Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Property tax is a tax levied by the state government and generally utilized by municipal corporations for maintaining basic civic facilities in their jurisdiction. Thus property tax in Indore will be fixed by the government of Maharashtra. The amount collected from property tax is used for the upkeep of infrastructure facilities like roads, drainage system, lighting, etc.

This tax is paid by the owners of concerned properties annually. Property tax differs from state to state, city to city, and even from circle to another within the same city. In India, property tax is levied mostly on real estate which consists of buildings or land attached to the concerned buildings.

Indore, famously known as the Mumbai of Madhya Pradesh, is one of the largest cities of the state and also its commercial hub. It is known for its top-notch educational institutions, right from schools to specialized technical colleges. Indore has been shortlisted to be developed as one of the 100 smart cities of India.

It is a fast-growing city where new properties are being developed rapidly. This brings us to the question of how to pay property tax in Indore. The Indore Municipal Corporation has an official website where taxpayers can pay their property tax online if they do not have the time to go personally to one of the corporation’s branches to pay the tax offline.

Step-1: Measure the Plinth Area (PA). It is the total built-up area of the property inclusive of garages and balconies.

Step-2: Determine the current rent per square foot in terms of market rate. The value so obtained will be considered the Monthly Rental Value (MRV) per square foot.

Step-3: The next step is to calculate the property tax using the following formula:

Annual property tax (in case of residential property)=

[PA * MRV * 12 (0.17-0.30)] – [10% (depreciation)] + [8% (library cess)]As of 2015, the property tax rate for properties in Indore have ranged from 1% to 6% depending on the zone in which the property is located. Get complete list of property rates by zone for Indore.

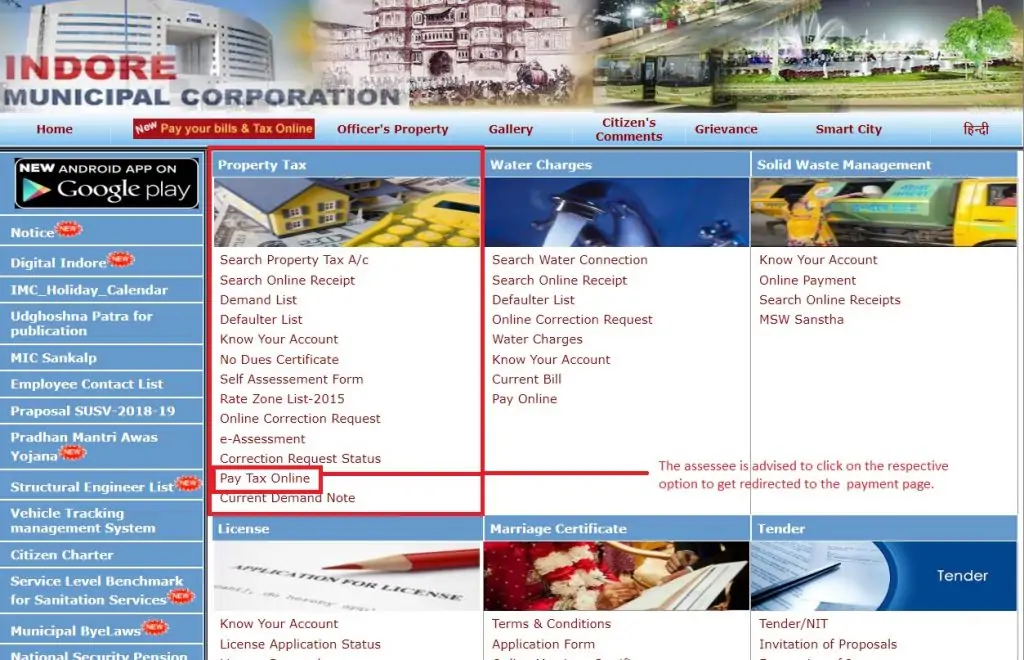

Please log on to the website of the Indore Municipal Corporation.

You can find the option for property tax on the left side. When you hover your mouse over this tab, it will show the various options related to property tax. You can click on the “Pay the tax Online” link to start the property tax online payment process.

