All normal and casual taxpayers registered under GST have to file GST Return Form 1 or GSTR-1. As this is one of the key documents, it very important for tax assessees to understand the different sections of GSTR-1, its filing procedure and the due date.

Table of Contents :

What is GSTR-1?

GSTR-1 is a statement of Outward Supplies that should be filed monthly or quarterly by all the normal and casual registered taxpayers. The following details of a tax period have to be mentioned in GSTR-1:

- Invoice-level details of supplies to registered persons, including those having UIN;

- Invoice-level details of Inter- State supplies for values greater than Rs. 2.5 lakh to unregistered consumers;

- Details of Credit/Debit Notes issued by the supplier against invoices;

- Details of exported goods and services including deemed exports (SEZ);

- Summarized state-level details of supplies to unregistered consumers;

- Summary Details of advances received for future supply and their adjustment;

- Details of any modifications to the reported information for any of the above categories;

- Nil-rated, exempted, and non-GST supplies; and

- HSN/SAC wise summary of outward supplies.

Who should file GSTR-1?

All the normal and casual registered taxpayers, including those with nil returns are required to file GSTR-1 to pay tax on a monthly/quarterly basis.

However, there are a few exceptions to this rule:

- Composition scheme taxpayers (need to file GSTR-4)

- Non-resident foreign taxpayers (need to file GSTR-5)

- Online Information Database and Access Retrieval (OIDAR) service providers (need to file GSTR-5A)

- Input Service Distributors (need to file GSTR-6)

- E-commerce operators collecting TCS (need to file GSTR-8)

What is the due date to file GSTR-1?

The due date to file GSTR-1 depends on the annual turnover.

-

If annual turnover is up to Rs. 1.5 crore – GSTR-1 is filed Quarterly

| Period | Due Date |

| April-June 2019 | 31st July, 2019 |

| July- September 2019 | 31st October, 2019 |

| October- December 2019 | 31st January, 2020 (Tentative) |

-

If annual turnover is more than Rs. 1.5 crore – GSTR-1 is filed Monthly

| Period | Due Date |

| April 2019 | 11th May 2019 |

| May 2019 | 11th June 2019 |

| June 2019 | 11th July 2019 |

| July 2019 | 11th August 2019* |

| August 2019 | 11th September 2019 |

| September 2019 | 11th October 2019 |

| October 2019 | 11th November 2019 (Tentative) |

| November 2019 | 11th December 2019 (Tentative) |

| December 2019 | 11th January 2020 (Tentative) |

*UPDATE: For taxpayers whose annual turnover is more than Rs. 1.5 crore and principal place of business in Jammu and Kashmir or certain districts of Bihar, Karnataka, Uttarakhand, Kerala, Maharashtra, Odisha and Gujarat, the due date to submit GSTR-1 for July 2019 was revised to 20th September, 2019 as per government notification.

