Form 16 is a document or certificate, issued as per Section 203 of the Income-Tax Act 1961, to salaried professionals in India by their respective employers. Also referred to as a “salary certificate”, it contains all the details regarding the salary given by the organization or employer to the employee in a particular financial year and the income tax deducted from the salary of the individual by the payer.

Table of Contents:

What is Form 16

As per the Income Tax Act, every employer, at the time of paying salaries, is required to deduct Tax (or TDS – Tax deducted at source), which is computed based on the income tax slab rates in force for that financial year. Companies usually calculate the tax payable by the employee based on the forecasted earnings and investment declarations made by the employee at the beginning or during the year.

TDS deducted by the organization or the employer is deposited with the Income Tax department, and is mentioned in Form 16. Employers need to issue the Form 16 of the FY to their employees on or before 15th June of the next financial year.

Components of Form 16

Form 16 is one of the most important income tax forms for salaried individuals. It contains all the information related to the salary received by the employee, along with the tax that has been collected from the salary by the deductor.

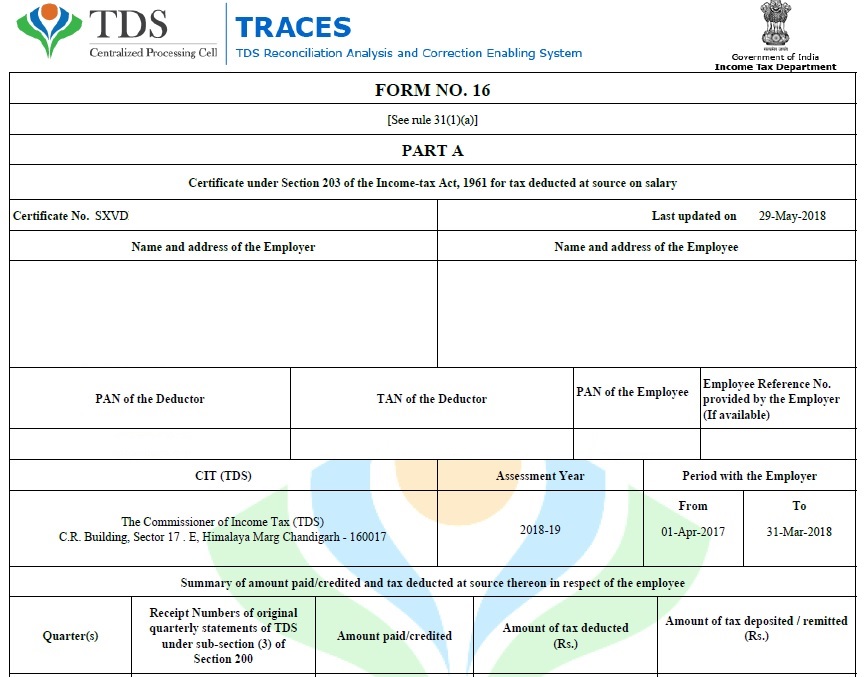

Form 16 Part A

Fundamentally, Part A gives the summary of tax collected by the organization or the employer from the salary income on behalf of the employee and deposited to the Income Tax Department. It is a certification duly signed by the employer that they have deducted the TDS from the employee’s salary and deposited it with the income tax department.

It contains the following details :

- Personal information of the employer as well as the employee. Particulars such as the individual’s and the employer’s name, address details, PAN details of both and the employer’s TAN details. (TAN refers to the number assigned to an account responsible for the deduction and collection of tax).These details help the IT Department to track the flow of money from the accounts of the employee and the employer. (It should be noted that if an organization does not possess the TAN, they are not entitled to deduct TDS. Thus, in this situation, they cannot provide Form 16)

- The Assessment Year (AY) – As the name indicates, this refers to the year in which the income is assessed or in other words, the year in which the taxpayer needs to work on the tax return processes.For example, for the income earned between 1 April 2025 and 31 March 2026, the Assessment Year will be 2026-27.

- The period for which the individual was employed with the employer in the concerned Financial Year

- Summary of the salary paid

- Date of tax deduction from the salary

- Date of tax deposit in the government account

- Summary of tax deducted & deposited quarterly with the Income Tax Department

- Acknowledgment Number of the TDS Payment

This part is generated and downloaded through the Traces portal of the Income Tax department. It also provides details such as Bank’s BSR code through which the payments are done, challan numbers, etc. for future reference. All the pages of Part A should be digitally or manually signed by the deductor.

