As part of attempts towards unifying all indirect taxes, the Goods and Services Tax (GST) was introduced by the government and it subsumed a number of taxes at central and state level into itself. The official GST Portal features a GST Services section designed to help GST Registered Tax Payers figure out various aspects of the GST regime.

Table of Contents :

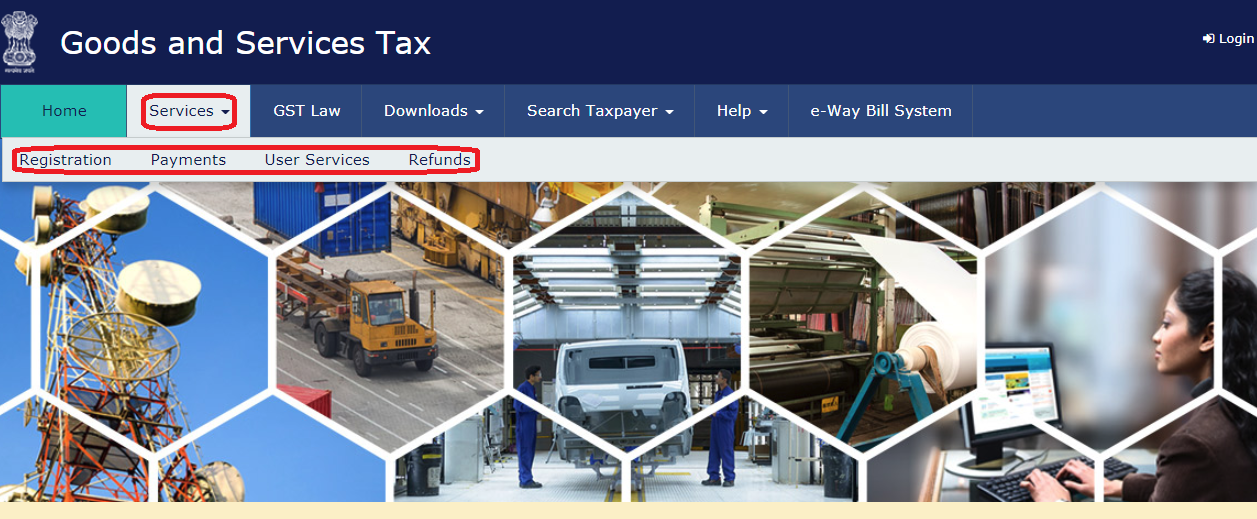

The services section of the Official GST Portal’s main page looks as follows:

Key services/information available under the subsections of the GST Services menu are as discussed in the following sections.