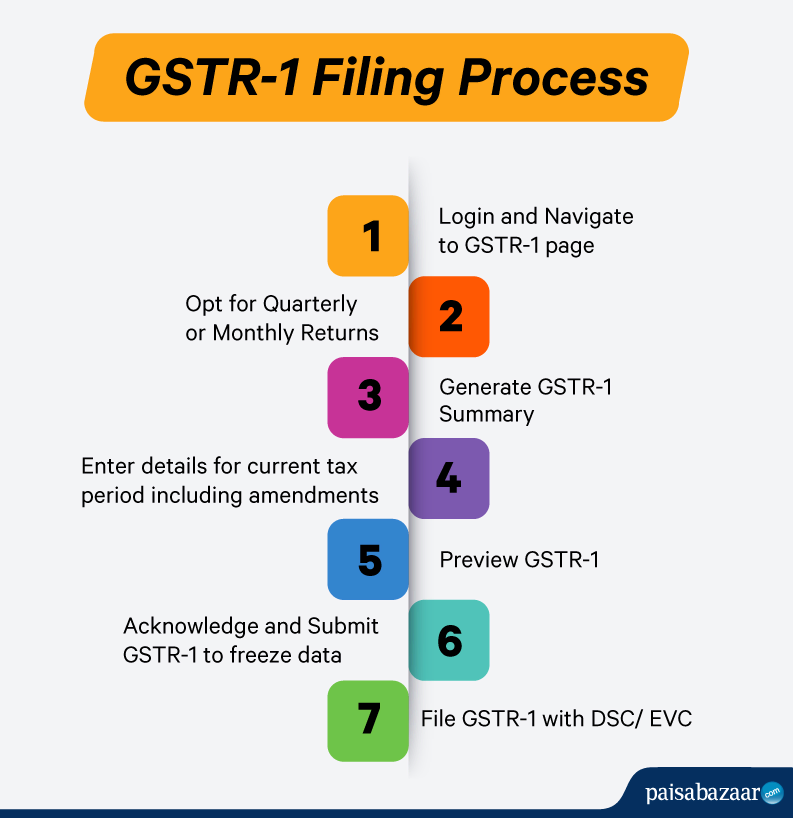

GSTR-1 Filing Process

Step by Step Guide to file GSTR-1 online

Step 1: Login into the GST portal with your credentials.

Step 2: On Dashboard screen, click “Returns Dashboard”.

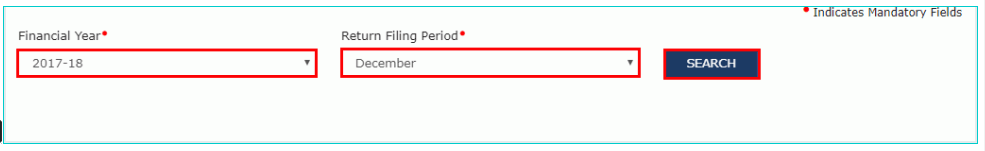

Step 3: Select the Financial Year and the return filing period and click search to view the available GST return filing options.

Step 3: Select the Financial Year and the return filing period and click search to view the available GST return filing options.

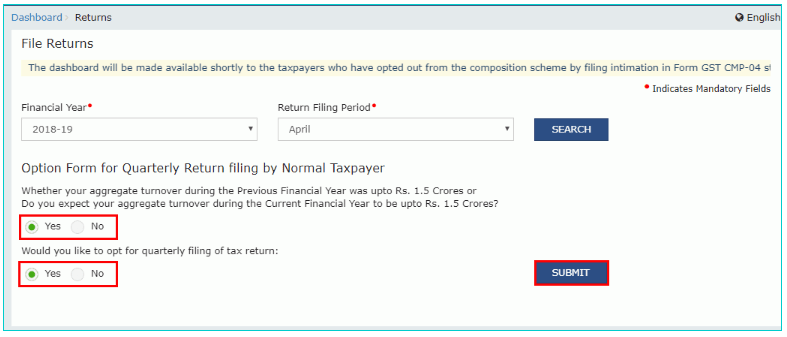

Step 4: The message “Option Form for Quarterly Return Filing by Normal Taxpayer” will be displayed. If your aggregate turnover for the applicable FY is up to Rs. 1.5 crore, you can opt for quarterly filing of GSTR-1. Otherwise, GSTR-1 has to be filed monthly.

Step 5: After you click “Submit”, tiles of all the relevant GSTR forms will be displayed.

Step 5: After you click “Submit”, tiles of all the relevant GSTR forms will be displayed.

Step 6: Click the “PREPARE” button on the GSTR-1 tile to begin the online filing process.