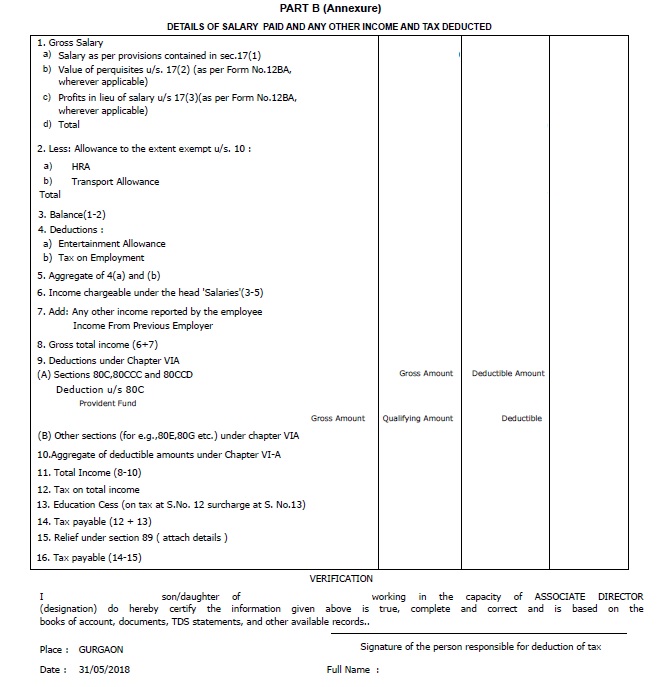

Form 16 Part B

Part B is a consolidated statement covering details regarding salary paid, any other income as disclosed by the employee to his/her organization, amount of tax paid and tax due, if any.

It represents the information in a comprehensive and orderly manner, stating the income earned by the employee along with the exemptions and deductions applicable thereon, in the prescribed format. Employee details such as name and PAN are mentioned even in Part B.

This section contains the following information:

Total Salary Received: Salary structure is further broken down into various components such as House Rent Allowance, Leave Travel Allowance, Leave Encashment, Gratuity and others.

Exemptions Allowed: As per Section 10 of the Income Tax Act, 1961, allowances given to employees for conveyance, housing rent (HRA), children’s education and hostel expenditure, medical, etc., are also mentioned in the form.

Gross Income: This is the sum of the salary income as received from the employer and any other income declared by the employee, such as income earned from house/property, etc. Details regarding other income need to be shared by the employee with the employer during the phase of investment proof submission.

Deductions From Salary: Section 80 C / 80 CCC / 80 CCD includes contributions made towards instruments or schemes such as Public Provident Fund, Life Insurance policies, tax saving mutual funds, pension, Sukanya Samriddhi among others. The maximum limit for the same is Rs. 1,50,000.

Deductions under other sections, such as 80D (premium paid towards health insurance or Mediclaim), 80E (interest payment on education loan), 80G (donations), deductions for disability and other applicable sections are provided. The details for all these deductions need to be submitted by the employee along with the necessary supporting documents to the employer.

Net Taxable Salary: Total deductions are aggregated under “Chapter IV-A” and reduced from the gross income to calculate the taxable income. Your tax liability is calculated on this amount.

- Education Cess and surcharges, if any

- Rebate under Section 87, if applicable

- Relief under Section 89, if any

- Total amount of tax payable on income

- Tax deducted, and the balance tax due or refund applicable

Types of Form 16

Other than Form 16, there are 2 other types of Form 16, which you will receive for earning income other than salary:

Form 16A

Form 16 is a TDS certificate that reflects TDS deducted on the salary income by your employer. On the other hand, Form 16A is a TDS certificate applicable for TDS on income other than salary.

For instance, you will receive a Form 16A when your bank will deduct TDS on your interest income earned from Fixed Deposits, TDS on rent receipts, TDS on insurance commission or any other income that is liable for such deduction.

Form 16A provides details of the income earned and TDS deducted and deposited on such income. It also contains the name and address of the deductor/deductee, PAN details, TAN details of the deductor and challan details of TDS deposited.

Form 16B

Form 16B is a TDS certificate for TDS deducted on the sale of property and reflects that the TDS amount deducted on the property by the buyer has been deposited with the Income Tax Department.

The buyer is required to deduct 1% TDS on the property from the amount he has to pay the seller at the time of sale of immovable property.

The buyer is later required to submit the TDS with the Income Tax Department and provide Form 16B to the seller of the property. Form 16B is proof that the TDS deducted on the sale of the property has been deposited with the Income Tax Department.

What are the Eligibility Criteria for Form 16

According to the regulations issued by the Finance Ministry of the Indian Government, every salaried individual who falls under the taxable bracket is eligible for Form 16.