GST Registration

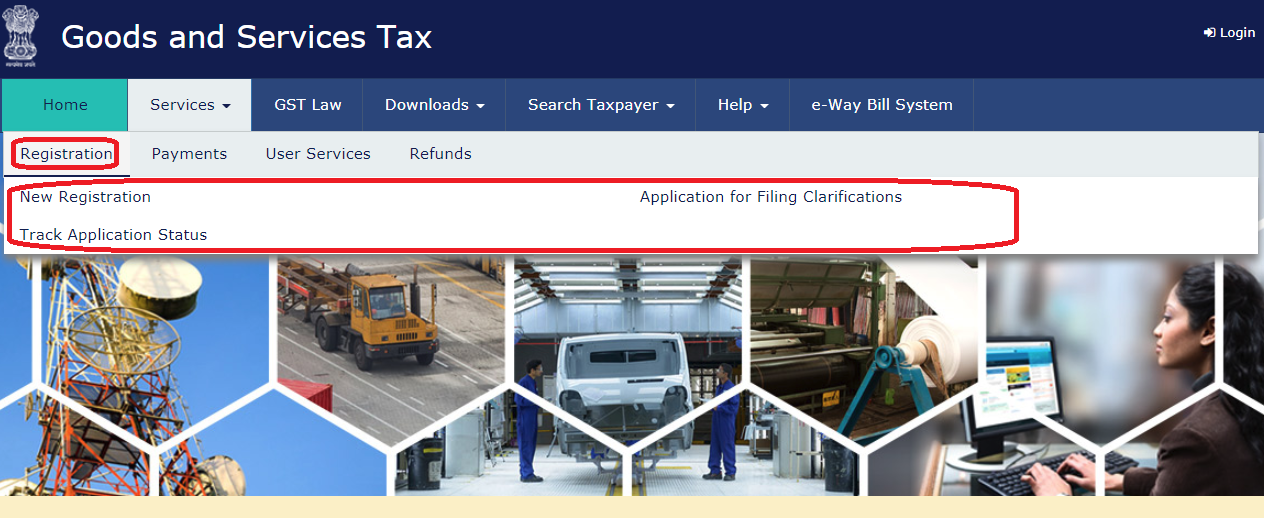

The first subsection under the GST services menu is the GST Registration sub-menu. On clicking the “Registration” link you are directed to the following page:

On this page, you can apply for a New GST Registration, Track status of a previously filed GST Registration application or file an application for clarification regarding GST filing-related issues. Know more about GST Registration Process

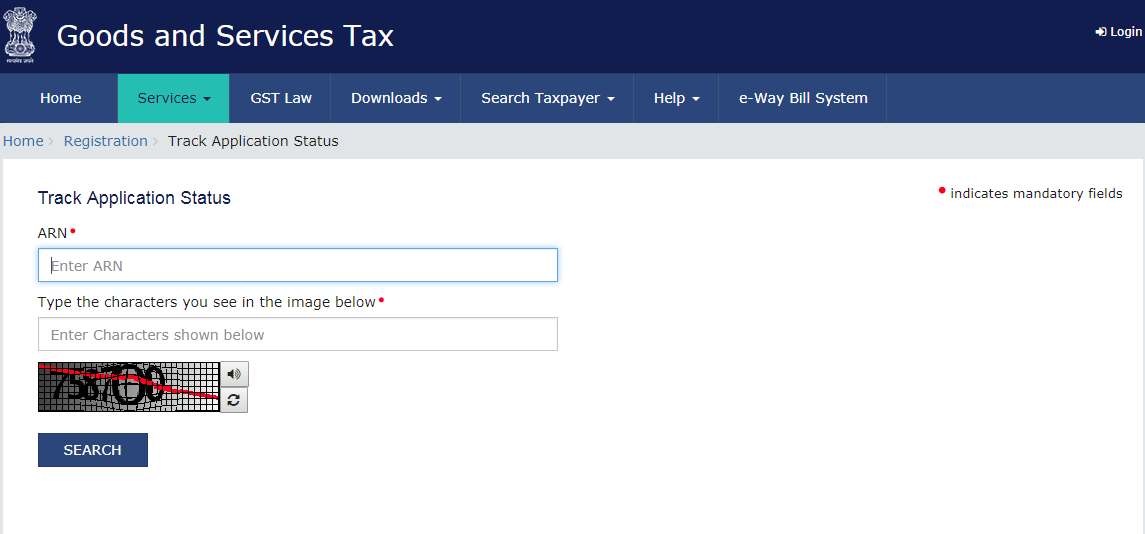

If you click on the “Track Application Status” link, you are directed to the following page:

On this page you can check the current status of your GST Registration application using the ARN (Application Reference Number) which was generated when you submitted your GST Registration Application.

