UPDATE: Due to Coronavirus outbreak, last date to file GSTR-3B for the months of March, April and May 2020 has been extended till the last week of June, 2020. However, the following should be kept in mind:

-

- No interest, late fee or penalty will be charged if your aggregate turnover is less than Rs. 5 crore.

- However interest will charged at a reduced rate of 9% per annum (earlier 18%) from 15 days after the due date, if your aggregate turnover is more than Rs. 5 crore. Please note that no late fee or penalty will be charged in this case as well.

With the introduction of GST in India, a number of new GST return forms have been introduced and GSTR-3B is one of the most important ones currently.

Table of Contents :

- What is GSTR-3B?

- Who should file GSTR-3B?

- What is the due date to file GSTR- 3B?

- What is the format of GSTR-3B?

- Step-by-step procedure for online GSTR-3B filing

- How to file GSTR-3B offline?

- How to check GSTR status?

- Late-filing fees or penalty associated with GSTR-3B

- Frequently Asked Questions (FAQs)

Get FREE Credit Report from Multiple Credit Bureaus Check Now

What is GSTR-3B?

GSTR-3B is a monthly self-declaration to be filed by a registered GST dealer along with GSTR 1 and GSTR 2 return forms. It is a simplified return to declare summary GST liabilities for a tax period.

IMPORTANT:

- You have to file GSTR-3B even when there has been no business activity (nil return).

- You cannot revise/amend GSTR3B.

- You have to file a separate GSTR 3B for every GSTIN you have.

Who should file GSTR-3B?

All taxpayers, including those with nil returns are required to file this GST Return Form on a monthly basis.

However, there are a few exceptions:

- Input Service Distributors & Composition Dealers

- Suppliers of OIDAR ( Online Information Database Access and Retrieval Services)

- Non-resident taxable person

The above are exempted from filing return in using the 3B form under existing rules.

UPDATE: Small taxpayers need not file GSTR-3B from October, 2019. Instead, they have to file GST PMT-08. Their first GST RET-01 for the Oct-Dec, 2019 quarter in to be filed in January, 2020.

What is the last date to file GSTR-3B?

This GSTR form is a monthly return form. The due date for submission every month is the 20th of the succeeding month. For example, the due date to file GSTR-3B for September, 2019 is 20th October, 2019.

Note: Form GSTR3B will be completely discontinued from January, 2020.

What is the format of GSTR-3B?

GSTR 3B is divided into following sections:

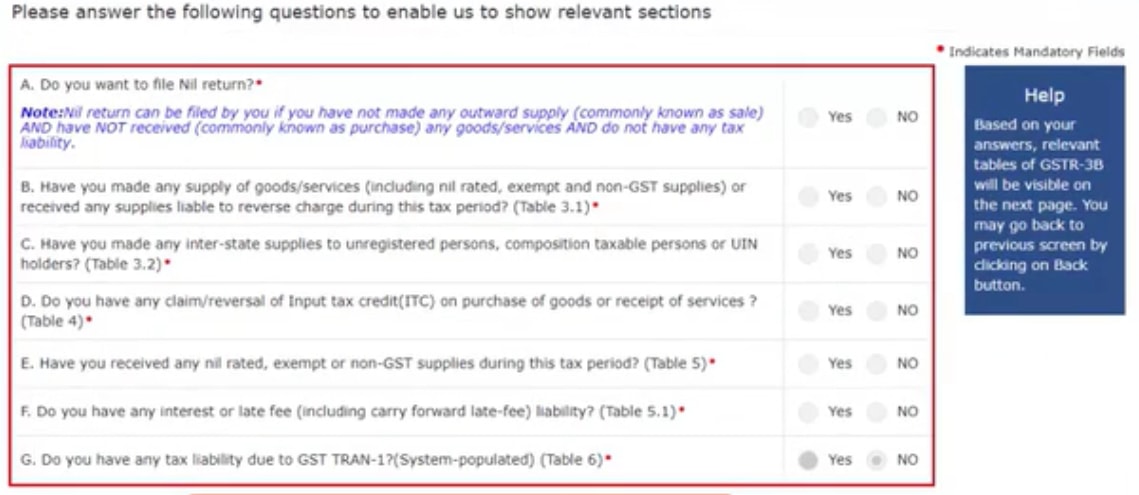

Section 1: Questionnaire pertaining to business activities and tax liabilities for the current tax period.

