In case you are planning to file your returns during the current assessment year, you have to mandatory pay your income tax dues as per the applicable Income Tax Act, 1961 rules. Currently, you have the option of making your Income Tax payment via either the online route or the offline route. The following is a step by step guide for paying income tax online on the TIN website managed by the Income Tax Department.

| Points to be noted before making online tax payment |

|

Table of Contents :

- Steps involved for online Income Tax payment

- Pay Income Tax Dues Online through Internet Banking

- How to Pay Income Tax Dues Offline

- Which Challan Should I use to pay due Income Tax?

- What to do after Income Tax online payment?

- Kinds of Income Tax payment

- What types of Income Tax Assessees can Pay Income Tax Online?

- Benefits of Online Income Tax Payment

Steps involved for online Income Tax payment

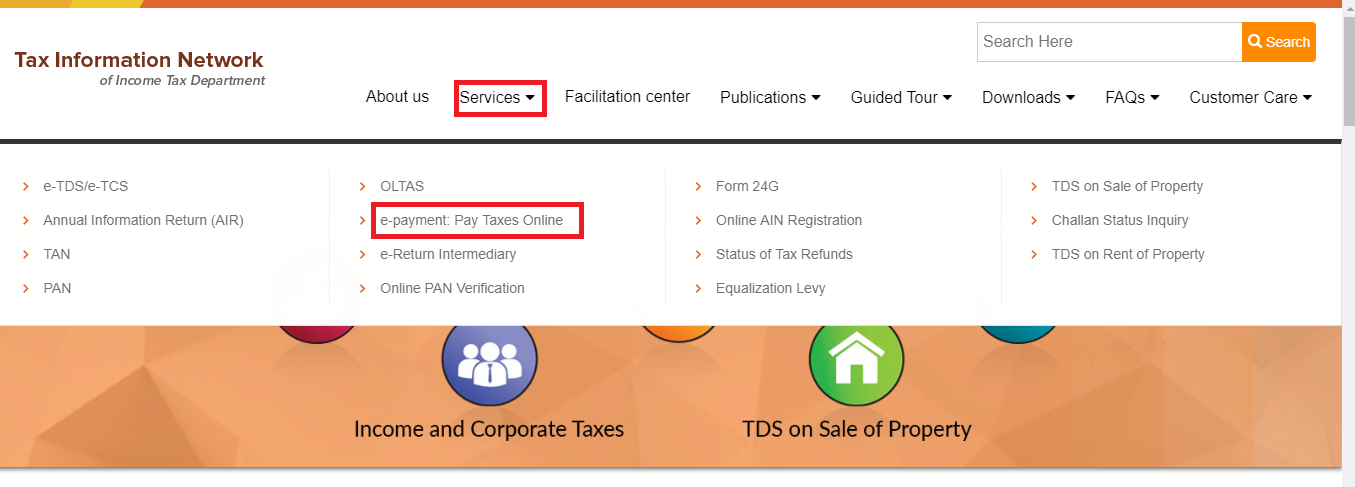

- Visit TIN Website and click the “e-payment: Pay Taxes Online’ option under the “Services” menu on the TIN homepage.

