After you have filed and verified your ITR, the next step is to wait for the intimation that the ITR has been processed. ITR processing involves checking the TDS claimed by you with Form 26AS, tax and interest calculation and other arithmetic calculations. Generally, ITR is processed within 30-45 days from the date of ITR verification. However, the time may vary depending on many factors, such as the type of ITR filed, the jurisdiction, the date of ITR filing, etc.

How to check ITR status?

ITR status can be checked by following the below steps:

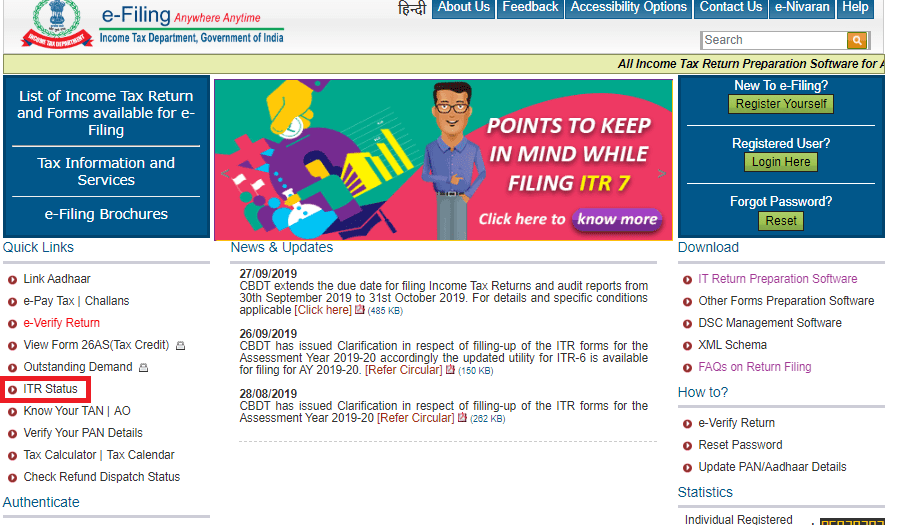

Step 1: Visit the e-filing portal of the Income Tax Department.

Step 2: Click “ITR Status” under the heading Quick Links.

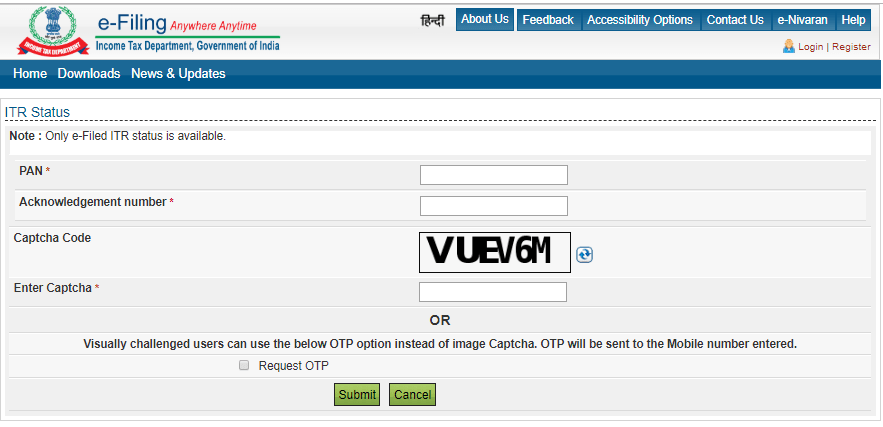

Step 3: Fill out your PAN, ITR Acknowledgement Number, Captcha Code and click Submit.

Step 4: ITR status will be displayed after you click Submit. If the status is “Return Submitted and Verified”, it means that ITR is yet to be processed. While if the status is “Return Processed”, it means that your ITR has been processed.

Step 4: ITR status will be displayed after you click Submit. If the status is “Return Submitted and Verified”, it means that ITR is yet to be processed. While if the status is “Return Processed”, it means that your ITR has been processed.

What to do when ITR is not processed?