If an employee does not fall within the tax brackets set, he/she will not need to have Tax Deducted at Source (TDS). Hence, in these cases, the company is not under an obligation to provide the Form 16 to the employee.

However, these days, as a good work practice, many organizations, even in these cases, issue this certificate to the employee as it contains a consolidated picture of the earnings of the individual and has other additional uses as well.

How to Download Form 16

Form 16 can only be downloaded by you and issued by your employer. No other individual can download your Form 16.

- There is a common misconception that an individual can download Form 16 on TRACES website using the PAN number. All salaried individuals are eligible to get a Form 16 from their employers.

- If your employer deducts TDS from your salary, then they must issue your Form 16 as it is a TDS certificate which reflects that TDS is deposited to the Government.

- Also, the employer should issue Form 16 before the due date of June 15th of every financial year.

How is Form 16 Important for a Salaried Individual

For a salaried person, Form 16 is of utmost importance for Income Tax. The details mentioned in this form are required for filing of Income Tax Returns.

With this certificate, the taxpayer can easily prepare their income tax return in India, by themselves, without seeking the help of Chartered Accountants or financial planners. This is more applicable for individuals whose only source of income is the salary that they receive from their organization.

Form 16 can be used to verify whether the correct taxes are deposited with the government account by comparing the amounts with the Form 26AS. Also, it is not only a proof of TDS but is also looked upon as a document of importance for tax compliance.

It is the only document that an employee has to furnish to prove that he or she has paid tax and can be shown as proof during any income tax related scrutiny. Banks, other lenders and financial institutions also accept it as a valid income proof.

For loan applications, many financial institutions require this document as part of their verification process. Many organizations require the income tax Form 16 of the previous employer (in that same financial year) to be submitted to them as part of their onboarding process. This helps them to ensure that they calculate the tax payable correctly, as the income tax slabs change depending on the total earnings of an individual in that year.

Also, if one is planning to travel abroad, many visa checklists, such as the one for a Schengen visa, ask for Form 16 as one of the documents to be submitted.

Multiple Employers in a Financial Year

In case of people who have changed jobs and hence worked with multiple employers in a particular financial year, they will receive individual Form 16 from all the employers.

What Should a Receiver Check in Form 16

Once an individual receives the Form 16 from the employer, it is his/her responsibility to ensure that all the details mentioned therein are correct.

In addition to verifying the personal particulars and details of the amount of income and TDS deducted, the most important thing one needs to confirm in Form 16 is the PAN number. If it is mentioned inaccurately, one should immediately reach out to the HR /Payroll/ Finance Department of the organization and get the same corrected.

The employee will be issued a rectified and updated Form 16 by his/her employer. Besides this, the employer would also need to correct details at their end by filing a revised return of tax, to credit the TDS proceeds to the correct PAN.

Responsibility of the Employer with respect to Form 16

The employer or the deductor should ensure that all the details mentioned in the Form 16, such as salary, deductions, PAN, TAN, etc. are captured correctly and each page is signed by a competent and responsible person of the company.

Also, the certificate should be issued to the employee, on or before the deadline of 15th June, so that individuals can file their tax returns well in time.

Form 16 for Previous Years

In the event, that an individual misplaces his/her earlier TDS Form 16, they can reach out to the concerned employer, who will issue them a duplicate copy of the same.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Is Form 16 and Form 16A Similar

While many people assume that both these forms are the same and use the terms interchangeably, in reality, these are two different documents. The objective of Form 16 and Form 16A is the same, as they are both TDS certificates, and the difference lies in the issuing body.

While Form 16 shows the tax deducted at source (TDS) for a salaried employee, Form 16A is applicable for non-salaried employee. In simple words, Form 16A is the TDS Certificate for income earned other than salary.

People rendering their services to an organization not as employees, but as consultants and earning contractual/professional and other fees for their services, are eligible to receive Form 16A.

Also, there are many other areas where TDS can be applicable like the tax for interest earned on your fixed deposits, savings accounts, etc. Here bank is the body/organization that deducts the tax at source. Hence, for every financial year they must issue a TDS certificate called Form 16A to the customer.

Form 16A is also issued for tax deductions on the insurance commission paid. This certificate has personal details of the deductor and deductee, such as name, address, PAN/TAN details, and details of TDS deducted & deposited. The income on which TDS is deducted is also specified.

Are Form 16 and Form 26AS Linked?

Form 26AS combines all the tax deducted from your salary and/or non-salary income and deposited with the authorities concerned. Details of tax refund, if any, received during the financial year will also be available in this form.

Tax deductions that are shown in Form 16 / Form 16 A can be cross-checked and verified using Form 26AS.