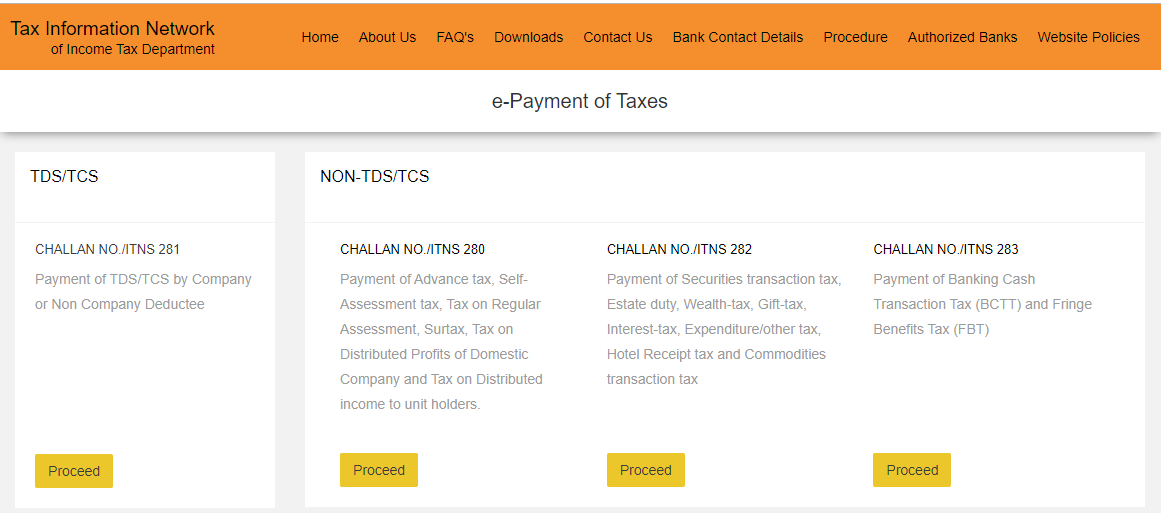

- On the subsequent page, you will get a complete list of challans. The most commonly used challan for online tax payment is ‘Challan No. /ITNS 280’. This challan is suitable for various types of online tax payment including advance tax payment, income tax dues payment, surtax payment, etc.

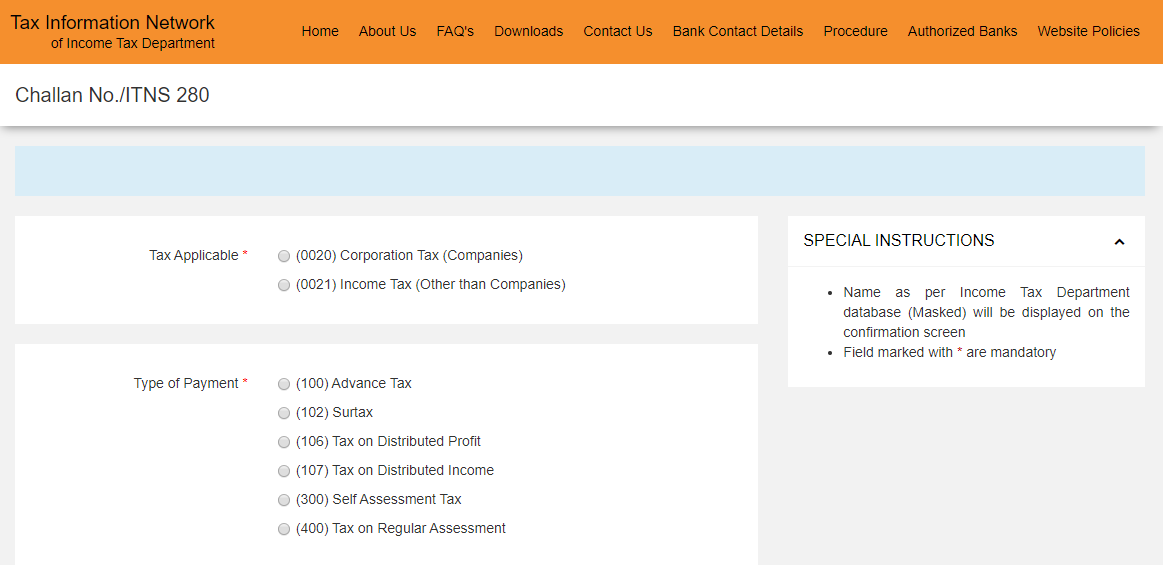

- You will be redirected to the next page, where select code 0021, which is meant for income tax users other than companies. Next, enter details of you PAN card. Select relevant assessment year for which the payment is being made. Provide your complete address. Select the type of payment. There are three options – 100 for advance tax, 300 for self-assessment tax and 400 for regular assessment tax. Choose the mode of payment through which you wish to make the payment. You can either choose net banking or debit card for this purpose. Then, verify that you are a real human by correctly entering the captcha code. Now, choose to proceed.

- After selecting ‘Proceed’, you will reach the next page. Cross check the information during the income tax online payment, as any mistake would cost your dearly. Click ‘Submit to the bank’.

- You will be directed to the next page – the website of your bank page for payment of the tax. On successful payment of the amount, you will be able to view a receipt for the tax paid by you. This receipt will contain all the details of the payment made by you. On the right side of the challan, you will be able to view the BSR code and the challan number. Remember to save a copy of this challan receipt or at least take a picture for your records so that it can be used later to vet out any discrepancy.

In case you have still missed out saving a copy of the receipt, you can retrieve it by logging in to your net banking account.

