Tax audit, as mentioned in section 44AB of the Income tax Act, needs to be conducted by a professional auditor approved by the Income Tax Department. This professional could be a Chartered Accountant (CA) having a full-time certificate of professional practice or a company specialising in this field. The tax audit ensures the accuracy and correctness of the Books of Account owned and maintained by the taxpayers and that their income is calculated on the basis of the applicable Income Tax Rules. Form 3CB is one of the key forms which is used to submit an audit report generated u/s 44AB of the Income Tax Act, 1961.

What is Form 3CB?

This form is needed when the taxpayer who is working as a professional or a business does not need to get the book of accounts audited by law. When an individual, partnership firm or proprietorship entity has a turnover of over Rs. 1 crore and has not opting for the presumptive taxation scheme, there is no audit of books of account needed under any law apart from the Income Tax Act. For this, they have to furnish Form 3CB. In addition to Form 3CB, the tax auditor can furnish the Form 3CD as well.

Who Files Form 3CB and When is its Submission Due?

Form 3CB is an audit report that is furnished by a professional CA on the behalf of the tax assessee who is working as a self-employed professional or carrying out a business. The assessee undergoing audit has to obtain the report in Form 3CB on or before September 30 of the applicable assessment year. For instance, if the relevant assessment year or financial year is 2017-18, then the audit report must be obtained by them until September 30, 2020.

Key Fields in Form 3CB

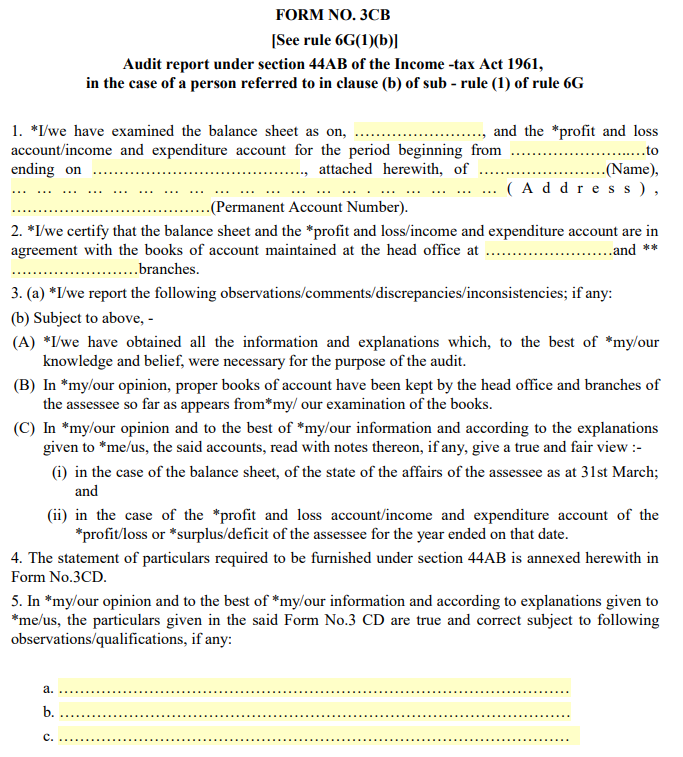

Key fields in Form 3CB that must be filled out by the auditor after conducting the audit of the books of account under section 44AB are as follows:

- Personal details of the assessee.

- Observations and comments of the auditor along with the consistencies or discrepancies, if any.

- A declaration stating the Books of Accounts such as Profit and Loss Account, Balance Sheet, Income and Expenditure Statements along with the Book of Accounts maintained at the entity’s head office

- A declaration specifying that the information provided is accurate and provides a fair outline of the major financial aspects of the entity

- A declaration saying that the details mentioned in audited report are also included in Form 3CB

- Declaration(s) of the CA stating that the profit and loss account, income and expenditure account and the balance sheet have been properly examined

- Annexure of Form 3CD

- Details of the CA i.e. name, address and signature

Sections in Form 3CB

The following are the key sections present in Form 3CB and key fields in each section:

Section 1

- Date of the balance sheet

- Duration of the Income and Expenditure Account/Profit and Loss Account (beginning and end date)

- Taxpayer’s name and address along with Permanent Account Number details

Section 2

- Address details where the books of accounts are kept

- Address details of the branches, in case the books are kept in branches as well

Section 3 (a)

This section contains various observations, qualifications, comments and discrepancies observed during the audit.

Section 3 (b)

This section features the declaration provided by the auditor

Section 4

- Declaration of Form 3CD and audit report

Section 5

- Observations and discrepancies found, if any, including applicable details

Section 6

- Date and place of signing the audit report

- Auditor’s details such as name, address and membership number

- Seal or stamp of the auditor

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to download Form 3CB

You can download Form 3CB for free from the Income Tax of India website. Subsequently the downloaded form can be printed, filled out and submitted with the appropriate authorities. The following is a sample Form 3CB:

What are the Key Differences between Form 3CA, 3CB and 3CD?

What are the Key Differences between Form 3CA, 3CB and 3CD?

The key difference between Form 3CA and Form 3CB is with respect to the applicability. While Form 3CA needs to be submitted by individuals who are mandatorily required to be audited u/s 44AB of the Income Tax Act, Form 3CB is applicable to even those who are audited under other sections too. While both 3CA and 3CB are short single page forms, Form 3CD is a much more detailed document that shows details of the audit that was carried out by the auditor. Form 3CD operates as a supporting document that needs to be submitted with both Form 3CA and 3CB as proof of completion of a mandatory audit.