Income Tax Return (ITR) forms provide can be downloaded online from the e-filing website of the Income Tax Department. Alternately, if you are using ITR 1 (Sahaj), you have the option of filling out the form and filing the return online without having to download the form. In case you have to fill out your ITR form after downloading it, you have the option of pre-filling certain sections using the appropriate XML file. While importing details from the .xml file makes the process of ITR filing easier and faster, you do have to confirm that the details are correct before you actually file your tax return. Let’s understand how you can download and use the pre-filled ITR forms by importing details from an XML file.

How to download an ITR form?

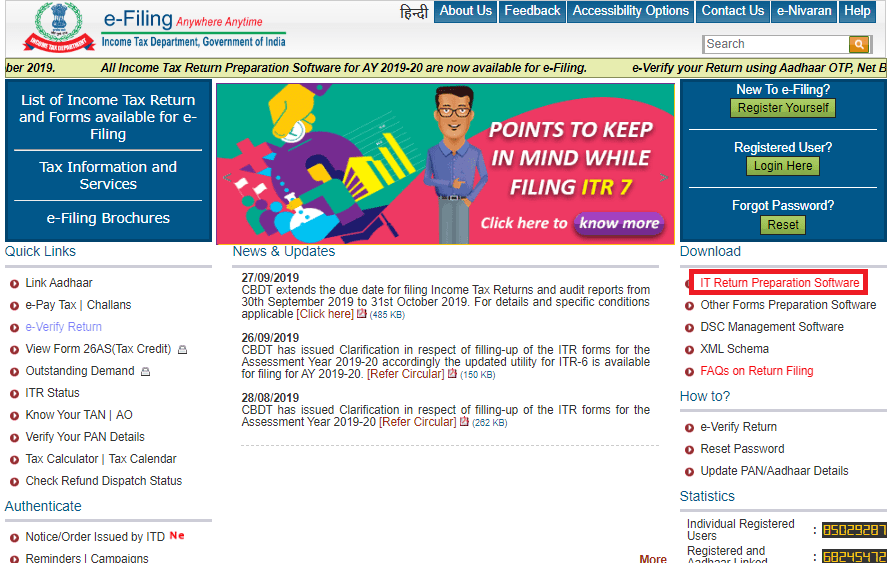

Step 1: Visit the e-filing portal of the Income Tax Department. Click “IT Return Preparation Software” under the “Download” tab.

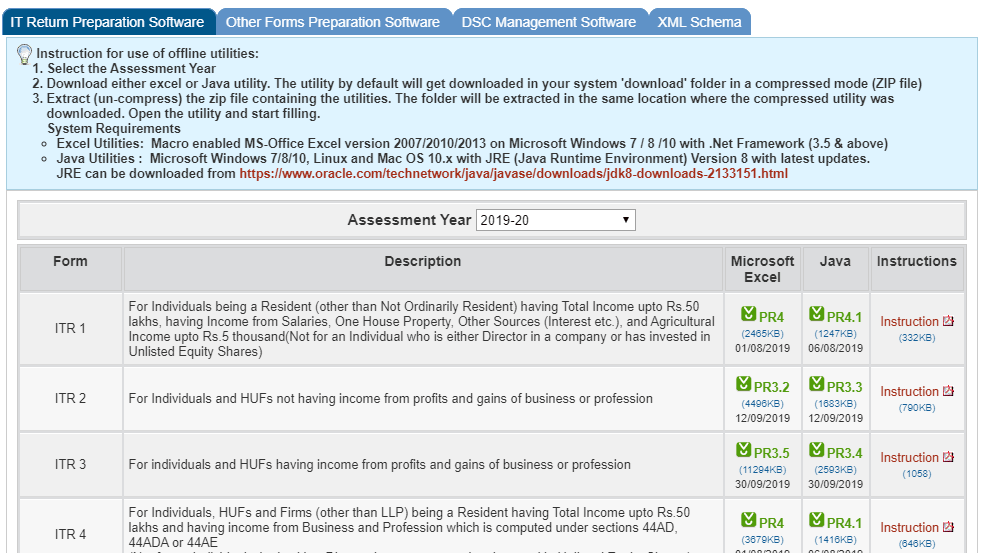

Step 2: The following web page will appear where you can select the relevant Assessment Year (AY) and download the applicable ITR form.

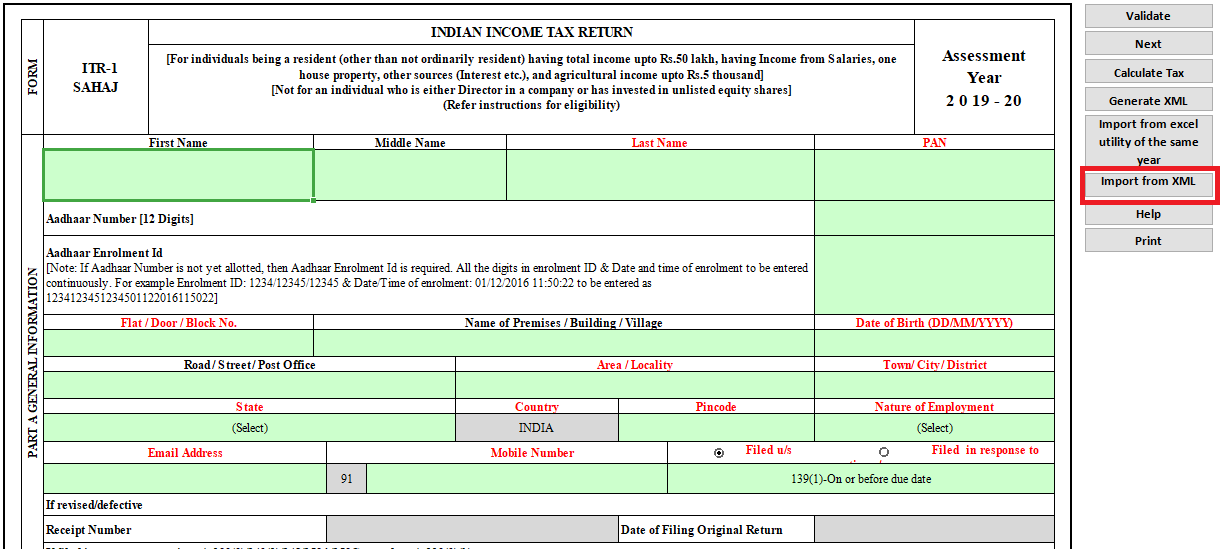

Step 3: Extract the ITR form from the zip folder and open it using MS-Excel. Remember to enable editing and macros before filling out the ITR form using Microsoft Excel. The downloaded ITR-1 as shown in MS-Excel has been shown below for your reference.

Step 4: Click on “Import from XML” to incorporate the basic details from the XML file. Typically, this will auto fill your personal details (name, Aadhaar number, PAN, address), employer details, tax exemptions, TDS and income details in case of ITR 1.

Note: Please ensure that the XML file used to import data is for the same ITR form and corresponds to the same year. Also, remember to double check the auto-filled data in the ITR form to ensure accuracy.

How to download pre-filled XML file?

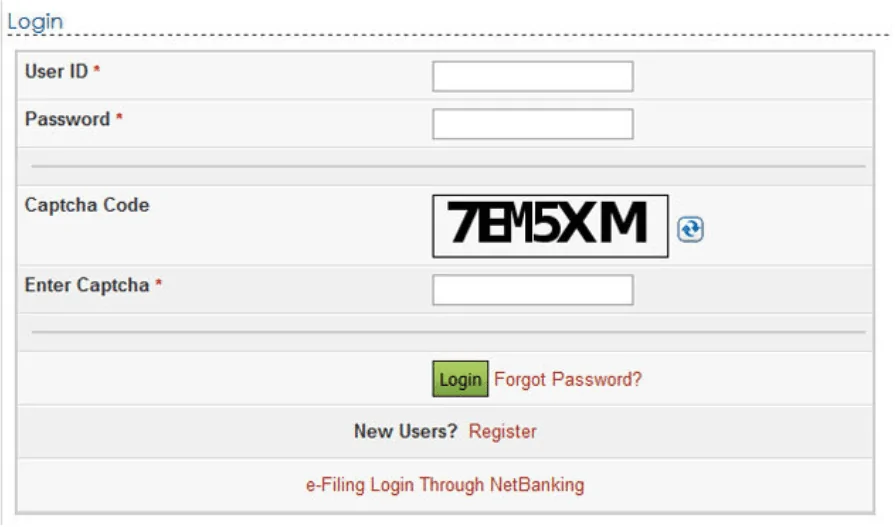

Step 1: Log in to the e-filing portal of the Income Tax Department by entering your PAN, password and captcha code.

