When employees leave a company and join a new one in the middle of an FY, their new employer needs to know some key details before crediting the salary to the new employee. These details include the income paid by the previous employer to the employee, TDS (tax deducted at source) transactions already made during the financial year, perquisites paid, etc. This is what makes the submission of Form 12B important. Section 192 (2) of the Income Tax Act, 1961 deals with the documentary requirements that need to be met with respect to tax considerations when an employee changes jobs during a financial year.

What is Form 12B?

Form 12B must be filled out and submitted by an employee to the new employer at the time of changing jobs during a financial year. The main purpose of the form is to help new employers get details about their new employees and deduct TDS from the employee’s salary for the rest of the financial year. Any discrepancy here can increase the tax liability of the employee and also create problems for the new employee to deduct applicable TDS on the employee’s salary. Along with Form 12B, a new employee must furnish the proof of all investments that he has made before 31st March 2019. It is important to note here that Form 12B is applicable to salaried individuals only and that too only if they have switched jobs in the middle of the financial year.

Download Form 12B: Click Here

What are the Different Parts of Form 12B?

Form 12B is submitted by an employee to the new employer if there has been a job change during the applicable financial year. Here are the details they need to fill out in Form 12B:

- TAN and PAN of the previous organisation in addition to other details

- Complete Break-up of your salary at the previous organisation including but not limited to

- Dearness Allowance (DA)

- House Rent Allowance (HRA)

- Leave Encashment

- Leave Travel Allowance (LTA)

- Commissions

- Income earned in the financial year before joining the new company

- TDS deductions already made by the previous employer

- Professional Tax paid if any

- Deductions made towards Provident Fund (PF), Rent-free Accommodation, etc.

- Deductions made under Section 80C, 80D, 80E, 80G, 24, etc.

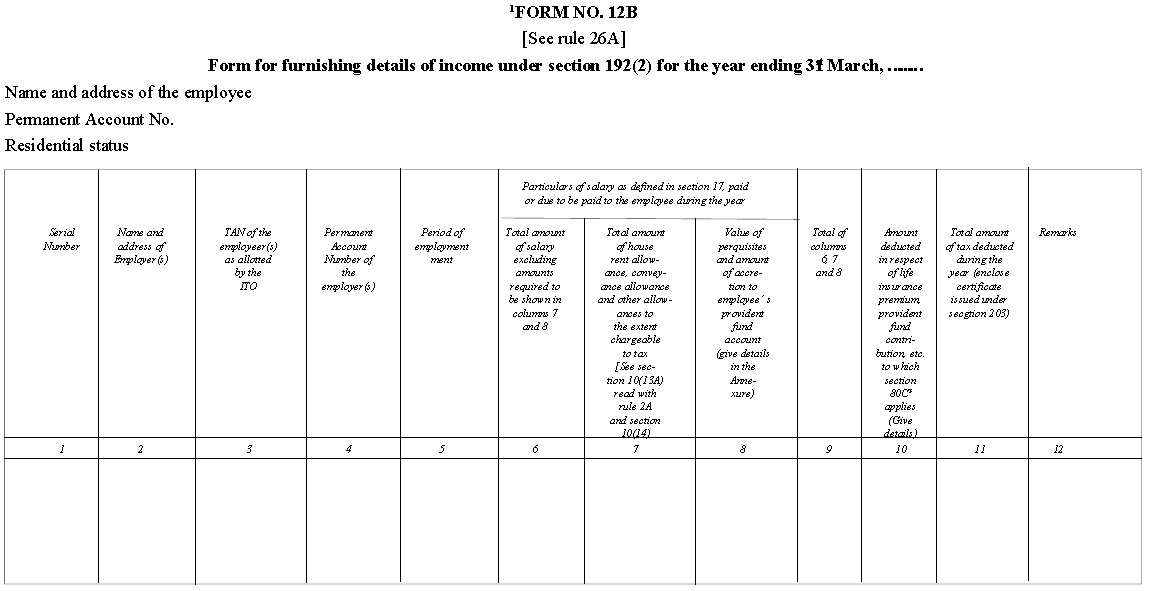

Sample Form 12B Format Sample

The following is a Form 12B Format sample of the first page. Subsequently, this form also features annexures that require you to provide some key information.