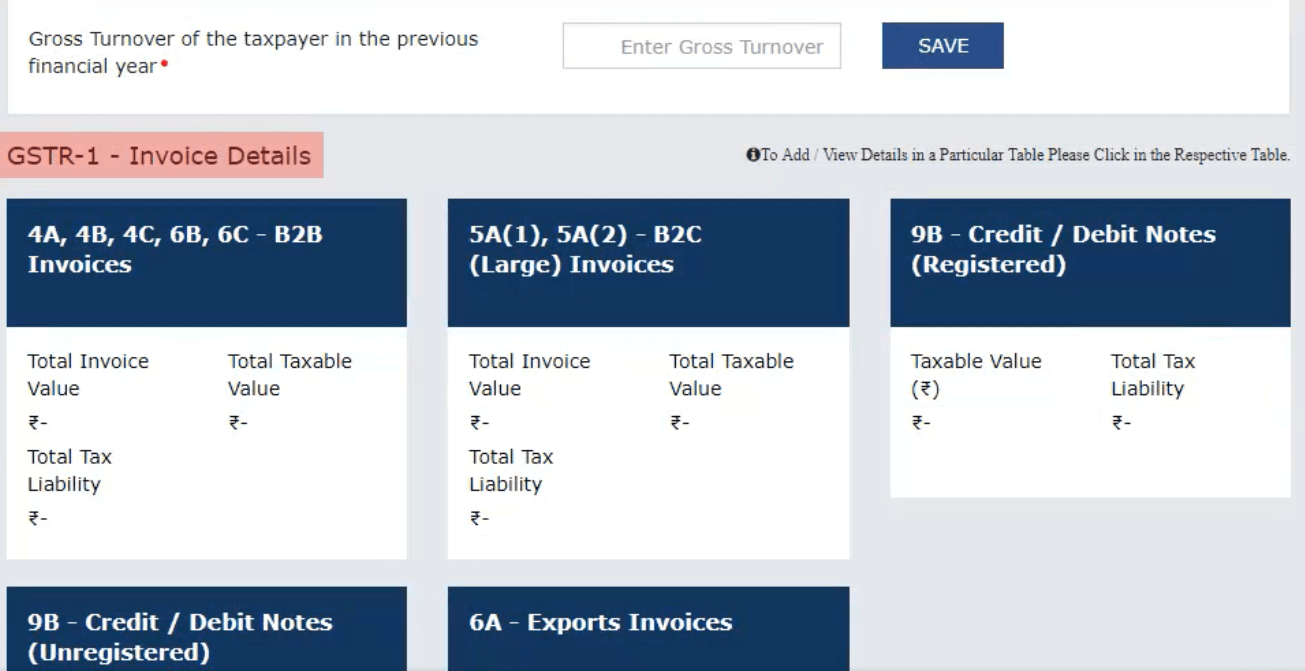

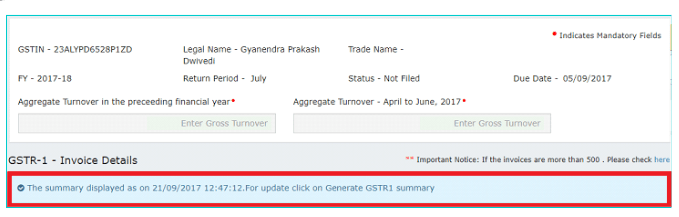

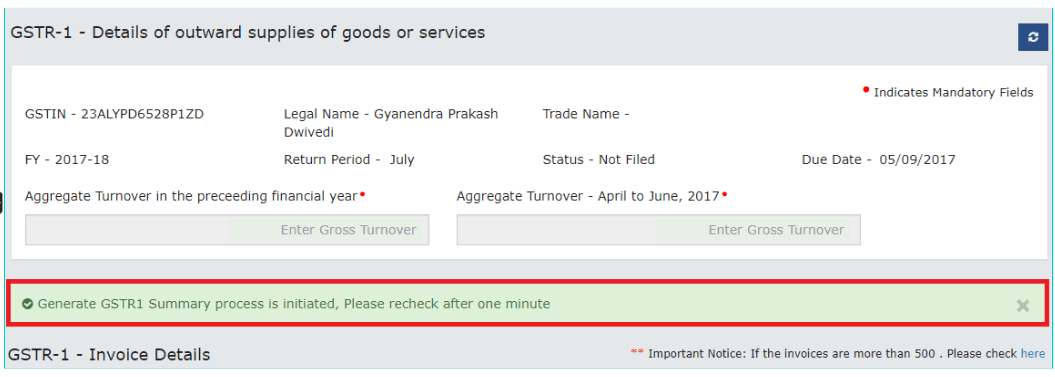

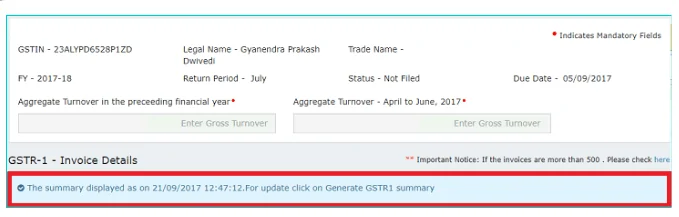

Step 7: The following web page “GSTR-1 – Details of outward supplies of goods and services” will be displayed. Enter the aggregate turnover for the applicable FY and the year preceeding it.

