Form 15G is a declaration that can be filled out by bank fixed deposit holders (individuals less than 60 years of age and HUF) to ensure that no TDS (tax deduction at source) is deducted from their interest income for the fiscal. Under existing income tax rules, banks are required to deduct tax at source in case interest on your fixed deposit, recurring deposit, etc. exceeds Rs. 10,000 in a financial year. In the Interim Budget 2019, this TDS threshold has been increased to Rs. 40,000 with effect from FY 2019-20.

Table of Contents :

- How to Download Form 15G

- Form 15G Sample

- Key Features of Form 15G

- Eligibility Criteria for Submitting Form 15G

- Instructions to Fill out Form 15G

- What if I Forget to Submit Form 15G?

- Difference Between Form 15G and Form 15H

- Submission of Form 15G

- How to Fill Form 15G Online

- IT Act Sections and Rates for Tax Deducted at Source

- Penalty for Submitting False Declaration using Form 15G

- FAQs

How to Download Form 15G

Form 15G for reduction in TDS burden can be downloaded for free from the website of all major banks in India. However, this form can also be downloaded from the Income Tax Department website.

Click here for free Form 15G download/15G Form PDF

You also have the option of submitting Form 15G online on the website of most major banks in India.

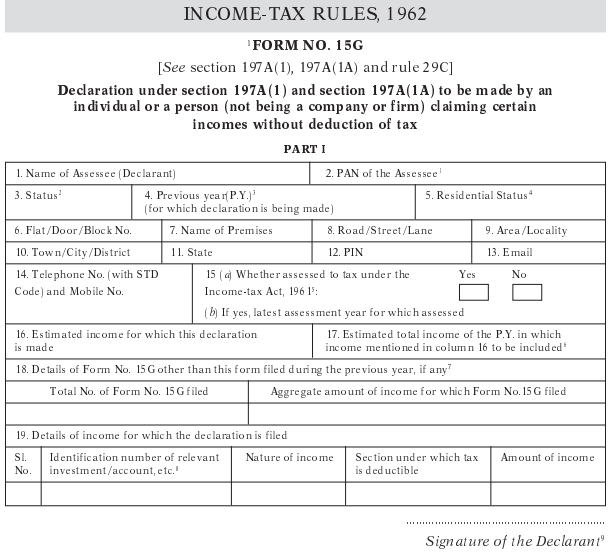

Form 15G Sample

Most banks and financial institutions offer their own variants of Form 15G, but, the generic version of the form is available on the official Income Tax Department website. The following is a snapshot of the first page of Form 15G as available on the IT Department website:

Key Features of Form 15G

The following are key features of Form 15G:

- Form 15G is a self-declaration form for seeking non-deduction of TDS on specific income as annual income of the tax assessee is less than the exemption limit.

- The rules for this specific self-declaration form are mentioned under the provisions of Section 197A of the Income Tax Act, 1961.

- The structure of Form 15G has undergone considerable change in 2015 to ease the compliance burden and cost for both tax deductor and tax deductee.

- The current format of Form 15G and Form 15H (the senior citizens variant for Form 15G) introduced by CBDT (Central Board of Direct Taxes)

- Form 15G can be submitted by individuals below the age of 60 years. Any individual above 60 years falls in the category of senior citizens.

- Form 15H, though similar in many ways to Form 15G, can only be utilized by senior citizens.

- To avail the benefit, this declaration needs to be submitted in the first quarter of the financial year in case of existing investments. However, for new investments Form 15G can be submitted before interest is credited for the first time.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Eligibility Criteria for Submitting Form 15G

One must fulfil the following eligibility criteria to submit Form 15G:

- You are an Individual or a person (other than company or a firm).

- You must be a resident Indian for the applicable FY

- Your age should not be more than 60 years

- Tax liability calculated on the total taxable income for the FY is zero

- Your total interest income for the financial year is less than the basic exemption limit.

Read more on Income Tax e-Filing

Instructions to Fill out Form 15G

Form 15G has two sections. First part is for the individual who wants to claim no-deduction of TDS on certain incomes. The following are the key details you need to fill out in the first portion of Form 15G:

- Name as mentioned on your PAN Card.

- Permanent Account Number. Valid PAN card is mandatory to file Form 15G. If you fail to furnish valid PAN details, your declaration will be treated as invalid.

- Declaration in Form 15G can be furnished by an individual but not by a firm or company.

- Previous year has to be selected as the financial year for which you are claiming non-deduction of TDS.

