Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Get your Free Credit Report with Monthly Updates

Let’s Get Started

The entered number doesn't seem to be correct

Note: The information on this page may not be updated. For latest updates, click here.

Whenever goods or services are bought and sold, a bill of sale needs to be created. As per current rules, if such goods or services are included in the GST (Goods and Services Tax) Act, this type of bill is termed as a GST Invoice. For sellers, creating and sending a GST Invoice to the buyer, is a necessary part of compliance with the GST rules regimes which was implemented across India on 1st July, 2017.

Table of Contents :

In case you are a GST registered business i.e. a business that has a valid GSTIN (GST Identification Number), you are mandatorily required to create and provide your customers with a GST Invoice for sales of any goods or services. Similarly in case you are purchasing goods and services from GST registered vendors, you will receive GST compliant invoices from them.

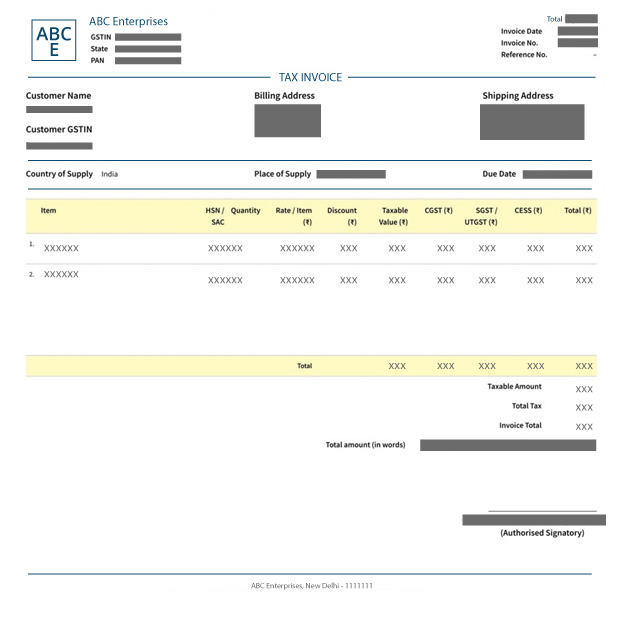

As per rules specified under the GST Act, to correctly create an invoice under GST rules, it needs to mandatorily have the following fields:

Know Latest GST Rates to create GST compliant Invoices

The following is a Sample Format for GST Invoice*:

*The above GST invoice format shown is for illustrative purposes only.

GST Expert Assistance by PaisabazaarFinding it difficult to avail online services related to GST? Paisabazaar’s offline stores provide expert assistance for GST services. Get step-by-step expert guidance for GST registration, GST filing and GST certificate. Once your GST is set up, you can apply for a business loan to scale your business through Paisabazaar. |

The GST Invoice format may be available as an excel document for use whenever a new GST-complaint invoice is to be generated. In some cases, excel GST format features an inbuilt GST calculator that helps you speed up the process of creating GST compliant invoices. Free excel GST Format is available from a variety of websites and can be modified according to the unique requirements of each GST registered company.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

With the advent of GST a number of companies have introduced GST software that automatically prepares invoices according to GST rules for the users after some key data have been provided. Many of these GST compliant invoice preparatory software are available as part of standard tax preparatory software packages. However, most GST invoice software are not free and a license fee is required for its use.

Invoices created using GST rules can be personalized in the following ways:

Under existing rules, there are specific time periods during which GST Invoices have to be mandatorily issued. The following are the key GST invoice issuing time limits that one needs to keep in mind:

The number of GST Invoice copies that are to be issued varies depending on whether goods or services are being supplied:

As a GST invoice can only be created by a GST registered business, businesses complying with other taxation rules such as composition tax are not required to issue GST compliant invoices. In such cases, current GST invoice rules suggest that the seller needs provide one of the alternatives to GST invoice.

Some of the alternatives to invoice are as follows: