Form 26AS, also known as Annual Statement, provides a consolidated record of all tax-related information such as TDS, TCS, and refund etc. associated with a PAN (Permanent Account Number). This form and its use by tax authorities/tax payers is governed by Section 203AA, Rule 31AB of the Income Tax Act, 1961.

Table of Contents :

How to Download Form 26AS from TRACES

You can download Form 26AS from TRACES website or using netbanking facility of authorized banks.

Step 1: Login to Income Tax e-Filing Website to download Form 26AS

Step 2: After logging into your account, the following screen will appear. Go to ‘My Account’ and click on ‘View Form 26AS (Tax Credit)’ in the drop-down menu

Step 3: Click on ‘Confirm’ and you will be redirected to the TRACES website

Step 4: Agree to the usage and acceptance of Form 16 / Form 16A generated from TRACES and click on ‘Proceed’

Step 5: Click on ‘View Tax Credit (Form 26AS)’ to view your Form 26AS

Step 6: Select the Assessment Year and the format (HTML/Text) in which you want to see Form 26AS. Form 26AS download can also be done in PDF format. Post selection, click on the button ‘View/Download’

Step 7: To open the document you will be required to enter a password. The password is your DOB in DDMMYYY format. For example: If your date of birth is 15th April, 1985 then your password would be 15041985.

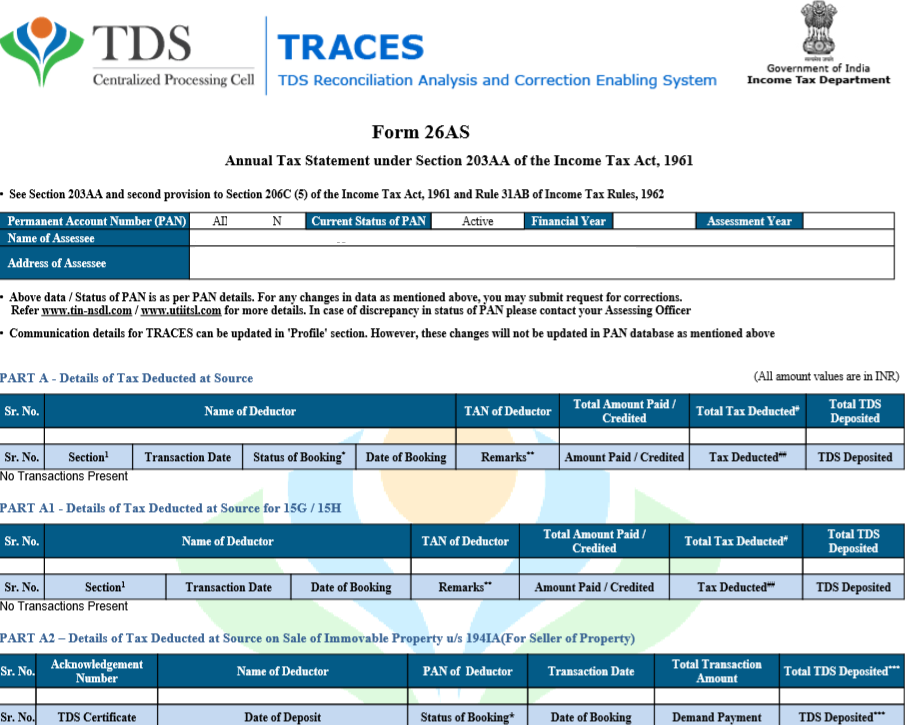

Form 26AS Sample

The following is a sample of what the first page looks like:

Usually, the Form 26AS document is 3-4 pages long however it may be longer if the number of TDS/TCS-related on the form entries is greater in number.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

