Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Get your Free Credit Report with Monthly Updates

Let’s Get Started

The entered number doesn't seem to be correct

Note: The information on this page may not be updated. For latest updates, click here.

Goods and Services Tax Identification Number (GSTIN) or GST Number is a unique identifier assigned to a business or person registered under the GST Act. GSTIN is utilized by tax authorities to maintain records of GST dues and payments of those who are registered under the GST Act. GST Number replaces earlier taxpayer identification systems such as the TIN (Tax Identification Number) which was used by state taxation authorities to track state tax records such as VAT. Businesses that were registered under older systems like TIN were automatically migrated to the GSTIN system and received their new GST number automatically. On the other hand, those making fresh GST registration would receive a new GSTIN once their registration has been completed and approved. As per current GST rules, all GST registered businesses are required to print the GSTIN on all GST Invoices that they provide to customers.

Table of Contents :

GST Number assigned to registered businesses/individuals follow a specific structure. Key facts about the GST Number Format are as follows:

GST Expert Assistance by PaisabazaarFinding it difficult to avail online services related to GST? Paisabazaar’s offline stores provide expert assistance for GST services. Get step-by-step expert guidance for GST registration, GST filing and GST certificate. Once your GST is set up, you can apply for a business loan to scale your business through Paisabazaar. |

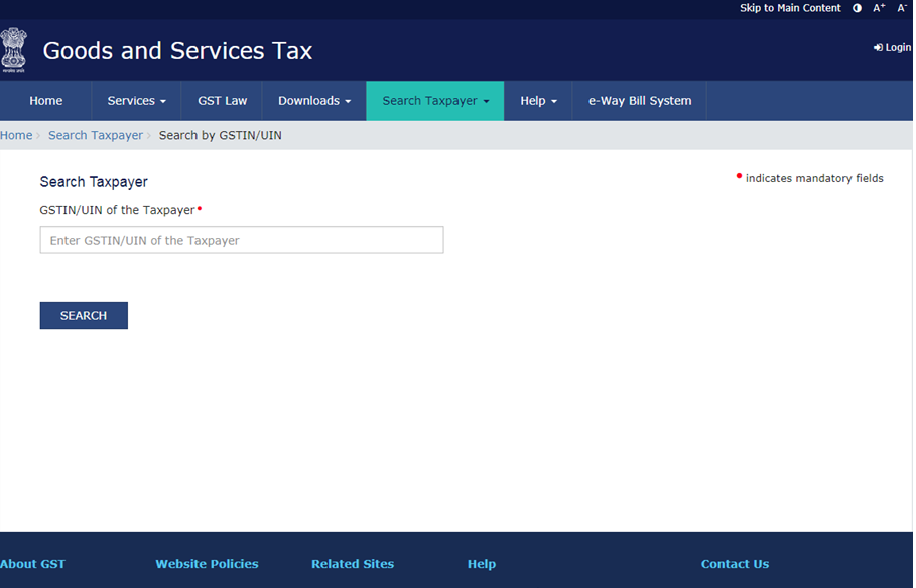

One of the benefits of GSTIN records being available not just to tax authorities but also the general public via the online route is the simple verification of legitimate businesses. All you need to do is search for the GST Number provided by a prospective vendor and you can verify the name, address, etc. as per the GST registration records. After introduction of GST and GST Number Search, multiple websites have started advertising the option. However, it is best to check GST registration details through the Official GST Portal. The availability of the option to search GSTIN of prospective business partners and vendors is expected to enhance trust among businesses across the country including across state borders. The Goods and Services Tax Identification Number search page on the GST website is as follows:

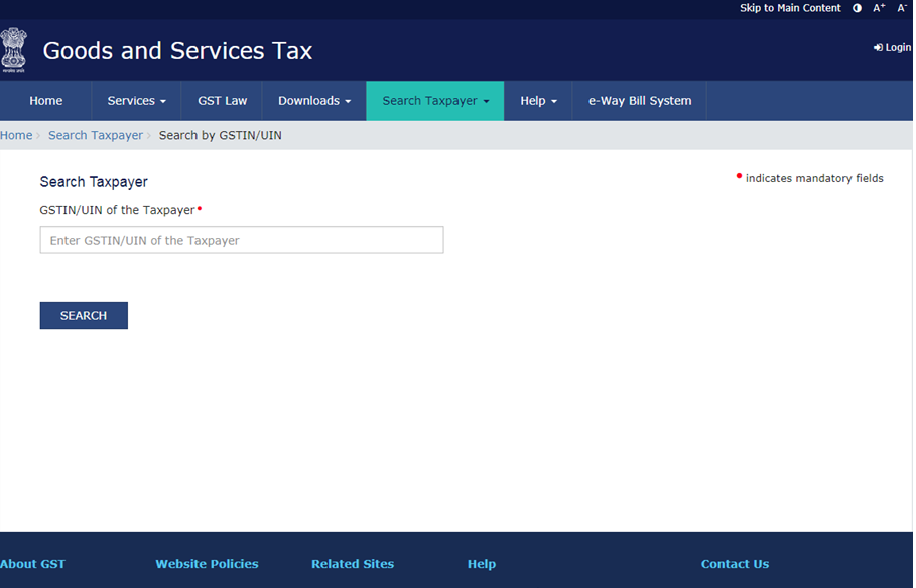

The current GST registration database also allows you to find the GST number using the PAN number of the business/individual. You can head over to the Official GST Number Search by PAN database to get access to those records. In case the business/individual is not registered under GST, a “no records found” message will be displayed. Otherwise the GSTIN records of the PAN linked to the GST registration will be displayed. The GST Number Search by PAN page is as follows:

At present, the official GST database does not provide the option of completing a GST Number Search by name of GST registered business or individual. However, this has not stopped many websites from advertising the option of a GST Number Search by Name. It is advisable to double check any records you receive from such websites before acting on the information.

In case you have recently applied for GST registration and received your new GSTIN, do ensure that you check that all details of your business have been updated correctly on the GST website. In case you have not registered for GST yet, check out the handy GST Registration guide from Paisabazaar. In order to verify GST details, all you need to do is input your GST number on the Official GST portal page titled Search Taxpayer by GSTIN. Alternately you could also use the Search Taxpayer by PAN option to complete GST Number verification online. The same options are also suitable for carrying out GST Number verification online in case of prospective vendors and business partners.