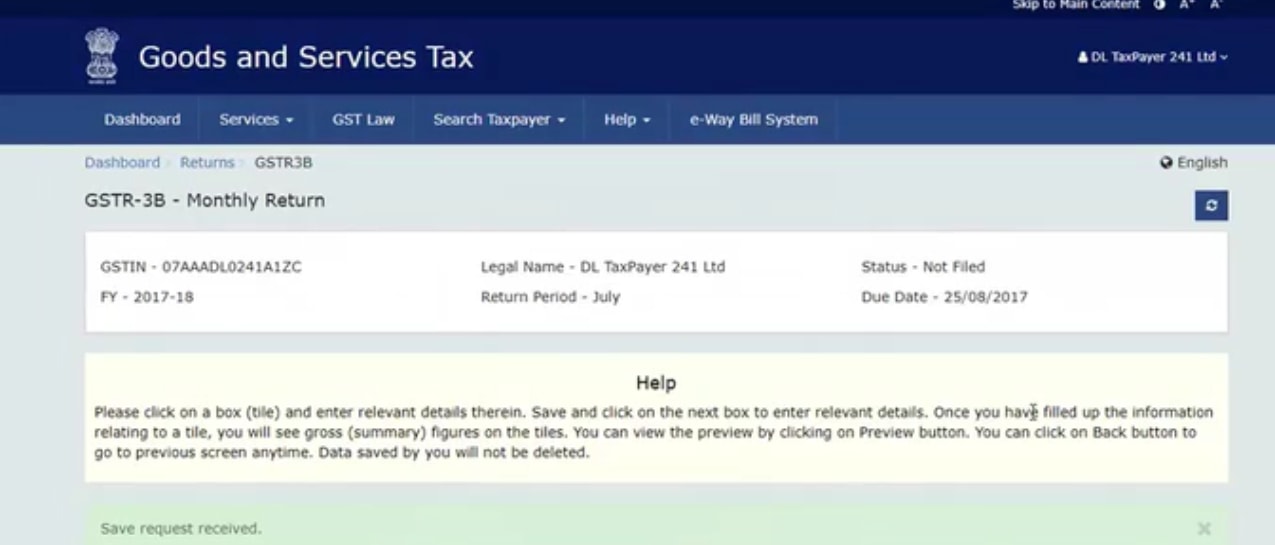

Section 2: A box showing GST-return related information, including Return Status.