GST Payments

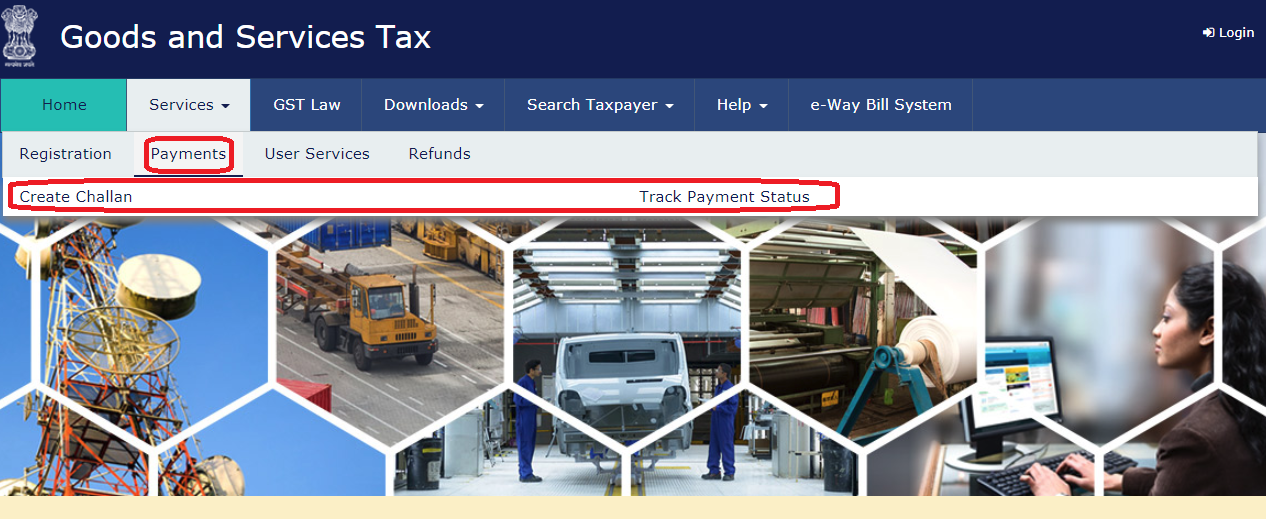

Payments sub-menu under the GST Services menu features the options of “Challan Creation” and “Track Payment Status” as shown below:

The creation of Challan and Payment tracking status are part of the completely online GST payment system. Know more about GST Online Payments

GST User Services

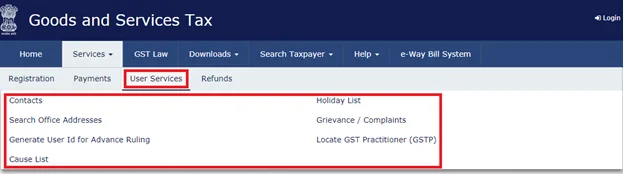

The “User Services” submenu on the homepage of the official GST Portal features a variety of links as shown below:

The following are various actions that you can complete by clicking on the links located under the user services menu.

