Form 15H is a self-declaration that may be submitted by senior citizen aged 60 years or above to reduce TDS (tax deducted at source) burden on interest earned from fixed deposits (FD) and recurring deposits (RD) investments. Under existing rules, TDS is deducted on interest earned from bank FD and RD held by senior citizens only if annual interest income from these deposits exceeds Rs. 50,000 for financial year 2023-24.

Table of Contents :

Eligibility for Using Form 15H

- Should be an individual tax assessee and not an entity or an organization

- Should be an Indian citizen residing in India

- Should be minimum 60 years of age

- The tax liability for the assessee for the applicable financial year should be nil

What to Do if I Forget to Submit Form 15H on Time

Forgetting to submit the required form on time may lead to deduction of TDS by the bank in interest income from deposits exceeding Rs. 50,000 for the applicable year. The individual will have to file an income tax return to claim a refund of the excess TDS deducted by the bank. TDS is usually deducted on a quarterly basis. Hence, one should make sure to submit the required form as early as possible in order to avoid deduction of TDS for the applicable financial year.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Uses of Form 15H

Form 15H for senior citizens is useful for a variety of purposes. The list of these is as follows:

- TDS on the interest income from Fixed Deposits: Form 15H helps a senior citizen save taxes on the interest earned by him from fixed deposits and recurring deposits kept with banks.

- TDS on EPF withdrawal: Generally, TDS is applicable to Employee Provident Fund (EPF) balances in cases where the EPF is withdrawn before completion of 5 years of regular or continuous service in a particular organization. However, if any individual has an accumulated fund of Rs. 50,000 or above and wishes to withdraw the same before completion of the continued service period of 5 years then he may do so and is free to submit Form 15H to avoid the deduction of TDS on his EPF balance. The only thing to be kept in mind is that the tax assessee should be eligible for submitting Form 15H, which means, that his taxable income inclusive of his EPF balance should not fall in the specified taxable bracket and should be free of tax liabilities.

- TDS on income generated from corporate bonds: TDS is applicable on any income exceeding Rs. 5,000 annually generated from corporate bonds. However, the individual may submit Form 15H to the issuer and place a request for no TDS deductions, subject to meeting the required criteria in order to submit the form in question.

- TDS on income generated from Deposits made in Post Offices: Certain Digitized Post offices may also choose to deduct TDS on an individual’s income generated via deposits made by them at the respective Post Office. In this case also, the individual is free to submit Form 15H to the Post Office and request for no TDS Deduction, subject to meeting the applicable criteria.

- TDS on Rent: Rental payments exceeding Rs. 1.8 lakh in a year also attract TDS. However, an individual may submit Form 15H to his tenant and request him to avoid TDS deduction. The only thing to be kept in mind is that the tax to be paid on his total income in the previous year should be zero.

How to Use Form 15H to Prevent TDS Deduction

Form 15H is a self-declaration form which helps individuals above 60 years of age save Tax Deducted at Source (TDS) on the interest income earned by them on their fixed deposits. The assessee is supposed to submit a declaration form to his banker to apply for no deduction or lower deduction on fixed deposits made by him.

Form 15H is perhaps best defined as a self-declaration form which clearly states that the assessee is not liable to pay taxes on the interest income earned by him. This is because the amount earned by the depositor as interest is lower than the minimum amount of money taxable under IT norms.

An individual has to furnish Form 15H to his deductor on time i.e. either before the due date of the interest payment or before the end of the applicable financial year. This form is an undertaking by the assessee, stating that the income earned in previous year does not fall in the taxable income bracket and is thus not liable to be taxed.

Factors Affecting Form 15H Submission

- Form 15H can only be submitted by an individual who has reached the age of 60 years and above i.e. senior citizens. Other individuals/HUFs are required to submit Form 15G in order to prevent TDS deduction.

- Form 15H can only be submitted by Indian citizens residing in India. It is not applicable to NRIs or foreigners.

- Form 15H has to be deposited at each and every branch of the bank, which is liable to pay interest to the individual on his deposits.

- Form 15H is just a declaration or an undertaking by an individual that the interest earned on his income should be kept free from any kind of TDS deduction, as his tax liabilities on total income earned is zero.

- An individual must always keep in mind that the income generated on his fixed deposits as well as recurring deposits is always taxable. Hence, this form should only be submitted when the individual is sure that the total income earned by him is lower than the taxation bracket.

- In case an individual has taxable income and still he has submitted Form 15H to the bank, he must immediately inform his bank regarding the same. Upon receiving intimation on time, the bank will make the required changes and deduct the applicable TDS on the interest income generated.

- Individual need not submit these forms to the Income Tax Department directly. It is the duty of the deductor to prepare a proper layout and submit the same to the IT department along with all the relevant details.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

TDS Deductor and Form 15H

The Income Tax Act of India, 1961 requires various TDS deductors to allocate a UIN or a Unique Identification Number to all individuals submitting Form 15G or Form 15H to them. The tax deductor is supposed to file a statement of the forms submitted to them by all the tax payers on a quarterly basis. This statement consists of the details of all forms submitted to them and a list of all the sources of income which have been exempted from tax. These forms must be retained by the tax deductor for a minimum period of 7 years subsequent to submission.