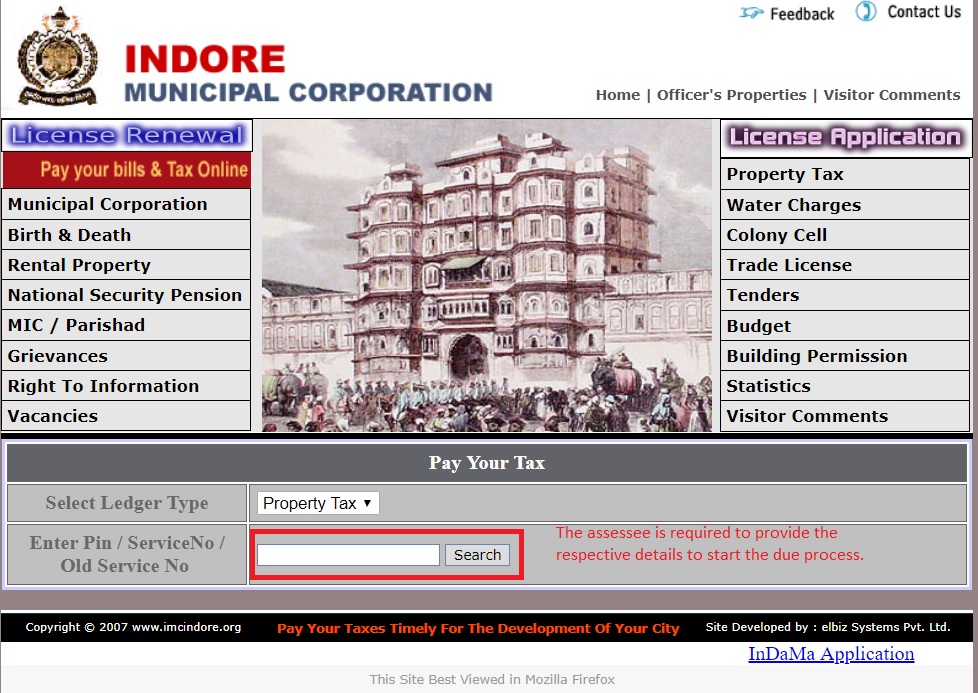

This will redirect the taxpayer to the payment page, where you will have to select property tax in the ledger type, fill in your service number and click on search.

The page where you land will display the amount of tax you need to pay on your property.

Then you will have to select the mode of payment and pay the amount accordingly to finish the payment process.

The IMC portal lets taxpayers fill out a self-assessment form to ascertain the property tax they are liable to pay on their property as per its location, construction, built-up area, and other key details.

It also lets taxpayers search for their personal property tax account, check if they have overlooked or defaulted on any property tax payments and get a no-dues certificate for their property.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

If you wish to search for any Indore property tax documents online, you can go to the official website of the Indore Municipal Corporation. There you will find all information regarding your property under the property section, as follows:

The first option is to search your property by zone, ward, colony, house number, your name and address. If you do not know the zone and ward number of your colony, just click on the ‘Find Colony’ button, and it display a list of all the colonies in Indore with the zone and ward numbers listed in the column against the name of the colony.

The second option on the page is to search for an online receipt of your property tax. Here you just have to enter your PIN or service number in the form and click the search button. It will display a page which gives you information such as the arrears, demand, old collection, current collection and balance due on your property tax.

The next option is to search defaulters list. If you are unsure about whether you have paid your property tax. You can just fill out the form on this page and get a list of defaulters and see if your name is featured on it. And in case you want to make any corrections related to your property, this page also has a link to a detailed property form in PDF format which you can download and check for any inaccuracies.

If you want a ‘No Dues Certificate’, just click on the option under the property tax section of the home page. You will just have to fill in your PIN number to get a digital copy of the “No Dues Certificate” for your property.

There is a rate zone list (2015) from which you can find out the rates of property tax applicable on your property as per the zone of the city in which it is situated. This gives you a detailed PDF document with a list of the zones and the rates applicable to it.

If you wish to assess the property tax applicable on your property, hit the ‘self-assessment form’ button, and you will get a detailed form in PDF format which you can fill up and get a fair idea of how much your property tax is going to be.

There is also an e-assessment section in which there is a form you have to fill in to assess the property tax applicable to your property. You will have to fill in details such as your personal details as an owner of the property, the dimensions of your property, category, location, exemptions details and assessment year.

In case you want to pay your property tax online, just hit the ‘pay tax online’ button. On the page it leads you to, select ‘property tax’ from the drop-down menu, enter your PIN or service number and pay up.

If you wish to get any information about your property, assess your property tax liability and get details about property tax you have paid till date and make your current payment with pending dues, you can easily do so on the official website of the Indore Municipal Corporation (IMC).