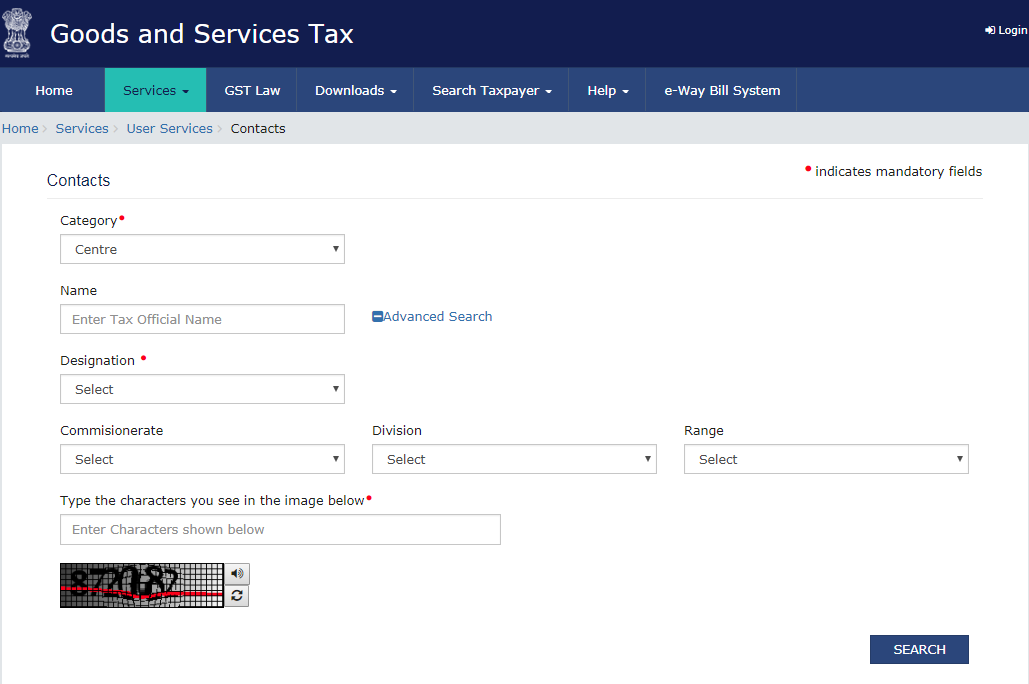

GST Contacts

The GST Contacts Page allows you to search and find the contact details of various central/state level tax officials. You have the option of filtering your search results by Name, Designation, Commisionerate, Division and Range. This provides an easy way for GST-registered businesses to get in touch with GST officials and get access to a range of GST services.

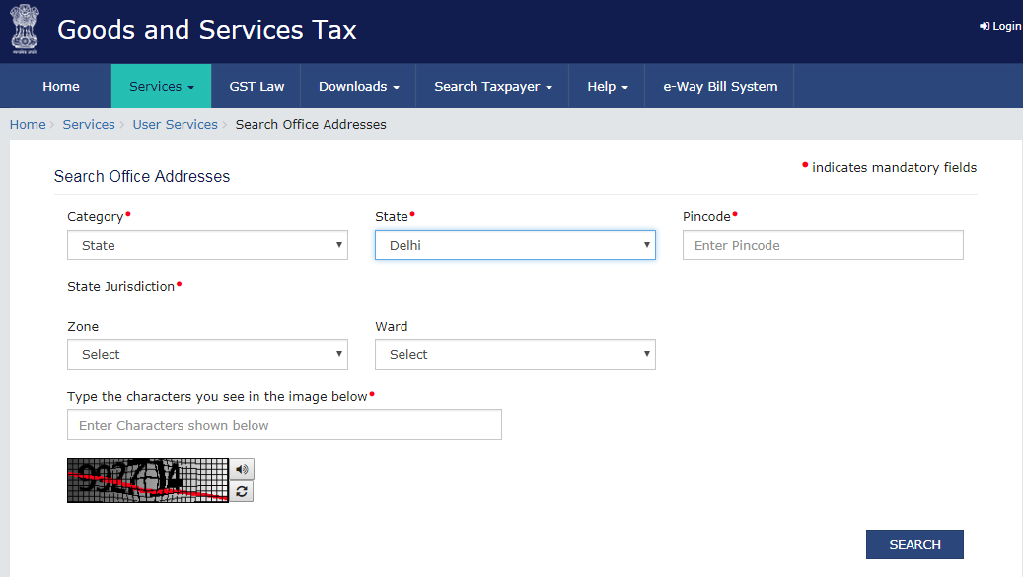

GST Office Address Search

The handy GST office address search tool allows you to access contact details/addresses of local GST offices online with ease as shown in the page below:

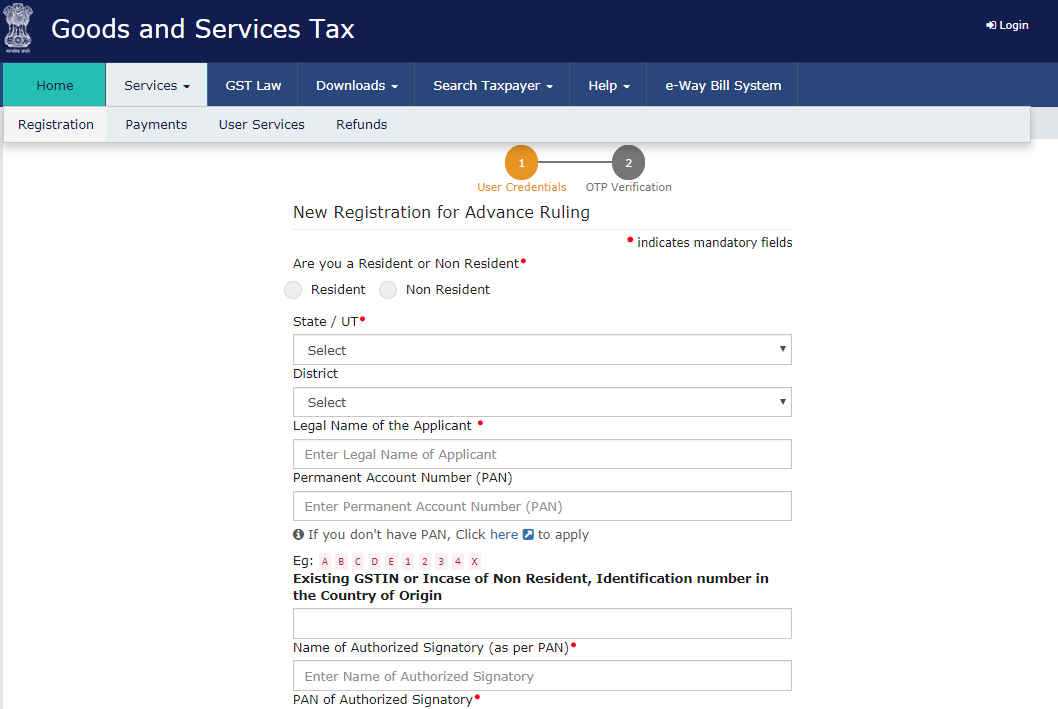

Generate User ID for Advance Tax Ruling

An advance tax ruling refers to a written clarification provided by relevant tax authorities to corporations and individuals on various tax matters. You need not have a GSTIN to get an advance tax ruling from GST authorities. If you are an unregistered business/individual, the current system allows you to register for an Generate User ID specifically for the purpose of advance tax ruling as shown in the following page:

Once you have filled out the required details and verified your registration using OTP, you can submit your query and receive an advance tax ruling from a competent GST authority.

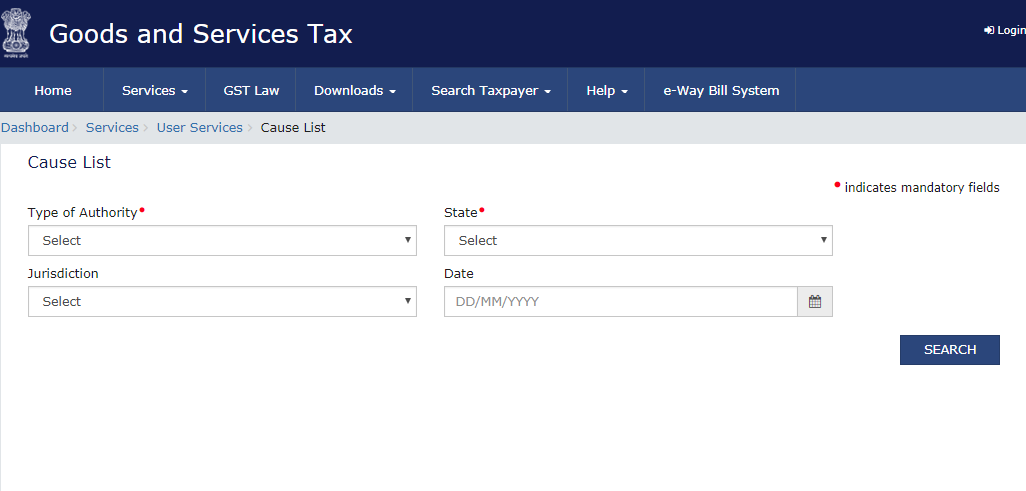

Cause List in GST Services

A cause hearing commonly occurs in case a GST application that has been filed or an order is being rectified by tax authorities. The date of cause hearings are issued by tax officials and communicated to the parties via the GST Portal. On this page, you can find details of any “Cause” hearings that are scheduled in a specific state and jurisdiction on a specified date. You can get access to the “Cause List” under GST rules by navigating the applicable link located under the GST Services menu as shown below:

The list of cause hearings can be downloaded / printed as a PDF from this page.

