Note: The information on this page may not be updated. For latest updates, click here.

It is mandatory to file Income Tax Returns for individuals with an income over Rs. 2.5 lakh for those below 60 years of age, Rs. 3 lakh in case of people over 60 years old but less than 80 years old and Rs. 5 lakh for those over 80 years of age. These exemption limits keep changing from time to time, depending on the government policies and notifications.

Also, the process for filing the returns is quite simple. One just needs to be aware of the different kinds of ITR forms, their applicability and some commonly used terms. The article discusses key details relating to ITR-1 Sahaj Form, its eligibility and applicability, documentation requirement, structure and more.

Table of Contents :

- ITR-1 Form

- Taxpayers Eligible to Use Form ITR-1

- Taxpayers Not Eligible to Use Form ITR-1

- Supporting Documents Needed for Form ITR-1

- How to Download Form ITR-1

- Due Dates for Filing Income Tax Return for FY 2021-22

- Last Dates for Filing Form ITR-1

- Penalty on Late Filing of ITR

- Structure of ITR-1 Form

- Procedure for Completing Form ITR-1 Online

- Common Terms Used in ITR-1 Form

- FAQs

ITR-1 Sahaj Form

Form ITR-1 or “Sahaj” (derived from the Hindi word meaning “easy”) is the most commonly used form for filing Income Tax Returns. ITR-1 form is for resident individuals whose total income does not exceed Rs. 50 lakh during the financial year. It is primarily used by salaried individuals. However, there are certain categories of salaried individuals who need to submit their returns through other forms like ITR or ITR-2A.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Taxpayers Eligible to File ITR Using Form ITR-1

ITR-1 Sahaj Form can be used by resident individuals who:

- Have a maximum income of up to Rs. 50 lakh during the financial year

- Earn an income from salary, family pension income, one house property, agricultural income (up to Rs. 5,000) and other sources such as interest from savings accounts/deposits (bank/post office/cooperative society)/income tax refund/interest received on enhanced compensation/any other interest income/family pension

- Income of Spouse (except for those covered under Portuguese Civil Code) or Minor is clubbed (only if the source of income is within the specified limits as mentioned above)

Taxpayers Not Eligible to Use Form ITR-1

ITR-1 Sahaj Form cannot be filed by the following individuals:

- Resident Not Ordinarily Resident (RNOR) and Non-Resident Indian (NRI)

- If the total income is more than Rs. 50 lakh

- If the income from agriculture is more than Rs. 5,000

- In case of income from lottery, legal gambling, horse races, etc.

- In case of taxable capital gains (short term and long term)

- In case of investment in unlisted equity shares

- In case of income from business/profession

- If the person is a Director in a company

- The individual has a tax deduction under section 194N of the Income Tax Act

- Those who receive a deferred income tax on ESOP from the employer being an eligible start-up

- Those who own and have income from more than one house property

- Not covered under the eligibility conditions for ITR-1

Supporting Documents Needed for ITR-1 Sahaj Form

A smart taxpayer should keep the following documents handy while filling the ITR-1 Form. This will not only simplify the process but also expedite it.

- Form 16: In case a taxpayer was employed with multiple employers in the previous year, he/she will need to keep all the Form 16 that he/she would have received.

- Form 16A: If the taxpayer has received any interest income or pension from banks or other institutions, they would have also issued the tax certificate or Form 16A. This will prove as a helpful document while filing the tax returns.

- Form 26AS: This form can be downloaded from the TRACES website. It contains comprehensive information regarding the amount of tax deducted and deposited on the taxpayer’s behalf by all the deductors in a particular financial year. One should verify that the TDS mentioned in Form 16/Form 16 A matches with the amount of TDS reflected in Part A of Form 26AS.

- Bank Statements or Passbooks: These are needed to check and provide complete details of the interest earned on savings account and time deposits like fixed deposits, recurring deposits, etc. The total amount of interest should get reflected under the category “Income from Other Sources”, irrespective of the TDS.

- Supporting Documents for Investments or Exemptions: If there are any investments that have been made post submission of proofs to the employer, but before the end of the financial year or if the taxpayer was unable to submit proof of certain exemptions or deductions (such as HRA allowance or Section 80C or 80D deductions) on time.

- PAN Card

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to Download Form ITR-1

For downloading ITR-1 Sahaj Form, a taxpayer needs to follow the below mentioned steps:

Step 1: Visit the Income Tax Department website and click on “Downloads”

Step 2: Click on “Income Tax Returns”

Step 3: Choose your Assessment Year and click on “Utility” under Common Offline Utility

Step 4: Extract the downloaded file and fill in the details

Due Dates for Filing Income Tax Return for FY 2021-22

| Category of Taxpayer | Due Date for Tax Filing |

| Companies excluding those required to furnish a report in Form No. 3CEB under section 92E | 31st October |

| Any person (corporate/non-corporate) who is required to furnish a report in Form No. 3CEB under section 92E | 30th November |

| Any person (other than a company) whose accounts require audit | 31st October |

| A working partner of a firm whose accounts require audit | 31st October |

| Any other assessee | 31st July |

Last Date for Filing Form ITR-1

Taxpayers need to submit the duly completed Form ITR-1 by 31st July of the assessment year to file taxes for the previous year. For example, if the income was earned anytime between April 1, 2021 and March 31, 2022, the assessment year for the same would be 2022-23. In this case, the ITR-1 Form needs to be submitted on or before 31st July, 2022.

Penalty on Late Filing of ITR

In case the taxpayer fails to complete the tax return formality within these timelines, he/she can file a “Belated Return” any time before 31st March, 2023. However, late filing attracts penalty. From April 1, 2018, the Government of India introduced the change of imposing fine for late filing of ITR. If the return is filed 3 months before the end of the relevant assessment year or before the assessment completion (whichever is earlier), a late filing penalty of Rs. 5,000 shall be payable. However, in case the income of the person is not more than Rs. 5 lakh, the maximum late filing fee to be paid is limited to Rs 1,000.

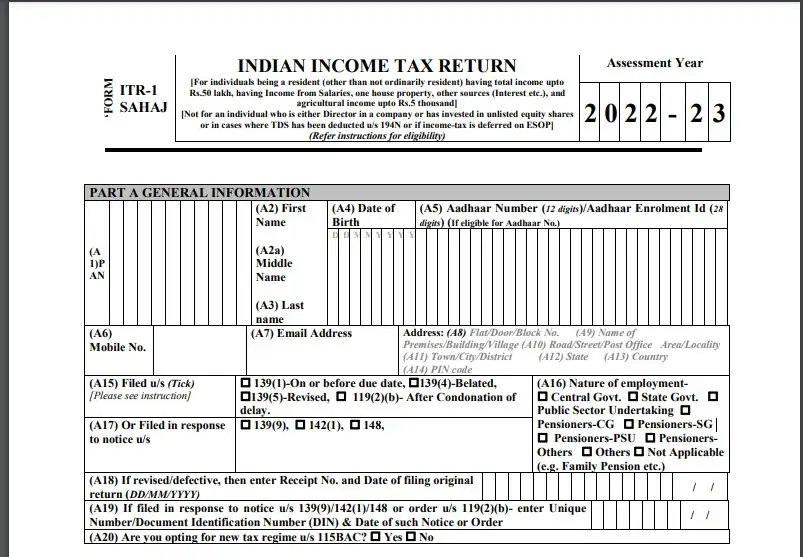

Structure of ITR-1 Form

ITR-1 Sahaj Form is made up of the following sections:

- Part A: Personal and identifiable details of the taxpayer, such as name, PAN and address

- Part B: Total income for the financial year

- Part C: Details of all deductions and total taxable income

- Part D: Details of tax calculations and status

- Schedule IT:Information regarding payments made towards self-assessed tax and advance tax paid.