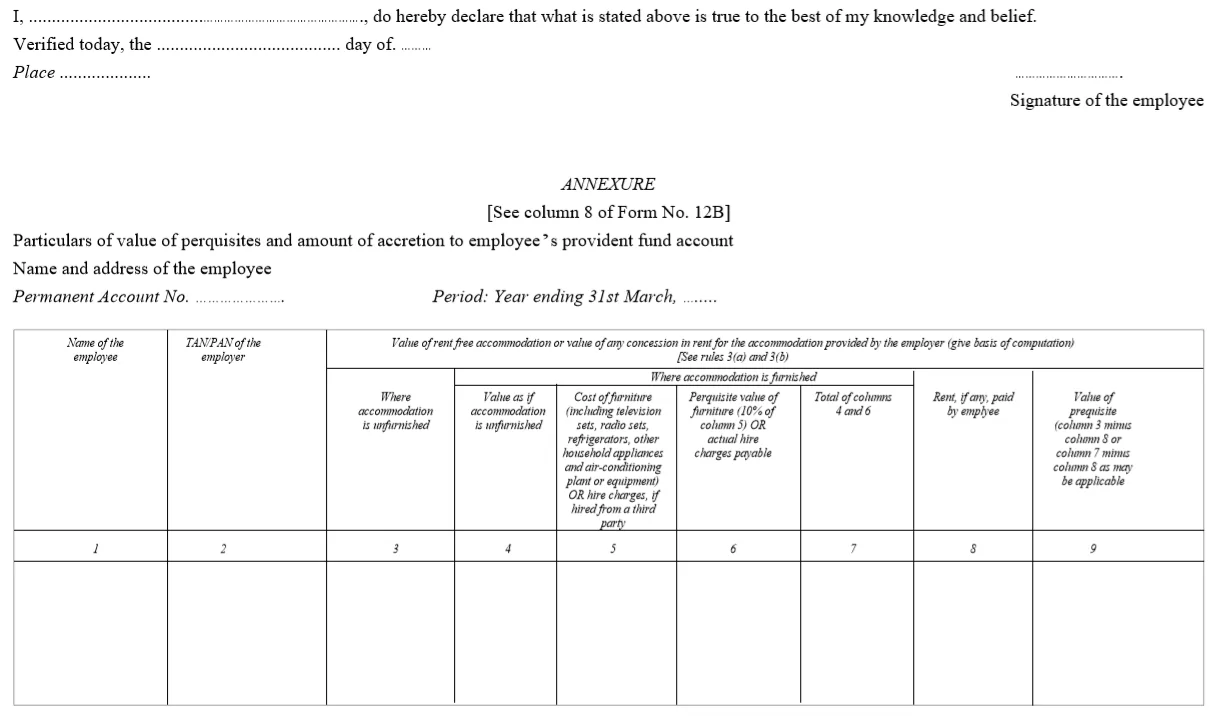

Form 12B Annexure Format

Form 12B typically contains 2 pages of annexures apart from the first page of the form as shown above. The follow is the first Annexure page:

Details to be provided in the first Annexure page include:

- Declaration with name, date, place and signature of employee certifying details provided in Form 12B

- Name of employee

- PAN/TAN of employer

- Value of rent-free accommodation provided by employer with separate columns to provide furnished and unfurnished accommodations (including perquisites value of furnishings)

- Rent paid by employee (if applicable)

