Note: The information on this page may not be updated. For latest updates, click here.

UPDATE: As a part of the COVID-19 relief package announced on 13th May’20, the last date to file GST returns has been extended to the end of June, 2020.

All the business entities and dealers registered under GST have to file GST returns, even if they were not involved in any business activity during the tax period. In such a situation they are required to file nil returns. Thus, it becomes very important to understand the GSTR filing procedure, the appropriate type of GSTR form and the official website of GST. Read on to know about these aspects and file GST returns on your own!

Table of Contents :

GST Login

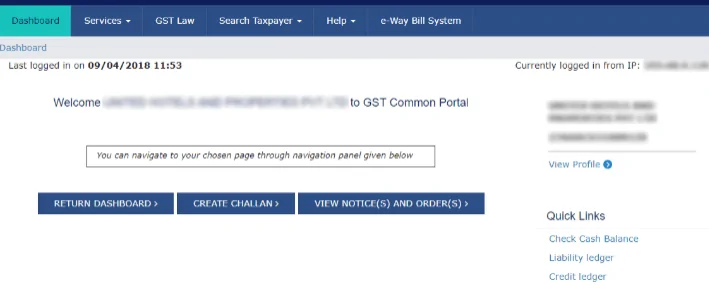

In order to file your GST Returns, you need to first complete GST Registration. Once you register yourself, login to the GST portal and file the returns. Read here to know the step-by-step procedure for GST login.

After logging into the GST portal, you will see the following web page showing the GST dashboard.

Key details that you can view on this page include name of the GST registered individual/business, GST number, etc.

Step-by-Step Guide for GSTR Filing

Step 1: Once, you login the GST portal, click “Services” tab on the Dashboard.

Step 2: In the “Services” menu, click “Returns Dashboard”

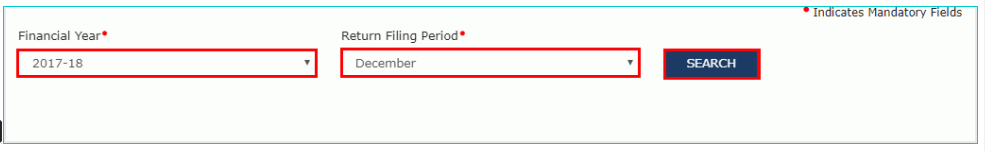

Step 3: Select the “Financial Year”, the “Return Filing Period” and click “Search”.