- Schedule-TDS1:TDS/TCS details

- Verification

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Offline ITR-1 Sahaj Form

Online ITR-1 Sahaj Form

Procedure for Completing Form ITR-1 Online

Procedure for Completing Form ITR-1 Online

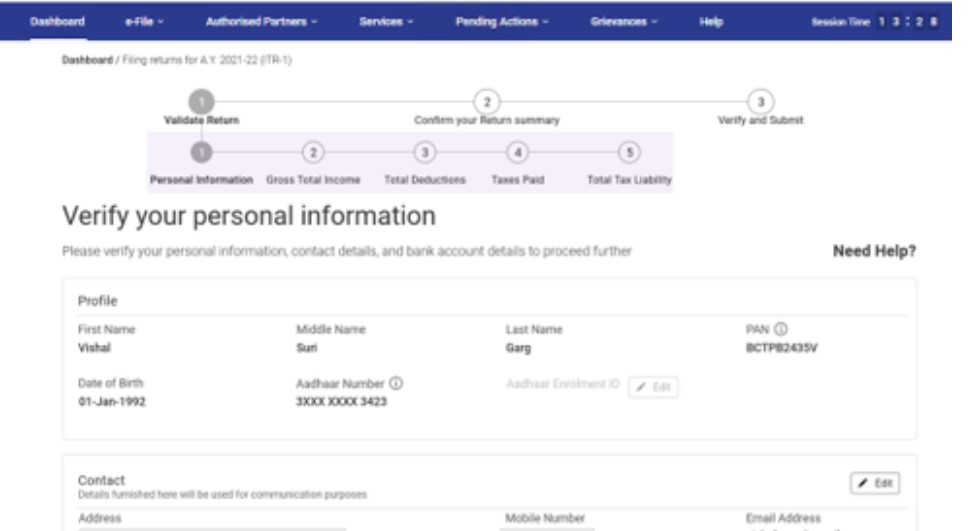

Given below is the step-by-step process to fill and submit your ITR-1 Sahaj Form online:

- Visit the Income Tax Department website

- Register in case you are a new user or login if you already have an account.

- Go to the ‘e-File’ drop-down menu and choose the ‘Income Tax Return’

- Select the assessment year and submission mode

- To file a fresh ITR, click on ‘Start New Filing’

- Select your applicable status, i.e., whether you are an individual/HUF/others and click on ‘Continue’.

- Choose ITR-1 Form to proceed further.

- Select the reason for which you are filing the ITR.

- Based on the information available with the Income Tax Department, you will get your pre-filled return. To proceed further, validate the details in each section such as your personal information, gross total income, total deductions, taxes paid and total tax liability.

- Fill in details that were not filled in earlier.

- Confirm your ITR-1 summary details.

- Make the payment of the required tax, if any.

- Preview and submit your ITR.

Read More: To know more about Income Tax e-filing, click here.

Acknowledgement of Income Tax Return

For taxpayers who choose to submit their returns via the electronic or online mode, the acknowledgement copy is mailed by the I-T Department on their registered e-mail ID. They can also download the same from the Income Tax website. Taxpayers who use the physical form to submit their returns, receive their acknowledgement copy from the I-T Department after the submission of the form.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Common Terms Used in ITR-1 Form:

- Advance Tax: Tax Deducted at Source (TDS) is a form of advance tax for individuals who have received income from salary. However, for other sources of income, such as interest earned on deposits (fixed, recurring as well savings) from banks, bonds, earnings as a landlord, capital gains or Interest on bonds, etc. A taxpayer is required to file advance tax in installments, if such income is above Rs. 10,000 per year. These payments need to be made on a quarterly basis i.e. September, December and March.

- Self-Assessment Tax Payments: Simply put, this is the gap between the tax payable and the actual tax paid. The amount needs to be calculated before filing the return. A taxpayer can fill in all the details in the ITR Form along with the details of advance tax paid, if any. This will help him/her identify any balance tax payable from his/her end.

- Notice Number: In case a taxpayer has received a notice or a demand from the I-T Department and he/she is filing the return as a response to such notice, then he/she is required to fill in these details in the form.

- Revised Return: In case a taxpayer realizes that the submitted ITR Form for the last financial year had any errors or omissions, he/she needs to re-file the same. This is referred to as a revised return. The window for this is open till the end of the next financial year. For example, for the FY 2021-22, a taxpayer can file the revised return till end of next the financial year 2022-2023i.e. March 2023.

- Annexure Less Return: ITR-1 Form is referred to an Annexure-less return form. This is so because the taxpayer does not need to attach any supporting documents, such as Form 16, Form 16A, Form 16B or Form 26AS along with this form.

FAQs

Q1. Am I required to show interest income from other sources when filing ITR-1 even if the TDS is already deducted?

Yes, you are required to include interest income from other sources even if the TDS is already deducted.

Q2. I am a joint owner of a property with my wife. Can I file ITR-1 in AY 2022-23?

Yes, you can file ITR-1 for the AY 2022-23 only if you are a single/joint owner of a single property. In case you own more than one property, you can’t file ITR-1 even as a single owner.

Q3. How am I required to report bank accounts in ITR-1?

You need to fill in details of all your savings and current accounts held during the previous year. However, it is not mandatory to add details of dormant accounts that haven’t been operational for more than three years. The bank account numbers have to be filled in Part E of the ITR-1 Form.

Q4. Am I supposed to include dividend income from mutual funds in ITR-1 Form?

Yes, dividend income from mutual funds is taxable and must be shown under ‘Other Income’ in ITR-1 Form.

Q5. My annual income is Rs. 52 lakh. Should I file ITR-1 or ITR-2?

Since your income is more than Rs. 50 you cannot file ITR-1. However, based on the course of your income, you can file ITR-2 or ITR-3. If you are salaried, you can file ITR-2 and in case you are an entrepreneur, you can file ITR-3.