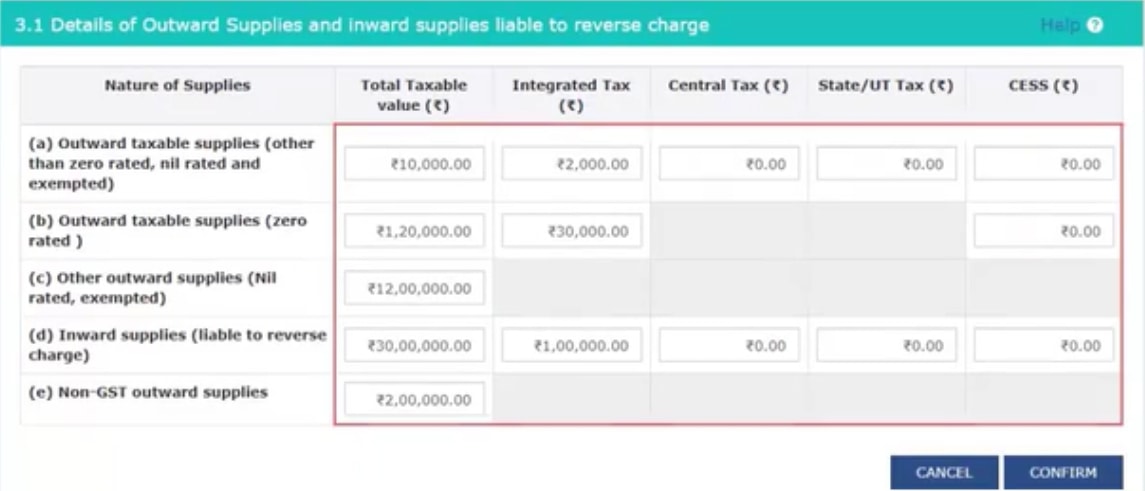

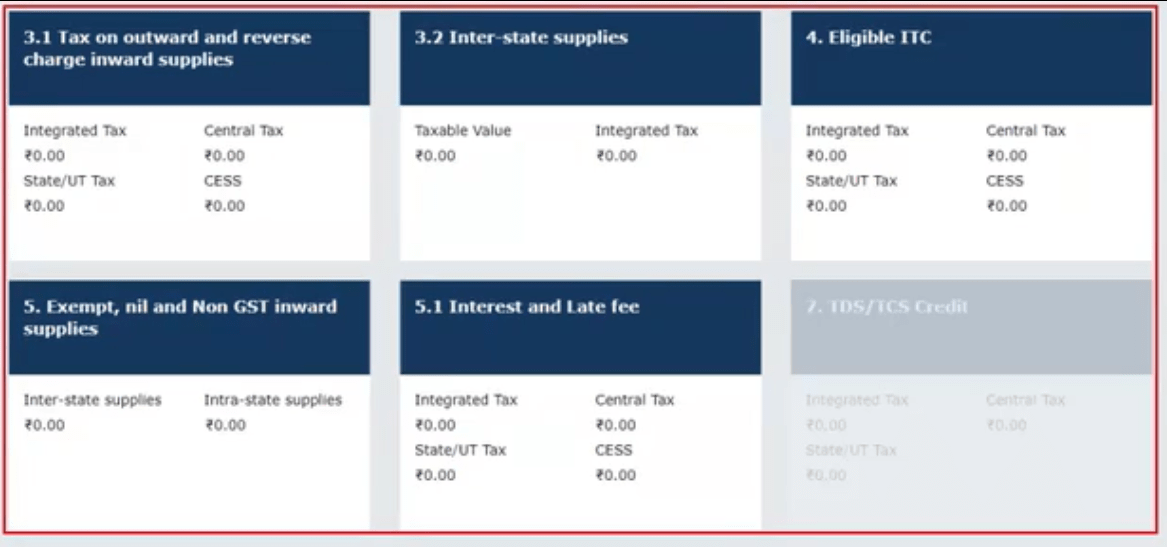

Section 3.1: Box for filling out details of tax on outward and inward supplies liable to reverse charge

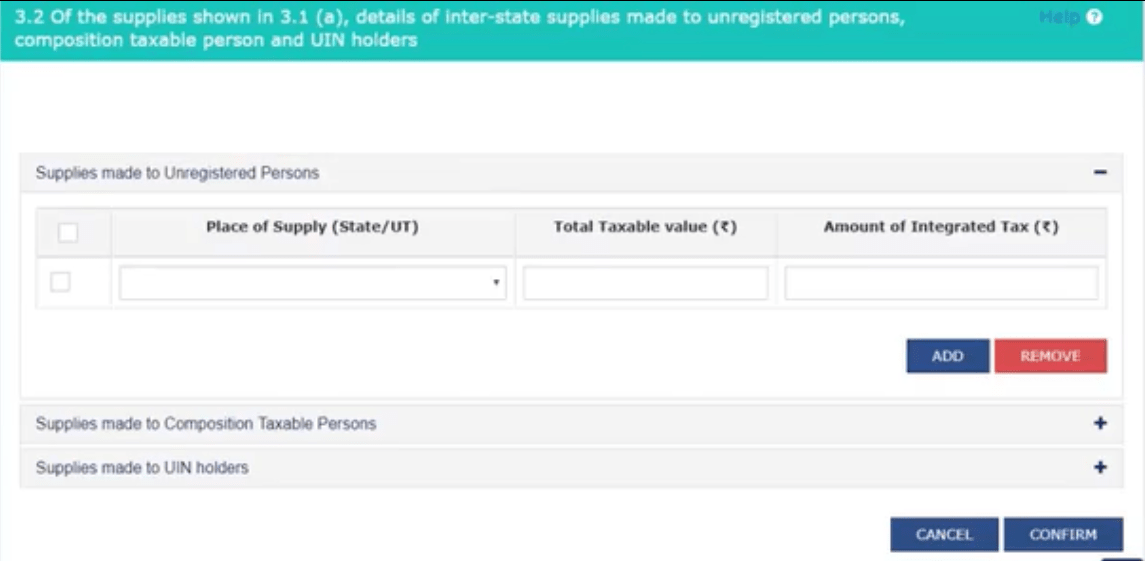

Section 3.2: Interstate supplies (supplies made to unregistered persons, composition taxable persons, UIN holders)

Section 3.2: Interstate supplies (supplies made to unregistered persons, composition taxable persons, UIN holders)

Section 4: Details pertaining to eligible ITC (Input Tax Credit)

Section 4: Details pertaining to eligible ITC (Input Tax Credit)