- Mention your residential status as resident individual because NRI are not allowed to submit Form 15G.

- Mention your communication address correctly along with PIN code.

- Provide valid email ID and contact number for further communications.

- Tick mark ‘’Yes’’, if you were assessed to tax under the provisions of Income Tax Act, 1961 for any of the previous assessment years.

- Mention the latest assessment year for which your returns were assessed.

- Estimated income for which you are making declaration needs to be mentioned

- Total estimated income for the financial year (which includes all the income)

- If you have already filed Form 15G anytime during the financial year, then the details of previous declaration along with aggregate amount of income needs to be mentioned in the present declaration.

- Last part of section 1 talks about the investment details for which you are filing declaration. You need to furnish the investment account number (term deposit/ life insurance policy number/ employee code etc)

- After filling the entire field, re-check all the details to ensure there is no error.

Second part of Form 15G is to be filled out by the deductor i.e. the person who is going to deposit the tax deducted at source to government on behalf of the tax assessee.

What if I Forget to Submit Form 15G?

In case you forget to submit Form 15G on time and TDS has already been deducted, here’s what you can do:

Step 1: Claim your TDS refund by filing income tax return.

Once bank or any other deductor deducts TDS, it cannot be refunded to you by them as they are mandatorily required to deposit the amount with the Income Tax Department. The only way out is to get an income tax refund by filing ITR. Upon verification, Income Tax Department will process your refund claim request and credit the excess tax deducted for the financial year.

Step 2: Immediately submit Form 15G to avoid further deductions for the current financial year.

Normally, banks deduct the TDS at the end of each quarter when applicable interest is calculated on the fixed deposit. It is better to submit Form 15G as soon as possible to avoid any additional deductions for the current fiscal.

When can Form 15G be Submitted?

Declaration in Form 15G can be submitted for reduction of TDS burden in the following cases:

- TDS on Interest Income from Bank Deposits: Banks are supposed to deduct TDS if the interest amount on fixed deposit or recurring is more than Rs. 10,000 in a year (As of FY 2019-20, this threshold has been increased to Rs. 40,000 annually). Important point to note here is that banks deduct TDS based on the provisional interest not on the basis of the actual interest payout. Hence, even if the tenure of a fixed deposit is more than one year, you need to submit Form 15G to avoid deduction of TDS.

- TDS on Employee’s Provident Fund Withdrawal: If employee’s provident fund is withdrawn prior to completing service tenure of 5 years with the current organisation, TDS is applicable on the proceeds. But even in that case, if your total taxable income including the provident fund withdrawal balance is zero, then you can submit Form 15G for non-deduction of TDS.

- TDS on Interest from Post Office Deposits: If you fulfil all the conditions to submit Form 15G, post office which provides deposit service also accept Form 15G declarations for your post office deposits and national savings schemes.

- TDS on Income from Corporate Bonds and Debentures: Income from corporate bonds exceeding Rs. 5000 for a financial year is subjected to tax deducted at source. In such cases, if you are eligible to submit Form 15G, you can do so and request the issuer of bonds to not deduct TDS.

- TDS on Proceeds from Life Insurance Policy: Under the provision of Section 194DA of the Income Tax Act, 1961, if the maturity proceeds from life insurance policy exceeds Rs. 1 lakh, such proceeds are subjected to tax deductions at source. However, if all conditions mentioned in Form 15G declarations are satisfied, the tax payer can submit Form 15G to life insurance company to prevent TDS deduction.

- TDS on Rental income: If your rental income for the financial year exceeds Rs. 8 lakh, such income is subject to tax deductions at source. However, if the taxable income is lower than the basic exemption limit, and then you can submit Form 15G for non-deduction of TDS.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Difference Between Form 15G and Form 15H

The following are the key differences between Form 15G and Form 15H:

| Form 15G | Form 15H |

| Applicable to individuals less than 60 years of age | Applicable to individuals aged 60 years or more |

| Can be submitted by HUF as well as individuals | Can be submitted only by individuals |

| Only applicable to individuals/HUF with annual income lower than basic exemption limit | Any senior citizen can submit the form irrespective of annual income level |