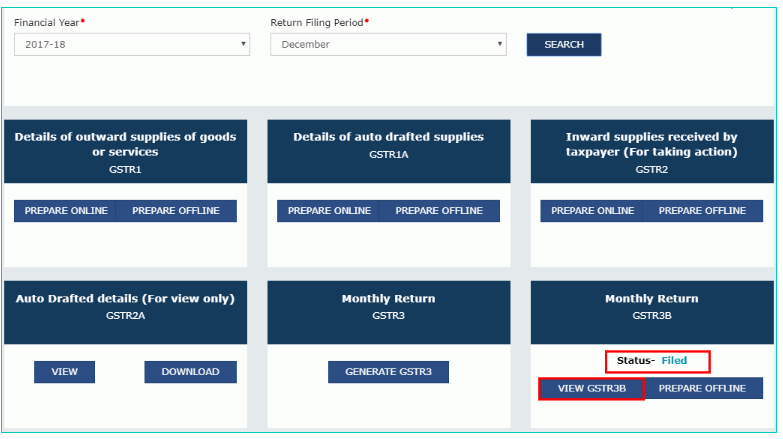

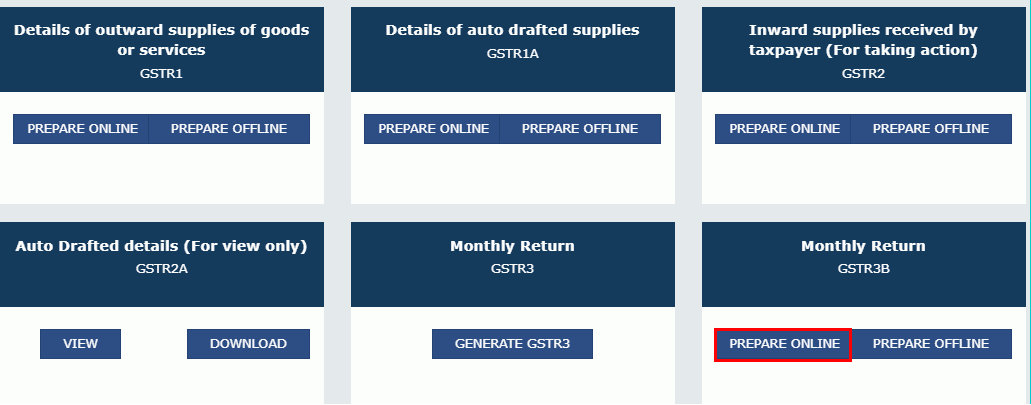

Step 4: Separate tiles of all the GST returns that can be filed are displayed. Select the GST return you want to file by clicking on either the “Prepare Online” or “Prepare Offline” button in the corresponding tile.

Step 5: You can file your GST returns in 2 ways, either online by clicking the “Prepare Online” button or using GST offline tools utility by clicking the “Prepare Offline” button.

Step 6: Enter the required information in the online GSTR form or the GSTR offline tool. Please note that you need to upload the completely filled offline utility form by clicking on the “Prepare Offline” button.

Click here to know about the various GST offline tools in detail.

Step 7: Once you enter all the details in the GST Return form, save the details and submit the form.

Step 8: After submitting all applicable details, you can make the GST payment online using the appropriate challan.

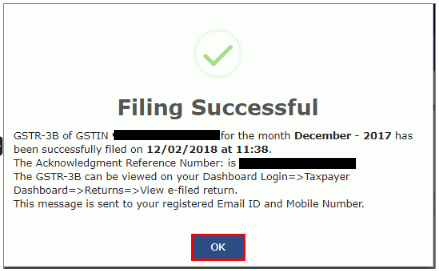

Step 9: On successful filing, the “Filing Successful” message will be displayed with the Acknowledgement Reference Number (ARN). Note the ARN for future reference.

Step 10: You can check the return filing status clicking on Services > Returns > Returns Dashboard. Select the Financial Year and return filing period and click “Search”. All the relevant GSTR forms will be displayed along with their filing status.

Types of GST Return Forms

| Type | Applicable Taxpayers | Frequency and Due Date |

| GSTR-1 | All registered and casual taxpayers except:

|

Turnover < Rs. 1.5 crore – Quarterly, 31st of the month succeeding the quarter

Turnover > Rs. 1.5 crore – Monthly, 11th of the succeeding month |

| GSTR-2 | Suspended | Monthly, 15th of the succeeding month |

| GSTR-3 | Suspended | Monthly, 20th of the succeeding month |

| GSTR-3B | All registered taxpayers except-

|

Monthly, 20th of the succeeding month |

| CMP-08

(Earlier GSTR-4) |

Composition Taxpayers | Quarterly, 18th of the month succeeding the quarter |

| GSTR-5

(for non-resident taxpayers) |

Non-resident taxpayers who do not wish to claim ITC | Monthly, 20th of the succeeding month |

| GSTR-5A | Online Information and Database Access or Retrieval (OIDAR) service providers | Monthly, 20th of the succeeding month |

| GSTR-6 | Input Service Distributors

|

Monthly, 13th of the succeeding month |

| GSTR-7 | Authorized TDS deductors as per Section 51 of CGST Act

|

Monthly, 10th of the succeeding month |

| GSTR-8 | Registered e-commerce operators who collect TCS | Monthly, 10th of the succeeding month |

| GSTR-9 | All normal taxpayers, including SEZ unit/developer, OIDAR service providers. Except-

|

Annually, 30th November’19 for FY 2017-18 |

| GSTR-9A | Composition Taxpayers | Annually, 30th November’19 for FY 2017-18 |

| GSTR-10

(Final Return) |

Taxpayers whose GST registration has been canceled or surrendered | Once, 3 months from the date of cancellation or order of cancellation, whichever is later |

| GSTR-11 | Taxpayers with Unique Identification Number (UIN)

|

Quarterly, not mandatory for UIN holders who did not receive any inward supplies during the quarter.

28th of the next month when refund statement is filed |

Also read about the purpose of various GST Return Forms and the associated Late Filing Penalties by clicking here.