Section 5.1: Exempt, nil and non-GST inward supplies

Section 5.2: Interest and late fee

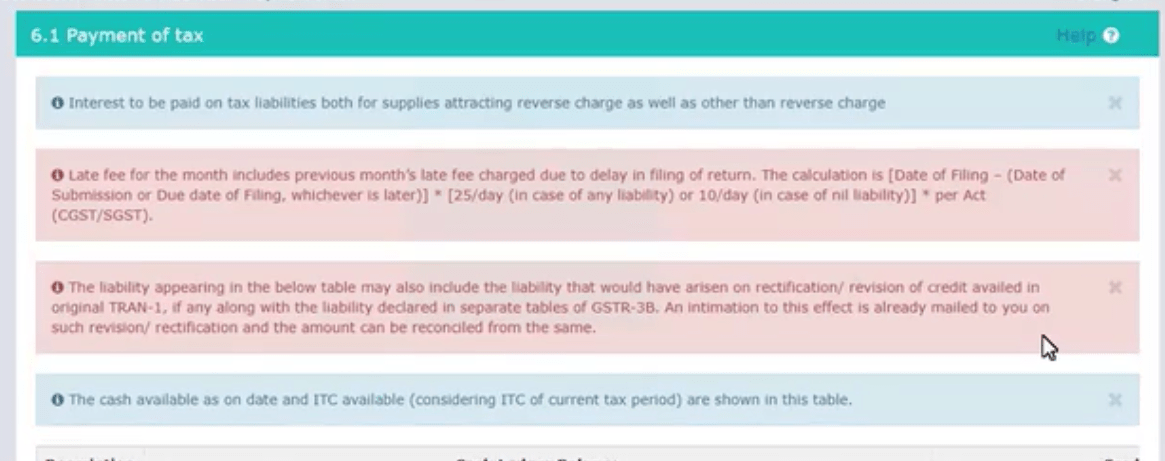

Section 6.1: Payment of Tax

Note: The earlier Section 7 related to TDS/TCS credit is not applicable anymore

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Step-by-Step Procedure for Online Filing of GSTR-3B

Step 1: Login into the GST portal with your credentials.

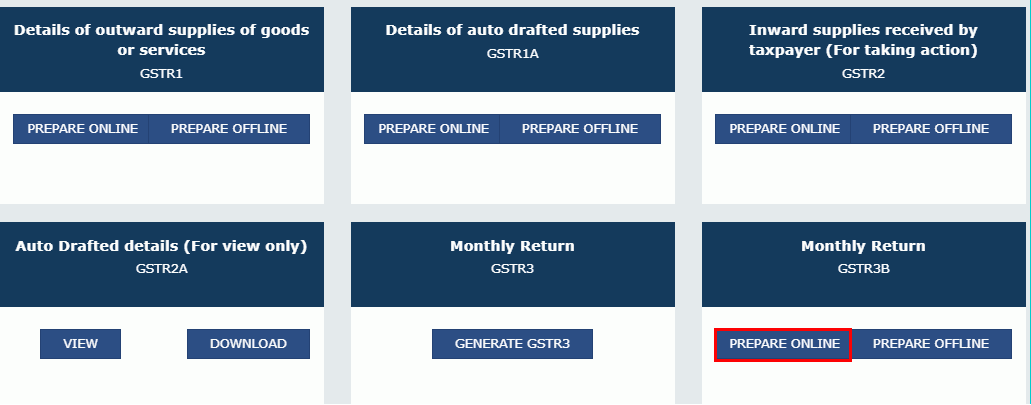

Step 2: On Dashboard screen, click “Returns Dashboard”.

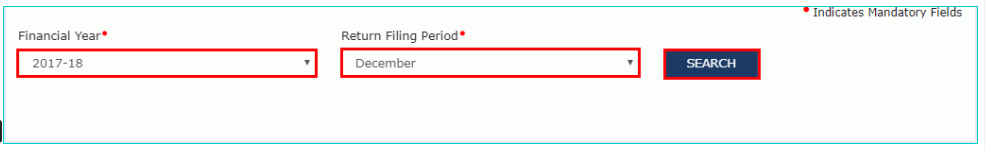

Step 3: Select the Financial Year and the return filing period.

Step 3: Select the Financial Year and the return filing period.

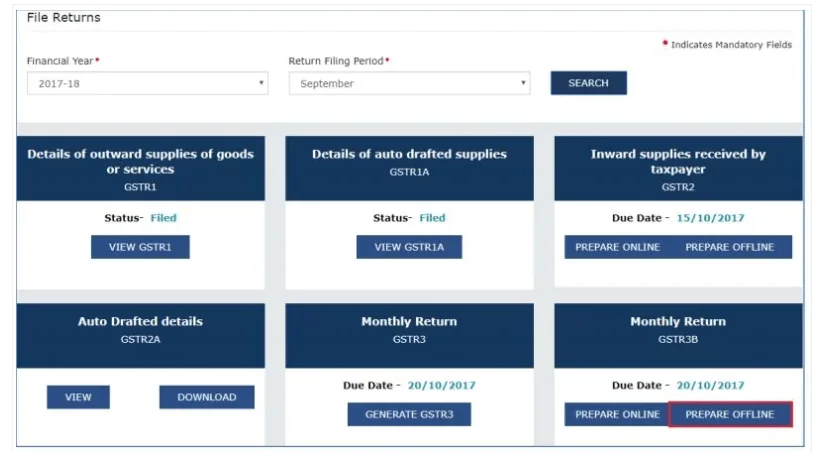

Step 4: Click “Search” and tiles of all returns to be filed will be displayed.

Step 5: Click “Prepare Online” button on the GSTR3B tile.

Step 5: Click “Prepare Online” button on the GSTR3B tile.

Step 6: A message showing that how GSTR 3B filing has become more user-friendly will be displayed. Read the message and click OK.

Step 6: A message showing that how GSTR 3B filing has become more user-friendly will be displayed. Read the message and click OK.

Step 7: A list of questions pertaining to business activities and tax liabilities for the current tax period will be displayed. Answer the questions relevant to you.

Step 8: Click Next and GSTR3B monthly return page will be displayed showing return related information and return status.

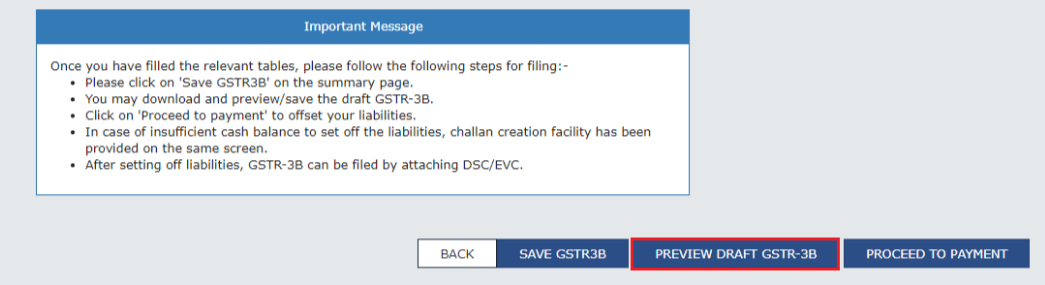

Step 9: Scroll down and you will see the following options:

- Back: To re-initiate the filing process from the Return dashboard and redo your responses in the questionnaire.

- Save GSTR-3B: Click this each time you make entries to save the entered details.

- Reset GSTR 3B: To delete the entered details and start afresh.

Step 10: Click on the first tile (Section 3.1 link) to start GSTR-3B filing. Enter details of various outward and inward supplies and click “Confirm”.

Step 11: You will be redirected to the Returns page. Click the second tile and enter details in the relevant sections. Ensure that the total amount of integrated tax declared in Section 3.2 is less than or equal to that declared in Section 3.1.

Step 12: Similarly, enter details in all the other pages of the form and ensure that you save the draft GSTR-3B form periodically.

Step 13: Click “Preview draft GSTR-3B”.

Step 14: If there is no error in the draft GSTR3B, click “Proceed to Payment”.

Step 14: If there is no error in the draft GSTR3B, click “Proceed to Payment”.

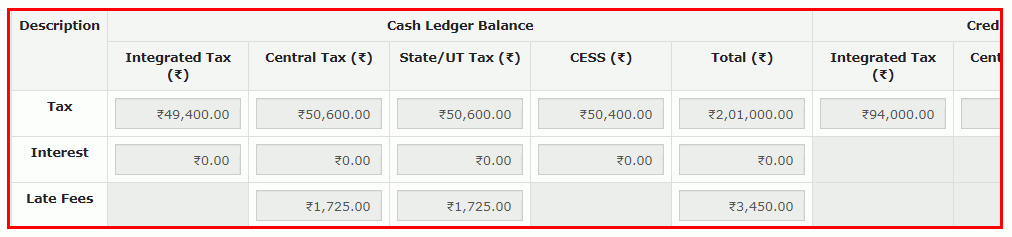

Step 15: Scroll down and you will see “Cash Ledger” balance with return related liabilities. The ledger will be auto-populated with taxes to be paid in part or full by ITC (Input Tax Credit).

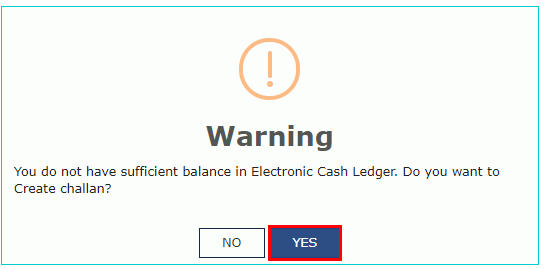

Step 16: If you do not have sufficient balance in the Electronic Cash Ledger, you will be prompted to create challan. Select “Yes” to create a new challan.

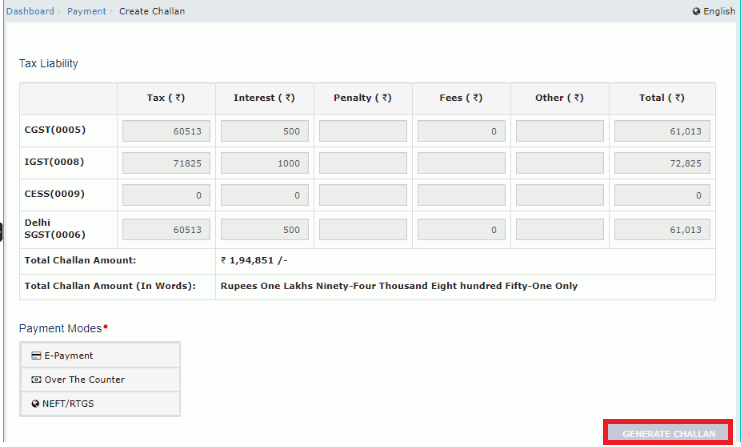

Step 17: On the “Create Challan” page, select the relevant payment mode and click on generate challan button to make payment.

Step 18: Click Continue.

Step 18: Click Continue.

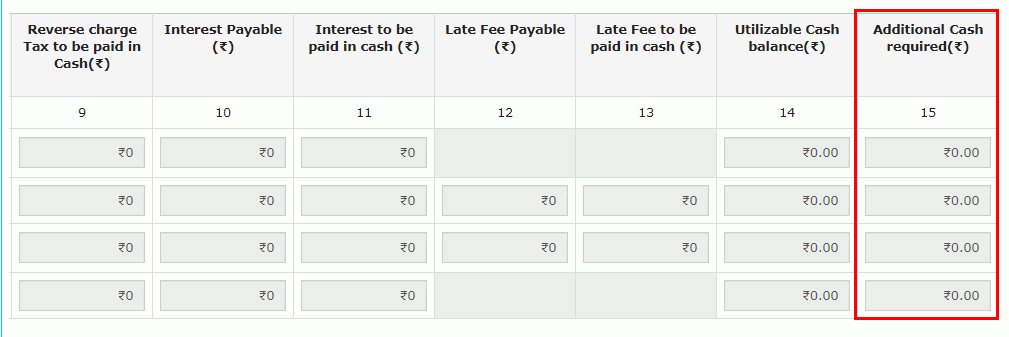

Step 19: Preview draft GSTR3B and ensure that the last column pertaining to “Additional Cash Required” is zero.

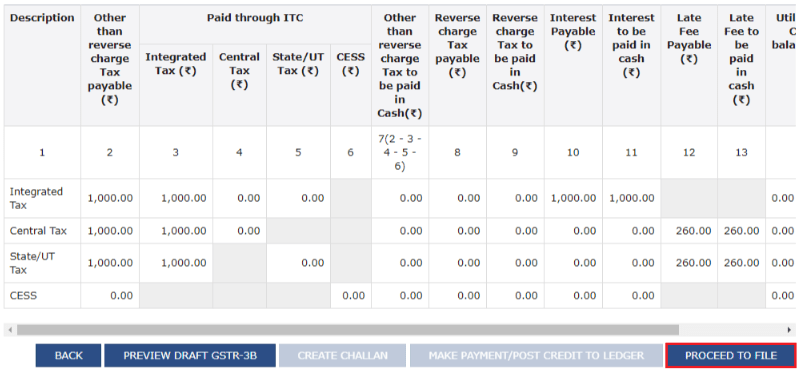

Step 20: Click “Make payment/ post credit to ledger”.

Step 20: Click “Make payment/ post credit to ledger”.

Step 21: Click “Yes”. Offset Successful message will be displayed.

Step 22: Select “Proceed to File”

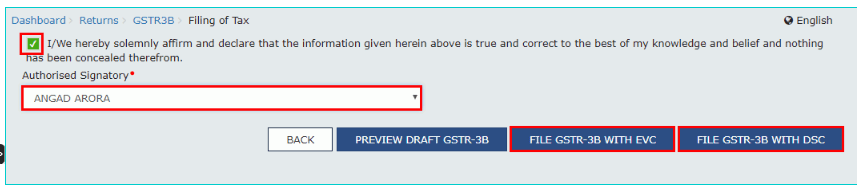

Step 23: Select the declaration check box and click “File GSTR 3B with EVC/DSC”. EVC stands for Electronic Verification Code while DSC stands for Digital Signature Certificate.

Step 23: Select the declaration check box and click “File GSTR 3B with EVC/DSC”. EVC stands for Electronic Verification Code while DSC stands for Digital Signature Certificate.

Step 24: Click “Proceed”.

Step 24: Click “Proceed”.

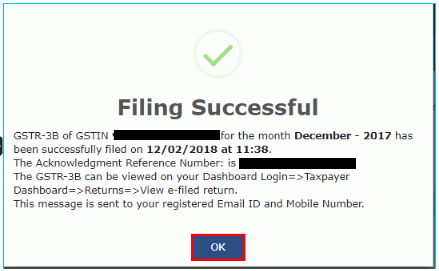

Step 25: Successful filing message will be displayed bearing “Acknowledgement Reference Number (ARN)”. Note this number for future reference.

Step 26: Click “Download filed GSTR-3B” to view the file GSTR3B.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to file GSTR-3B Offline?

Step 1: Click the “Downloads” tab on the GST portal.

Step 2: Click Offline Tools > GSTR3B Offline Utility.

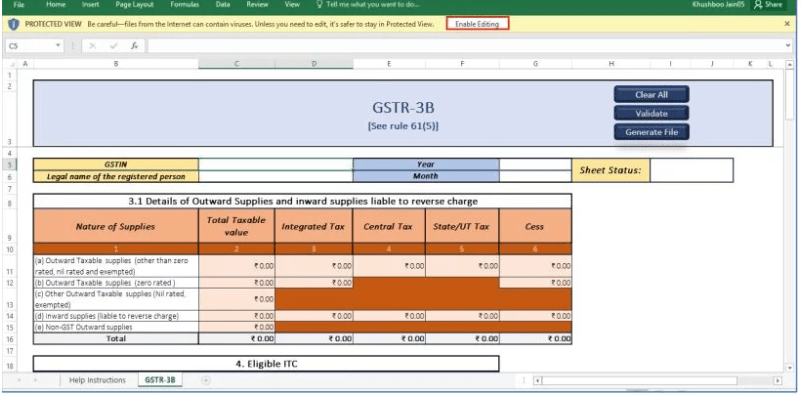

Step 3: Extract the excel utility from the zipped folder and open the excel file.

Step 4: Click “Enable Editing” button in the excel sheet.

Step 5: Enter the legal name of the registered person, GSTIN, FY and month.

Step 5: Enter the legal name of the registered person, GSTIN, FY and month.

Step 6: Enter details in Section 3.1 – Tax on outward and reverse charge inward supplies.

Step 7: Enter details in Section 3.2 – Inter-state supplies. Ensure that the total amount of integrated tax declared in tile 3.2 is less than or equal to that declared in tile 3.1.

Step 8: Enter details in Section 4 – Eligible ITC.

Step 9: Enter details on Section 5.1- Exempt, nil and non-GST inward supplies.

Step 10: Enter details in Section 5.2 – Interest and late fees.

Step 11: Validate the entered details using the Validate button.

Step 12: Generate JSON file using the Generate file button.

Step 13: Upload the JSON file on the GST portal by selecting the “Prepare Offline” option on the returns dashboard.

Also read: GST Offline Tools

Also read: GST Offline Tools

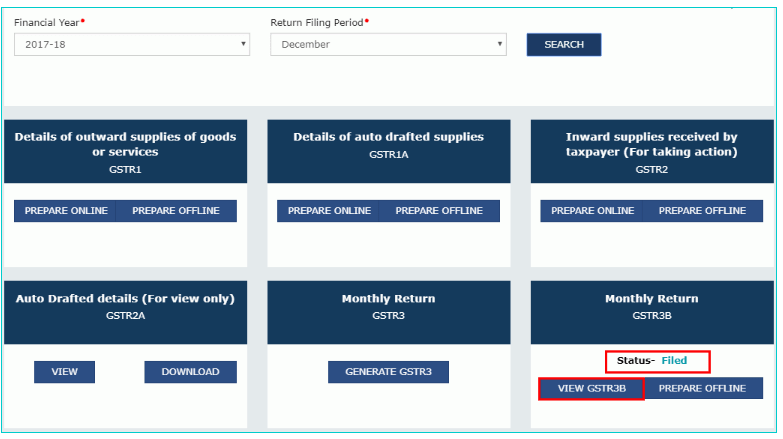

How to view GSTR-3B filing status?

- Login into the GST portal with your credentials.

- On Dashboard screen, click “Returns Dashboard”.

- Select the Financial Year and the return filing period.

- Click “Search”.

- All the relevant GST returns will be displayed along with their filing status.

Late fees and penalty for missing the GSTR-3B due date

GSTR-3B is a monthly return form. The due date for every month is 20th of the succeeding month, which can be extended by the government.

If you miss the due date to file GSTR-3B, you will be liable to pay the following penalties:

- Taxpayers with NIL GST liability: Rs. 20/day of delay

- Other taxpayers: Rs. 50/day of delay

Moreover, penal interest at the rate of 18% per annum will be charged on the outstanding tax amount.

Note: The late-filing fees field (if applicable) is auto populated in the GSTR3B form.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Frequently Asked Questions (FAQs)

Q1. What is Form GSTR-3B?

Ans. This GSTR form is a monthly self-declaration form to be filed by every registered GST dealer to declare summary GST liabilities for a tax period.

Q2. What is the purpose of GSTR3B?

Ans. It is to declare summary GST liabilities for a particular tax period and discharge these liabilities in a timely manner.

Q3. Who needs to file GSTR-3B?

Ans. All normal and casual GST registered businesses/individuals are required to file GSTR3B every time there is an extension of due dates of filing for Forms GSTR-1 and GSTR-2.

Q4. How can I file GSTR 3B?

Ans. GSTR3B can be filed both online and offline. For online filing of GSTR 3B, login to the GST portal. Click Returns Dashboard on the dashboard screen. Select the relevant FY and return filing period and click “Prepare Online” button on the GSTR 3B file.

For offline GSTR3B filing, go to the GST portal > Downloads > Offline Tools > GSTR 3B offline utility tool

Q5. What is the due date to file GSTR 3B?

Ans. It is a monthly return form. The due date for every month is 20th of the succeeding month. For example, the due date to file GSTR 3B for September, 2019 is 20th October, 2019.

Please note that the due date to file GSTR3B can be extended by the government.

Q6. Is filing GSTR 3B mandatory?

Ans. Yes, filing GSTR3B filing is mandatory for all the normal and casual taxpayers, including those with no business in the particular tax period.

Q7. Is invoice matching required for filing GSTR3B?

Ans. No, invoice matching is not required for filing GSTR-3B. All the details in GSTR 3B are self declared in summary manner and the taxes are paid as per table 6 of Form GSTR3B.

Q8. Can I preview GSTR-3B before submission?

Ans. Yes, you can preview GSTR 3B before submission. After adding details in various sections of GSTR3B, scroll down the page and click “PREVIEW DRAFT Form GSTR3B” to verify the details before making the payment.

If there is any discrepancy, edit the information in the relevant section of the form or else click “MAKE PAYMENT/POST CREDIT TO LEDGER” button.

Q9. Can I revise/reset Form GSTR-3B?

Ans. No, you cannot revise/reset GSTR3B after it has been submitted. Thus, make sure that all the details mentioned in the form are correct before making the final payment.

Q10. How can I file nil GSTR-3B?

Ans. Nil return can be filed when you have not made any outward supply and do not have any tax liability. To file “Nil” GSTR3B return form, login to the GST portal. Click Services > Returns > Returns Dashboard. Select FY, the return filing period and click the GSTR 3B tile.

Select “Yes” for question A: “Do you want to file Nil return?”, Subsequently, file nil GSTR3B by affixing your e-signature.