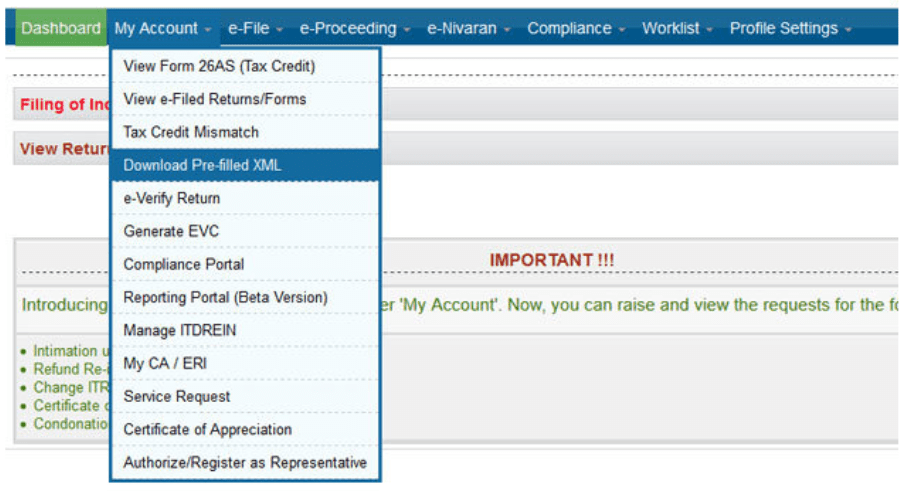

Step 2: Go to “My Account” tab and select “Download Pre-filled XML”.

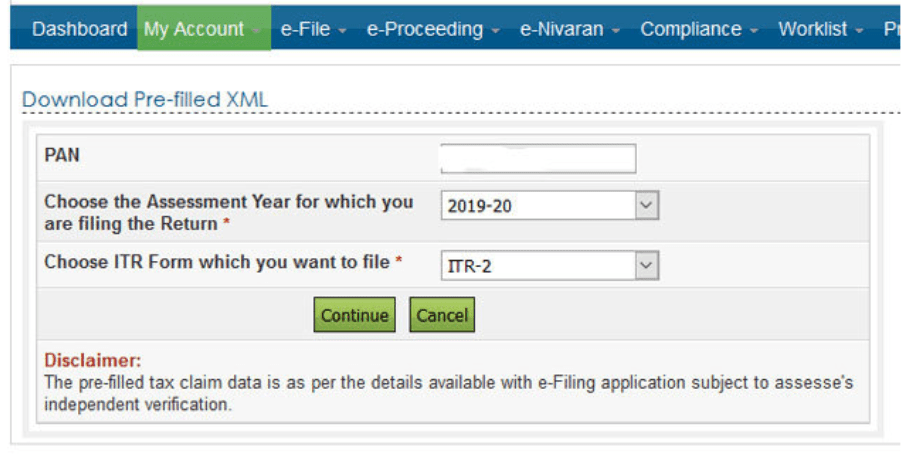

Step 3: Select the relevant Assessment Year and ITR form.

Step 3: Select the relevant Assessment Year and ITR form.

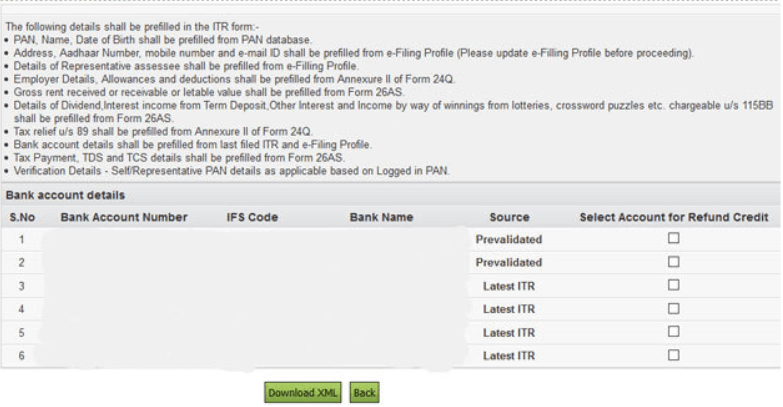

Step 4: Select the bank account details which you want to get auto filled in the ITR form. Additionally, select a pre-validated bank account in which you would like to receive your Income Tax Refund, if any, then click “Download XML”.

Step 5: Extract the XML file from the downloaded zip folder and import its details to the relevant ITR form.

The introduction of pre-filled ITR forms through use of downloadable .xml files has significantly improved the accuracy and ease of filing income tax returns.