In case, the total income tax liability of an assessee exceeds the tax already paid for the financial year by TDS (Tax Deducted at Source) or other mechanism, the assessee is required to pay the income tax due. In case total tax deducted exceeds the total tax liability of the assessee for the fiscal, the tax payer is eligible for an income tax refund. If you do not pay your income tax dues in a timely manner, you may have to pay hefty fines in addition to penal interest on unpaid income tax due.

Paying Due Income Tax on TIN Website

Online payment of tax dues can be completed on the Tax Information Network (TIN) website of the Income Tax Department. The following is a step by step guide to pay income tax online on the TIN website.

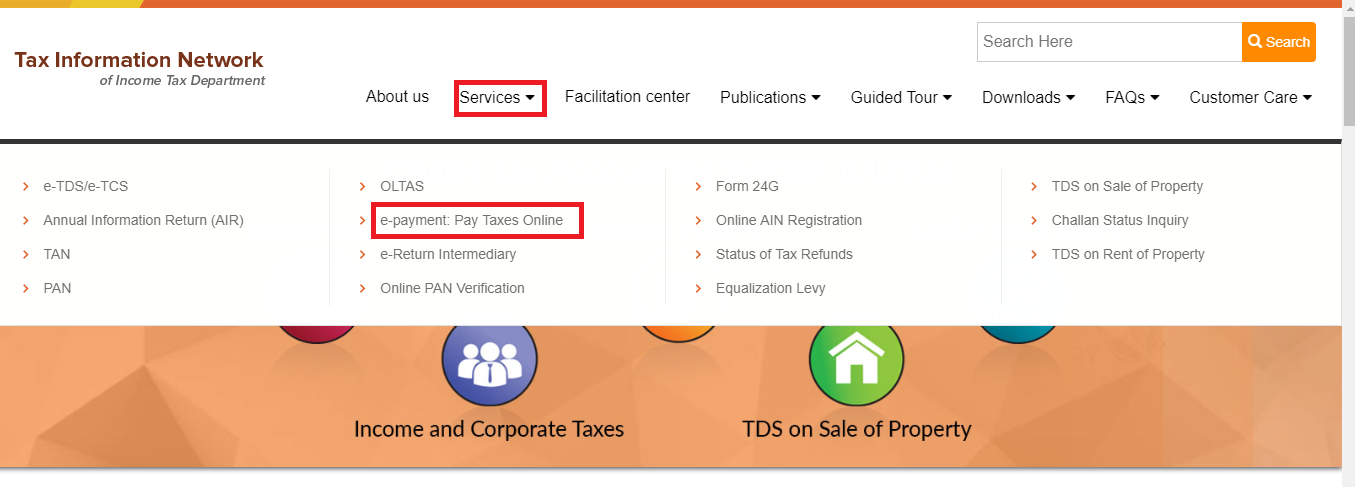

Step 1 – Log on to the TIN website and click on the “e-payment: Pay Taxes Online” link located under the “Services” menu on the TIN homepage:

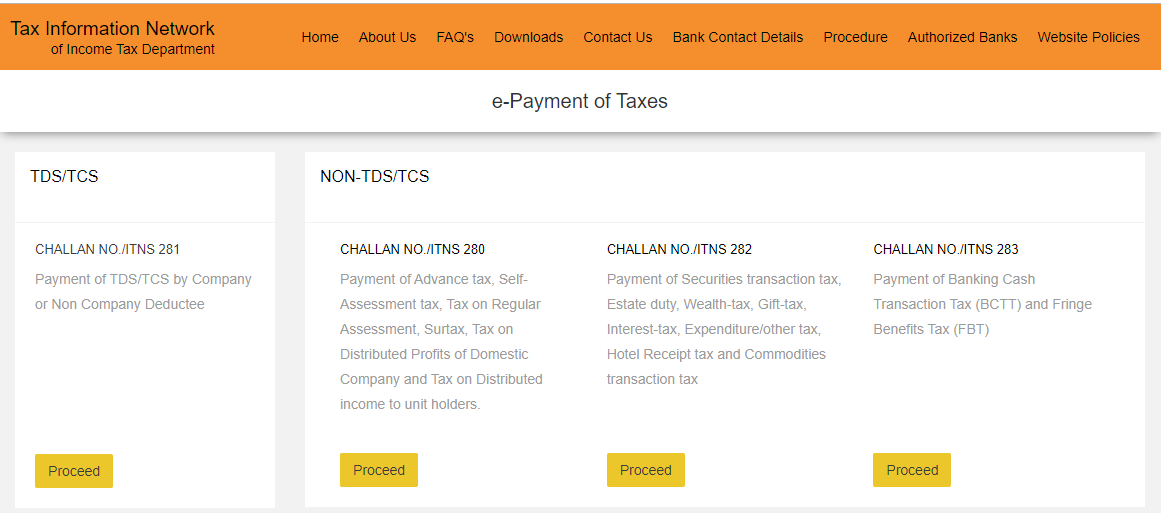

Step 2 – By clicking on “e-payment: Pay Taxes Online” menu, you are directed to the following page which features a list of the different Challans that you can use to pay due income tax:

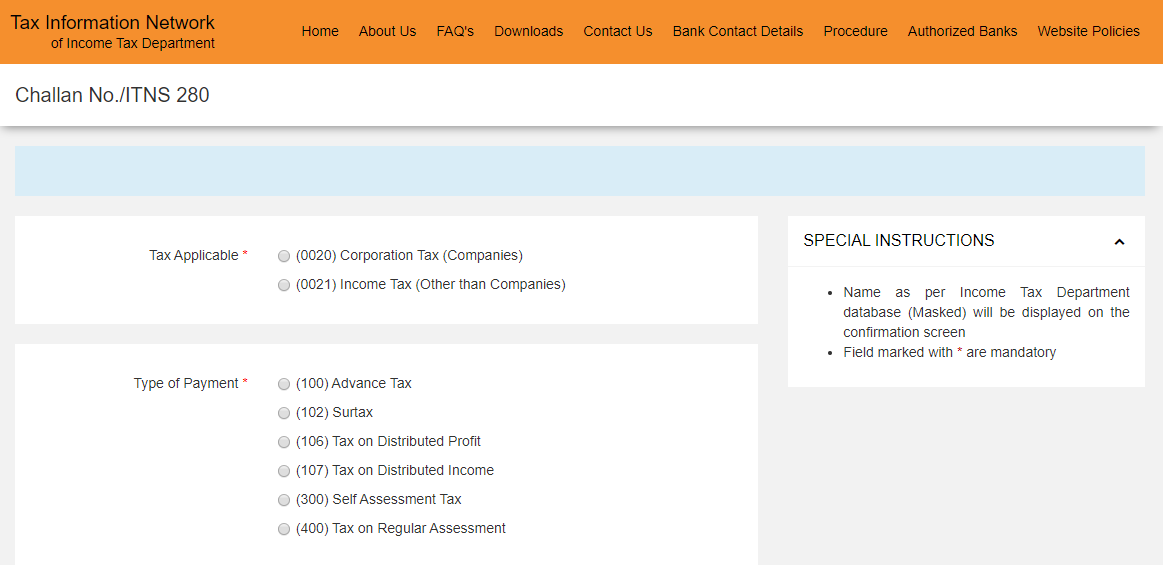

Step 3 – The most commonly used challans for paying income tax dues in India is ITNS 280, ITNS 282 and ITNS 283. If you click on any of the “Proceed” buttons located under the applicable challan (Challan 280 in for example), the following page is displayed

Step 3 – The most commonly used challans for paying income tax dues in India is ITNS 280, ITNS 282 and ITNS 283. If you click on any of the “Proceed” buttons located under the applicable challan (Challan 280 in for example), the following page is displayed

Fields you are required to select/fill out on this page include:

- Tax Applicable

- Type of Payment

- Mode of Payment – Net-Banking/Debit card of major banks in India

- PAN (Permanent Account Number)

- Assessment Year (select from drop down menu)

- Complete Mailing Address as per PAN records

- Email and Phone Number

Step 4: Once you have filled out the applicable information and provided the captcha code, you can click on the “Proceed” link provided at the bottom of the page. Subsequently, you will get directed to the Net-banking or Debit Card payment page where you can complete payment and receive a transaction id number.

Currently, you can not only pay your due tax online using the TIN website but also use the UMANG App to pay income tax. However, currently tax payment using UMANG App only supports Challan 280 payments.

How to calculate Income Tax Dues?

Income tax is payable every year on your earnings for the applicable fiscal. You total tax liability is calculated based on the specific income tax slab rate applicable to your taxable income. In case of salaried individuals, employers deduct tax from salary using the tax deducted at source (TDS) mechanism. Similarly, self-employed individuals can pay income tax during a financial year using the presumptive tax mechanism. In case you overpay Income Tax, you are eligible for an income tax refund after you efile your income tax return.

Challans for Paying Income Tax dues Online

The different challans available for paying income tax due online on the TIN website and their applicability are as follows:

| Challan Number | Applicability |

| Challan 280 (INTS 280) | Payment of advance tax, self-assessment tax, regular assessment tax, etc. |

| Challan 281 (INTS 281) | TDS/TCS Payment by company or non-company deductee. |

| Challan 282 (INTS 282) | Payment of securities transaction tax, gift tax, estate duty, wealth tax, etc. |

| Challan 283 (INTS 283) | Banking Cash Transaction Tax (BCTT) and Fringe Benefits Tax payment. |

| Challan 285 (INTS 285) | Equalisation Levy payment. |

| Challan 286 (INTS 286) | Payment of tax due under Income Declaration Scheme, 2016 scheme. |

| Challan 287 (INTS 287) | Payment under Pradhan Mantri Garib Kalyan Yojana, 2016 scheme. |