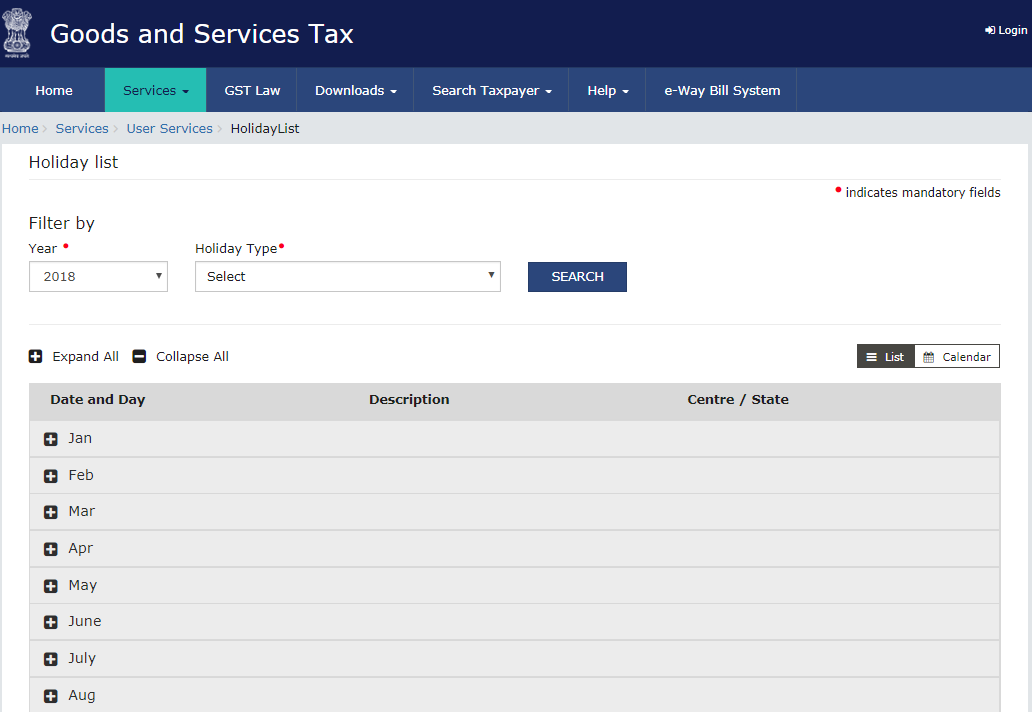

GST Holiday List

The GST Services section of the Official GST Portal also features a month-wise holiday list for GST offices and officials as on the following page:

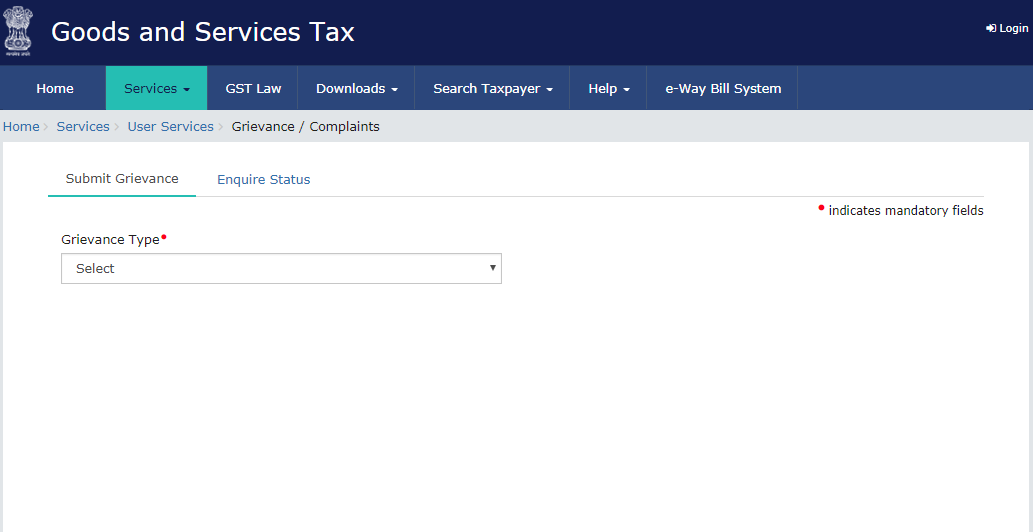

GST Grievance/Complaints

The GST grievance/complaints link under GST Services serves as a GST self-service portal where you can submit your GST-related grievances as well as check the status of GST grievances that you have submitted earlier through the self-service system. The page looks as follows:

Know more about using the GST Helpline

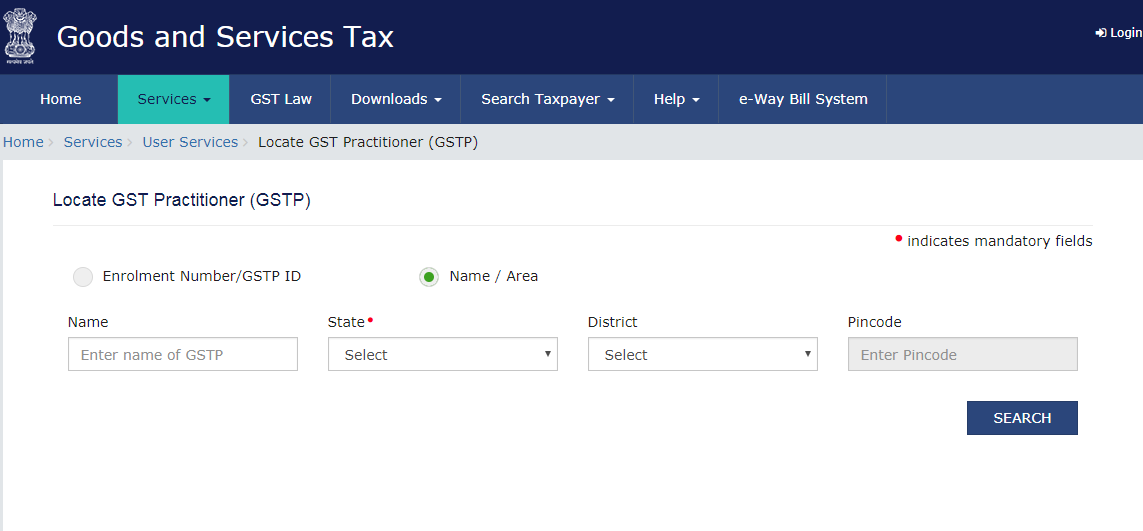

Locate GST Practitioner

In case you are facing issues keeping up with various GST requirements such as monthly GST filings, refunds claim filing, etc. you can opt to engage the services of a GST Practitioner. An approved list of GST practitioners can be found online on the GST Portal under the GST Services menu. The following is the page which you can use to search for approved GST Practitioners in your area:

Know more about what GST services are available through GST Practitioners

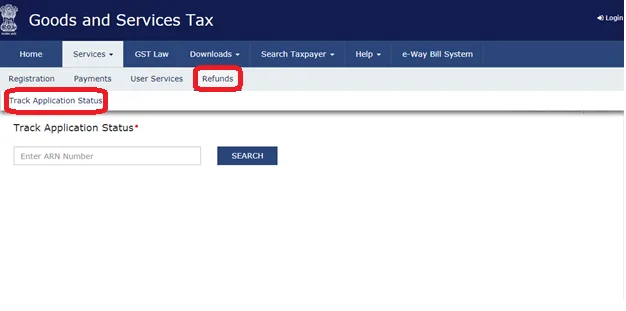

GST Refunds

In case you have previously filed for GST refund, you can check the status of your refund application using the ARN (Application Reference Number) generated at the time of applying for GST refund. The following is the page that you can get to for tracking refund status using the GST services menu on the GST portal: