Department of Goods and Tax, Maharashtra

As per the Maharashtra State Tax on Professions, Trades, Callings and Employment Act, 1975, individuals (both self-employed and salaried) as well as corporate entities are liable to pay profession tax on their income. However, in order to pay the profession tax, one needs to obtain an Enrollment Certificate. The act provides a provision to levy a penalty if any entity which is liable to pay the profession tax fails to obtain the enrollment certificate.

In order to make the registration process for the profession tax, a hassle-free experience, the state government has made the entire process available online.

How to Enroll Maharashtra Profession Tax ?

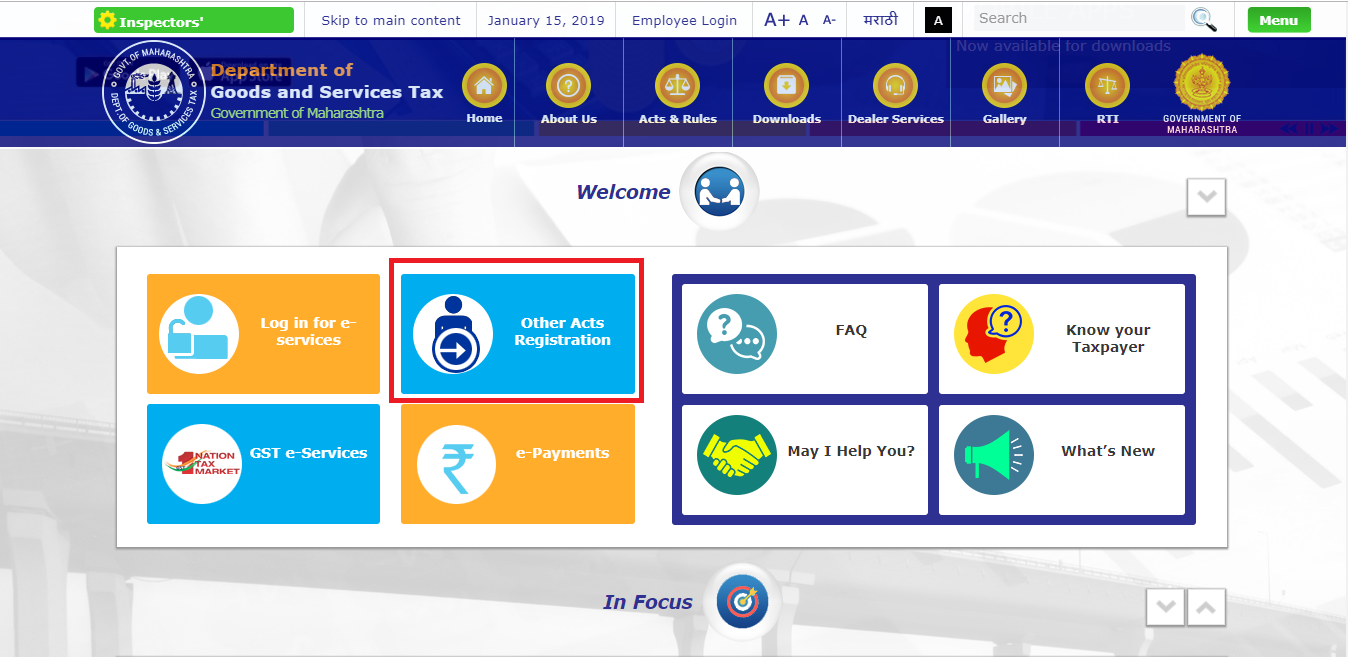

- Go to Department of Goods and Tax, Maharashtra Website.

- Click on ‘Other Acts Registration’ and select ‘Other Acts Registration’ in that.

