You are eligible to receive an income tax refund when you pay an amount in excess of your actual tax liability for a particular financial year. The income tax refund can be claimed online by filing an ITR. Read on to know the step-by-step process to check your income tax refund status online, interest on tax refund, types of income tax refund status and more.

Table of Contents :

What is Income Tax Refund?

When a taxpayer pays excess tax i.e., the amount of taxes paid exceeds his/her actual tax liability for a particular financial year, then the Income Tax Department returns the ‘excess tax’ paid in the form of Income Tax refund.

For example: A salaried individual could not declare the details of his tax-saving investments on time to his employer. As a result, his organization deducted extra taxes via the TDS mechanism. In this case, the employee can claim an income tax refund equivalent to the amount of excess tax deducted.

Below are some more cases wherein you can claim refund:

- The amount of tax deducted at source (TDS) on your salary, interest from bank deposits, interest on bonds, etc. exceeds your actual tax liability for the applicable FY.

- Advance tax paid on self-assessment is more than the tax liability as per regular assessment.

- Double taxation of income.

How to Claim Income Tax Refund?

A taxpayer can claim income tax refund as per Section 237 of Income Tax Act, 1961. Earlier, Form 30 was required to claim income tax refund. But with the advent of e-transfer of refunds, Form 30 is no longer required. It can now be simply claimed by filing the ITR and verifying the same, either physically or electronically within 120 days of filing. However, do ensure that the tax paid in excess is reflected in Form 26AS. In case the excess tax paid by you as per your ITR filing is not reflected in the annual tax statement, your refund claim may be rejected by the assessing officer.

How to Check Income Tax Refund Status?

Income Tax Refund status can be checked from either of the following:

⦁ NSDL Website or

E-filing portal of Income Tax Department

Check Income Tax Refund Status Through NSDL Website

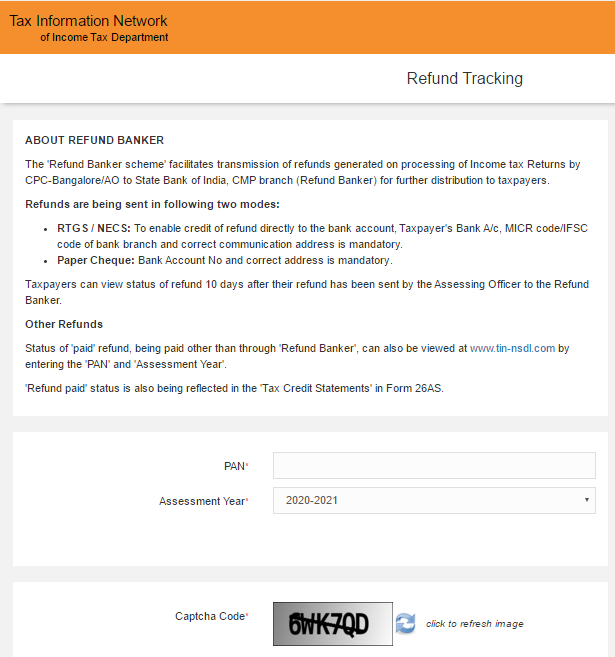

Step 1: Go to the NSDL website to track refund.

Step 2: Fill in your PAN, Assessment Year, enter the captcha code and click ‘Proceed’.

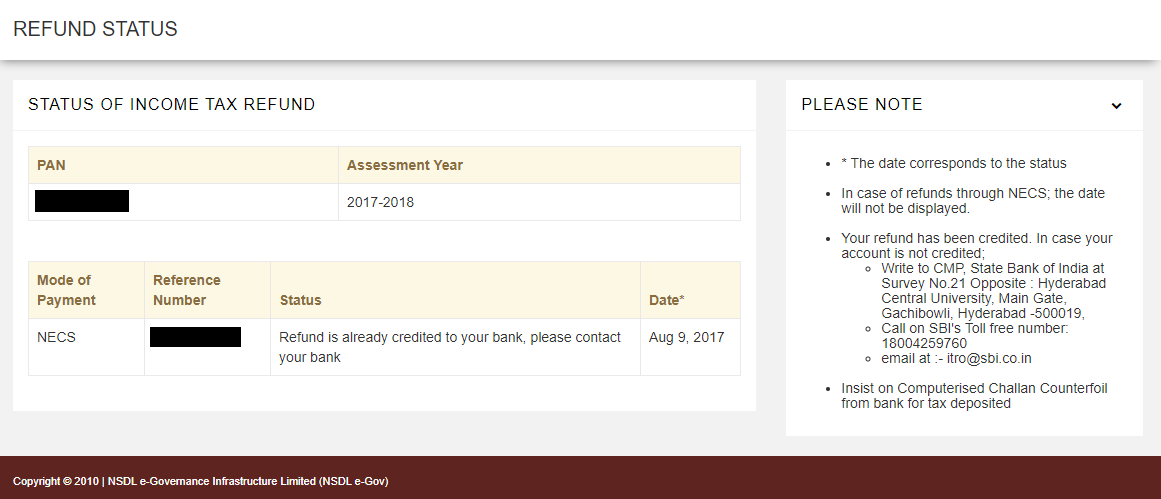

Step 3: Your income tax refund status will be displayed as depicted in the following image:

Check Income Tax Refund Status Through e-Filing Portal

Step 1: Log onto the e-filing portal of Income Tax Department.

Step 2: Under the “e-File” menu, select ‘Income Tax Returns” and click on “View Filed Returns”.

Step 3: On the subsequent page, you will see a list of your previously submitted income tax returns. Click on the Acknowledgement Number corresponding to the tax filing in which you have claimed a refund.

Step 4: On the page that opens next, you can find return details along with income tax refund status.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Interest on Income Tax Refund

You are entitled to receive an interest on the refund amount, if the refund amount is 10% or more of the total tax paid. Interest on income tax refund is payable at the rate of 0.5% per month or part of the month on the refund amount. This interest is calculated from 1st April of the applicable assessment year till the date of issuing the refund. It should be noted that interest on income tax refund is treated as income of the tax assessee and taxable as per the applicable slab rate.

How to interpret your Income Tax Refund Status?

| Income Tax Refund Status | Meaning | What should you do next? |

| Refund Paid | Your ITR has been processed and refund has been credited. | Check with the bank to confirm the receipt of refund. If you have not received the refund, contact your bank or State Bank of India to find out the error. |

| No Demand No Refund | Your tax calculation matches with that of the IT department. You are neither required to pay further tax nor eligible for a tax refund. | Just retain the applicable tax records in case they are required at a later date. |

| Refund Status Not Determined | Your ITR has not been processed yet. | Recheck the status after few days. |

| Refund Determined and sent out to Refund Banker | Refund has been accepted by the Income Tax department and refund banker has been informed | Wait for the refund to be credited or contact the refund banker to know the status of your refund payment |

| Refund Unpaid | Refund has been accepted by the Income Tax department but not yet credited. This can be due to 2 reasons. Either the bank details provided for refund credit are incorrect; or, if opted for refund through cheque, your address is incorrect. | Reason is displayed in such cases. Take corrective action as required and request a refund reissue. |

| Demand determined | Your tax calculation does not match with that of the IT department and an additional tax has to be paid. This means that you have to fulfil a ‘Tax Demand’ and are not eligible for a Tax Refund. | Verify the information with your e-filing form to figure out the mismatch/error. If you actually find an error in your e-filing request, then make a payment to Income Tax Department within the specified timeline.

In case there is no error in your e-filing request, file an appeal along with all the supporting information and documents to justify your refund claim. |

| Rectification Processed, Refund Determined and Details sent to Refund Banker | The Rectified return has been accepted by the Income Tax department. Moreover, the refund amount has been recalculated and the refund amount has been sent to the bank for processing the payment. | Check your bank account to confirm the receipt of refund. |

| Rectification Processed and Demand Determined | Rectified return has been accepted by the Income Tax department. However, there are outstanding tax dues (tax demand) which need to be paid within a specified time. | Pay the outstanding tax/ tax demand after cross-verifying all the details within the specified time period. |

| Rectification Processed, No demand and No Refund | Rectified return has been accepted by the Income Tax department. Additionally, you are neither required to pay any additional tax nor eligible for a tax refund. | – |

Read more about: Income Tax Refund

FAQs

Q1. My employer deducted extra amount in TDS. Will I be able to get refund of this amount?

You can claim this extra amount while filing ITR. Once your ITR is assessed, the refund is processed by the Income Tax Department.

Q2. Do I have to pay any charges to check my income tax refund status?

No, no charges are to be paid to check your income tax refund status.

Q3. Is it mandatory to file a tax return to get an income tax refund?

Yes, you need to file your ITR for the assessment year in case you wish to claim your income tax refund.

Q4. The status shows I have a refund amount due. Will I have to pay tax on my income tax refund?

The income tax refund corresponds to the excess amount of tax that you have paid. It is not an income and hence is not taxable. However, the interest earned on your income tax refund will be taxable.

Q5. Can someone else check the status of my income tax refund on my behalf?

Yes, your CA, ERI (e-Return intermediary) or any Authorized Representative can assist you in ITR filing and other related services such as checking the status of your income tax refund on your behalf.