Did you know that being a taxpayer, you can file Income Tax Return (ITR), access previous year ITRs, e-verify ITR, know the current status of tax refund claim etc. online on the Income tax website? However, to perform these tasks, you first need to be registered on the IT department’s e-filing website.

Details Required for Registration on Income Tax Portal

The following are the key information required for registration on the Income Tax website:

- PAN Card

- Mobile Number

- Email Address

- Current Address

How to register on the Income Tax Department online portal?

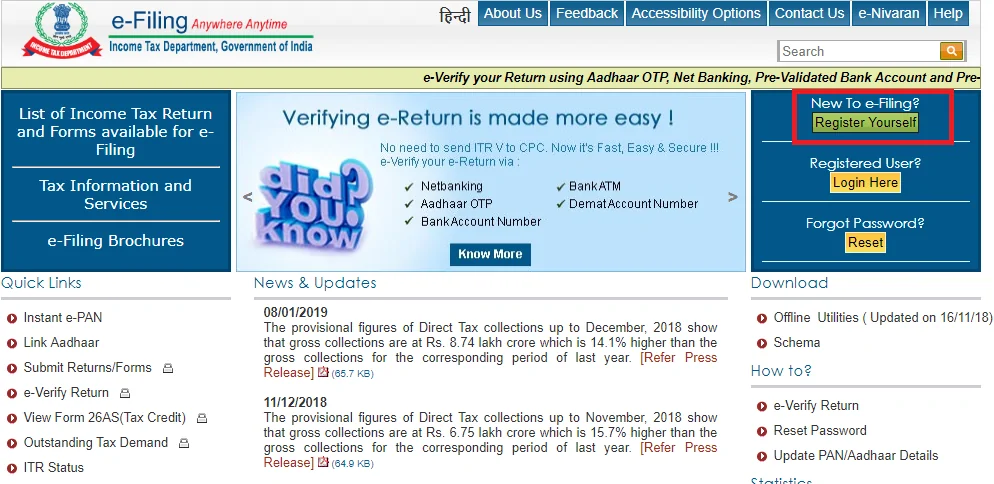

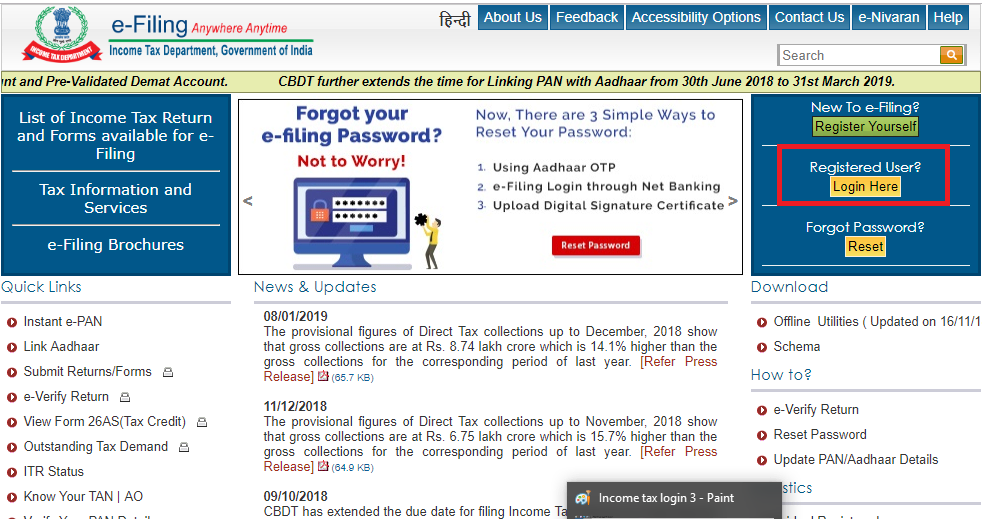

- First visit the Income Tax Department’s e-filing portal. Click on the ‘Register Yourself’ option displayed in the right-hand side of the home page.

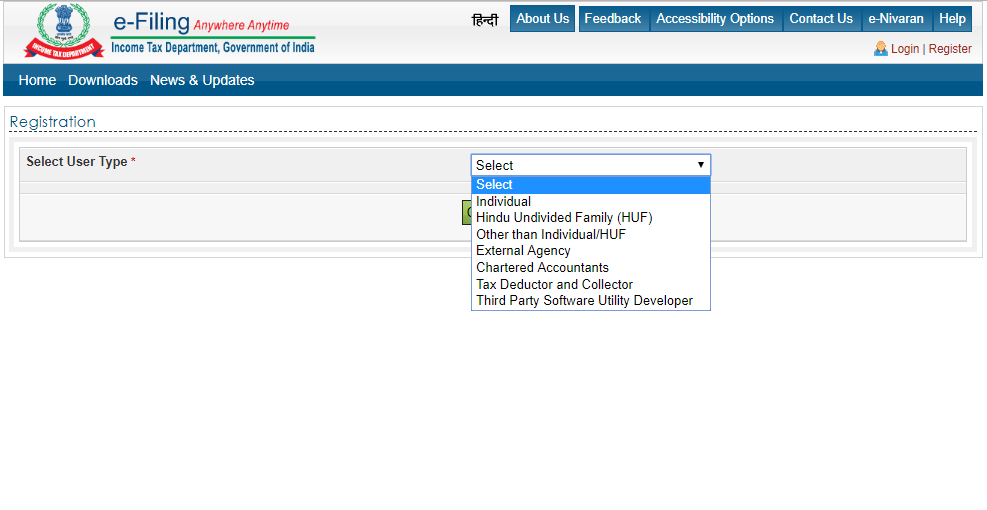

- Now Select User Type as applicable from the given options.

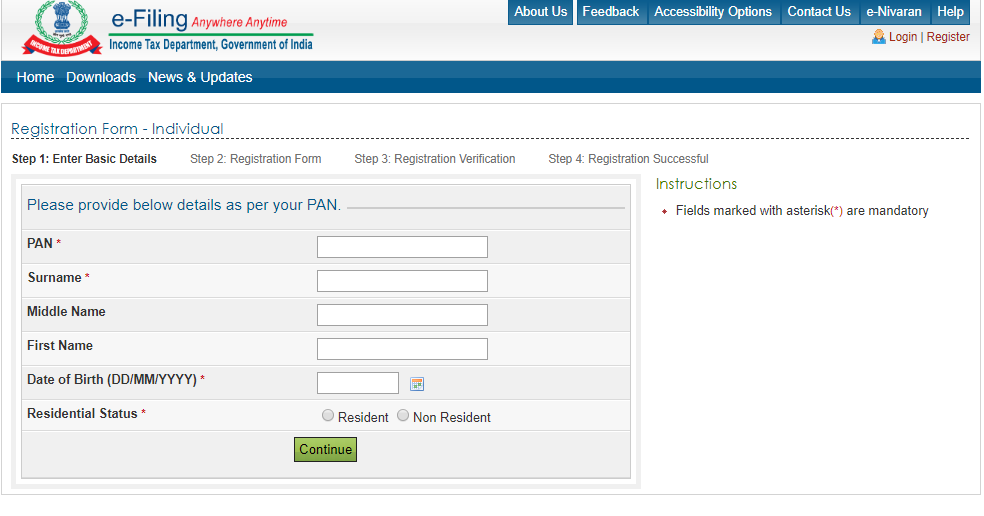

- Enter the key details such as PAN, Name, Residential Status and Date of Birth.

Now you need to provide login details such as password for signing into the efiling website, contact and address details. Click on ‘Submit’ option after providing the required details.

- A 6 digit One Time Password (OTP) will be sent to your registered mobile number and to your email id. Please verify your mobile number and email id by entering the OTPs in respective columns. In case of a non-resident individual, OTP will only be sent to the email id. Once you have provided the correct OTP, the online registration for ITR filing is completed.

Note: The OTP is valid only for 24 hours. If you fail to enter the OTP within 24 hours of receiving it, the registration process shall expire and therefore, the entire process of registration must be initiated again.

Income Tax E-filing Login Portal

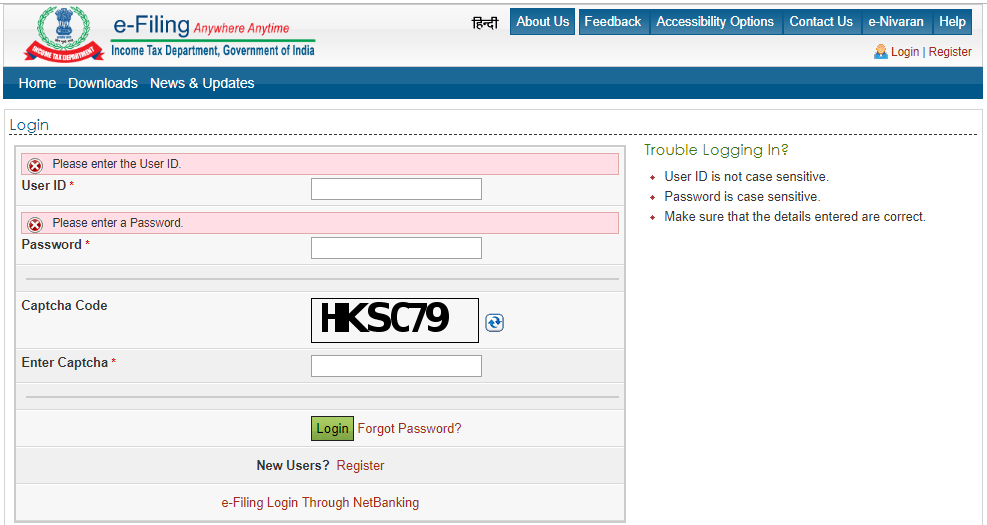

- Once registered on Income tax online portal, you can directly login to your account by visiting the e-filing portal.

- Click on ‘Login Here’ option shown in a right-hand the website’s homepage.

- You will be directed to the login page. Please enter the login credentials. The PAN number provided at the time of registering online for ITR filing will act as your User ID.