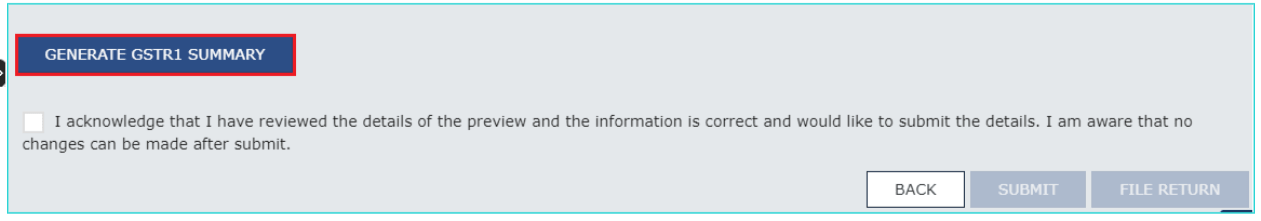

Step 8: Scroll down the page and click “Generate GSTR-1 Summary”. This will add all the auto drafted details pending for action from recipients.

Step 8: Scroll down the page and click “Generate GSTR-1 Summary”. This will add all the auto drafted details pending for action from recipients.

Step 9: After the process of summary generation is started, you will see a message to recheck after 1 minute.

Step 10: Once the summary is generated, you will see a success message at the top.

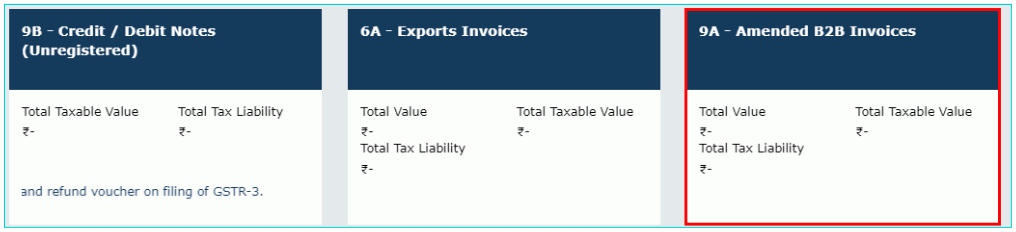

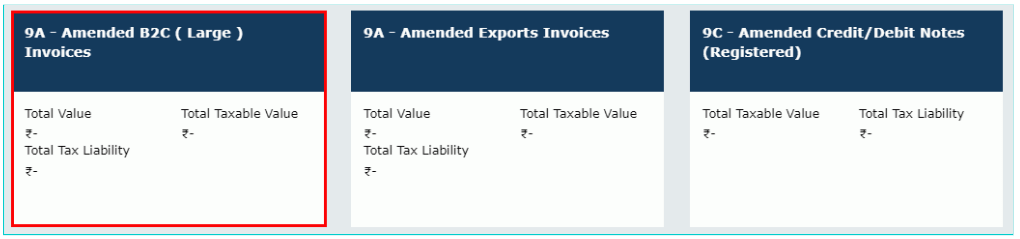

Step 11: Scroll down and a number of tiles representing various tables to enter invoice details will be displayed. These invoices include:

Step 11: Scroll down and a number of tiles representing various tables to enter invoice details will be displayed. These invoices include:

- 4A, 4B, 4C, 6B, 6C – B2B Invoices: To enter invoice details for B2B transactions (goods/ services sold to a registered taxpayer).

- 5A, 5B – B2C (Large) Invoices: To enter invoice details for B2C inter-state transactions of more than Rs. 2.5 lakh.

- 9B – Credit / Debit Notes (Registered): To enter details of credit or debit notes issued to the registered recipients or details of refund voucher against an advance received.

- 9B – Credit / Debit Notes (Unregistered): To enter details of credit or debit notes issued to unregistered recipients.

- 6A – Exports Invoices: To enter the invoice details for exported supplies.

