For the state government, property tax happens to be a significant source of income. Property tax is a direct tax imposed by state governments through the local municipality organisations on real estate holdings. The tax is levied on a variety of real estate properties including but not limited to corporate buildings, residential buildings, apartments and even vacant lands. The taxes raised by the government is later used for improving the infrastructure of the city by repairing the potholes and maintaining the other civic services efficiently and smoothly. The tax amount to be charged depends on the property valuations based on factors such as circle rates. Property tax has to be paid annually by the owner of the property. The Greater Hyderabad Municipal Corporation (GHMC) raises the property tax from Hyderabad city. For the residential properties, GHMC has a slab rate for taxation of property.

How to calculate the property tax in Hyderabad?

The calculation of property tax for residential properties and that of commercial properties are different. GHMC has adopted slab rates for computation of residential property tax in Hyderabad. Below mentioned is how you can calculate your applicable residential property tax:

Computation of residential tax property

Annual property tax = Gross Annual Rental Value (GARV) X (17% – 30%) slab rate to be determined based on MRV as fixed by GHMC – 10% depreciation + 8% library cess

GARV = Plinth area x Monthly rental value in Rs/sq ft x 12

| Monthly rental value (in Rs) | General tax | Other Tax (Conserting Tax, Lighting Tax, Drainage Tax) | Total |

| 300 and above | 15% |

15% |

30% |

| 201-300 | 7% | 22% | |

| 101-200 | 4% | 19% | |

| 51-100 | 2% | 17% | |

| Up to 50 | Exempt | ||

A whole build-up area including balconies and garage is called Plinth area. In the case of self-occupied residential property, to calculate the GARV, rental of other properties of the same area has to be considered. In the case of rented-out properties, the rental amount has to be determined from the rent agreement.

Commercial property tax computation

Annual property tax = 3.5 x Plinth Area in sq.ft. x Monthly Rental Value in Rs/sq.ft.

For commercial properties, monthly rental value/sq.ft. is decided by GHMC on the basis of various aspects like taxation zones, usage and type of construction.

Before computing the property tax, the allowance for repairs regarding the property is deducted from the annual rental value of the building. The below-mentioned table will help you to understand the deduction allowed based on the age of the building:

| Age of the building | Deduction allowed |

| 25 years or below | 10% of the building |

| 25 years – 40 years | 20% of the building |

| Above 40 years | 30% of the building |

Property tax on Renovated Buildings

In case you are expanding or modifying your property such as building a new floor or extending a portion of your house, the PTIN number and the door number remains the same. Whereas the amount of property tax increases. You can also contact the concerned deputy commissioner at the GHMC office in case you want to re-assess your property.

Due dates, rebates and penalties

The last date for completing property tax payment is 31st July and 15th October for half yearly property tax payment.

Penal interest at 2% per month on the outstanding amount is raised as a result of the delay in paying the property tax.

GHMC is trying its best to ensure that a maximum number of people are paying property tax on time as well as collecting the payments and arrears promptly. They have also initiated a lucky draw for people who pay tax before the due date. This way more people are encouraged to pay the property tax within the given time.

New Property Assessment by GHMC

For assessing or registering any new property under the Greater Hyderabad municipal corporation, key documents such as occupation certificate, sale deed, etc. has to be submitted along with the application to the respective deputy commissioner of the property tax. The building will be inspected physically by the concerned Assistant Municipal commissioner/Valuation officer/Tax Inspector and also the legal title will be verified. Subsequently, the assessment for purpose of property tax will be conducted as per fixed rates for non-residential properties and prevailing rates for residential properties.

Online self-assessment Scheme

GHMC introduced the Online Self-Assessment Scheme.

The owner of the property can file an application online for the self-assessment of the property. Key details that have to be provided include personal information of the owner along with property details like occupancy certificate number, building permission number, nature of the building, plinth area, locality, usage, etc. Based on this, an approximate amount of annual property tax will be computed and this will be displayed on the screen.

Once you file the online application, it is then forwarded to concerned deputy commissioner. The property will then be inspected and the tax amount calculated as per applicable rates.

Later on once the process is completed, you will receive a unique PTIN (Property Tax Identification Number).

Offline self-assessment Scheme

For the offline assessment for your property, you will have to submit your application to the concerned Deputy Commissioner.

You need to submit the required documents along with the application which are registered sale deed/partition deed/gift deed, the copy of the building sanction plan and occupancy certificate.

The documents linked has to be attested by the gazetted officer.

Concession/Exemption from Property Tax Payment

> There is currently a concession of 50% on properties which have vacant premises.

> Properties having rental value up to Rs. 50 per month are exempt as mentioned above in the table of property tax rate slab.

> Properties owned by charitable institutes, places of religious worship, properties owned by ex or current military servicemen and staff of recognised schools are exempt from making property tax payments.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to pay Property Tax Online?

You can check your due property tax if you have the PTIN (Property Tax Identification Number) number.

To know your dues you can follow the steps mentioned below;

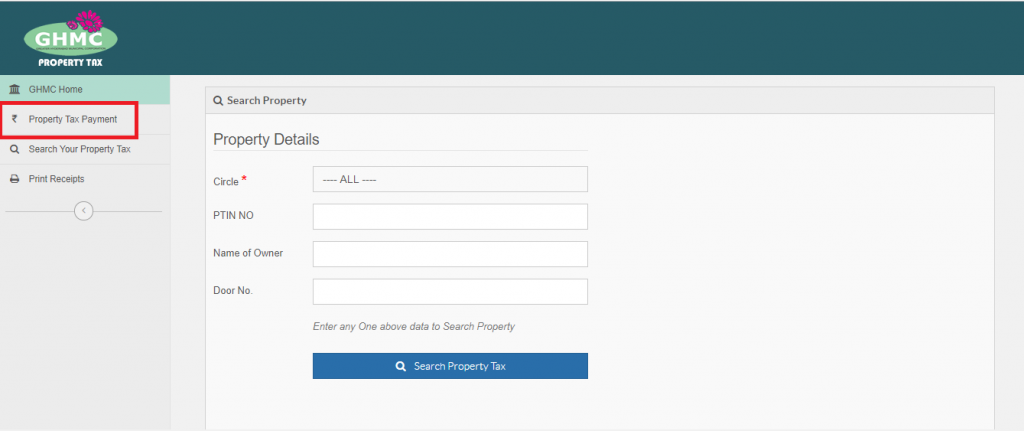

1. Go to the following link https://ptghmconlinepayment.cgg.gov.in/SearchYourProperty.do

2. Enter your PTIN number in the required column. Your PTIN number is also mentioned on the property tax payment receipts of the previous year.

3. Click on Know your property tax dues.

4. Verify the details and choose a suitable option for payment.

5. Subsequently, you will be directed to a payment gateway where you can complete your payment either through debit/credit card or via net banking.