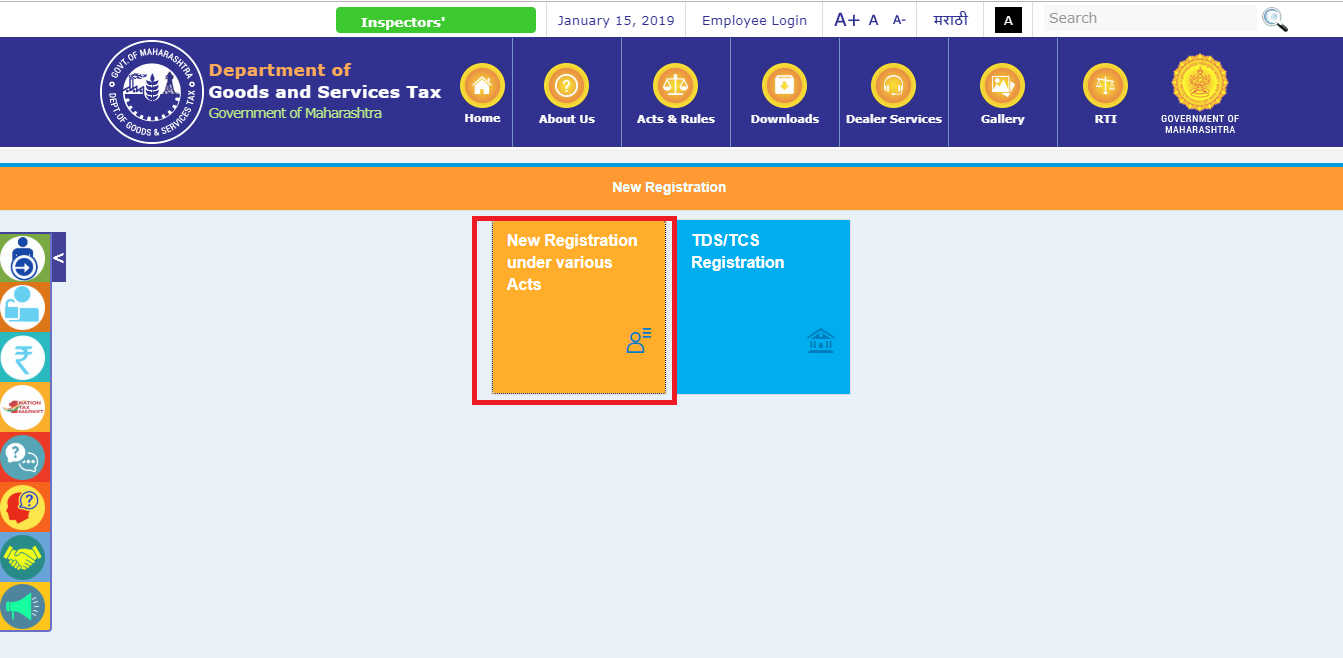

- Now, click on ‘New Registration Under Various Acts’. An instruction sheet will appear, detailed guidelines regarding application process flow, a list of required documents are provided in the instruction sheet. After carefully examining the guidelines, Click “next”

- Click on ‘New Dealer’ if you do not have any active registration certificates under any of the acts administered by MSTD and click on ‘Next’.

- Please enter your PAN or TAN number as applicable.

- A temporary activation link will be sent to your email id. Click on that link and log in using the password sent to your registered mobile number. Once verified, new login id and password will be sent to your registered email id.

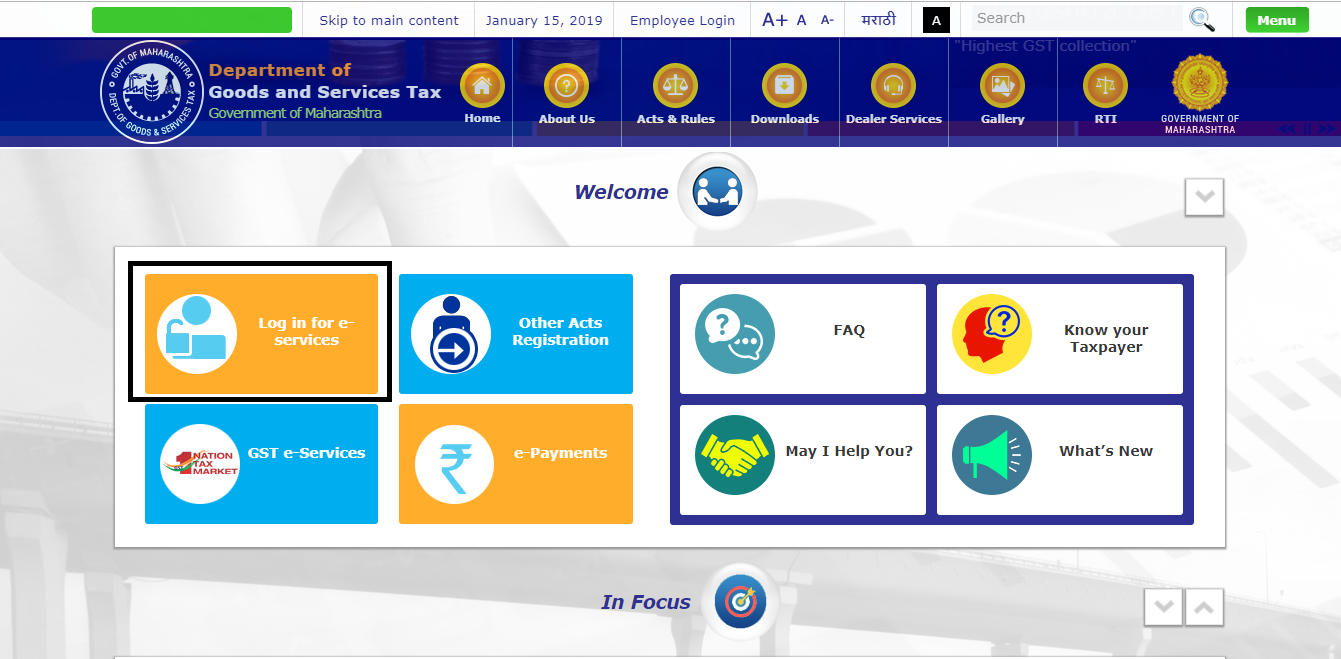

- Please go to Home Page again.

- Click on ‘Log in for e-Services’ and then click on ‘Vat and allied acts’.

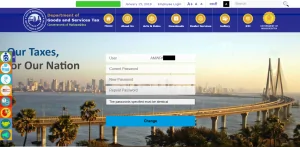

- Now, Please enter the user credentials to reset your password.

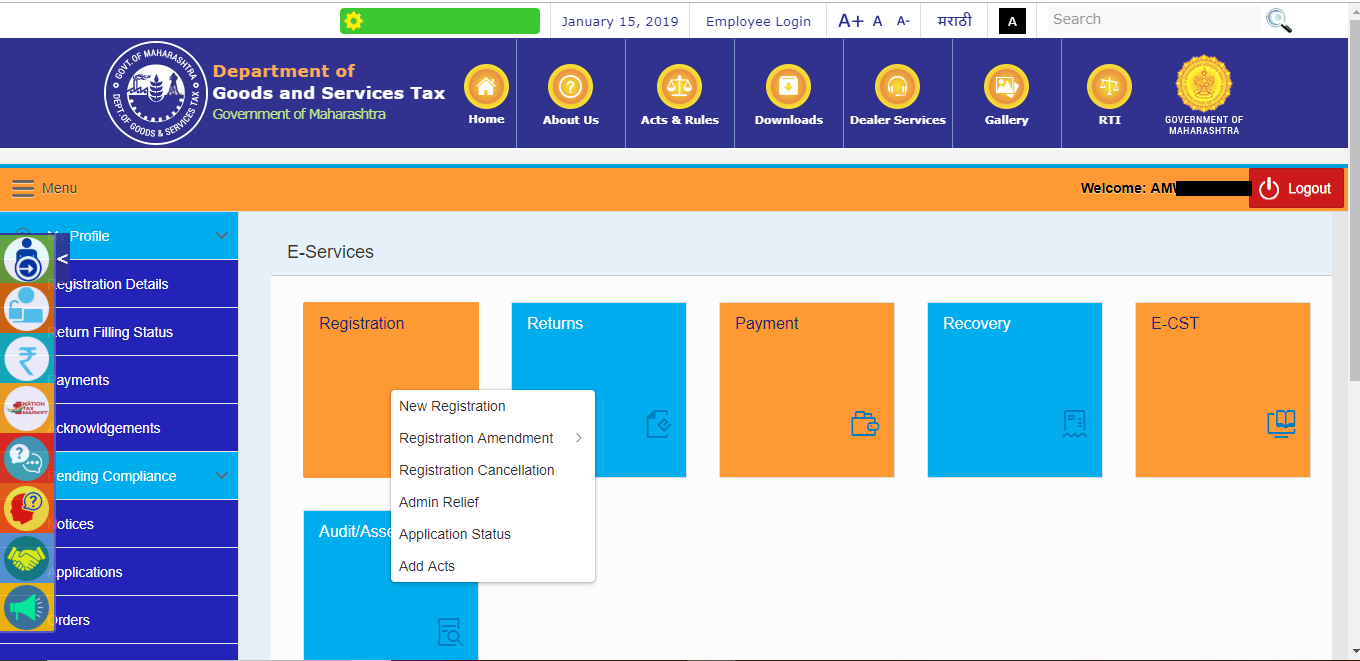

- Once you have reset your password, please click on ‘Continue’. You will be directed to a new page. Please click on ‘Registration’ and then on ‘New Registration’.

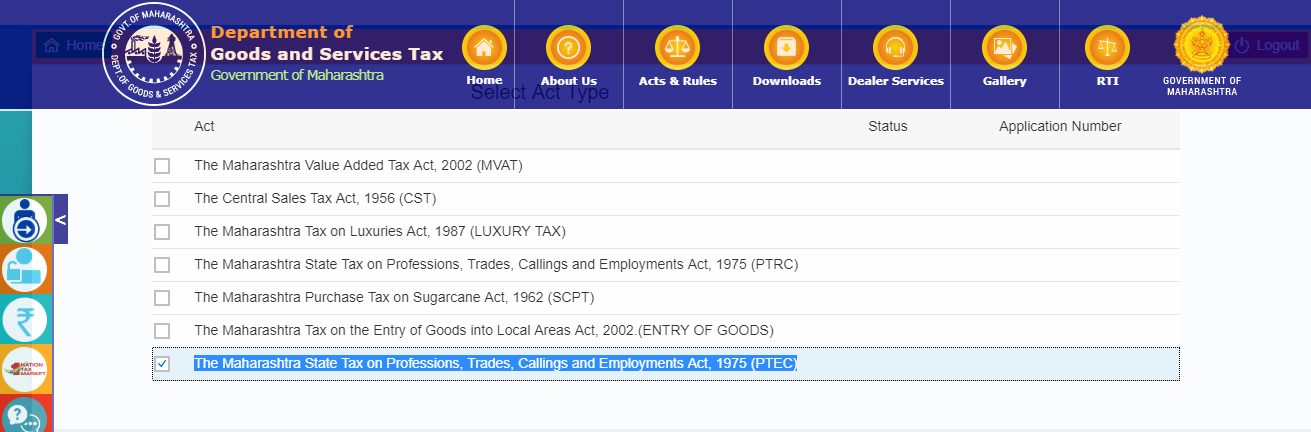

- Select The Maharashtra State Tax on Profession, Trades, Callings and Employments Act, 1975 (PTEC) tab from the list and click on ‘Next’.

- Form II will be displayed on your screen. Please fill in the additional details required in Form II like the type of the applicant (individual/company), individual details, entry number, registration number etc. Now, click on ‘Next’.

- Now, you need to provide your address details and click on ‘Next’. After that, please enter details related to your place of business like address and contact details, electricity bill details and IGR (property) details. Again click on ‘Next’.

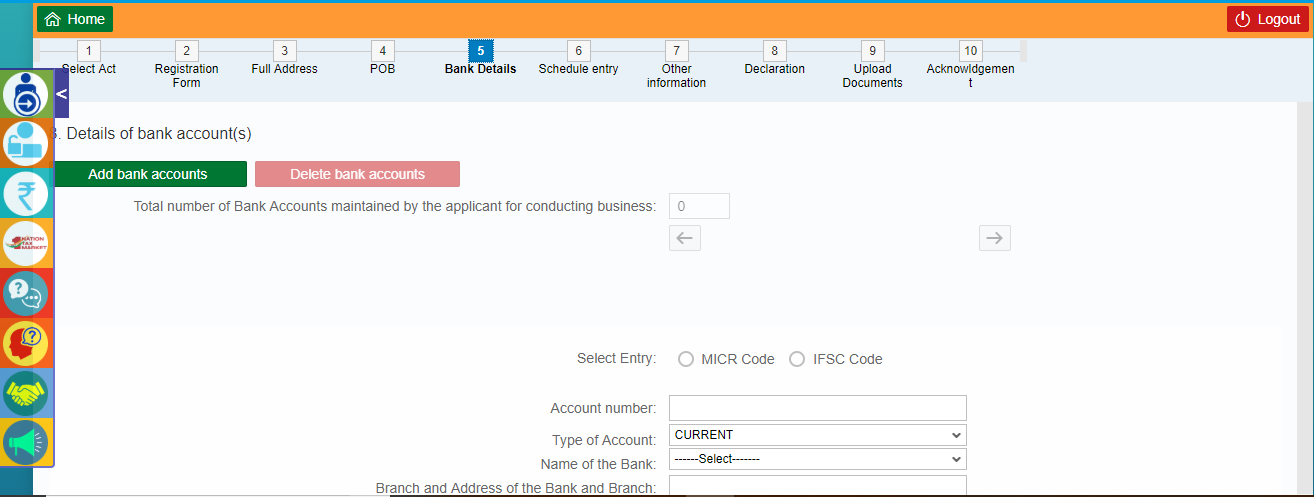

- Here, you are required to provide the bank details. You can a bank account by filling in the necessary details.