- 9A – Amended B2B, 9A – Amended B2C (Large) and 9A – Amended Exports Invoices: To modify details of outward supplies to registered and unregistered persons as well as supplies exported in the earlier tax periods.

- 9C – Amended Credit/ Debit Notes (Registered) and 9C – Amended Credit/ Debit Notes (Unregistered) : To modify details of credit or debit notes issued to registered and unregistered recipients of earlier tax periods

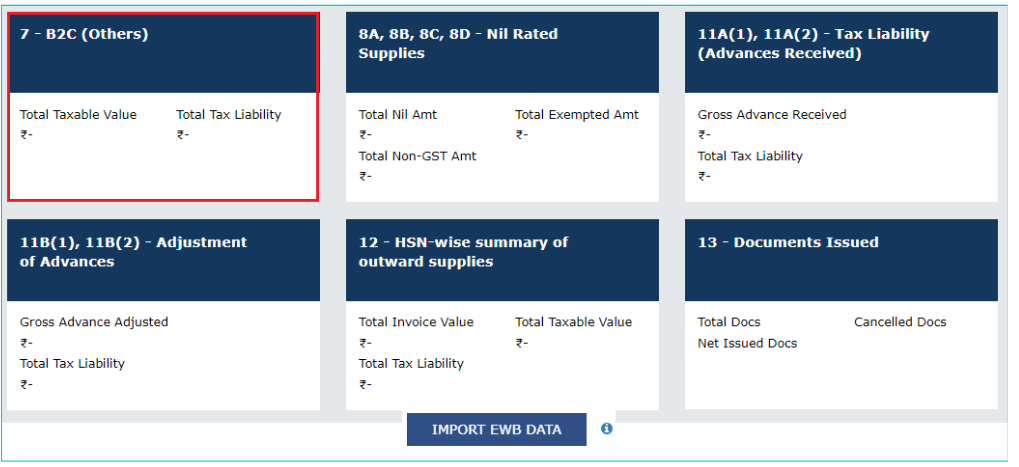

Step 12: The following additional details should be mentioned after submitting the invoice details.

- 7- B2C (Others): To add details of taxable outward supplies of less than Rs. 2.5 lakh and all intra-state supplies to unregistered customers.

- 8A, 8B, 8C, 8D – Nil Rated Supplies: To add details of nil rated, exempted and non-GST outward supplies.

- 11A(1), 11A(2) – Tax Liability (Advances Received): To add details of taxable transactions on account of Time of Supply, like receipt of advances.

- 11B(1), 11B(2) – Adjustment of Advances: To enter details of tax paid on invoices issued in the current period.

- 12 - HSN-wise-summary of outward supplies: To enter HSN-wise and rate-wise summary of outward supplies along with the quantitative details.

- 13 – Documents Issued: To add details of documents issued during the tax period.

- 11A – Amended Tax Liability (Advance Received): To modify statement of advances received in earlier tax period.

- 11B – Amended of Adjustment of Advances: To modify statement of advances adjusted in earlier tax period.

- 10 – Amended B2C (Others): To modify details of B2C transactions as mentioned in earlier tax period.

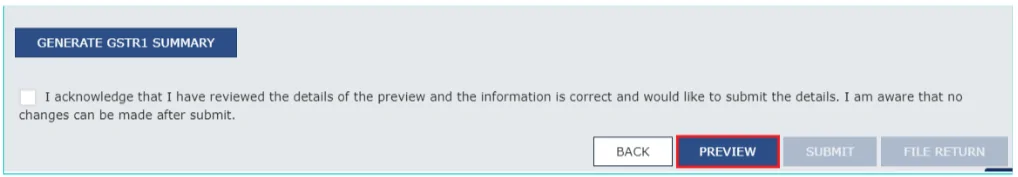

Step 13: After entering all the above details, click the “PREVIEW” button. This will generate the draft summary page of your GSTR-1.

Note: It is recommended that you download this Summary page and review the entries made in different sections carefully before submitting your GST Return Form 1.

