Note: The information on this page may not be updated. For latest updates, click here.

The introduction of Goods and Services Tax (GST) in India in July 2017 has led to major reformed of the country’s indirect tax regime. It was introduced with the goal of “One Nation, One Tax” and is still a work in progress. But how did the idea of implementing GST in India come up? When was the GST Bill introduced and passed in the Parliament? And how did the GST Bill finally become the GST Act 2017? Read this article to understand the journey of GST in India starting from the earliest recommendations for a proposed GST Bill to the GST Act of 2017.

Table of Contents :

What is GST?

GST is a comprehensive indirect tax that has replaced a number of indirect taxes, such as VAT, excise duty, entertainment tax and additional duties of customs. It is multi-stage in nature, as it is levied at all stages from manufacturing to final consumption. Moreover, it is applied at every point of sale. SGST and CGST are levied in case of intrastate sale, while IGST is levied in case of interstate sale of goods and services. Another major characteristic of GST is its destination-based application. In other words, GST is levied at the point of consumption and not at the point of production. Now that we have understood what is GST and its major features, let us see how it came into effect in the subsequent section.

Read more about GST.

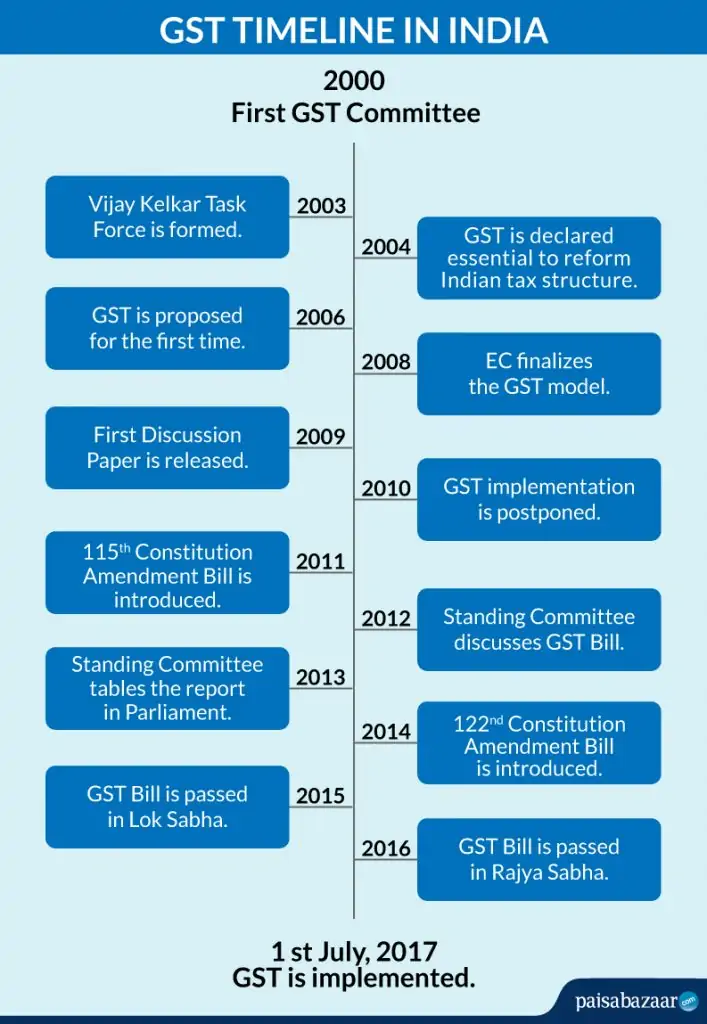

Journey of GST in India : GST Timeline in India

Following is the timeline from conception to implementation of the biggest tax reform, called GST.

- 2000 – First GST Committee was set up under the then finance minister of Bengal, Mr. Asim Dasgupta with the objective of designing and establishing a GST model as per the Indian federal structure.

- 2003: Vijay Kelkar Task Force was formed under the Vajpayee government to develop GST model.

- 2004: The Task Force recommended GST to be essential to reform the tax structure.

- 2006: The then FM, P Chidambaram proposed GST in the Budget speech for the first time with April 1st, 2010 as the deadline for GST implementation.

- 2008: Empowered Committee (EC) of state finance ministers finalized the model and road map for GST implementation.

- 2009: EC released First Discussion Paper (FDP) in the public domain.

- 2010: Computerization of state commercial taxes started, but GST implementation was postponed.

- 2011: 115th Constitution Amendment Bill was introduced in Lok Sabha.

- 2012: Parliamentary Standing Committee started discussion over the GST Bill.