Also Read: How to Pay Income Tax Online using UMANG App

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Pay Income Tax Dues Online through Internet Banking

Many leading public and private sector banks in India are allowing their existing banking customers to pay their income tax dues online through their Internet Banking interface. Typically, this service can be accessed under the “Tax Services” menu after you have logged into your online banking account. The subsequent steps include selecting the correct payee type (individual/corporation) and challan in order to pay the due income tax. The following are some of the top banks for making online income tax payments through Internet Banking on the TIN website:

| State Bank of India | Punjab National Bank |

| Axis Bank | ICICI Bank |

| Union Bank of India | Bank of Baroda |

| HDFC Bank | Federal Bank |

| Canara Bank | Indian Overseas Bank and many other |

How to Pay Income Tax Dues Offline

While the online income tax payment process is definitely more convenient and can be completed from the convenience of one’s home or office, offline payment of income tax dues is also possible. Under the existing system, offline payment of due income tax can be completed using the applicable challans through specific bank branches as notified by the Income Tax Department.

Which Challan Should I use to pay due Income Tax?

The following is a list of challans listed on the TIN website for payment of income tax and their applicability for making income tax payments online or offline.

| Challan Number | When to use |

| INTS 280 (Challan 280) | For regular assessment tax, self-assessment tax, advance tax, etc. payment |

| INTS 281 (Challan 281) | For TCS/TDS payment by individual or company deductee. |

| INTS 282 (Challan 282) | For wealth tax, gift tax, securities transaction tax, estate duty, etc. payment |

| INTS 283 (Challan 283) | For Fringe Benefits Tax and Banking Cash Transaction Tax (BCTT) payment. |

| INTS 285 (Challan 285) | For payment of equalisation levy. |

| INTS 286 (Challan 286) | For payment of due income tax under Income Declaration Scheme, 2016. |

| INTS 287 (Challan 287) | For payment of tax under Pradhan Mantri Garib Kalyan Yojana, 2016 scheme. |

What to do after Income Tax online payment?

Always remember to furnish the details of the income tax paid by you in the income tax return filed later. By forgetting to do so, you will end up filing a return with a default because of which you can end up getting a notice from the I-T department.

Kinds of Income Tax payment

The Government of India uses a part of your income in the form of income tax for the development of the country. There are three types of taxes collected from your income by the government. They are:

Tax Deducted at Source (TDS): According to the I-T laws, an employer, who provides an income to the employee, deducts a part of the salary before giving it to the employee and then pays it to the government. This is TDS. This move helps the government keep a check on tax evasion.

Advance Tax: When the estimation and payment of tax is done before the end of the financial year, it is called advance tax. This is also called ‘pay as you earn tax.’ This payment can be done in installments according to the due dates given by the government. One needs to pay advance tax if the tax liability is over Rs 10,000. However, for a salaried employee, this is not necessary as tax is deducted form his income every month. However, if you are a freelancer, or if you are running a business, or if you have incomes other than salary such as capital gains, you will be required to make payment of advance taxes. This can be done by making an income tax online payment.

|

Dates to pay Advance Tax |

|

| Dates | Payable advance tax |

| On or before 15th June | Up to 15% tax |

| On or before 15th September | Up to 45% of tax |

| On or before 15th December | Up to 75% of tax |

| On or before 15th March | Up to 100% of tax |

Self-assessment Tax: This tax is calculated by the taxpayer and is the balance tax paid by the taxpayer on the assessed income after taking the TDS and advance tax into account. One needs to clear all outstanding tax in order to file an income tax return. The self-assessment tax is usually subject to interest under section 234 B and 234 C.

What types of Income Tax Assessees can Pay Income Tax Online?

Assessees who can pay their income tax online via the TIN website using various challans can be classified into two broad categories as follows:

- All individual/non-individual assessees (Hindu Undivided Family, Limited Liability Partnerships, Association of Persons, Body of Individuals, etc.) who are subject to provisions of Section 44AB of the Income Tax Act, 1961.

- All corporate income tax assessees.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Benefits of Online Income Tax Payment

The following are the key benefits of making income tax payments online:

- Time and effort are saved as no need to stand in queues

- Service is available throughout the day hence convenient for tax payer.

- Automated generation of receipt and tax payment data is immediately updated on applicable forms such as Form 26AS

Easy online verification of tax payments any time of the day