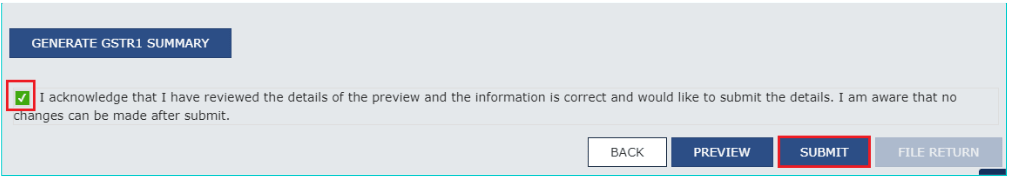

Step 14: Select the acknowledgement checkbox and click “SUBMIT”.

Note: After clicking submit, you will not be able to upload any further invoices for that particular month. In case you have missed adding any invoice, you will have to upload the missed invoices in the next month.

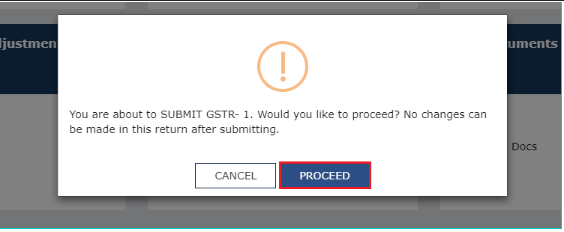

Step 15: Click “PROCEED”.

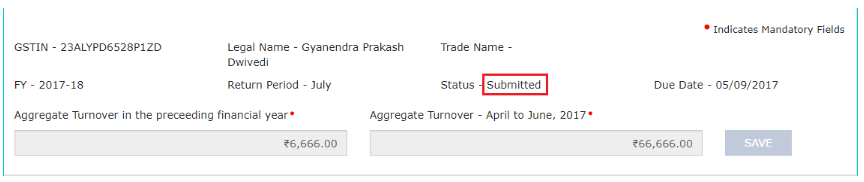

Step 16: Refresh the page to check the status of GSTR-1 after submission.

Step 17: Click the “PREVIEW” button again at the bottom of the page to download the submitted GSTR-1 in PDF format.

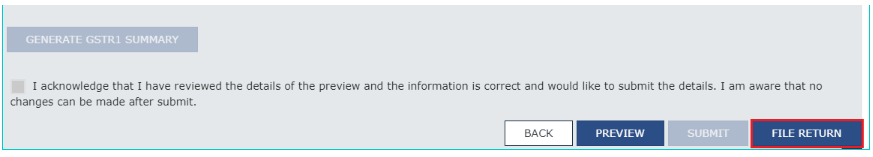

Step 18: Click the “FILE RETURN” button to complete GSTR-1 filing with Electronic Verification Code (EVC) or Digital Signature Certificate (DSC).

How to check GSTR-1 status?

The following are the key steps to check the status of your GST Return filing online.

Step 1: Login into the GST portal with your credentials.

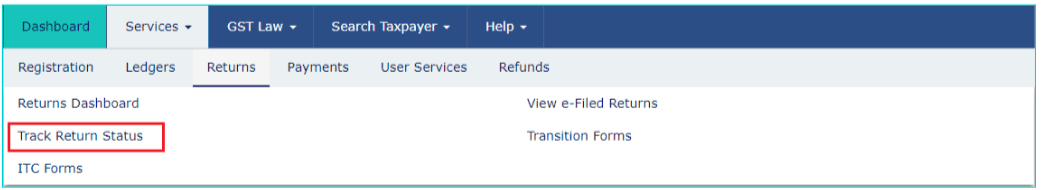

Step 2: Click Services > Returns > Track Returns Status.

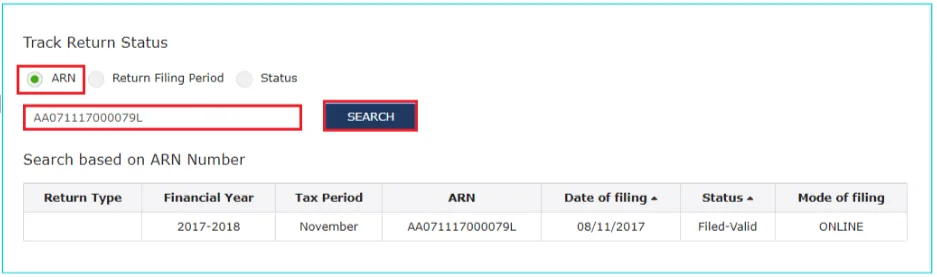

Step 3: Now you can check the status of your previously files GST returns by providing ARN (Acknowledgement Reference Number) or the return filing period.