If your ITR has not been processed for a long time, then you can raise a grievance for the same. Following are the steps t raise the grievance:

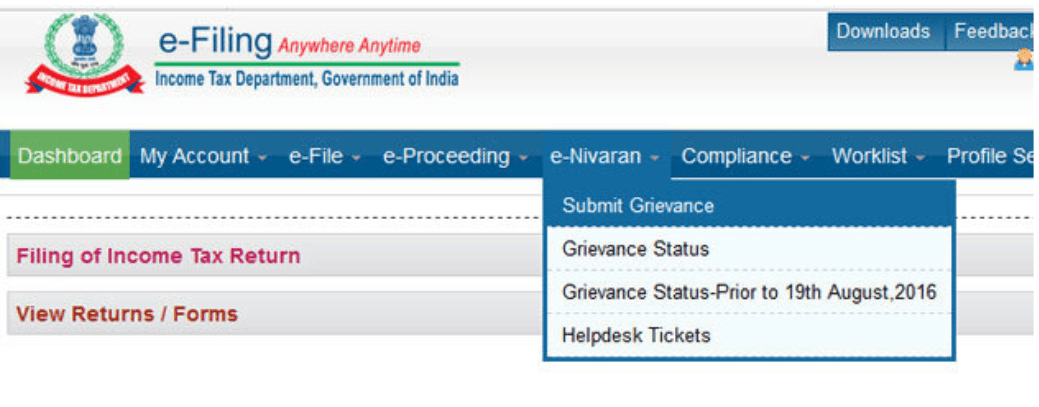

Step 1: Log into the e-filing portal of the Income Tax Department.

Step 2: Under the “e-Nivaran” tab, click “Submit Grievance”.

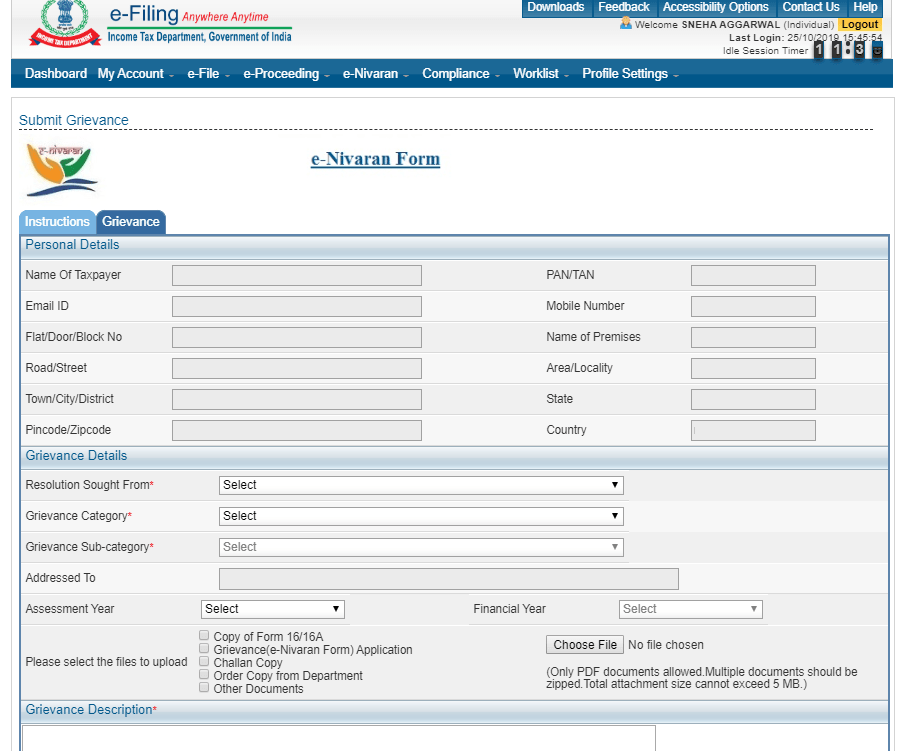

Step 3: A grievance form will be displayed with auto-populated personal details. Make sure that the details are correct.

Step 3: A grievance form will be displayed with auto-populated personal details. Make sure that the details are correct.

Step 4: Fill out the grievance details.

Step 4: Fill out the grievance details.

- Resolution Sought From: Centralised Processing Center for Income Tax Return (CPC – ITR).

- Grievance Category: Processing

- Grievance Sub-category: Others – Processing

- Assessment Year: Select the relevant AY.

- Financial Year: Select the relevant FY.

Step 5: Write the details of your grievance in the description box and click “Preview and Submit”.

A grievance ID will be shown after you submit the grievance. Also, a link will be shown to download your grievance.

Generally, the Income Tax Department replies to a grievance message within 7 to 10 days of submission.