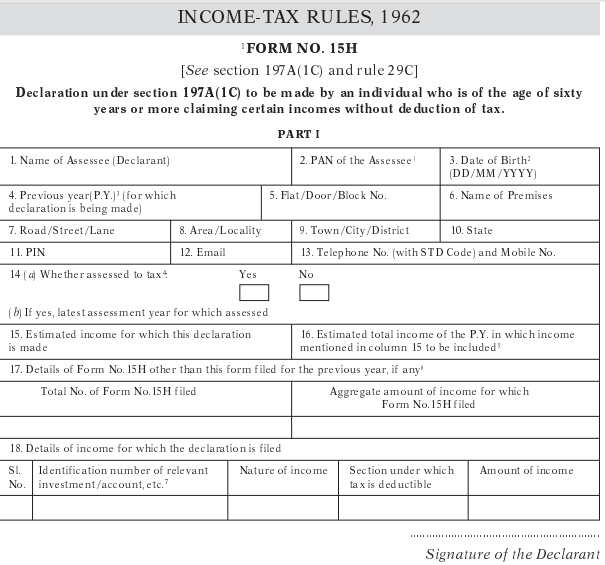

Form 15H Sample

The following is a sample of the Form 15H as available on the Income Tax Department website:

How can I Download Form 15H?

Form 15H is available in fillable format on the website of most banks operating in India. However, you can easily download Form 15H for free from the Income Tax website. Once you have downloaded the form, you have to print it, fill it out and submit it with the appropriate bank/authority in order to decrease your TDS burden. Do keep in mind that separate Form 15H has to be submitted with each bank/post office you have deposits with to reduce your overall TDS burden.

How to Fill Form 15H

Form 15H is divided into two parts – Part 1 and Part 2.

Part 1: This part has to be filled out by senior citizen individual applicants who wish to claim TDS on different types of income earned by them during the fiscal.

Let’s understand various points that have to be duly filled by the applicant before submitting the form.

- Name and PAN of Applicant

- Date of birth

- Financial year pertaining to the mentioned income

- Residential status

- Complete residential address and contact information

- The applicant has to enter ‘YES’ if he has been assessed in any of the years out of the six assessment years prior to the mentioned assessment year

- The estimated total income for which the applicant wishes to submit a declaration

- The estimated total income for the current year along with the estimated income in the previous point

- The exact number of Forms filled by the applicant along with the total income pertaining to which the declaration is being filed by the applicant

- Details pertaining to the applicant’s number of shares, account number of the deposit, NSS details and LIC policy number along with his employee code

- The applicant then needs to diligently verify and rectify the errors, if any, before signing the form.

Part 2: The second part of the form has to be filled and submitted by the deductor who is required to deposit the TDS deducted with the bank authorities. For example: A bank, which is supposed to deduct TDS on the interest earned by a depositor on fixed/recurring deposits.

Recent Updates on Form 15H

As per changes effective from June 1, 2016, certain rental income can also be declared and included in Form 15H declarations. The various types of incomes that fall under this category are:

- Amount Received from EPF withdrawals

- Dividend income

- Interest other than the interest earned on securities

- Income received from Life Insurance policies

- Income received from National Savings Scheme, and

- Rental Income

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Form 15H for EPF Withdrawal

Form 15H for PF withdrawal has to be filled when you withdraw offline. Purpose of form 15H is to request EPFO not to deduct TDS. Such TDS is applicable only if one is withdrawing EPF before completion of 5 years of service and/or amount withdrawn is greater than Rs. 50,000.

Provident fund withdrawal before five years of completion of service will attract TDS effective June 1 2015.

- TDS on EPF will be applicable if withdrawal is more than Rs 50,000. This is applicable from June 2016. Earlier this limit was Rs 30,000.

- TDS will be deducted at 10% provided PAN is submitted. Otherwise, TDS is deducted at the rate of 34.608% if PAN is not submitted.

- If you withdraw offline you can submit form 15G/15H to prevent TDS being applied.

FAQs

Q. What is the validity of Form 15H?

Form 15H can be used by an individual only for a particular assessment year. 15H Form is valid only for 1 financial year and a person will have to use a new form for different assessment years.

Q. What is the difference between form 15G and 15H?

Both Form 15G and Form 15H need to be submitted as a self-declaration by individuals whose income is below the taxable threshold and so no TDS should be deducted for the income credited to their account. However, Form 15G is to be submitted by individuals below 60 years of age and Form 15H can be submitted by individuals aged 60 years and above.

Read more on Form 15G

Q. What will happen if Form 15H is not submitted?

In case you do not submit Form 15H TDS will be deducted and you will get TDS certificate which can be attached while filing income tax and pay the remaining tax (in case any).