- 2013: The Standing Committee tabled the report in Parliament suggesting some changes.

- 2014: 122nd Constitution Amendment Bill was introduced in Lok Sabha.

- 2015: GST Bill passed in Lok Sabha, but not in Rajya Sabha

- 2016: Constitution Amendment Bill/GST Bill was passed in both the houses.

- 2017: CGST, SGST, IGST and Compensation Cess Bills were passed. Finally, GST was implemented on 1st July, 2017.

Advantages of GST

GST has revolutionized the indirect tax system of India. It has taken 17 long years of hard work and planning to create the GST model, which has not only simplified the tax system but has also reduced tax burden on common man. Let us understand more about its advantages in this section.

- Eliminated the cascading effect of taxes: In the pre-GST regime, taxes were levied at three levels, namely centre, state and local. As a result, some goods and services were taxed multiple times. This phenomenon of tax on tax is called cascading effect of taxes. Implementation of GST has removed this effect, thereby reducing tax burden on common man.

- Simplified the indirect tax system: GST has replaced 17 indirect taxes across all sectors of Indian economy. This has simplified the concept of indirect taxes for consumers as well as the tax-implementing authorities.

- Increased the ease of doing business: Uniformity in taxation has removed the interior trade barrier within the country. Consequently, GST has increased the ease of doing business both at intrastate and interstate levels.

- Technology driven: GST model is technology driven, that is procedures from registration to filing to getting a refund, all can be completed online.

Components of GST

GST has following 3 components:

- Central Goods and Services Tax (CGST): It is applied by the Centre in case of intra-state transaction.

- State Goods and Services Tax (SGST)/ Union Territory Goods and Services Tax (UTGST): It is applied by States and Union Territories in case of intra-state transaction.

- Integrated Goods and Services Tax (IGST): It is applied by the Centre in case of a inter-state transaction. IGST is later divided between the Centre and the State.

Additionally, GST Compensation Cess is levied on certain notified goods and services to compensate for potential losses suffered by manufacturing states.

Must Read: Types of GST.

How is GST regime different from Pre-GST regime?

GST has been implemented with the goal of “One Nation, One Tax”, and consequently has subsumed the following indirect taxes levies by Centre and State.

Key taxes subsumed by GST implementation include:

- Central Excise Duty

- Duties of Excise

- Additional Duties of Excise

- Additional Duties of Customs

- Special Additional Duty of Customs

- Service Tax

- Central Surcharges and Cess and many others

Subsumed taxes earlier levied by the State:

- State VAT

- Central Sales Tax

- Luxury Tax

- Entry Tax

- Entertainment and Amusement Tax

- Taxes on Advertisements

- Purchase Tax

- Taxes on Lotteries

- States Surcharges and Cess

| Particulars | Pre-GST Regime | GST Regime |

| Number of Taxes | Multiple indirect taxes including cess and VAT. | One indirect tax for the entire nation. |

| Cascading effect/ tax on tax | Existed. | Eliminated. |

| Sales Tax on Services | Central Sales Tax (CST) & States Sales Tax (SST) were collected. | Subsumed in GST. |

Frequently Asked Questions (FAQs)

What is the effect of GST on tobacco and tobacco products?

Under the new GST regime, tobacco and tobacco products are taxed at 18% to 28%. Additionally, Central Excise Duty may be levied on these goods.

Also Read: GST Rates- Complete List of Goods and Services Tax Slabs

What is the meaning of Dual GST?

Dual GST refers to the concept of fiscal federalism, where both Centre and State levy GST to maintain their respective revenues. Please note that in India, both Centre and State levy GST at the same rate, and thus the tax burden on the consumers remain unaffected due to the dual nature.

What is Input Tax Credit?

Input Tax Credit refers to the mechanism, that allows you to save GST by only paying the difference between the tax already paid on raw materials and the tax paid on the final product. For example, you are liable to pay Rs. 300 as GST on the final product, but you had already paid Rs. 100 as GST on raw materials. In this case, you can claim Rs. 100 as Input Tax Credit (ITC) and pay only Rs. 200 as GST on the final product.

What is GSTIN?

GSTIN stands for Goods and Services Tax Identification Number. It is a unique 15-digit alphanumeric code allotted to all GST registered entities.

What is GST Compensation Cess?

GST is a destination based tax. This means that if a product is manufactured in state A but consumed in State B, then GST will be collected by state B and not state A. As a result, manufacturing states feared revenue losses, and hence GST Compensation Cess was introduced. It is levied on certain notified goods and services to compensate for the possible losses incurred by manufacturing states.