandatorily generated by every state and UT under the VAT regime.

Q10. What are eWay bill masters?

Ans. A large chunk of repetitive information needs to be filled out when generating an eWay bill. This can be very time consuming. The GST eway bill system allows the creation of masters under the heads of customers, suppliers, products and transporters. Use of masters allows various details to be auto populated leading to significant reduction in the time taken to generate the GST way bill document.