Step 3: Now you can check the status of your previously files GST returns by providing ARN (Acknowledgement Reference Number) or the return filing period.

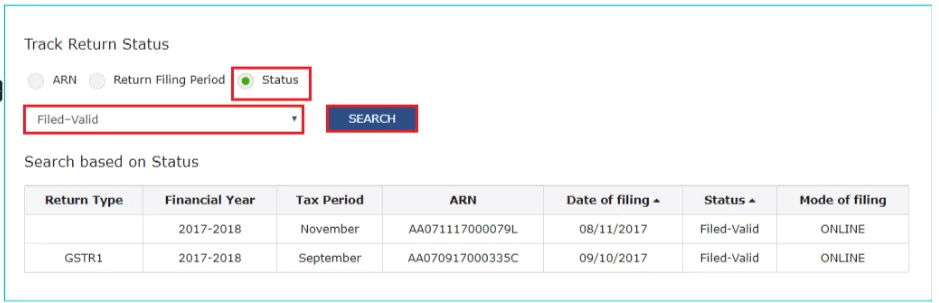

Step 4: Alternatively, you can track the GSTR status by selecting the status type from the drop-down menu. There are 4 different types of return status that you might see:

- To Be Filed,

- Submitted But Not Filed,

- Filed-Valid and

- Filed-Invalid.

Penalty for Late Filing of GSTR-1

If you miss the due date to file GSTR-1, you will be liable to pay the following penalties:

- Taxpayers with NIL GST liability: Rs. 20/day of delay

- Other taxpayers: Rs. 50/day of delay

Moreover, interest at the rate of 18% per annum will be charged on the outstanding tax.

Read more about GSTR Forms- Types, Due Dates and Late Filing Penalties.

Frequently Asked Questions (FAQs)

Q1. What is GST Return Form 1?

Ans. GST Return Form 1 or GSTR-1 is a statement of outward supplies that needs to be filed monthly or quarterly by all normal and casual GST registered taxpayers.

Q2. What is GSTR-1A?

Ans. GSTR-1A is used to update details of sales in earlier filed GSTR-1. However, GSTR-1A has been temporarily suspended.

Q3. Who needs to file GSTR-1?

Ans. All normal and casual registered taxpayers, including those with nil returns are required to file GSTR-1 to pay tax on a monthly/quarterly basis.

Q4. Who are not required to file GSTR-1?

Ans. The following registered taxpayers are not required to file GSTR-1:

- Composition scheme taxpayers (need to file GSTR-4)

- Non-resident foreign taxpayers (need to file GSTR-5)

- Online Information Database and Access Retrieval (OIDAR) service providers (need to file GSTR-5A)

- Input Service Distributors (need to file GSTR-6)

- E-commerce operators collecting TCS (need to file GSTR-8)

Q5. When can I opt for quarterly filing of GSTR-1?

Ans. If your turnover during the preceeding FY was up to Rs. 1.5 crore, then you can file GSTR-1 quarterly.

Q6. When can I opt for monthly filing of GSTR-1?

Ans. If your turnover in the preceeding FY was more than Rs. 1.5 crore, then you have to file GSTR-1 monthly.

Q7. What are B2B supplies?

Ans. Business-to-business (B2B) supplies refer to transactions between registered taxable persons or entities. For example, between a manufacturer and a wholesaler or between a wholesaler and a retailer.

Q8. What are B2C supplies?

Ans. Business-to-consumer (B2C) supplies refer to transactions between a registered supplier and an unregistered consumer.

Q9. What are debit notes?

Ans. Sometimes, the value of original invoice is lower than the actual value of goods and services provided. In such cases, a debit note is issued against the invoice to account for the difference amount. It can also be issued in case of post supply price negotiations.

Q10. What are credit notes?

Ans. A credit note is issued when the value of original invoice is greater than the actual value of goods and services. It may also be issued when the invoice value is reduced due to post supply negotiations, or when the goods supplied are returned by the recipient, or where goods and services are found to be deficient.