Read more about Form 15H

Illustration to Understand the Criteria of Form 15G

| Income of | Savita | Devesh | Smita |

| Age | 50 years | 23 years | 66 years |

| Salary Income | Rs. 1,80,000 | – | – |

| Pension received | – | – | Rs. 1,10,000 |

| Interest from Fixed Deposit | Rs. 86,000 | Rs. 2,61,000 | Rs. 1,80,000 |

| Total Income for the year (before section 80 Deductions) | 2,66,000 | 2,61,000 | 2,90,000 |

| Deductions allowed under section 80 | Rs. 45,000 | Rs. 30,000 | Rs. 10,000 |

| Total Taxable income | Rs. 2,21,000 | Rs. 2,31,000 | Rs. 2,80,000 |

| Basic Exemption Limit | Rs. 2,50,000 | Rs. 2,50,000 | Rs. 3,00,000 |

| Are they eligible to submit Form 15G? | Yes | No | No |

| Explanation | Form 15G can be submitted as the total tax liability for the year is nil and aggregate interest income for the year is less than basic exemption limit. And she also satisfies the age criteria of below 60 | Form 15G cannot be submitted since aggregate interest income for the year is more than basic exemption limit | Form 15G cannot be submitted as she is more than 60 years old. However, Form 15H can be submitted in this case as tax calculated on total income is nil. |

Submission of Form 15G

Central Board of Direct Taxes (CBDT) has digitalized the process of submission of Form 15G and Form 15H.The following is the process of online submission of Form 15G with major banks:

- Taxpayer needs to fill in the Form 15G online and submit it. As per Central Board of Direct Taxes (CBDT), the deductor is supposed to assign UIN (Unique Identification Number) to each self-declaration made by tax payers.

- Deductor needs to furnish the details of all the self-declaration along with unique identification number (UIN) to Income Tax Department via quarterly TDS statement.

One should keep in mind that self-declaration using Form 15G holds good only for that particular financial year. A fresh declaration needs to be submitted for the next financial year. However, as per current Government rules and regulations, deductor is supposed to retain Form 15G for a period of seven years.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to Fill Form 15G Online

Most banks in India now provide the option of filling out and submitting Form 15G online. Having an operational internet banking login is mandatory for availing this facility. Here’s how you can do it:

- Log into your bank’s internet banking with applicable User ID and Password

- Click on the online fixed deposits tab which will take you to the page where your fixed deposit details are displayed.

- On the same page, you should have the option to generate Form 15G and Form 15H. Click on the available link to open the fillable form option.

- Once the form is opened online in fillable format, start filling out the details and information very carefully.

- Mention the branch details of the bank with which your FD/RD is held. If you do not have these details handy, use the bank’s branch locator tools to easily find the required details.

- Fill out all other details pertaining to your investment without any error and submit it

IT Act Sections and Rates for Tax Deducted at Source

Below are some common TDS Sections for ready reference

| Investment Type | Sections of Income Tax Act | Threshold limit | TDS (with Valid PAN) | TDS without PAN |

| Interest on Bank Deposits | 194A | 10,000 | 10% | 20.00% |

| EPF Proceeds- Premature Withdrawal | 192A | 30,000 | 10% | 34.61% |

| Interest on securities | 193 | – | 10% | 20.00% |

| Dividend income | 194 | 2,500 | 10% | 20.00% |

| Interest other than interest on securities | 194A | 5,000 | 10% | 20.00% |

Penalty for Submitting False Declaration using Form 15G

Providing a false declaration in Form 15G just to avoid TDS can lead to fine and even imprisonment under Section 277 of the Income Tax Act, 1961. The following are the details of punishments u/s 277 of the IT Act, 1961.

- Imprisonment for a period of 6 months to 7 years if wrong declaration was provided to evade tax of more than Rs. 1 lakh

- For all other cases, imprisonment between 3 months to 3 years.

Hence, instead of making a false declaration, you should consider submitting Form 15G only if you are eligible to do so.

FAQs

Q. Do I have to submit Form 15G to the income tax department?

No, you need not submit Form 15G/Form 15H directly to the income tax department. Simply submit it to the deductor and they will prepare and submit it to the income tax department.

Q. Do I need to submit Form 15G at all branches of the bank?

Yes, you should submit one copy of 15G Form at each bank branch from which you receive interest income. However, TDS is deducted only when the total interest earned from all branches is more than Rs. 10,000.

Q. Does filing Form 15G imply that my interest income is not taxable?

Form 15G or Form 15H is just a declaration that no TDS should be deducted on your interest income since tax on your total income is nil. However, interest earned from recurring deposits, fixed deposits and corporate bonds is always taxable.

Read more: Tax Slabs for FY 2023-2024

Q. Do NRIs need to submit Form 15G or 15H?

No, NRIs are not eligible to fill these forms. Only resident Indians can fill Form 15G or 15H.