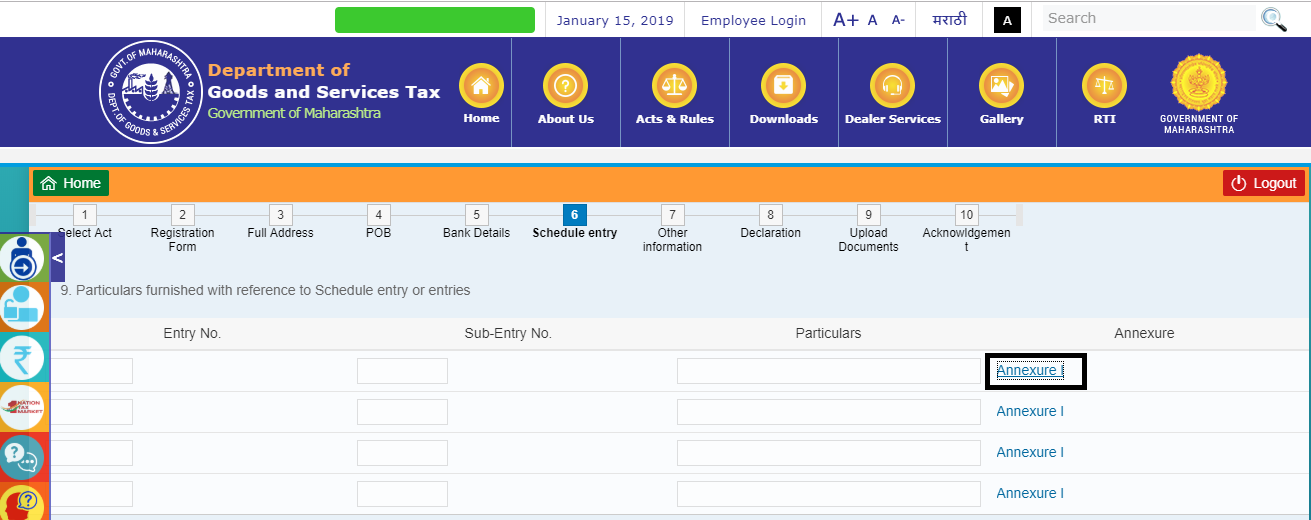

- Now you need to enter your entry no. and sub-entry no. as per the applicable category. In order to find your category, please click on Annexure I.Then click on ‘Next’.

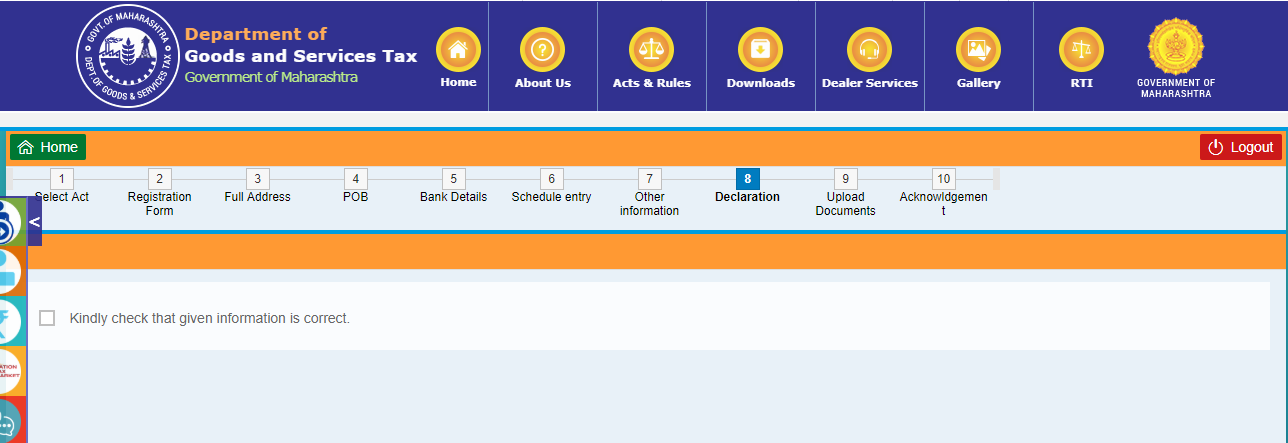

- Kindly make a self-declaration about the veracity of the information provided by checking right the declaration box and click on ‘Next’.

- Now, you need to upload a scanned copy of supporting documents as required and click on ‘Next’.

- Acknowledgement would be generated. Congratulations! You have successfully registered for the Profession Tax payment. You will be allotted an unique enrollment certificate.