Get FREE Credit Report from Multiple Credit Bureaus Check Now

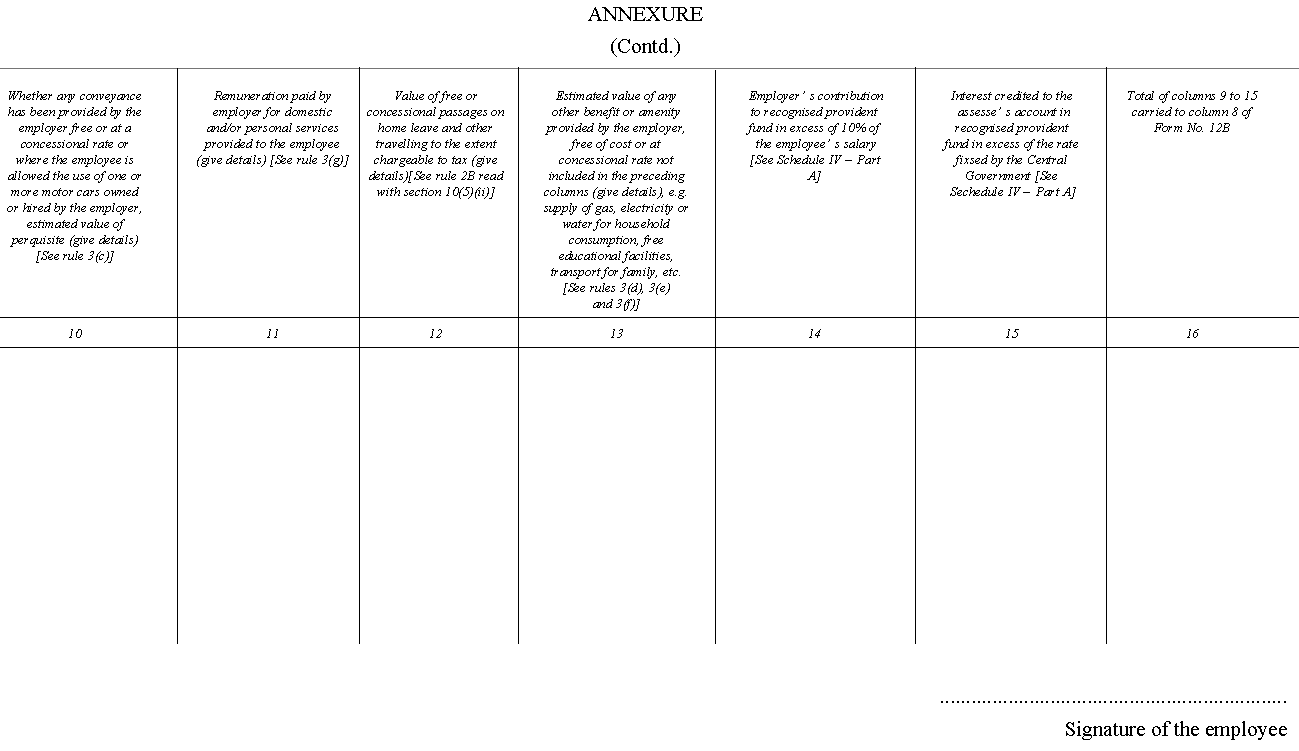

The second annexure of Form 12B is as follows:

Key fields to be filled out in this part of Form 12B include:

Key fields to be filled out in this part of Form 12B include:

- Value of perquisites in terms of conveyance provided by employer (for free/at discounted rate)

- Remuneration provided by employer to employee for domestic/personal services

- Value of free/concessional travel allowances provided

- Estimated value of any other benefits or perquisites

- Contribution to EPF by employer in excess of 10% of employee salary

- Interest credited to account of employee in recognised provident fund if it exceeds rates fixed by government

When is Form 12B to be Submitted and to Whom?

Form 12B is to be submitted by all salaried individuals to his/her new employer whenever they change jobs during a financial year. However do note that a self-employed individual taking up a salaried position is not required to submit the form as it applies only when a salaried employee takes up new salaried employment for the applicable FY. The new employer can then calculate the salary of the employee and deduct applicable TDS. It is essential to know that the previous employer is not obliged to provide these details to the new employer and the employee might have to collate it from his/her payslips and Form 26AS.

What is the result of Form 12B submission?

After an employee submits Form 12B with the new employer, the employer issuing Form 16 at the end of the year will consolidate the details provided by the employee. The employee must verify the details in Form 16 such as income, TDS, etc. issued both by both the old employer and the new one. No discrepancies must be present in Form 16 to avoid any tax-related issues at a later date.

What are the key differences between Form 12B and 12BA?

Form 12B and Form 12BA serve different purposes even though they are both issued under Rule No. 26 of the Income Tax Act. Here are the key differences between them:

- An employee must fill out Form 12B with details such as income from salary, TDS deducted, etc. and submit it to his new employer if he joins a new company as a salaried employee in the middle of a financial year. However, Form 12BA gives a detailed statement of fringe benefits, perquisites, profits, etc. in lieu of income from salary.

- Form 12BA is a statement of perquisites to be issued by the employer to the employee whereas, Form 12B is a statement to be provided by the employee to a new employer if he is joining in the middle of a financial year.

Form 12B is filled and submitted by the employee to the employer at the time of joining in the middle of the financial year. Form 12BA is issued along with Form 16 by the employer to the employee on 15th June in the FY immediately following the applicable financial year. Thus, Form 12BA for FY 2018-19 will have to be provided by the employer on or before 15th June 2019 (excluding any extension provided by the government).