Rules and regulations of the Income Tax Act, 1961 require taxpayers to get their bank accounts audited under Section 44AB. The auditors of businesses/individuals covered by Section 44AB have to provide their audit reports using a specified audit forms specified by the Income Tax Department. Form 3CA is one such audit report form that needs to filled out and submitted by auditors.

What is Form 3CA and Who Submits it?

Under existing rules, audit reports have to be provided by filling out either Form 3CA or Form 3CB. Income Tax assessees such as professionals and self-employed businessmen, who are covered u/s 44AB, and already mandated to get their account audited under the prevailing Income Tax laws, will require their auditors to fill out form 3CA. In addition to this, auditors of companies or organisations that need to get their accounts audited compulsorily under the prevailing Companies Act, 2013 must also furnish the Form 3CA.

This form must be submitted along with Form 3CD and will be furnished by a professional or a chartered accountant (CA) after the audit. Apart from Form 3CA, other forms that are prescribed for specific types of audits include Form 3CB, 3CD and 3CE.

How to Download Form 3CA?

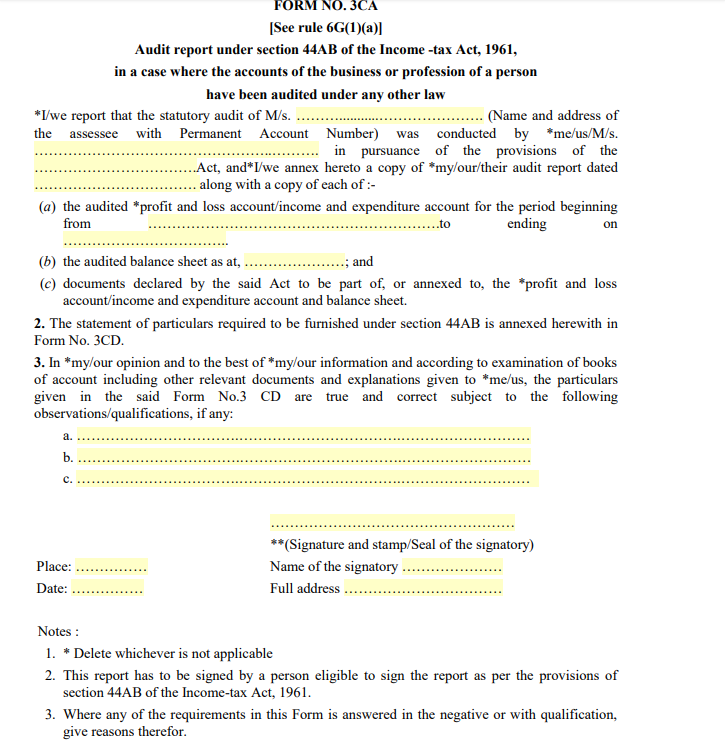

You can download Form 3CA for free from the Income Tax Department website. The following is a sample of what this single-page audit form looks like:

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to Fill Form 3CA

Form 3CA being an audit form requires some key data to be provided by auditors regarding the tax assessee being audited. The key fields to be filled out in this audit report are as follows:

- Personal details of the tax assessee including name, address and Permanent Account Number (PAN)

- Name of the auditor (either firm or individual)

- Number and section/subsection of prevailing Companies Act under which the accounts have been audited

- Date of the audit and audit report

- Period of the Income and Expenditure Account or Profit and Loss Account (Start and end date)

- Date of Balance Sheet used to perform the Audit

- Declaration that Form 3CD has been attached along with the audit report

- Qualifications/ audit observations found in the details associated with the Form 3CD

- Date and place of signing the audit report

- Details of the auditor i.e. name, address and the membership number

- Seal and stamp of the auditor

Do keep in mind that the auditor is required to attach and maintain records of key documents such as Form 3CD, Balance Sheet, P&L statement, etc. based on which Form 3CA is filled out.

What is the Due Date of Obtaining the Audit Report for a Taxpayer?

Taxpayers who are due to be audited need to obtain their audit report in Form 3CA on or before September 30 of the specific assessment year. For instance, if your relevant financial year is 2017-2018 i.e. Assessment Year 2019-20, you must obtain the audit report by September 20, 2020.

In case the taxpayer is obtaining the form 3CE for audit report, then the due date is November 30 for the same assessment year. Hence, for financial year 2017-2018, the form 3CE must be obtained till November 30, 2020. When auditors submit the audit reports to the taxpayers digitally/electronically, they have to be checked and approved by the taxpayers before they get filed with the tax authorities.

What are the Key Differences between Form 3CA, Form 3CB and Form 3CD?

The key difference between Form 3CA and Form 3CB is the audit requirement clause. While audit requirement is compulsory requiring submission of Form 3CA, no such mandatory requirement exists in case of Form 3CB. The main difference between Form 3CA and Form 3CD on the other hand, is related to the fact that Form 3CD is a very detailed statement of accounts used as supporting document for Form 3CA.

The following are the key differences between these three forms covered by Section 44AB:

| Form 3CA | Form 3CB | Form 3CD |

| For professionals/businesses requiring mandatory audit under law other than Income Tax law. | For those not requiring mandatory audit under any law apart from Income Tax Law. | Detailed form with fields featuring different audit information |

| Single Page form containing audit details obtained from multiple documents such as Balance Sheet, Form 3CD, P&L Statement, etc. | Single Page form containing income details of document obtained from multiple documents such as Balance Sheet, P&L Statement, etc. | Detailed audit report form featuring multiple fields that need to be filled out with specific details such as revenue, turnover, expenses, profits, asset-liability details and much more. |

| Can be submitted by any applicable tax assessee irrespective of income/turnover. | Only tax assessees with income exceeding Rs. 1 crore who have not opted for presumptive tax mechanism can file this form. | This document is applicable to all business audits and is a detailed account of all transaction carried out by the business/professional being audited. |