Ideally, TDS amounts reflected in Form 26AS and Form 16/16A should always match. If there are discrepancies, the Income Tax Department considers the TDS figures as per the Form 26AS only.

Tax Return and Form 16

Form 16 is one of the most critical documents that one needs to keep handy before or while filing the Income Tax return before 31st July every year. It’s a rookie mistake to believe that if there is no balance tax payable mentioned in the Form 16, then the individual can simply copy the details of Form 16 in the tax return form.

This is not always true. The tax collected at source by the organization or employer is based on the tax slabs applicable to the total earnings, as known by and disclosed to the employer. If one has earned any income during the year, which has not been shared with the employer (such as bank interest), the same will not be reflected in the Form 16 but it should form part of the tax return.

It is also possible that the TDS deducted by another deductor, such as a bank, may not be sufficient as they deduct tax on usually a flat percentage such as 10%, whereas a higher slab rate may be applicable when all the income sources are consolidated and hence there is a tax due in your return. So, there may be a tax payable during the filing of the return beyond the deductions as shown in Form 16 and/or 16A. Read more on How to File Income Tax Return

Is No Form 16 = No Tax Return

The responsibility of deducting tax on salaries and providing a certificate of TDS is the responsibility of the employer, and failing to do so will attract a financial penalty of Rs. 100 per day of default, as per Section 272A(2)(g) of the I-T Act.

Despite multiple requests, if an organization or employer denies issuing the certificate, then there is a possibility that the tax deducted has not been deposited by the deductor with the concerned government authorities. Employees are urged to inform the concerned Assessing Officer, who in turn will take the necessary remedial action and initiate the penalty proceedings against the employer.

However, the onus of paying Income Taxes and Filing Returns is on the individual. Hence, if for any reason one does not receive the Form 16 from the employer, he/she is not exempt from filing tax returns on those grounds. Alternate documents such as Form 26AS, which can be downloaded from the Income Tax / Bank website, TDS Certificates from the bank, tax saving investment proofs, rent receipts and your salary slips can be used to work on your Income Tax Return filing.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Form 16 vs. Form 16A vs. Form 16B

All three forms—Form 16, Form 16A, and Form 16B—are TDS (Tax Deducted at Source) certificates issued under the Income Tax Act, 1961.

Form 16 is issued by an employer to salaried employees. Form 16A is issued for income generated from activities other than salary. Form 16B is issued by a buyer of a property to the seller for TDS on the sale of a property. Here is a difference between these forms in tabular format:

| Feature | Form 16 | Form 16A | Form 16B |

| Applicable To | Salaried Employees | Non-Salary Income Earners | Property Sellers |

| Issued By | Employer | Banks, companies, individuals | Property Buyer |

| TDS On | Salary Income | Interest, rent, professional fees, etc. | Sale of Property |

| Applicable Section | 192 | Various (194A, 194J, etc.) | 194IA |

| Issued | Annually | Quarterly | Per Transaction |

Form 16 FAQs

Q. What is Form 16 and why is it important?

Form 16 contains all TDS deductions made by an employer. It shows that your employer has paid income tax to the government on your behalf.

Q. How to get Form 16? Can I download my Form 16 myself?

Form 16 can only be downloaded and issued by your employer. An individual cannot download Form 16 on their own. All salaried individuals are eligible to receive Form 16 from their employers.

Q. Can Form 16 be generated without PAN?

Form 16A can be generated only for a valid PAN. In case a PAN is not reported in TDS statement or an invalid PAN, Form 16A will not be generated.

Q. Who issues Form 16 for pensioners?

The bank through which a pensioner receives their pension issues Form 16 for them. Their previous employers are not responsible for issuing their Form 16.

Q. Can I download Form 16 for salaried employees in PDF format?

Yes, Form 16 can be downloaded in PDF format.

Q. Is Form 16 applicable to both salaried and self-employed individuals?

Form 16 applies only to salaried individuals, whereas self-employed professionals may get Form 16A and 16B as per the task they perform.

Q. What should I do if I have not received Form 16 from my employer?

In case you do not receive your Form 16 by June 15th, you can request your employer to issue it at the earliest. In case of delays beyond the deadline, the employer is liable to pay a fine of Rs. 100 for every delayed day, amounting to a maximum of the tax deducted by the employer.

Q. What are the common mistakes in Form 16 and how can I fix them?

An employee cannot fix errors in Form 16. If there are errors, you can request that the employer to rectify them and share the update Form 16.

Q. Can Form 16 be used for applying for loans or credit cards?

Yes, you can use Form 16 as proof of income while applying for a loan or credit card.