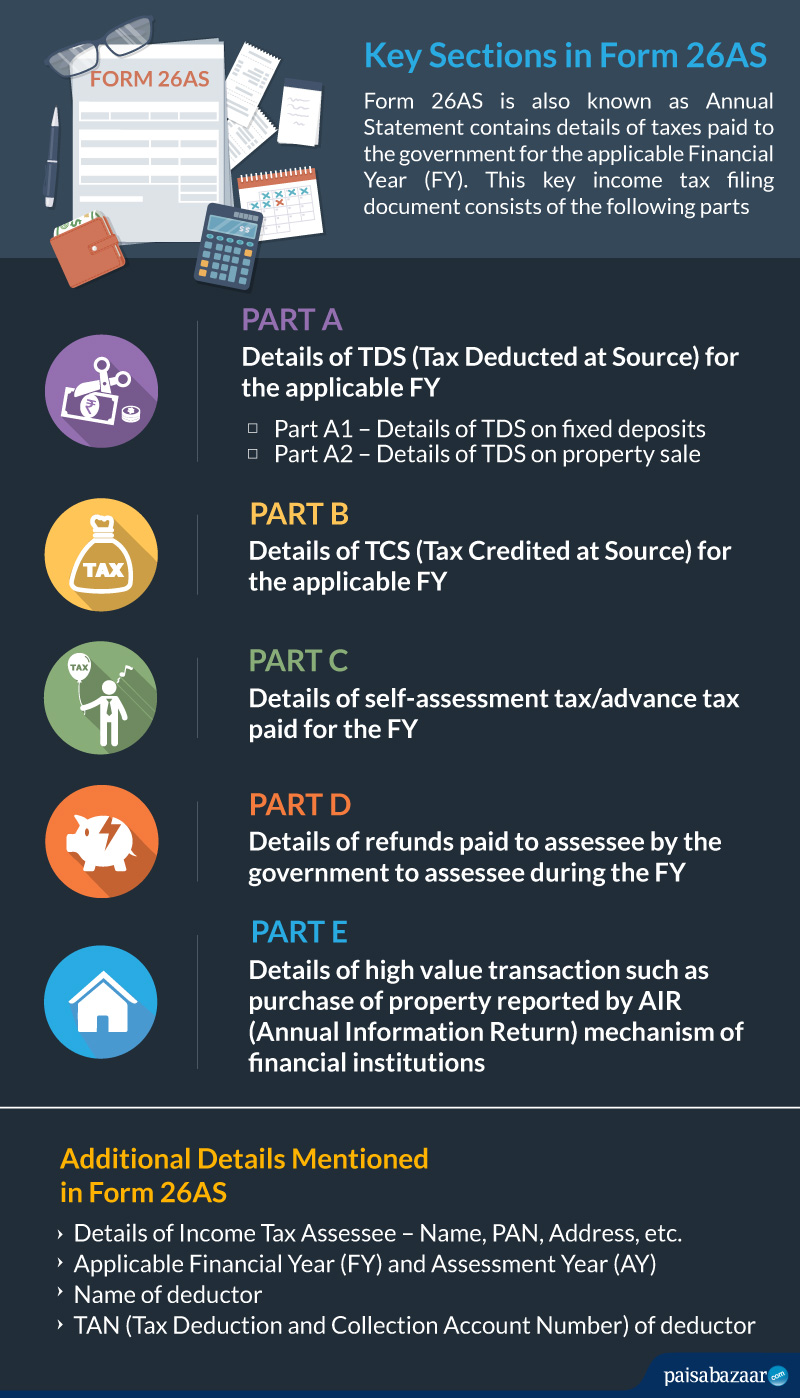

Structure of Form 26AS

Form 26AS for each financial assessment year is divided into multiple parts. The tax credits (to government tax authorities) appearing in Part A, A1, and B of this form are given on the basis of details furnished by the deductor/collector in the TDS/TCS statement filed by them. Brief details of the sections are provided below:

Form 26AS Part A

Part A of the form contains details of the Tax Deducted at Source (TDS) in Indian currency (INR). This section of the form exclusively highlights the TDS deducted from your salary/pension income, TDS deducted by the banks on the interest generated from your investments.

Form 26AS Part A1

This section of the form is specially kept for the details of TDS from Form 15G/15H. This portion of the form shows transactions in financial institutions such as banks where the individual has submitted Form 15G/15H. TDS, in these cases, would be zero because the individual has already submitted Form 15G/ Form15H to the institution concerned, and they would not deduct any tax based on the information in this form. This section also enables you to keep a track of the earned interest that has not been taxed.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Form 26AS Part A2

This section of the form contains details of TDS credit applicable to sale of house property. Part 2 of the form would show a TDS credit on behalf of the seller of a property and can be adjusted against the total tax liability of the property seller. The rate of TDS applicable to the proceeds on sale of a property is 1% as of FY 2022-23.

Form 26AS Part B

This section of the form is kept for the details of the Tax Collected at Source (TCS). This tax is collected by the seller from the buyer at the time of sale of specified category of goods (such as liquor, parking lot, toll plaza, etc.) The amount is deposited by the collector to the government on a quarterly basis.

Part C: Form 26AS Part C discusses and maintains the details of tax paid other than TDS or TCS. If you have paid advance tax or self-assessment tax, it will be listed here. Whenever you deposit advance tax /self-assessment tax directly to the bank, it will upload this information within three days after the cheque has been cleared.

Part D: This part of the income tax Form 26AS keeps the details of paid refunds. All the refunds that you have applied for and received will be listed under this section of the annual tax statement. It may be helpful to keep a track of this information to check if you have been paid for all of the tax refunds you have applied for.

Part E: The Part E of the Form 26AS is responsible for keeping the details of the Annual Information Return (AIR) transactions. If you make some high-value transactions, such as a purchase of property, investment in mutual funds, etc., these transactions are automatically reported to the Income Tax Department by banks and other authorities through the AIR.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Why is Form 26AS Important?

Key details featured on Form 26AS include tax amount that has been received by the government in lieu of TDS/TCS along with consolidated information about all of your income sources including your monthly salary, pension, income from investments, income for professional services, etc.

Form 26AS is considered as an important financial document since it contains all the tax-related statements. The major purposes that this form fulfils are:

- It helps check if the deductor has accurately filed the TDS statement or the collector has accurately filed the TCS giving details of the tax deducted or collected on your behalf.

- It enables one to check that the tax deducted or collected by the deductor or collector respectively has been deposited to the account of the government on time.

- It helps verify the tax credits and computation of income before filing the income tax return.

Apart from this, the form also reflects details of the Annual Information Return (AIR), which is filed by different entities based on what an individual has invested or spent on, mostly for high value transactions. If the total amount deposited in a savings account exceeds Rs. 10 lakh, the bank will send an AIR. The same holds true if an amount more than Rs. 2 lakh is invested in a mutual fund or spent on a credit card.

Form 26AS tends to serve both the citizen and the government. An income taxpayer is no longer required to attach a photocopy of the TDS certificate along with Income Tax Return as long as he or she has Form 26AS. The Income Tax Department will allow a taxpayer to claim the credit of taxes as reflected in his or her Form 26AS if no other payments are due from him or her as income tax (or interest thereon) payable to the Government.

Here is an example to illustrate how Form 26AS helps. Suppose Mr. Narayan wants to pay his annual income tax for his yearly salary of Rs. 4.8 lakh (Rs. 40,000 per month) and income of Rs. 2 lakh from other sources. Though his Form 16 tells him how much tax has been deducted by his employer, he has no idea of how much tax has been deducted from his other income by the payer.

However, all details of the Tax Deducted at Source (TDS) will be reflected in his Form 26AS that can be viewed on the Income Tax Department website. The form will show the TDS deducted by his employer as well as any other TDS deductions made by the payer of other income. This form will contain a quarterly account of the taxes paid on behalf of Mr. Narayan, and he will know exactly whether he needs to pay any more income tax or whether he is eligible for a refund.

Form 26AS: Availability

It is easy to access and download Form 26AS. Here is how to get form 26AS:

- Download Form 26AS by logging in to your income tax filing account directly on The Income Tax Department e-filing website at https://incometaxindiaefiling.gov.in. Once you log in, click on “View Form 26AS (Tax Credit)” button, either under the My Account or Quick Links section. You will be redirected to the TDS-CPC website to view and download your Form 26AS. You need to choose the relevant Assessment Year (AY) for which you want to download the statement. It is issued on behalf of the Income Tax Department and has the heading ‘TDS Reconciliation Analysis and Correction Enabling System.’ This is the best way to find Form 26AS and all information related to it.

- Another easy way to download Form 26AS is by registering at the TDS Reconciliation Analysis and Correction Enabling System (TRACES) of the Income Tax Department. It comes in the right format and is easy to read.

- You can also get this form through authorized banks using their net banking facility. However, Tax Credit Statement (Form 26AS) is available only if the PAN is mapped to the bank account that is going to be used to download the form. The facility is available free of cost. The list of authorized banks that provide the form is given below:

| Allahabad Bank | ICICI Bank | Yes Bank |

| Andhra Bank | IDBI Bank | State Bank of India |

| Axis Bank | Indian Bank | HDFC Bank |

| Bank of Baroda | Indian Overseas Bank | Syndicate Bank |

| Bank of India | IndusInd Bank | Federal Bank |

| Bank of Maharashtra | Karnataka Bank | Karur Vysya Bank |

| Canara Bank | Kotak Mahindra Bank | UCO Bank |

| Central Bank of India | Oriental Bank of Commerce | Union Bank of India |

| City Union Bank | Punjab National Bank | South Indian Bank |

| Corporation Bank | Punjab & Sind Bank |

The form besides cross-checking the income tax related data serves another purpose as well – you need it to file your income tax return. Form 26AS contains consolidated details of your deductors and collectors including their names, tax deduction account numbers, tax collection account numbers, the amount of income received, and Tax Deducted at Source (TDS), etc. The form makes it quite easy for you to fill in the data while you are filing your return.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Importance and Utility of Form 26AS

