Before introduction of GST, taxpayers used to have different identification numbers to help state/central tax authorities track the payment of different taxes. For example, dealers registered under VAT were provided TIN by state taxation authorities, whereas service providers were assigned a service tax registration number by the Central Board of Excise and Customs (CBEC). Implementation of GST has eliminated the need of multiple tax identification numbers with the concept of One Nation – One Tax- One Tax Identification Number in the form of GSTIN. The full form of GSTIN is GST Identification Number. It is a 15-digit alphanumeric code issued to all GST registered taxpayers. In subsequent sections we will discuss the meaning of GSTIN, format and importance of GSTIN, methods to obtain and verify GSTIN, cost of GSTIN and also the difference between GSTIN with GSTN.

Table of Contents :

What is the meaning of GSTIN?

GSTIN or Goods and Services Tax Identification Number is a unique 15-digit alphanumeric code, that is allotted to every GST-registered entity. GST Registration Process is a simple 2-stage process including generation of a Temporary Reference Number (TRN) and an Application Reference Number (ARN). Once GST registration is complete, a unique GST number i.e. GSTIN and GST registration certificate are issued.

What is the Format of GSTIN?

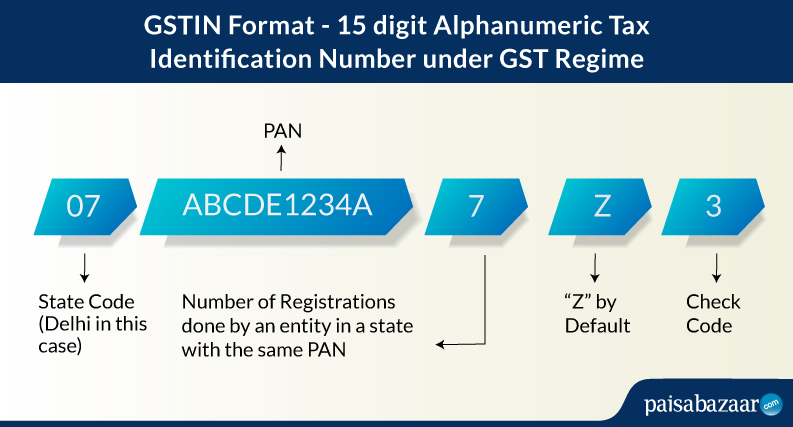

GSTIN is a 15-digit alphanumeric code. The structure of GSTIN is as follows:

First Two Digits – The first two digits of the GSTIN represent the state code where the business is being operated. The state code is taken from the Indian Census of 2011. For example, the state code of Delhi is 07 and for Bihar, it is 10. You may check your state code here.

Next 10 Digits – the 3rd to 12th digit of the GSTIN represent the Permanent Account Number (PAN) of the GST registered entity/individual.

Thirteenth Digit – This number indicates the number of registrations done by an entity in a state with the same PAN. A total of 35 registrations are allowed in such cases. This is an alphanumeric code. For first 9 registrations, codes from 1 to 9 are given and after that, alphabets are assigned. For example, if it is the first registration for a specific PAN, the code is 1 and if it is the tenth registration, the code assigned is A.

Fourteenth Digit – The fourteenth digit is kept Z by default.

Last Digit – The fifteenth digit is the check code which is used to detect errors (check sum). This may be either a number or an alphabet.

Advantages of GSTIN

It is important to obtain GSTIN i.e. complete GST registration for the following reasons:

- To get legal recognition as a supplier of goods and/or services

- To claim Input Tax Credit under the GST ITC mechanism

- To legally collect tax (GST) from the buyers of goods/services

- To ensure proper accounting and payment of GST to tax authorities

How to obtain GSTIN?

Obtaining GSTIN is a part of GST registration process. If you meet the following annual turnover limits, you are mandatorily required to register under GST and obtain a GSTIN.

| State Categories under GST | For Sale of Goods | For Providing Services |

| Normal Category States | Annual Turnover of Rs. 40 lakh or more | Annual Turnover of Rs. 20 lakh or more |

| Special Category States | Annual Turnover of Rs. 20 lakh or more | Annual Turnover of Rs. 10 lakh or more |

The form for GST registration comprises 2 parts – A and B. Once you complete both Part A and Part B of the GST registration form, a GST official validates your application. If approved, a unique GSTIN and a GST registration certificate are issued.

Also Read Step-by-step procedure for GST Registration

How to verify GSTIN/UIN?

As GST is still a new system, it is very important to check the authenticity of the vendors and the business you are dealing with. You can easily verify the GSTIN of the vendors by using either their GST number (GSTIN)/UIN or PAN (Permanent Account Number). Moreover, you can check if details of your business have been uploaded correctly on the GST portal. This is an online service provided by the Government GST portal (gst.gov.in).

Method 1: Search by GSTIN/UIN by clicking here.

Method 2: Search by PAN by clicking here.

QUICK TIP: You can verify part of the GSTIN by just checking if the 3rd to 12th digits of the GSTIN are same as the vendor’s PAN.

What is the cost of obtaining GSTIN?

Obtaining GSTIN is absolutely free. Applicants do not have to physically visit any authority or make any payment online or offline to get registered under GST and get their GST number. However there may be charges if you take the assistance of a 3rd party to register under GST.

GSTIN vs GSTN

Do not get confused between GSTIN and GSTN. Although they are abbreviated similarly, they are completely different.

| Comparison Criteria | GSTIN | GSTN |

| Full Form | GST Identification Number | GST Network |

| What is it? | A unique 15-digit Tax Identification Number under the GST regime. | A non-profit organization partly held by government to provide IT infrastructure to Central and State governments, taxpayers and other stakeholders. |

| What is it used for? | To recognize GST registered taxpayers as legal suppliers of goods and services. | Used by Government of India to track GST and eWay bill statistics. |