Form 26QB is a return-cum-challan form for the payment of Tax Deducted at Source (TDS) to the government for deductions made under Section 194-IA of the Income Tax Act, 1961. This section of the Act specifically deals with transactions involving the sale of immovable property and the applicable TDS along with Form 26QB needs to be submitted within 30 days counted from the end of the month in which TDS was deducted. For instance, if the transaction occurred on 14th March then Form 26QB must be mandatorily submitted by 30th April.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Key Features of Form 26QB under Section 194-IA

The Income Tax Act, 1961 has laid out a few key rules regarding sale and purchase of immovable property. In such transactions covered under Section 194-IA, the buyer, also known as the deductor, is required to deduct TDS if the transaction value is more than Rs. 50 lakhs. Subsequently, the deductor will required to issue Form 16B to the deductee (seller).

All the requirements for Form 26QB have been listed under Section 194-IA. They are:

- Under Section 194-IA, the buyer must deduct TDS at the rate of 1% of the total sale amount at the time of completing the transaction.

- TDS u/s 194-IA is not applicable to transactions involving agricultural land.

- TDS on immovable property sale is not applicable for transactions valued at less than Rs. 50 lakhs. For transactions beyond this limit, TDS is deducted on the entire transaction amount. For instance, if the property cost Rs. 52 lakhs then you have to pay TDS on Rs. 52 lakhs and not Rs 2 lakhs (Rs. 52 lakhs – Rs. 50 lakhs).

- If the payment is made in installments then TDS is deducted proportionately on each individual installment.

- The buyer does not need to obtain Tax Deduction Account Number (TAN) to deduct and deposit TDS. However, PAN is mandatory for both the seller and the buyer in case TDS deduction occurs using Form 26QB.

- The buyer is supposed to deposit TDS and submit form 26QB within 30 days from the end of the month in which TDS was deducted.

- In case there are multiple buyers and sellers involved in the transaction, the deductor will be required to submit multiple Form 26QB.

- After deducting and depositing TDS, the buyer must furnish a TDS certificate to the seller within 15 days of the transaction in lieu of the tax deducted and deposited to the government.

- The buyer must then obtain Form 16B and furnish it to the seller.

Penalties Related to Section 194-IA Form 26QB

It is important to note here that not deducting TDS, issuing Form 16B or not filing Form 26QB attracts interest and penalty. The applicable penalties are as follows:

| Condition | Penalty |

| Non-deduction of TDS | Penalty of 1% interest on the amount not deducted for TDS |

| Non-remittance of TDS to the government | Penalty of 1.5% of the deducted amount per month |

| Delay in filing of TDS returns | Penalty of Rs. 200 per day for each day of default |

How to Download Form 26QB?

If you are wondering about how to pay through Challan 26QB and download the form then here the steps you need to follow:

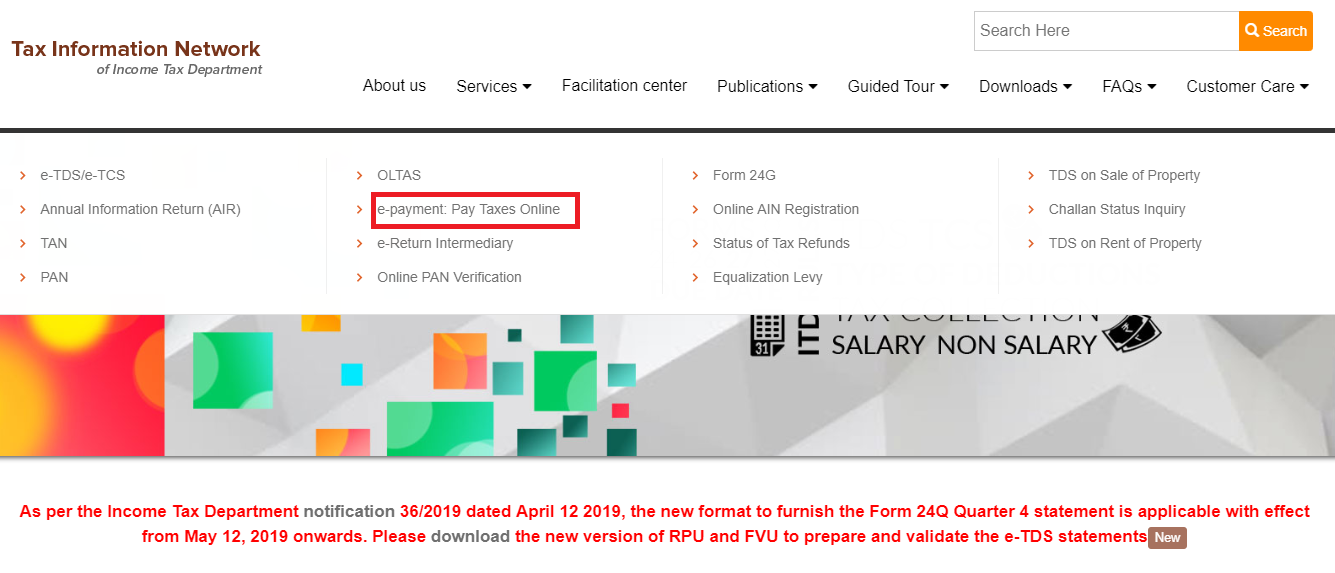

- Go to TIN NSDL website and click on the “e-payment: Pay Tax Online” link located under the “Services” menu of the home page.

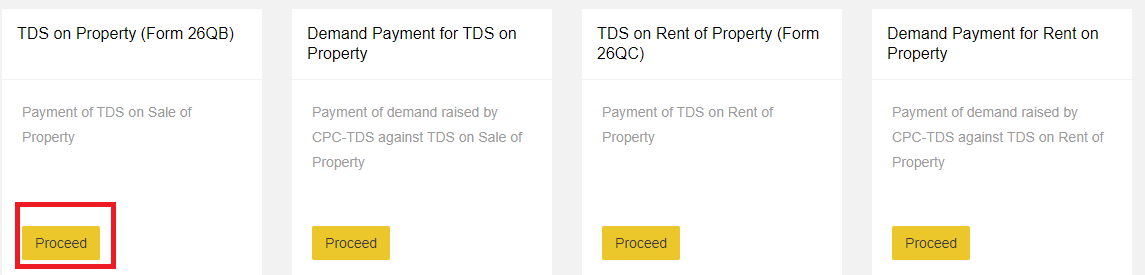

- On the subsequent page, under the TDS on sale of property menu, click on Form 26QB (Online form for furnishing TDS on property):

- Fill in the relevant details

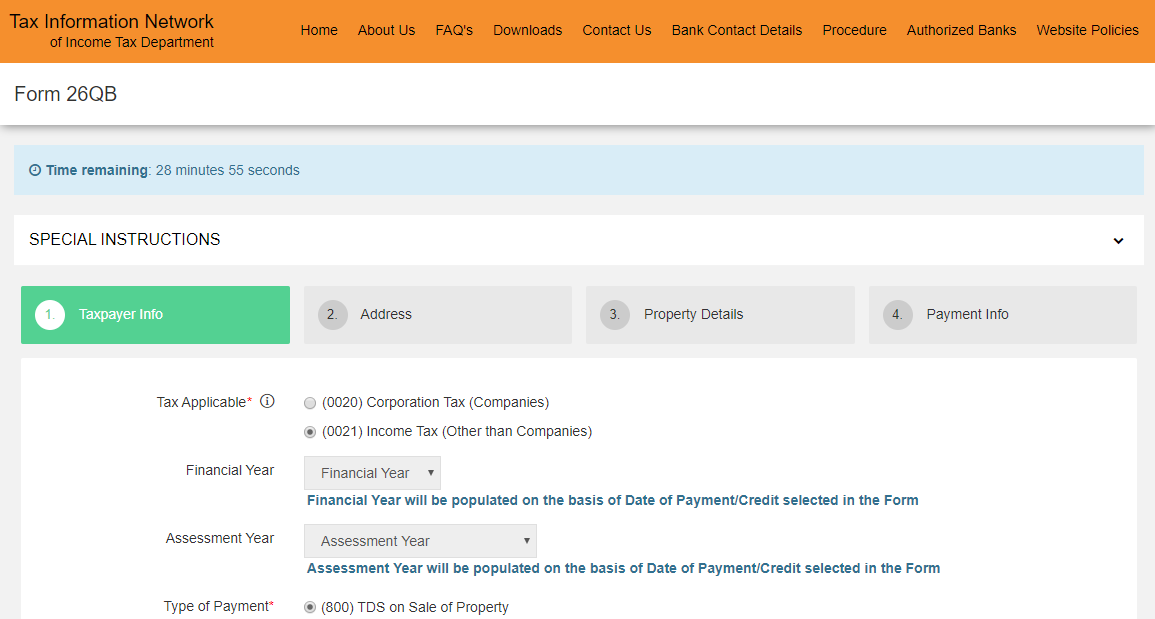

To fill Form 26QB, select one of the options given:

-

- (0020) Corporation Tax (Companies)

- (0021) Income tax (other than companies)

- Financial Year and Assessment Year

- Address of TDS deductor and

- Property Details

- After this, select the Mode of payment

- e-tax payment immediately (through net banking facility)

- e-tax payment on a subsequent date (payment at later date through a bank branch)

- If you choose the net banking option then you need to login to your account using your Internet banking credentials and make the payment. Once payment is completed, you can now download the Form 26QB.

- However, if you choose the “Pat Later” option then Form 26QB will be generated for you with a unique Acknowledgement Number. You need to print it out and take this form to your bank branch to make the payment. The TDS payment using Form 26QB needs to be made within 10 days of generating this form.

After completing the TDS payment and checking that the payment is reflecting in Form 26AS, the taxpayer can log on to the TRACES website and download Form 26AS from the Downloads menu after providing the relevant details.

Know More about Form 26AS

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Frequently Asked Questions (FAQ)

A few of the frequently asked questions about Form 26QB have been answered here:

Q. I do not have a TAN Number. How can I deduct TDS?

A. The buyer does not need to have Tax Collection and Deduction Account Number (TAN) to deduct TDS. However, the buyer as well as the seller needs to furnish their PAN for the transaction including the deduction of TDS.

Q. I forgot to deduct TDS when I purchased a property. What should I do now?

A. Non-deduction of TDS attracts a penalty interest of 1% on the TDS amount outstanding. You need to take action and pay the penalty as soon as possible to set the account straight. Make sure to remit the TDS to the government and file TDS return within the stipulated time as well to avoid other penalties.

- Should I deduct TDS if I am purchasing agricultural land?

- No. If you are purchasing agricultural land, you do not need to deduct TDS for the transaction u/s 194-IA.

Q. How can I pay TDS using Form 26QB?

A. You have two options to remit TDS to the government using Form 26QB. They are:

- Pay online with net banking using the e-tax payment option on the TIN NSDL website.

- Generate Form 26QB with a unique acknowledgement number and visit your bank with this form to make the payment. The form 26QB with acknowledgement number is valid for 10 days.