Most people are already aware of the importance of Form 26AS. Here are a few reasons why you need it:

- Form 26AS gives key information regarding tax deducted/collected by authorised deductors/collectors as has been deposited with the government tax authorities.

- This form enables you to access all of the financial transactions involving TDS/TCS during the relevant financial year at once.

- The form also helps in claiming the tax credits and computation of income at the time of filing of return on income. It can help you verify your income tax return easily.

- Form 26AS aids seamless processing of income tax return and speedy credit of funds is also possible with the help of this form.

- Verification of refunds during the applicable Assessment Year/Financial Year can also be confirmed using Form 26AS.

Things to Verify in Your TDS Certificate with Form 26AS

Form 26AS must be cross-checked and verified with the details of TDS certificate, also known as Form 16 (salaried) and Form 16A (non-salaried), to make sure that the TDS deducted from the payee’s income was actually deposited with the income tax department.

Other things that must be verified in the TDS certificate with Form 26AS are discussed here:

- Do not forget to check your name, PAN, Deductor’s TAN, refund amount paid to you, and TDS amount on Form 26AS to make sure that they are correctly reflected. These are significant taxation information and as such it is important to confirm the figures before you accept the certificate. A mismatch may create problems when you file your income tax return.

- Verify that your Tax Deducted at Source (TDS), as shown in the TDS certificate, has actually been received by the government. This is only possible by comparing the TDS data on your payslips with the Form 26AS data. If the deductor has failed to file TDS or submit the tax on your behalf, it can be an issue for both of you. Contact the deductor and ask him to file the TDS return and submit the tax amount at the earliest.

- You must also check that the TDS mentioned in Form 16/16A is reflecting in Form 26AS correctly. If the TDS shown in your TDS certificate is not reflecting in your Form 26AS, it would imply that the deductor has deducted the tax on your behalf but has not deposited TDS to the Income Tax Department. You need to take action promptly by contacting the concerned deductor if you face this issue.

Read more on Form 16

In case of any kind of discrepancy between the TDS certificates and Form 26AS, inform your deductor and ask for the reasons for this discrepancy and get it corrected as soon as possible. Make sure the deductor has filed TDS using your PAN number and other details. In a lot of cases, if the TDS is filed under an incorrect PAN, it can result in a lot of problems for both the deductor and the income tax assessee.

TDS Certificate (Form 16/16A) vs. Form 26AS

You might wonder why you need a TDS certificate or Form 16/16A when the same information is already available in Form 26AS. In reality, both of them serve their own unique purpose.

It is true that you can gather all of the relevant information related to TDS in Form 26AS which is more than sufficient to file any income tax return. However, you cannot doubt the significance of a TDS Certificate. The rationale behind introducing Form 26AS is to enable the taxpayer to cross-check and thoroughly verify the details mentioned in his TDS certificates with those mentioned in Form 26AS and maintain transparency of information.

If you do not have a TDS certificate or Form 26AS, you will not be able to verify your details and find any mismatch that might have occurred. If you have both, you can compare the details and cross-check. In the case of a discrepancy, you can easily get it corrected.

Further, in the case of salaried persons, Form 26AS in itself is not sufficient to file income tax return since it does not show the breakup of your income and details of deductions claimed under Section 80C to Section 80U which are available in Form 16 i.e. TDS certificate. Therefore, you need a TDS certificate in addition to Form 26AS.

FAQs

Q. How to rectify errors in Form 26AS?

To make corrections in Form 26AS, one must inform the deductor and ask him to file a rectified TDS return. The deductee cannot make any corrections in 26AS Form himself.

Q. When does Form 26AS get updated?

When the TDS return filed by the taxpayer is processed by the Income Tax department, Form 26AS gets updated.

Q. Why is Form 26AS needed?

Form 26AS is required as it serves as proof of tax deducted and collected at source on the behalf of taxpayers. Moreover, it also confirms that employers and banks have deducted specific taxes on your behalf and deposited it in the government’s account.